ANALYSTS noted the relatively better performance of banks in the second quarter due to higher earnings but said the attractiveness of bank stocks remain tied to prospects of economic recovery.

The Philippine Stock Exchange’s (PSE) financials sub-index — which included the banks — ended the second quarter at 1,498.54. On a quarter-on-quarter basis, this marked a 9.1% gain in the sub-index as compared with the 5.1% decline in end-March and the marginal 0.8% gain in end-June 2020, respectively.

The sub-index outperformed the PSE index’s (PSEi) 7.1% gain in end-June, which in turn, marked a rebound from the 9.8% contraction logged in the first quarter.

In the three months to June, quarter-on-quarter gains were noted in the share prices of the following listed banks: Rizal Commercial Banking Corp. (RCB, 34.4%), BDO Unibank, Inc. (BDO, 11%), China Banking Corp. (CHIB, 10.6%), UnionBank of the Philippines (UBP, 10%), Metropolitan Bank & Trust Co. (MBT, 9.7%), Bank of the Philippine Islands (BPI, 8.8%), East West Banking Corp. (EW, 7.2%), Asia United Bank (AUB, 6.5%), and Philippine Business Bank (PBB, 1.1%).

On the other hand, the following listed banks saw their share prices decline in the second quarter: Philippine Bank of Communications (PBC, -13.9%), Security Bank Corp. (SECB, -2.5%), Philippine Savings Bank (PSB, -0.4%), and Philippine National Bank (PNB, -0.2%).

“We attribute the solid performance of banking stocks to three main factors: (1) [Moody’s Investors Service’s] upgrade of PH banks outlook to “stable” from “negative” in April, (2) the release of the implementing rules and regulations for FIST (Financial Institutions Strategic Transfer) law that will allow banks to identify which among the nonperforming assets can be unloaded to FIST corporations, and (3) the compelling recovery in [first-quarter] earnings, supported by lower provisions for loan losses,” said Unicapital Securities, Inc. Research Head Justin Lawrence J. Tembrevilla.

To recall, Moody’s upgraded in April its outlook for the Philippine banking industry to “stable” on expectations of an improvement in the operating environment amid a “mild economic recovery.” However, it also warned that risks to banks’ asset quality remain as borrowers’ ability to pay is still hampered by the prolonged disruption of business activities, subdued consumer sentiment, and the challenged labor market conditions.

Regina Capital Development Corp. Senior Equity Research Analyst Paola Beatrice C. Lopez said that banks that they monitored “performed as expected” during the second quarter.

“[N]et interest income growth remained intact despite the weakened loan demand because the low-interest rate environment offset the former’s dragging effect,” Ms. Lopez said.

China Bank Securities Corp. Research Associate Zoren Philip A. Musngi noted that while most banks reported year-on-year improvements in their profits due to lower loan loss provisions, their core lending performance is “concerning.”

“[L]oan portfolios continued to contract while net interest margins declined from the low-interest rate environment, and [that] nonperforming loans (NPL) steadily inched higher,” he said.

The Bangko Sentral ng Pilipinas’ (BSP) latest Senior Bank Loan Officers’ Survey published last July showed most respondent banks maintained their lending standards for both enterprises and households in the April to June period, based on the modal approach. However, there was net tightening of credit standards for both enterprises and consumers when based on the diffusion index approach of the study.

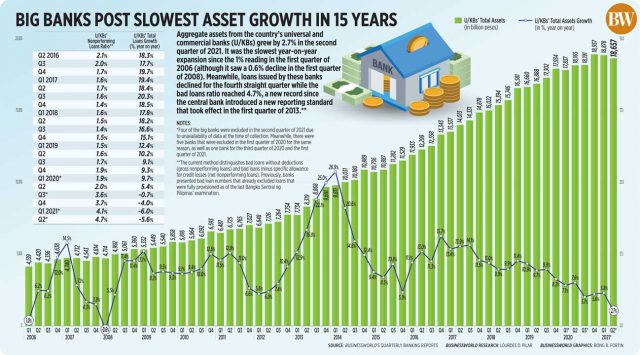

Since the onset of the coronavirus disease 2019 (COVID-19) pandemic, the quarterly survey reflected banks’ aversion to granting credit. Latest BSP data showed outstanding loans by big banks shrank for the seventh straight month in June by 2%, a softer pace compared with previous months as demand picked up with the further reopening of the economy.

In a separate BSP release, universal and commercial banks (U/KBs) showed net interest margin — or the ratio that measures banks’ efficiency in investing their funds by dividing annualized net interest income to average earning assets — further dipped to 3.39% as of June versus the 3.49% in March 2021 and 3.68% in June 2020.

Provision for credit losses on loans and other financial assets among these big banks amounted to P56.14 billion as of end-June, less than the P99.14 billion in the same period last year. However, this was higher than the P20.61 billion recorded in the first quarter this year.

Nevertheless, aggregate profits amounted to P113.49 billion, 44.3% more than P78.67 billion last year and more than double the P48.44 billion in the previous quarter.

Meanwhile, the gross NPL ratio among U/KBs stood at 4.03% as of June, the highest since the 4.17% posted in May 2008

OUTLOOK

Similar to the previous quarter, analysts remain cautious over the prospects of listed banks in the next few months even as there is still room for investors to take positions and rake in gains.

China Bank Securities’ Mr. Musngi said, the emergence of COVID-19 strains is a “source of concern” despite the improvement in vaccination rates.

“At this point, we are cautious on bank stocks since there remains a lot of uncertainty over the effectiveness of the current lockdown measures in containing the Delta variant,” Mr. Musngi said, referring to the more contagious variant of the COVID-19 strain.

“Investors should continue to monitor the monthly banking industry lending data for signs of improvements, along with the BSP lending standards survey for any remarkable changes in lending appetite. Meanwhile, NPL ratios should be eyed as they continue to creep up. This may lead to more provisioning (especially in banks with lower NPL coverage ratios), impacting profitability,” he added.

COL Financial Group, Inc. Senior Research Analyst John Martin L. Luciano said investors should continue to monitor asset quality indicators following the reimposition of the enhanced community quarantine (ECQ) in August.

“Moreover, investors will look at the pace of the government’s vaccination rollout as well as its ability to contain the uptick in COVID-19 cases as these would determine how restrictive the quarantine protocols will be going forward. These, in turn, would affect how fast the economy will recover and ultimately loan demand,” he said.

Meanwhile, Regina Capital’s Ms. Lopez advised investors to keep an eye out on macroeconomic data as they would influence the BSP’s decision to implement changes in monetary policy.

“Furthermore, the business and consumer sentiment could also be a factor in determining the return of loan demand. For now, we expect the same trends to generally persist in the near term. Provisions would likely continue to taper, but asset quality is something to look out for,” Ms. Lopez said.

“The pandemic, and the uncertainty it brings, has weakened loan demand and is putting the banks’ asset qualities at risk,” she added.

First Metro Investment Corp. Head of Research Cristina S. Ulang said to watch out for credit and NPL cycle directions as these two are “picking up speed relative to the economic trajectory.” She also recommended to load up on the BDO, MBT, and BPI shares.

Unicapital Securities’ Mr. Tembrevilla said investors will remain watchful for the possibility of NPLs to “remain elevated” as the return to stricter quarantine measures “will present cash flow challenges to most borrowers.”

On the other hand, he said second-quarter earnings “could present a positive surprise” on low-base effects, adding a further easing of loan loss provisioning is also a “welcome development.” — Nadine Mae A. Bo