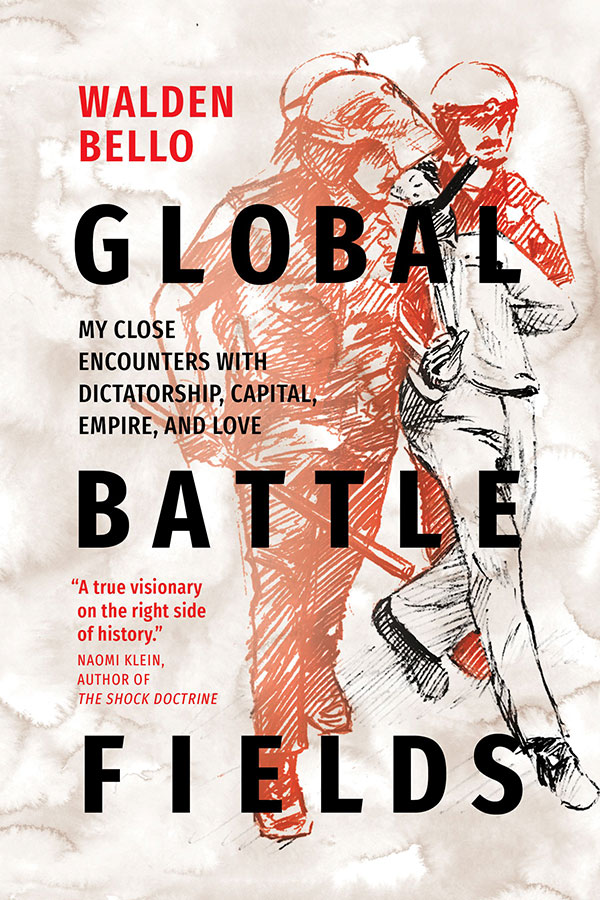

This column is drawn from Walden Bello’s speech at the “Afternoon with Risa and Walden,” the launch of the book Global Battlefields: My Close Encounters with Dictatorship, Capital, Empire, and Love by Walden Bello, published by the Ateneo de Manila University Press, at Corinthian Gardens on May 20.

This column is drawn from Walden Bello’s speech at the “Afternoon with Risa and Walden,” the launch of the book Global Battlefields: My Close Encounters with Dictatorship, Capital, Empire, and Love by Walden Bello, published by the Ateneo de Manila University Press, at Corinthian Gardens on May 20.

Do not be fooled by the title of my presentation, “My Life (and Loves).” It’s a teaser; I will not speak of my loves.

The purpose of this occasion is to launch a memoir that, according to the back cover of the book, is “the search for meaning of what the author calls the “lost generation” — his cohort of revolutionary youth that reached for the stars, fell short, but still made a difference.”

But that lovely piece of advertising is simply an excuse. The real purpose of this gathering is for my cohort of classmates to have a good time, to have one great fling as we head towards the sunset.

It took some eight years of people pushing me to write the memoirs before I finally decided to do it.

In 2023, my good friend, Prof. Carol Hau, brought up the suggestion a third time. You don’t say no to Carol, and so I began this memoir in Kyoto and finished it six months later in Bangkok, fortified by the improbable combination of a daily run of seven kilometers and daily intake of Suntory single malt whiskey.

Once I decided to write, I made myself an adherent of what I call the Clint Eastwood School of memoir writing. You write not only about the good but also the bad and the ugly. No one wants to read the life story of a saint but everyone loves to peek into that of a sinner.

The bulk of the memoir is about my political adventures or misadventures. This includes my 15 years with the international branch of the Communist Party of the Philippines (CPP), working to overthrow the Marcos dictatorship, a struggle that was the romance of my generation; and my 15 years as an agent of the global anti-globalization movement and the movement against the US invasion of Afghanistan and Iraq.

Those 30 to 35 years were spent roaming the globe, participating in protests or hatching conspiracies or simply hanging out with interesting characters like Hugo Chavez, Vaclav Havel, Hamas, and Hezbollah in places like Santiago de Chile; San Francisco; Washington, DC; New York; Nairobi; Johannesburg; Mexico City; Paris; Dakar; Bangkok; Hanoi; Beijing; Beirut; Caracas; Rio de Janeiro; Damascus; Baghdad; Lima; Prague; Genoa; Moscow; Pyongyang in North Korea; and scores of other cities in all continents, including the continent of convicts and kangaroos.

Regarding this period of my life, I just want to make two things clear. First, while we both fought against the US intervention in the Middle East, I had absolutely nothing to do with Osama Bin Laden. Though I must confess that I did lead a mission to Baghdad to try to prevent the overthrow of Saddam Hussein by the Americans in 2003.

Second, though Donald Trump declared himself against globalization and embraced the strategy of Deglobalization that the Economist magazine accused me of cooking up, I disclaim any responsibility for his thinking or his crazy acts. I must say this because a good friend, the mercurial internet personality Ronald Llamas, accused me during the launch of this book at UP last month of paving the way for Trump, like John the Baptist paved the path for Jesus Christ.

The last section of the book covers that part of my life that you know about, including my time in the House of Representatives for three terms, from 2009 to 2015, when I made the only recorded resignation on a matter of principle from Congress owing to my refusal to tolerate our fellow Atenean President Benigno “PNoy” Aquino’s double standards when it came to dealing with corruption among his allies and enemies. It also covers my post-Congress life, that included my campaign for the Senate in 2016, my kamikaze run for the vice-presidency in 2022, and my arrest on charges of cyberlibel filed by the camp of our lovely vice-president for which I still fly down to Davao once a month for my trial, which is ongoing.

Looking back, let me recount an encounter with my spiritual adviser, the late Father Benigno Mayo. After our high school graduation retreat in 1962, I thought I had a vocation to join the Jesuits. I went to see Fr. Mayo, and he told me I should wait for one year. That turned out to be the single best piece of advice I ever got, for in the year that followed I realized that I could not do with just the Blessed Virgin as my partner for life.

But the paradoxical thing is, I ended up following the vows of poverty, chastity, and obedience that the Jesuits make. Now, those who have read the memoir are astounded when I make this claim since they say it is contradicted by thoughts and deeds documented in the book.

But, friends, hear me out.

On the vow of poverty. When my dear departed wife Ko, who was Thai and Buddhist, proposed to me in 2013, she did not fully reveal who she was. I thought I was getting together with someone who was also committed to a vow of poverty. That she concealed her real economic status I know not why, except perhaps to test if I was marrying her not for money but only for her beauty.

Only when she was dictating her will to her lawyer before her departure in 2018 did I realize that she had kept hidden from me an important dimension of her existence, that of being a successful investor in stocks and real estate.

But who was I to refuse her generosity? A refusal on my part to accept her gift, I was told by Buddhist monks, might bar her from entry into the blessed state of Nirvana for it was her last act of what Buddhists call “merit-making.” At that point, my Jesuit-trained mind kicked in and said, follow the monks’ advice.

And as insurance that nothing messed up my beloved Ko’s passage to the afterlife, it ordered me to give the good monks a portion of her generous legacy and keep the rest for future acts of Christian charity like contributions to the annual Ateneo Alumni Association fundraising drive. The Christian injunction, the Jesuits tell us, is not to repudiate or part with material wealth but to be poor in spirit, to be humble and be wretched in the eyes of the Lord.

On the vow of chastity, you’re joking, other readers have exclaimed. You’ve been married three times and who knows how many relationships you’ve had. In fact, did you not write that you were nearly sent to the hospital by irate jealous husbands? But, hear me out. The Jesuits tell us that there’s a higher form of chastity than the chastity of the body, and that is the chastity of the spirit. It is this higher chastity of the spirit, of the soul, that I am committed to, not to the chastity of the flesh.

“Fear not the corruption of the body but the death of the soul.” This line penned by the great Japanese novelist Yukio Mishima could very well have been written by a Jesuit. Isn’t it beautiful? We are so lucky to have had such wise teachers.

Finally, on the vow of obedience, again people laugh. You’re kidding. You were thrown out of your first two jobs, you were disobedient to your political chief Joma Sison when you were a communist, you got into trouble with President Aquino III because you refused to be a good, obedient ally.

Again, hear me out. There is a higher authority than temporal authority, the Jesuits say, and that is God, or, if you don’t believe in God, your conscience. Your conscience or sense of right and wrong is higher than even a spiritual authority, like the Church, and it must be followed when there is a conflict between the two. That’s what the Jesuits taught us.

And that’s why, when I was in Congress, I was one of the principal sponsors of the Reproductive Health Law that the bishops unanimously opposed and I supported the long overdue decriminalization of abortion that they condemn as the advocacy of the devil.

Indeed, the Jesuits are themselves a good example of following your conscience against the order of spiritual authority, of defying your superiors if they’re wrong. They refused to follow the Pope’s orders to stop their subversive style of reasoning, and this why Rome expelled them from the Philippines and many other countries in 1768 and did not allow them to return until 1859, the very year they founded our beloved Ateneo de Manila to train generation after generation of Filipino youth in their subversive reasoning.

By the look on your faces, it seems that I have convinced you that, despite appearances to the contrary, I have indeed been faithful to the Jesuit vows of chastity, obedience, and poverty. Am I correct? Thank you, my friends, but I regret to inform you that I have been taking you all for a ride.

The point of this exercise has been to underline the importance of the Jesuit system of reasoning in our lives. Ratiocinatio Jesuitica, or Jesuit reasoning, undergirds the ratio studiorum or program of studies we were socialized into at the Ateneo. It is both a wonderful gift and a dangerous weapon. It can make one either a pillar of the establishment or, as in the case of Naphta, the shadowy ex-Jesuit in Thomas Mann’s great novel The Magic Mountain, an agent of subversion.

But whether the Jesuit style of reasoning has turned us into adherents of the status quo, or into partisans of reform like Rizal, or into revolutionaries like the martyred Edgar Jopson, the fabled Atenean who became a key leader of the Communist Party of the Philippines, let us this afternoon declare a truce, enjoy the wine and the company, and join hands to celebrate our shared legacy of ratiocinatio Jesuitica that seduced us into our separate, contradictory paths. Thank you, Ateneo, thank you, our Jesuit mentors, for seducing our pure, young minds, for better or for worse.

Walden Bello is a retired professor of sociology at the University of the Philippines and the State University of New York at Binghamton. He served in the House of Representatives as a congressman for Akbayan Citizens’ Action Party from 2009 to 2015 and ran for vice-president in the 2022 national elections.