Greenbelt 3 unveils new flagship stores

HAVING been under construction for most of the quarantine period, Greenbelt 3 is reopening with several major flagship stores and first-in-the-Philippines retail concepts along its newly renovated wing. Opening boutiques in Greenbelt 3 before the end of 2021 are Louis Vuitton, Fendi, Dior, Off White, Univers and Thom Browne, Bvlgari, Kenzo, Max Mara, RIMOWA, Patek Philippe, and L’Officine Universelle Buly. Meanwhile, 2022 will see the launch of Celine, Salvatore Ferragamo, Tod’s, Ermenegildo Zegna, Roger Vivier, Loewe, Jimmy Choo, and the store expansion of Hermes. The new Greenbelt 3 will feature over 18 soon-to-launch brands plus an expansion of Hermes’ boutique. It flows seamlessly with the boutiques found Greenbelt 4. Store openings at the renovated wing will commence gradually starting this month. The first to open is French fashion house Louis Vuitton, which will unveil its newly renovated 1000-sqm boutique that incorporates Filipino culture through its collaborations with local artists and interior design firm, Philux. Dior will be opening its biggest flagship store in the country and will exclusively carry Dior’s seasonal women’s ready-to-wear for the first time. Italian brand Max Mara will open in the Makati mall offering its collections of ready-to-wear and accessories for women. Greenbelt 3 will house German luggage label RIMOWA’s first flagship store, which will offer the brand’s most recognizable collections alongside one-of-a-kind collaborations and seasonal designs. The RIMOWA Personal in a limited-edition Bamboo shade collection will be available exclusively at the flagship store to celebrate its opening. Kenzo will open its first inline space at the Ground Floor of the refreshed wing. Two globally acclaimed brands will open stores in the Philippines for the first time at Greenbelt 3: Roger Vivier, known for its footwear, bags, and accessories; and L’Officine Universelle Buly, a Parisian perfume and cosmetics brand. For everyone’s safety, Greenbelt partnered up with the Department of Health and the LGU to immunize all mall employees. The mall also a recipient of the Safety Seal.

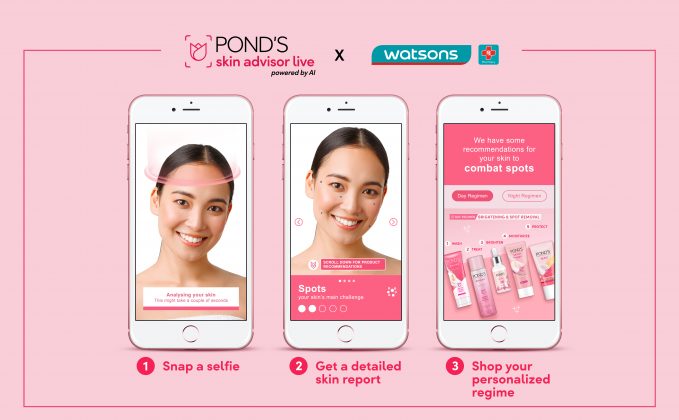

Pond’s launches AI-powered skin analysis

THE PHILIPPINES’ biggest beauty brand, Pond’s, unveils real-time skin analyzing technology in partnership with Watsons. The Skin Advisor Live (SAL) skin analysis is a virtual beauty experience developed using cutting-edge AI and AR technology that provides users with near-instant skin analysis and a personalized skincare regimen tailored to their specific concerns. Drawing from data gathered from 1 million sources, the SAL skin analysis is a diagnostic tool that provides users with accurate, real-time results and solutions to their skin concerns. With the rise of at-home treatments, and the downturn in beauty services and clinic visits, the SAL skin analysis provides the next best option for users who wish to get expert updates on their skin condition and a deeper understanding of how to best care for their skin. It utilizes artificial intelligence (AI) technology to power its skin analysis, relying on a combination of machine vision and machine learning methods to detect faces and lighting conditions, and to extract and analyze facial information. To get their free skin analysis, users can simply scan their skin using their smartphone or web cameras on the SAL skin analysis platform and can get their Skin Scores —gauging levels of hydration, wrinkles, acne, or pigmentation — in less than eight seconds, all from the comfort of their homes. A personalized skin care regimen for both day and night, with products selected to best address each person’s specific skin challenges, is then provided by an advanced algorithm. Visit https://www.watsons.com.ph/ponds-skin-advisor-live to experience the Pond’s Skin Advisor Live skin analysis.

Tod’s No_Code J urban sneaker

TOD’S No_Code projects (a synthesis of advanced technology and high production quality) latest is the No_Code J, equipped with performance suitable for rough terrains. Korean designer Yong Bae Seok took many points of inspiration for the ‘J’ project from his trip to Silicon Valley in 2020 to produce the book, Silicon Valley, No_Code Life. In Yong’s words, “The new No_Code J (where ‘J’ stands for journey) answers the needs of people who are looking for adventure, contact with nature and the outdoors, even in a more urban context; thus making ‘J’ ‘all terrain’ where, in the words of the architect Louis H. Sullivan, ‘Form follows function.’” In the Philippines, Tod’s is exclusively distributed by Stores Specialists, Inc., and is located at Greenbelt 4, Rustan’s Shangri-La, and Shangri-La Plaza and online at Trunc.ph, Rustans.com, Zalora, and Lazada.

Asics’ new footwear and apparel collection

ASICS launches their new Celebration of Sport Collection, a cross-category footwear and apparel collection that celebrates the power of sport to uplift the world. Launching alongside a full apparel range, the Celebration of Sport Collection sees footwear across Asics’ Performance Running, Core Performance Sport and Sport Style categories given a striking design revamp. Each piece in the collection features bright, bold confetti-style detailing, taking visual cues from the sense of uplift and celebration that sport will inspire across the world this 2021. The 46-piece collection encompasses more than five different sports. For runners there are new iterations of the Gel-Kayano 28 and Novablast 2; tennis and volleyball players get the supportive, lightweight Court Speed FF and the responsive Netburner Ballistic FF 2. There is also an array of re-imagined Sport Style silhouettes, including the Gel-quantum 360 6 and Gel-quantum 180. The Celebration of Sport Collection is available online and instore. For details visit https://www.asics.com/ph/en-ph.

Blythe launches new Lip Treat After Party Collection

TO CELEBRATE Careline’s young brand ambassador Andrea Brillantes, Careline has launched its Blythe Lip Treat After Party Collection. It is an elegant nude lip collection that is enriched with vitamin E that protects lips from irritation and reduces damage caused by UV rays. It comes in five versatile shades namely Oatmeal, Pudding, Cheesecake, Banoffee, and Tiramisu. Whether one prefers a neutral or earth-toned shade, this collection has the shade to match a preferred look and skin tone. The Blythe Lip Treat After Party Collection is available on Careline’s official store on Lazada (bit.ly/CarelineLazada), Shopee (bit.ly/CarelineShopee), and in leading supermarkets, department stores, and drug stores nationwide.

Holiday gift shopping at RWM

RESORTS World Manila (RWM) integrated resort offers one-stop, non-stop shopping for those who are eager to start their holiday gift hunting. Streetwear brand Vans, and classic casual wear brand Dickies recently opened retail outlets at RWM’s Garden Wing, 3F Newport Mall. RWM has also opened its own signature retail outlet, The Exclusives Store, at the Ground Floor gaming area of the Grand Wing. RWM’s The Exclusives Store offers a curated selection of premium branded items from gadgets to apparel and accessories, and many more. Customers can pay for purchases using RWM membership points, cash, and credit cards. The Apple iPhone 13 now available for reservation at The Exclusives Store, which is open daily from 11 a.m. to 10 p.m. The Exclusives Store also carries premium signature items from RWM’s food outlets. Mall goers are assured of safety within the entire RWM complex, especially when shopping as the Newport Mall boasts of 100% vaccination rate of all retail frontliners. To know more about RWM’s shopping offers and operating hours, visit www.rwmanila.com or follow RWM’s official social media accounts, @rwmanila on Facebook and Twitter, and @resortsworldmanila on Instagram.

Uniqlo reopening Iloilo store

JAPANESE global apparel retailer, Uniqlo, is set to reopen its store at SM City Iloilo mall on Oct. 29. The revamped store, stationed at the Upper Ground floor of the mall’s North Wing, has been expanded from 608 sqm to 969 sqm sales area to ensure a better shopping experience for the Ilonggos. To celebrate the reopening of Uniqlo SM City Iloilo, a number of items will be offered for special prices during the opening weekend: Men’s Dry Pique Short Sleeve Polo Shirt will be available at P790 from P990; the Men’s and Women’s U Crew Neck Short Sleeve T-Shirt will be available at P390 from P590; the Women’s Mercerized Cotton Short Sleeve Mini Dress will be available at P790 from P990; the Women’s Ultra Stretch Cropped Leggings will be available at P790 from P990; and the Kids Easy Shorts will be available at P390 from P590. For updates, visit Uniqlo Philippines’ website at uniqlo.com/ph or download the Uniqlo App via Google Play Store or Apple Store.

Shop with Ayala Malls’ Zing App

TO SHOP and dine from home, Ayala Malls has come up with Zing, its customer convenience and rewards app. Shoppers are assured that only authentic items will get delivered as they access the stores’ official websites, plus, they get to earn points and access perks while shopping. Zing makes it easier for patrons to shop online via ZingShops. The feature lets customers scroll through Ayala Malls’ retail offerings. Participating labels and merchants are categorized accordingly: Fashion, Sports Active, Beauty & Health, Gadgets & Appliances, and Specialty. It also features Pinoy Artisano, which carries an assembly of distinctive brands featuring stylish local and international collections. Browse, click, and get redirected to various brands’ online stores. To assuage hunger pangs, check out ZingEats, the newest food ordering platform that lets customers pick and choose from multiple Ayala Malls food outlets including Botejyu, Denny’s, Italianni’s, Las Flores, and Wingzone among many others. Earn points for every ZingShops and ZingEats order by upgrading as a Zing Plus member. Zing Plus members have access to exclusive promos and flash sales.