Fed poised to cut rates this week, with more easing likely on tap

Federal Reserve policymakers are widely expected to reduce US short-term borrowing costs this week by a quarter of a percentage point for the second time this year as they look to prevent further slowing in the labor market.

Odds are it won’t be the last of the series.

Climbing unemployment insurance claims suggest that labor market demand continues to cool, even as the government shutdown delays publication of most official economic statistics, including the unemployment rate, last estimated at 4.3% in August.

Milder-than-expected inflation readings, including last week’s report that the consumer price index rose 3% in the 12 months through September, have put worries of tariff-driven price pressures on the back burner.

And perhaps more importantly, the Fed’s consensus-crafted post-policy-meeting statement following last month’s quarter-point rate cut incorporated a reference to “additional adjustments” in the policy rate.

Fed Vice Chair for Supervision Michelle Bowman called out that language specifically as foreshadowing future interest-rate cuts, and analysts do not expect the Fed to point to a possible pause by tweaking that language.

“While a good chunk of the committee would probably like to signal that a December ease shouldn’t be taken for granted, we think this alternative wording choice might be too hawkish for the leadership,” wrote JP Morgan Chief US Economist Michael Feroli.

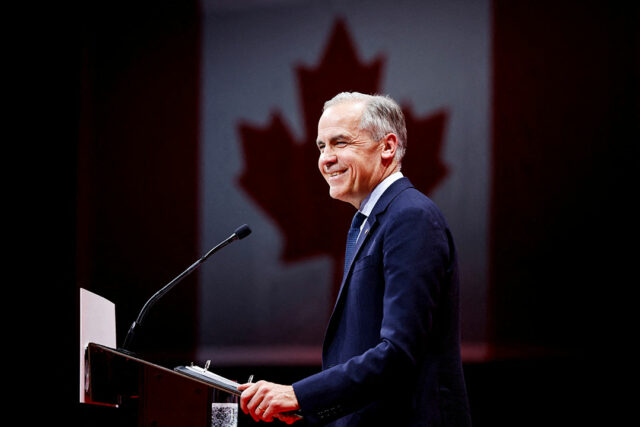

To be sure, Fed Chair Jerome Powell won’t use his post-meeting news conference on Wednesday to suggest another rate cut in December is already in the bag.

There’s too much that could change before then, with global trade discussions in flux that could remake the outlook for prices as well as for economic growth more broadly.

And an end to the government shutdown that restarts the publication of data could also mean Fed policymakers get three months of employment data between now and their December meeting, potentially reshaping their views of the state of the labor market.

“Powell is likely to keep options open and not pre-commit to a particular action through year-end,” Deutsche Bank economists said.

A quarter-point rate cut on Wednesday at the close of the Fed’s two-day meeting would put the policy rate in the 3.75%-4.00% range. Financial markets are betting heavily on further rate cuts in both December and January.

The Trump administration has been vocal about its desire for lower interest rates, keeping Powell under intense political pressure to deliver rate cuts even as he manages a deep split within the Fed’s own policymaking ranks.

Since September’s decision, several Fed policymakers have called for caution on policy easing, citing worries about inflation that has been well above the Fed’s 2% target for the last several years.

More, however, have said they feel further rate cuts will be needed to manage the risk of more job-market deterioration.

New Fed Governor Stephen Miran, who plans to return to his job as White House economic advisor at the end of his Fed term in January, could cast a dissent this week, as he did last month in support of a half-point interest rate cut.

Beyond the interest-rate decision itself, the Fed could signal this week it will soon stop shrinking its balance sheet, ending its so-called quantitative tightening as soon as this month. Analysts say this week’s meeting will also likely include a vigorous debate about how the Fed communicates its rate-path guidance as it looks to revamp its communications. — Reuters

Since its founding in 2002,

Since its founding in 2002,