PHILIPPINE shares closed in the green on Tuesday as investor sentiment got a boost from improvements in the country’s vaccination rate and fresh data showing a narrower budget deficit in July.

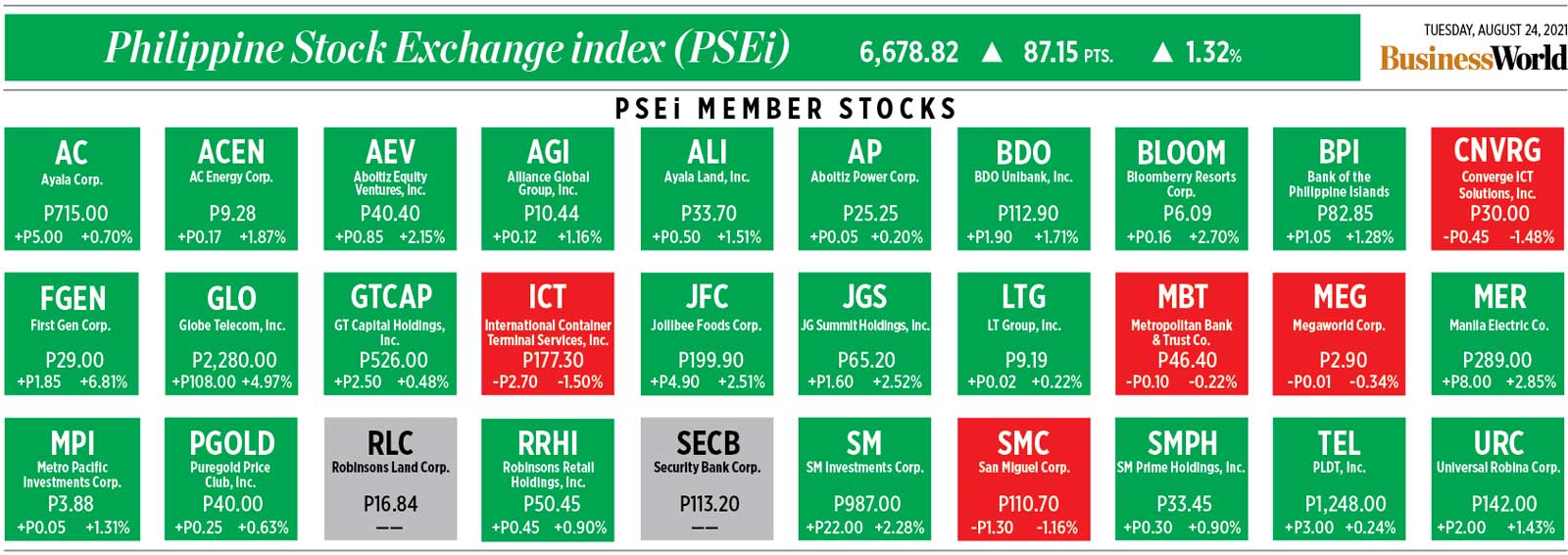

The Philippine Stock Exchange index (PSEi) gained 87.15 points or 1.32% on Tuesday to close at 6,678.82, while the broader all shares index added 33.92 points or 0.82% to end at 4,144.88.

“[This is] after the latest budget deficit data narrowed to the least in three months, local COVID-19 vaccines administered [went] above the 30 million mark, and after US stock markets mostly posted new record highs on optimism on increased immunization requirements or mandates versus COVID-19, stronger US existing home sales data,” Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a text message.

The Treasury reported on Tuesday that the country’s budget deficit narrowed to P121.2 billion in July, 13.57% lower than the P140.2 billion in the same month last year. Year-to-date, the budget deficit swelled to P837.3 billion, 19.5% up from a year ago.

“Market sentiment [is] also supported by Metro Manila already vaccinated 43% of the target population and targeting 50% by end-August 2021,” Mr. Ricafort added.

Overall, the country has administered over 30 million coronavirus disease 2019 (COVID-19) vaccines, but only 12.14% or 13.13 million Filipinos have been fully vaccinated.

The local stock market also appeared to have shrugged off the continued rise in COVID-19 cases. On Monday afternoon, the Health department reported a record 18,332 in daily COVID-19 infections, and admitted there was already community transmission of the more infectious Delta variant in Metro Manila.

Darren Blaine T. Pangan, trader at Timson Securities, Inc. said the US markets positive performance overnight appeared to have spilled over to the local market.

Investors cheered the news that the US Food and Drug Administration gave its full approval for the COVID-19 vaccine developed by Pfizer, Inc. and BioNTech SE, a move seen to boost vaccination rates.

“The local bourse closed higher as foreigners continue to be net buyers today. This comes after the two-day profit taking activity that happened the past few days,” Mr. Pangan said.

Net foreign buying increased to P291.11 million on Tuesday, from the P105.79 million logged in net purchases on Monday.

All sectoral indices posted gains on Tuesday. Holding firms rose by 112.85 points or 1.71% to finish at 6,678.89, while industrials went up by 138.04 points or 1.42% to close at 9,807.25.

The property index increased by 30.32 points or 0.99% to 3,073.39, while mining and oil gained 81.64 points or 0.89% to close at 9,199.61. Financials moved up by 12.70 points or 0.88% to 1,440.59; and services inched up by 6.01 points or 0.36% to end at 1,650.68.

Value turnover declined to P5.53 billion with 2.68 billion shares switching hands on Tuesday, from the P6.29 billion with 1.94 billion issues traded the previous day.

Advancers beat decliners, 106 against 83, while 54 names remained unchanged.

Timson Securities’ Mr. Pangan said he expects the market to trade within the 6,270 to 6,840 range. — K.C.G. Valmonte