Yields on gov’t debt end mixed as lockdown stays

YIELDS ON government securities ended mixed last week amid the extension of the modified enhanced community quarantine (MECQ) in Metro Manila and nearby provinces as well as lack of market catalysts.

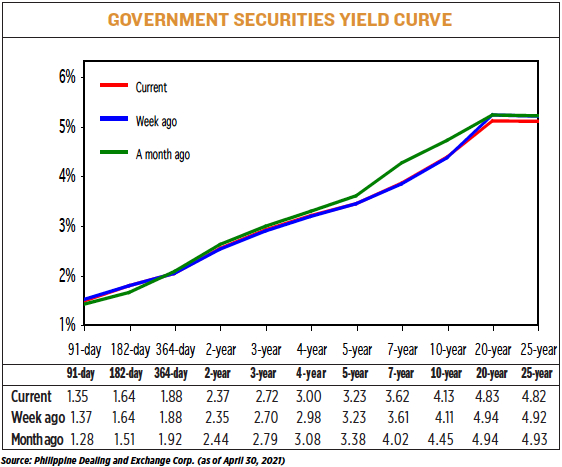

GS yields, which move opposite to prices, went down by an average of 1.35 basis points (bps) week on week, based on the PHP Bloomberg Valuation Service Reference Rates as of April 30 published on the Philippine Dealing System’s website.

GS yield movements were mixed at the secondary market last week. The 91- and 364-day Treasury bills (T-bills) saw their yields inch down by 2.70 bps (to 1.3458%) and 0.19 bp (1.8816%), respectively. On the other hand, the rate on the 182-day paper was flat with a 0.06-basis-point increase week on week to 1.6444%.

At the belly, yields increased with the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) climbing 2.03 bps (2.3659%), 2.47 bps (2.7225%), 1.46 bps (2.9987%), 0.37 bp (3.2305%), and 1.13 bps (3.6236%).

With the exception of the 10-year T-bonds, yields on the long-dated papers declined, with the 20- and 25-year tenors slipping by 11.22 bps and 9.87 bps to fetch 4.8299% and 4.8239%, respectively. The 10-year T-bonds, on the other hand, went up by 1.60 bps to 4.1287%.

“Domestic yields moved broadly lower this week as market participants cautiously awaited [last week’s] announcement of new local quarantine policies for May 2021,” a bond trader said in an e-mail.

In a phone interview, Security Bank Corp. Chief Investment Officer for Trust and Asset Management Group Noel S. Reyes said last week was characterized by range trading as market players were more focused on the government’s decision on whether to ease lockdown restrictions.

President Rodrigo R. Duterte on Wednesday evening extended the MECQ — the second strictest lockdown level — in Metro Manila, Bulacan, Cavite, Laguna and Rizal until May 14 as the country continues to have one of the worst coronavirus disease 2019 (COVID-19) outbreaks in the region.

The Health department on Friday reported 8,748 new cases, bringing the number of active cases to 73,908. Total cases have reached the one-million mark last Monday.

As announced in a news briefing on Friday, the province of Ifugao was placed under MECQ, while the city of Puerto Princesa in Palawan was placed under a more lenient general community quarantine for the whole of May.

Moreover, the modified lockdown in the Quirino province and Santiago City in Cagayan Valley, and Abra province in the Cordillera Administrative Region would be reduced to two weeks from one month previously.

“GS yields might be influenced by anticipations ahead of the April 2021 inflation report… However, yields might increase from likely stronger US reports on employment, manufacturing, and non-manufacturing,” the bond trader said.

The employment situation report in the US is scheduled to be released on Friday evening, local time.

For Security Bank’s Mr. Reyes: “We’re likely going to see more of this [range-trading activity] until we get more data on the direction of the economy… [T]hat is going to be initially brought about by inflation rate… followed by the unemployment rate [scheduled this week],” he said.

Latest results show inflation rate at 4.5% as of March, higher than the Bangko Sentral ng Pilipinas’ 2-4% target for 2021 and its forecast of 4.2%. The BSP projects inflation to settle within 4.2%-5% for April.

Meanwhile, preliminary results of the Philippine Statistics Authority’s (PSA) January round of the Labor Force Survey released on March 9 reported around 3.953 million unemployed Filipinos, up from 3.813 million in October 2020 and 2.391 million in January 2020.

This will put the unemployment rate at 8.7% in January, unchanged from October 2020 but higher than the 5.3% seen in January 2020.

The PSA will report April inflation and May jobs data on Wednesday and Thursday, respectively. — Abigail Marie P. Yraola