If we rewind to 10 years ago when the global economy was busy recovering from the global financial crisis, and fiscal authorities were dialing back public spending and central banks were thinking of normalizing monetary policy, tax avoidance would not have made a lot of noise. But noise they made anyway when global firms such as Google and Amazon were accused of avoiding paying tax on their British sales.

The culture of naming and shaming big companies became more entrenched.

However, at the time, given these companies’ complicated tax structures, it proved difficult for tax authorities to prove illegal activities in what, for instance, Starbucks was reported to have done in 2013. With sales of about £400 million in UK, the British Broadcasting Co. (BBC) reported it “paid no corporation tax, transferred some money to a Dutch sister company in royalty payments, bought coffee beans from Switzerland and paid high interest rates to borrow from other parts of the business.”

What about Google and Amazon?

The BBC cited Google’s UK unit payment of only £6 million from sales turnover of £395 million. Amazon made £3.35 billion in the UK in 2011 but only reported tax expense of £1.8 million.

Like the coffee giant, these Silicon Valley behemoths were found to have avoided, but not evaded, tax obligations. All that the civil society could do was to name and shame them by saying something like “avoiding tax robs our public services.”

Today, when the world is imprisoned in economic lockdowns in a never-ending cycle of health protocols and prohibition of face-to-face gatherings and the demand for public money has never been so high, even tax avoidance, not to mention plunder of public money, may be considered a moral issue.

Even if naming and shaming produced results and public opinion should force big companies to pay the right taxes, this is far from socially desirable. A “voluntary” tax system could not be sustainable and, more important, predictable, in programming public spending for both social and economic services and infrastructure.

There is nothing new to this so-called tax avoidance. If we go by the tax books, conglomerates do it but the issue arises when companies cross a line that may be considered morally and legally inappropriate. This occurs when their accountants start employing “black-box” arrangements in which transactions are done for no commercial reason but to avoid paying tax.

Of the so-called Silicon Six — Amazon, Apple, Facebook, Google, Microsoft, and Netflix — it was reported by the Fair Tax Foundation that between 2011 and 2020, cash tax paid relative to their revenues ranged from only 0.4% for Amazon to Facebook’s 5.1%. Value-wise, Amazon made $1.6 trillion in revenues and paid only $5.9 billion in income tax. Facebook’s revenues of $327.8 million yielded income tax of a relatively big $16.8 million. In contrast, Apple’s $2.1 trillion in revenues resulted in tax payment of $101 billion and Microsoft’s $963 billion in revenues warranted a tax payment of $55 billion.

Amazon justified its modest tax payment based on its retail business model where profit margins are supposedly low and its huge investments in job creation and infrastructure. Facebook, on the other hand, explained that it would be more meaningful to compare their tax payment with their profits rather than revenues. Even if one were to do this, we see that Apple, with profits 4.5 times that of Facebook, paid nearly six times more than Facebook in taxes.

While Google and Amazon are the most visible of these digital companies that conduct business across borders, financial technology companies have mushroomed in recent years and have therefore posed new tax challenges on existing fiscal framework and ground rules.

In the Philippines, as in the rest of Asia, these new tax challenges could not have come at a more appropriate time than today. Digitalization has become more entrenched, opening up new grounds in driving fintech, e-commerce, and online services. These have enabled various applications in mobile money transfers, online procurement, and no-touch services transactions that are crucial in coping with the pandemic. With increased use of digitalization, tremendous opportunities have been opened to collect more revenues to finance the huge cost of containing the health crisis and to engineer economic recovery.

The view of the IMF’s Asia Pacific Department and Fiscal Affairs Department is reflected in their joint publication Digitalization and Taxation in Asia, and the webinar to launch it held three days ago, Sept. 14. A blog entry was also released in the IMF website by some of the 10 authors, Era Dabla-Norris, Ruud De Mooij, Andrew Hodge, and Dinar Prihardini. The common idea is that it’s been challenging for many Asian countries to tax tech giants because their presence is virtual.

First, what is the opportunity base in Asia? The Fund noted that in Asia, the market consists of about two billion internet users with great prospects for the future. Asia runs tech giants Alibaba, JD.com, Rakuten, and Tencent and hosts foreign tech giants like Facebook. Current tax regimes have issues on where these tech giants that straddle borders should pay. These tech giants are not exactly physically around Asia, their presence is limited in the digital platform. Collecting taxes on e-services and small-parcel deliveries is therefore less than straightforward.

Second, what are the potential issues? While some Asian countries have started to collect digital taxes by withholding taxes on payments for cross-border digital services or user-based turnover taxes on digital activities, it is possible this initial fiscal effort may be rendered superfluous should a new global system for profit taxation is agreed upon. The Fund reported that aside from the US and major Asian economies, some 134 countries under the umbrella of the Inclusive Framework of the Overseas Co-operation and Development have decided to allocate taxing rights on profits to countries where consumers and users are located, reflecting that tax administration is based on digital presence.

Does this mean trouble for multinational companies and tech giants? It might be too early to judge because innovative accounting techniques or the actual implementation of the future tax regime could change the possible outcome.

What is somewhat clear at this point is that some portion of the profits of those companies with global revenues in excess of a certain threshold would be allocated across countries in proportion to local sales and taxed under domestic laws.

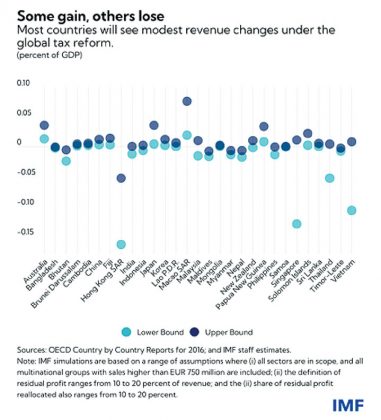

The 75-page report of the Fund outlined the potential outcome of the proposal on corporate tax revenues across Asian countries. In addition, the Fund also laid down the merits of digital services taxes and their revenue potential. An estimate of potential gains from collecting value-added tax on digital services and cross-border e-commerce sales of goods was presented in the report.

It was clarified that while easier to implement, the potential of digital services taxes is not very significant. For the Philippines, together with Bangladesh, Indonesia, and Vietnam, the estimate is just about 0.02% of GDP. With our current GDP level of around P21.5 trillion in 2019, this would only be about P4.3 billion. The other side to this small gain is its possible distortionary effect on business decisions without the assurance that it would deter tax avoidance. Trade relations could also be strained.

On the other hand, implementing the value-added tax would be difficult because online sales are exempted. This may be resolved by requiring non-resident suppliers of digital services to register with local tax authorities and pay appropriate taxes on their local sales. From this source, the Fund estimated a possible additional revenue of some $365 million or P18.3 billion for the Philippines.

Our take of these computations is that the Department of Finance should carefully assess the dynamics of these proposals and their possible impact on both tax administration — on whether this type of taxation would be simple enough to encourage tax payment and discourage tax avoidance — and tax take — whether under different scenarios, the numbers would remain pathetically insignificant.

At this time, every peso of public revenue is too precious to be lost either in tax avoidance or the plunder of the government treasury.

Diwa C. Guinigundo is the former Deputy Governor for the Monetary and Economics Sector, the Bangko Sentral ng Pilipinas (BSP). He served the BSP for 41 years. In 2001-2003, he was Alternate Executive Director at the International Monetary Fund in Washington, DC. He is the senior pastor of the Fullness of Christ International Ministries in Mandaluyong.