By Lourdes O. Pilar, Researcher

RISING INTEREST RATES and further reopening of the economy brought strong earnings to listed banks in the second quarter.

During the second quarter, the barometer Philippine Stock Exchange index (PSEi) lost 14.5% on a quarter-on-quarter basis, a reversal from the 1.1% growth posted in the first quarter and last year’s 7.1%.

Meanwhile, the financials subindex, which included the banks, also dropped by 14.9% quarter on quarter in the April-June period versus the 5.5% growth recorded in the first quarter. This was a turnaround from the 9.1% jump recorded at the end of last year’s second quarter.

Most of the banks’ stock performance dipped in the second quarter.

“With regard to price performance, most bank stocks slid into negative territory (on both a year-on-year and quarter-on-quarter basis) on general equity market weakness as investors’ risk appetite deteriorated against a backdrop of rising inflation and tightening liquidity due to hawkish monetary policy moves across the globe,” said Rastine Mackie D. Mercado, research director at China Bank Securities Corp.

Among the top 3 largest private banks in terms of assets, shares in BDO Unibank, Inc. (BDO) dropped by 16.7% quarter on quarter to P110.50 each in the second quarter. Metropolitan Bank & Trust Co. (MBT) also declined by 16.1% to P47.48 apiece, while Bank of the Philippine Islands (BPI) slid by 14.9% to P84.80 per share.

Bank of Commerce (BNCOM) which was listed in the PSE last March, dropped the most by 34.5% to P8.00 per share from P12.22 at the end of first quarter.

Meanwhile, listed banks that saw quarter-on-quarter growth in their stock prices were Asia United Bank Corp. (AUB), which went up by 2.3% to P44.80 each, and Philippine Bank of Communications (PBC), which inched up by 0.1% to P17.98 apiece.

Though most of the banks showed losses in their stock prices, lenders still showed strong earnings performance in the second quarter.

Rachelleen A. Rodriguez, research analyst at Maybank Investment Banking Group–Philippines, said that the reopening of the economy brought strong earnings in the second quarter.

“The sector’s strong second-quarter earnings results were mainly a function of the economic reopening, which not only improved borrowers’ credit profiles (which, in turn, led to lower NPL [nonperforming loans] incidence and lower provisions expense for banks), but also drove borrowing appetite across corporates and SMEs (small and medium enterprises),” Ms. Rodriguez said.

Cristina S. Ulang, research head at First Metro Investment Corp. (FMIC), said in an e-mail that yield spread is wider due to the rising benchmark interest rates by the central bank’s Monetary Board.

“That means more net interest income for the banks as they increase their lendings amid the strong GDP (gross domestic product) growth recovery story,” she said.

“Banks also took advantage of the excess liquidity in the system which means lower cost of funds for them even as the general level of interest rates rose,” Mr. Ulang said. “That’s because a large part of their funding were from cheap demand and savings account.”

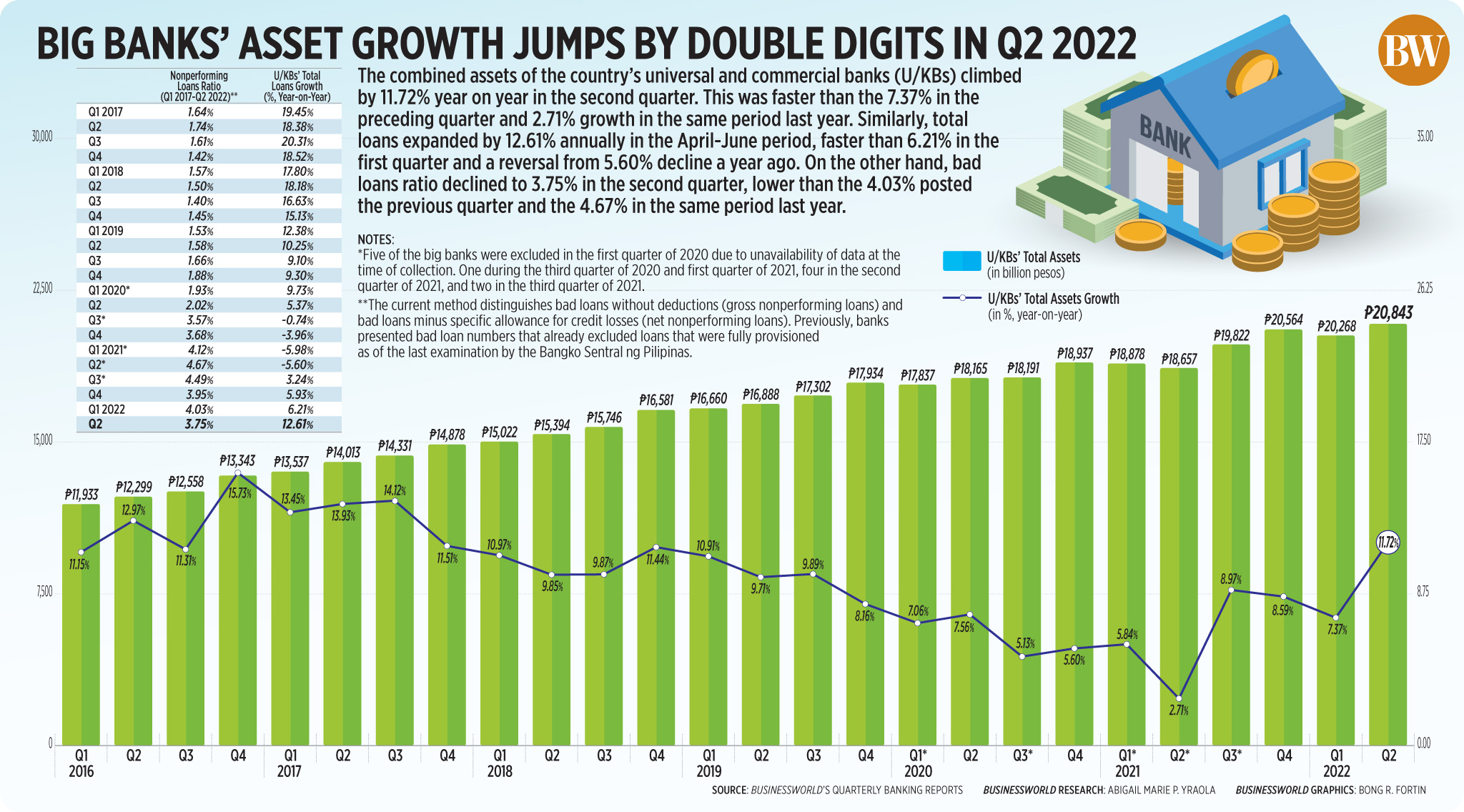

Aggregate net income of universal and commercial banks went up 16.2% to P131.82 billion as of end-June from P113.49 billion last year, data from the Bangko Sentral ng Pilipinas showed.

Gross total loan portfolio of these big lenders rose by 11.3% to P10.96 trillion as of end-June from P9.84 trillion a year ago.

The big banks’ gross NPL ratio also improved to 3.25% in June from 3.38% in May and 4.03% in June last year.

The big banks’ net interest margin (NIM) — a ratio that measures banks’ efficiency in investing their funds by dividing annualized net interest income to average earning asset — improved to 3.29% in the second quarter from 3.23% in the first three months of the year. However, this was lower than 3.39% NIM recorded in the second quarter of last year.

Since March, most parts of the country have remained under the most lenient alert level.

In the second quarter, the Philippine economy expanded by 7.4% as rising inflation weighed on consumer spending, based on preliminary data released by the Philippine Statistics Authority.

The second-quarter growth print was slower than 12.1% a year earlier and 8.2% in the first quarter.

BANK STOCK PICKS

Analysts suggested that investors should pick those bank stocks showing strong income growth, their loan portfolio composition, and the ability to play with high interest rates.

For BDO Securities Corp., investors should look at banks that are able to maintain good asset quality and are better positioned to benefit from broadening economic activity and the rising interest rate environment.

“Banks that beat earnings expectations such as BPI and SECB (Security Bank Corp.) stood out, with their first half earnings up 73% and 100% respectively. Both banks also posted strong loan growth of 14%-15%, which are above industry average of 12%,” BDO Securities said in an e-mail.

“Healthy core operations were supplemented by asset sale gains and tax adjustments in the case of BPI. While SECB’s performance was boosted by significantly reduced provisioning costs and normalized tax expenses,” it added.

“Among the banks we follow, the names that beat our expectations were BPI and SECB. The common ground of the aforementioned is the significant reduction in their credit loss provisions and healthy expansion in their core business,” said Luis A. Limlingan, head of sales at Regina Capital Development Corp.

Mr. Limlingan added that the banks investors eyeing to get into position should consider the bank loan portfolio composition and have guided attractive NIM sensitivity to BSP’s rate adjustments.

FMIC’s Ms. Ulang said MBT stood out after its first-half earnings hit its pre-pandemic level, adding that the bank “got earnings momentum, which was 33% up year-on-year to P15.6 billion.”

“In terms of stock price performance, AUB and China Banking Corp. (CHIB) stood out as they managed to stay in positive territory in terms of year-to-date (YTD) gains at 3.6% and 3.5%, respectively,” China Bank Securities’ Mr. Mercado said.

“It is also worthy to note that both banks posted robust first half of 2022 bottom line performance as measured by RoE (return on equity) at 15.8% and 16.4% for AUB and CHIB, respectively, both among the top in the industry,” he added.

RATE HIKES

Last May, the Philippine central bank raised its key benchmark rate by 25 basis points (bps), the first time since 2018 followed by another 25 bps in June, to tame inflation and prevent the peso from further devaluation.

However, the BSP raised its key interest rates by 75 bps in a surprise move in July and kept the door open for further tightening. On Aug. 18, the central bank further tightened its policy rate by another 50 bps. The central bank has raised rates by a total of 175 bps so far this year.

The overnight reverse repurchase rate now stands at 3.75%, while the rates on the overnight deposit and lending facilities were also increased to 3.25% and 4.25%, respectively.

“Rising rates are generally positive for the banks, especially for the BDO, BPI, since over 70% of their loan portfolios have variable rates, 75-78% of their borrowers are corporates and their current account/savings account percentages are high, at 72-85,” Maybank’s Ms. Rodriguez said.

“It typically takes six months for banks to fully price in the incremental rate adjustment, so we expect banks’ NIMs to reflect the 75-bps rate hike in July by first quarter of 2023,” said Ms. Rodriguez.

Aniceto K. Pangan, trader at Diversified Securities, Inc., said in an e-mail that the recent rate hike to reign on inflation will positively increase interest loan margin in banks and further enhance banks earning’s growth.

“Though increase in interest rate may slow down economic activity, it may continue to provide growth for the banking sector on increase interest loan margin, as long as, this would not cause economic recession,” said Mr. Pangan.

Allyza L. Espiña, equity research analyst at RCBC Securities, Inc., expects the rate hikes to expand banks’ NIMs.

“We don’t see any substantial impact of the increased rates on loan growth as industry loan levels have been picking up even with rising interest rates,” said Ms. Espiña in an e-mail.

OUTLOOK

Moving forward, listed banks’ stock prices as well as net incomes would be sustained until next year, analysts said.

Ms. Rodriguez expects the increased lending activity, particularly in the corporate segment, which accounts of 75% of current exposures.

“This will be boosted by a collective expansion of the NIMs, particularly in the coming quarters as the banks reflect the incremental rate hikes to the predominantly variable-rate loan books. Although banks have begun to rebuild their securities portfolio which resulted higher interest income accruals, we expect trading to continue to be weak,” said Ms. Rodriguez.

Ms. Rodriguez also added that rate hikes dropped trading incomes by 20%-40% year on year, the downward impact on earnings was more than offset by better asset yields, given that 70% of banks’ loan books have variable rates, and higher foreign exchange (FX) trading volumes arising from the volatile FX during the period.

“We expect this trend to continue towards third quarter and until 2023,” she said.

“On the fundamental front, I think the current bottom-line growth momentum would just be sustained until next year. Although this assumes a couple of factors including continued loan demand restoration, proper timing of passing through rates to clients, and local economy stays on track to recovery,” Mr. Limlingan said.

“Banks shares are likely to remain firm given good earnings prospects amid a reopened economy and a likely peaking inflation based on BSP messaging,” Ms. Ulang said.

Toby Allan C. Arce, head of sales trading at Globalinks Securities and Stocks, Inc., said in an e-mail that the current monetary policy tightening cycle is favorable for Philippine banks but is not expected to result in a significant decline in credit growth and asset quality.

“Profits and loans of Philippine banks will likely continue to grow as the economy recovers from the coronavirus pandemic. The banking sector is also seen to remain resilient amid shocks on the back of their strong capital positions,” said Mr. Arce.

“Banks’ NPL ratios are expected to have peaked and will continue to gradually decline by end-2022. Over the next year, higher inflation and rising rates could dampen demand for loans and increase defaults among consumers and small businesses, but these risks are seen to be manageable,” he added.