Let us begin by describing the healthcare situation through the realities of ordinary Filipinos.

The 2023 Philippine National Health Accounts show that for every P10,000 spent on healthcare, a significant P4,000 is shouldered by the individuals themselves, placing a heavy and often overwhelming financial burden on the average Filipino.

Supreme Court Associate Justice Jhosep Lopez narrated during one of the oral arguments that he incurred a P7 million hospital bill for undergoing treatment for esophageal cancer, of which the country’s state insurer, the Philippine Health Insurance Corp. (PhilHealth), only covered a minuscule portion — 0.71% or P50,000. For an average middle-income household, this will mean depleting a lifetime of savings and, in many cases, incurring debt.

Those who cannot afford the cost of healthcare may skip going to health facilities altogether. The 2022 National Demographic and Health Survey (NDHS) shows that among 15- to 49-year-old women respondents, almost half expressed that the most common problem in accessing healthcare was getting money for treatment (42%).

Amidst all these, in 2024, the Department of Finance (DoF) ordered PhilHealth to remit P89.9 billion of its alleged “excess” funds to the national treasury to fund the unprogrammed appropriations. This order was based on a provision, inserted for the first time, that authorizes government-owned and -controlled corporations (GOCCs) to allocate a portion of their fund balances to finance key programs in the Unprogrammed Appropriations, which includes non-health programs such as the government counterpart funding for the Panay-Guimaras-Negros Island Bridges and the Metro Manila Subway Project.

This brazen move by Congress and the Executive (through the DoF) compelled citizens’ groups to seek redress from the Supreme Court by filing a petition in August 2024, challenging the legality of the fund transfer. Two tranches of remittances totaling P60 billion were made before the Supreme Court issued a temporary restraining order. However, this P60 billion that was withdrawn from PhilHealth was just the tip of the iceberg.

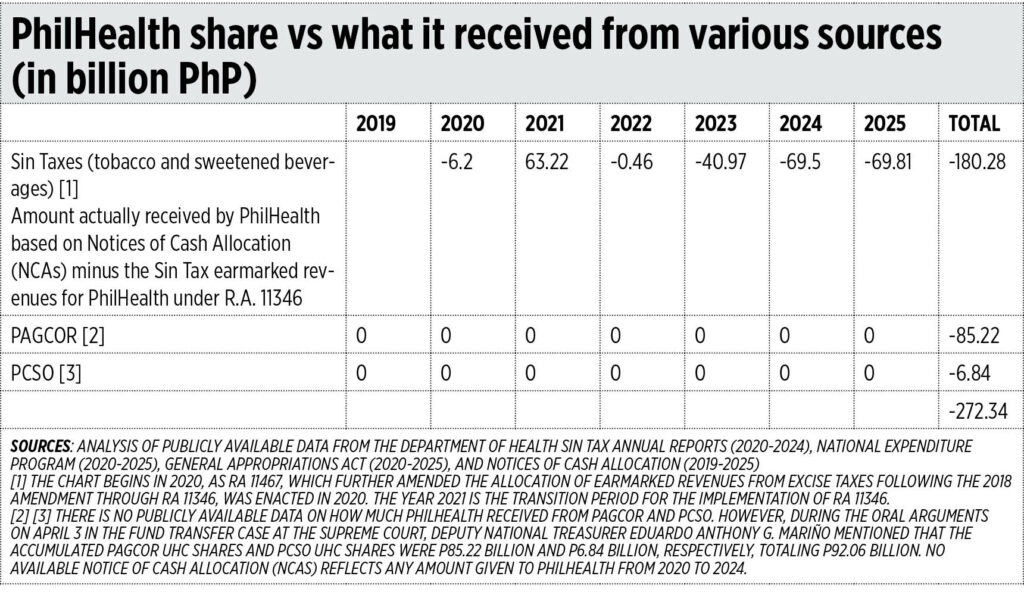

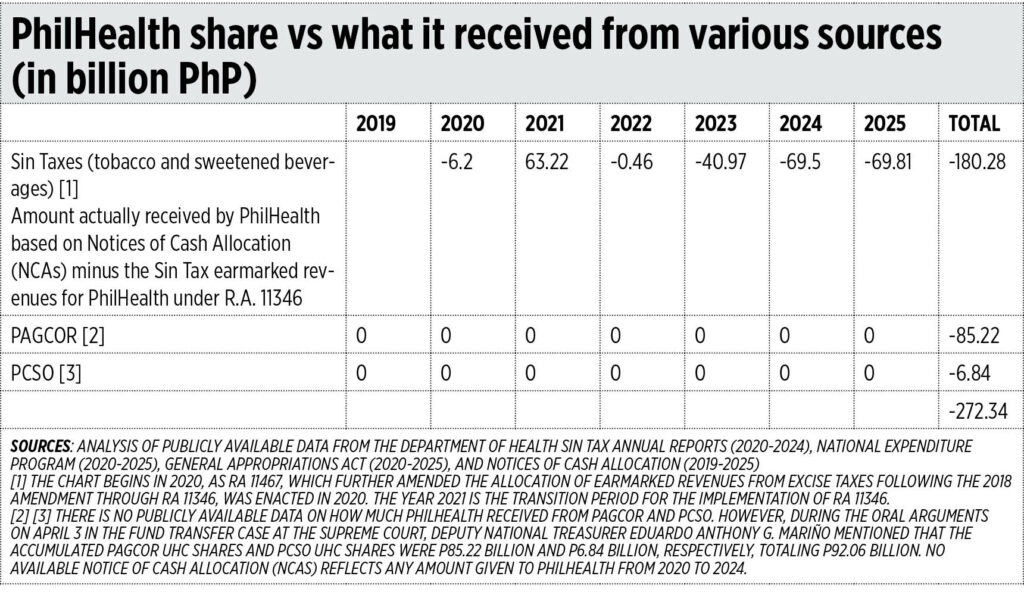

The Universal Health Care Act, enacted in 2019, directs the collection of funds from sin taxes derived from alcohol, cigarettes, and sweetened beverages; in particular, the Sin Tax Reform Laws mandate that 80% of 50% of revenues from tobacco and sweetened beverages are allocated to PhilHealth. Other sources of PhilHealth funding are the following: 50% of the National Government’s share from the income of the Philippine Amusement Gaming Corp. (PAGCOR) and 40% of the Charity Fund of the Philippine Charity Sweepstakes Office (PCSO) for the ongoing improvement of PhilHealth benefit packages.

The available data reveal that since 2019, PhilHealth has yet to receive a single centavo of its share from PAGCOR and PCSO since the implementation of the UHC Law. In total, the funds withheld from PhilHealth would amount to P272.34 billion. If the P60-billion fund transferred by PhilHealth to the national treasury is to be included, which is also sourced from the sin taxes, the total amount withheld from PhilHealth will yield a staggering P332 billion (see the accompanying table).

This shows that the budgeting process goes far beyond simple allocations from the national budget. It involves multiple layers of authorization before public funds are disbursed. Agencies must first secure allotment releases through General Allotment Release Orders (GAROs) for General Fund items and Special Allotment Release Orders (SAROs) for budget items needed for special budget requests, like the National Health Insurance Program (NHIP), which only allows them to incur obligations, not to spend cash.

As clarified by the Supreme Court in the case Belgica vs Executive Secretary (G.R. 208566), SAROs do not guarantee fund release and may even be revoked, making the Notice of Cash Allocation (NCA) the ultimate directive and indicator for government spending.

Despite the Department of Budget and Management (DBM) reporting high allotment release rates, actual disbursement — where goods and services are delivered and paid for — depends on the issuance of NCAs.

But the DBM has systematically deprived the provision of cash allocation for NHIP and inexplicably denied the same for the PhilHealth benefit improvement packages in the past six to seven years.

Adding insult to injury, as the reduction of PhilHealth funds was being challenged over at the Supreme Court, Congress’ Bicameral Conference Committee decided to give zero budget to PhilHealth for fiscal year 2025, effectively slicing at least P69.81 billion from the country’s health insurance that should have been allocated to it based on the calculated allocations from earmarked revenues from the sin taxes for the said year.

It would seem that the neglect and deprioritization of spending on PhilHealth since 2023 paved the way for a zero budget in 2025, as approved at the bicam level. A significant cut of P40 billion was made to the 2024 PhilHealth budget, which was also dastardly engineered at the bicameral conference committee level, where there was no public scrutiny.

COUNTING THE COST: HOW MUCH HEALTHCARE WAS DENIED TO FILIPINOS?

The funding withheld from PhilHealth since 2019 could have already made an impact in reducing the high out-of-pocket health expenses of Filipinos, which, based on the 2023 Philippine National Health Accounts, is about 44% of the country’s total health expenditure, or P550.2 billion.

Let us give some examples of where the PhilHealth funds should have gone. For instance, the full implementation of PhilHealth’s Konsulta package — a set of comprehensive outpatient benefits which includes consultation, selected diagnostic and laboratory tests, and medicines — which costs P194 billion annually, could significantly reduce high out-of-pocket expenses in the long run by providing cost-effective preventive interventions at the primary level, thereby offering healthcare support that reaches communities.

This shift could potentially change the healthcare focus from curative care, which is typically more expensive, to preventive care. Preventive care not only costs less but also enables early intervention, leading to better health outcomes and a reduced burden on hospitals. However, it currently accounts for only about 7% of the country’s health expenditures. The Universal Health Care Law also requires that the Konsulta service be rolled out and implemented in 2023. As of June 30, 2024, only 20% of the population had registered with an accredited PhilHealth Konsulta provider.

It is essential to recognize that UHC is not solely about health financing, which is done primarily through PhilHealth. Health financing should be complemented by a public health system that efficiently, effectively, and equitably provides affordable health services to the people. This implies the ongoing need to strengthen and scale up the capacity of DoH to ensure that, with the expanded utilization of PhilHealth benefits, trained personnel, medical facilities, and supplies are there to put those PhilHealth benefits to work. Absent these medical complements, the PhilHealth benefits will have limited use and impact.

The denial of P332 billion mandated to go to PhilHealth by law since 2019 also betrays a lack of understanding and appreciation of policymakers regarding the role of social insurance as a social protection measure that promotes equity and redistribution in society. It seems that this lack of appreciation of the role of a social health insurance flows from a policy mindset that sees the value of public services from a fiscally conservative perspective. This limited policy mindset is exemplified by the following comments such as when the Executive and Congress sought to justify the fund transfer by insisting that “may mga natutulog na pera na binabayaran pa natin ng interest, mas mabuti na kung hindi nagagamit ang iba diyan at natutulog lang, sayang naman, gamitin natin (There are some dormant funds that we are still paying interest on, it would be better if some of them were not used and just lying around, it’s a waste, let’s use them),” (Finance Secretary Ralph Recto, Aug. 19, 2024); “…hindi puwedeng sisihin na nagkulang tayo sa pagbibigay sa kanila [PhilHealth] kasi nga ang daming pera na nandyan. Hindi nila pinamimigay ’yong pera doon sa mga nangangailangan, tinuturuan din natin sila ng leksyon… (…we can’t be blamed for not giving them [PhilHealth] enough because there’s a lot of money there. They’re not giving that money to the needy, we’re also teaching them a lesson…),” (Senator Grace Poe, Dec. 12, 2024). Furthermore, Solicitor General Menardo Guevarra remarked that “the Congress’ inclusion of Special Provision 1d in the General Appropriations Act of 2024 and DoF’s issuance of Circular No. 003-2024 are the government’s common sense approach” (Feb. 4).

What needs to be underscored to our policy makers are two things: one, the Filipino people have a right to health, the fulfillment of which has been mandated by law; and two, increasing (rather than reducing) the budget of PhilHealth is an investment in the human development of our people, which in turn can help them become more productive citizens.

Unless the full potential of the UHC is realized, there is no room to discuss if there are indeed “excess” funds in PhilHealth. For example, this means that PhilHealth and the Department of Health should first fully implement the Konsulta Package and make sure all patients who need the basic PhilHealth package are covered.

In this context, we look forward to the decision of the Supreme Court, which can further shed light on the true state of the PhilHealth funds. Some questions to ponder are: Is there such a thing as “excess” funds when the 10-year implementation of the UHC is still ongoing, and unpaid recorded and recognized hospital claims remain outstanding? During the Supreme Court Oral Arguments on the PhilHealth fund transfer, Associate Justice Amy Lazaro Javier cited Commission on Audit reports showing that PhilHealth was actually “bankrupt.” It was also established that PhilHealth’s insurance contract liabilities exceeded its reserve fund.

Furthermore, Associate Justice Benjamin Caguioa thoroughly questioned the absence of a Special Account in the General Fund (SAGF) of the earmarked revenues from the sin taxes. During the Oral Arguments, the Bureau of the Treasury admitted that special funds derived from sin taxes are commingled with all the other funds of the government in the general fund. According to Justice Caguioa, this matter of establishing guardrails for the specific revenue measures earmarked for the implementation of the UHC Law may become part of the Supreme Court’s decision. We are hopeful that the Supreme Court will issue a ruling in favor of the Filipino people who are all PhilHealth members.

Meanwhile, there is a new Supreme Court petition filed by 14 organizations and individual petitioners questioning the non-allocation of mandated funds for PhilHealth. Among the petitioners is former health secretary Dr. Jaime Galvez Tan, the first chairperson of the PhilHealth Board, who is known for his decades-long work and advocacy on the shift to a primary healthcare approach to health.

As the budget legislative season approaches, we join our fellow budget advocates in calling for a genuinely open, transparent, and accountable process in budget-making at all levels. In particular, there is a need to prevent anomalous and highly irregular decisions by the bicam committee from happening again. As such, the practice of secretive bicameral conference committee meetings must end.

We call on the legislators to allow the public to monitor all budget-related meetings; after all, the budget decisions arrived at in those meetings are about funds that came from us, the taxpayers, whether direct or indirect.

Finally, we respectfully remind our policymakers to follow the law on the automatic appropriation of earmarked revenues from sin taxes to PhilHealth. This law is the hard-earned fruit of a long and arduous advocacy waged by many citizens and health professionals together with like-minded government officials from the past. Let us not undo the gains that the Filipino people have won; instead, let us secure these and move forward.

Maria Victoria Raquiza, PhD, is an associate professor at the University of the Philippines National College of Public Administration and Governance (UP NCPAG) and co-convenor of Social Watch Philippines. Alce Quitalig is the senior budget specialist at Social Watch Philippines.