By Edg Adrian A. Eva, Reporter

FOR CLUB BALAI ISABEL, a lakeside resort in Talisay, Batangas province, Taal Volcano, one of the Philippines’ most iconic natural landmarks, is both an economic lifeline and an ever-present risk.

“Taal Volcano is both a gift and a curse,” Chief Operating Officer Cecille Terrible told BusinessWorld in an interview. “It’s a blessing because it is a world-class beauty, a world-class treasure to be close to. But it has also been active since the 2020 eruption.”

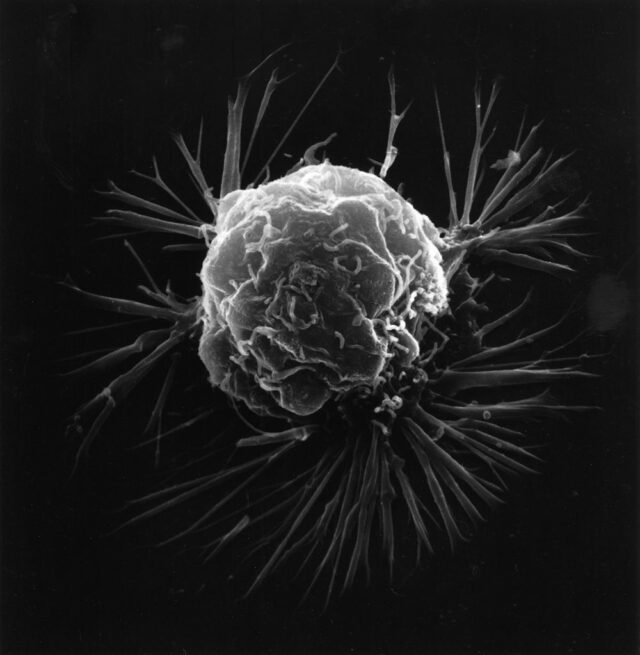

Taal Volcano sits majestically in the heart of Batangas, its calm green waters and postcard-perfect crater having long defined the skyline of Tagaytay City and powered the province’s tourism and agriculture industries.

Yet beneath its beauty lies an unpredictable force that has repeatedly reshaped lives, economies and landscapes.

Yet beneath its beauty lies an unpredictable force that has repeatedly reshaped lives, economies and landscapes.

Taal’s power is as real as its beauty. Its last major eruption in January 2020 blanketed nearby provinces in thick ash and caused P3.4 billion in damage to infrastructure and agriculture across Batangas, Laguna and Cavite, according to the National Disaster Risk Reduction and Management Council (NDRRMC).

The volcano remains under Alert Level 1, with a minor phreatic eruption recorded as recently as this week.

The volcano’s eruptions have made Taal both a symbol of resilience and a source of recurring hardship for communities that live around it.

Batangas recorded about nine million tourists in 2022, nearing pre-pandemic levels after peaking at 13.5 million in 2018, according to data from the Cavite Provincial Tourism Office. Much of that tourism is anchored on Taal Volcano, which dominates the view from Tagaytay City.

Originally designed as a residential subdivision, Club Balai Isabel transitioned into a resort in 2007 to meet rising demand from local and international visitors. It now spans 14 hectares, making it one of the biggest properties around Taal Lake.

When Taal erupted in 2020, the resort was buried in ash. “All the trees were destroyed, and we looked like a vast wasteland,” Ms. Terrible said.

The resort reopened a month later but has continued to face cancellations whenever Taal’s alert level rises. “Every time there’s a scare, people cancel. They get scared to come,” she said.

To address this, Club Balai Isabel now works closely with the Philippine Institute of Volcanology and Seismology to provide guests with real-time updates and educational materials on volcanic alert levels.

The town of Taal, known for its heritage houses and ancestral architecture, also bore the brunt of the 2020 eruption.

“It really became a ghost town,” Jocelyn Villavicencio Joven Quiblat, owner of Villavicencio Wedding Gift House, one of Taal’s most prominent ancestral homes, said in an interview.

A report by the Batangas Provincial Tourism and Cultural Affairs Office showed that tourism sites within 14 kilometers of Taal Volcano suffered P86.5 million in damage and P123.2 million in losses after the 2020 eruption. Cultural sites reported an additional P2.8 million in damage.

The Villavicencio house, fortunately, escaped significant destruction. Ms. Quiblat said that while the disaster disrupted tourism, Taal Volcano remains a defining part of their identity.

“It’s still a gift to our province,” she said. “Because the town shares its name with the volcano, people recognize us more — it draws visitors back.”

ENDEMIC SARDINE

Beyond tourism, Taal Lake sustains thousands of fisherfolk and farmers. It is home to sardinella tawilis, the world’s only freshwater sardine, found exclusively in this lake.

In 2021, Taal Lake’s fisheries produced about 1,000 metric tons of fish, with tawilis accounting for almost half, based on data from the National Fisheries Research and Development Institute.

Fishing in Taal Lake has been a key livelihood source for almost five decades for Jessie Dano Nabor, 61, from Agoncillo town. While the tawilis was declared an endangered species in 2019, Mr. Nabor said his daily catch had not declined dramatically.

But the 2020 eruption paralyzed their operations for months. “We couldn’t fish properly, and the Philippine Coast Guard did not allow us to,” he told BusinessWorld in Filipino. “The risks were too high.”

The NDRRMC estimated that fisheries suffered P1.6 billion in losses, the heaviest hit among agricultural sectors. High-value crops followed with P1.4 billion in losses, while livestock and rice sustained smaller damage.

The Department of Agriculture allotted P468 million from its quick-response fund in 2020 and P100 million in 2022 to support rehabilitation.

Still, Mr. Nabor said aid alone is not enough.

“What we really need are more buyers,” he said. “Most of us only sell to people who make dried fish. If there were a factory that could make canned tawilis, our income would increase.”

For Batangas residents, coexisting with Taal Volcano means balancing opportunity and danger. The volcano’s fertile soil supports agriculture, its lake fuels fisheries, and its scenery sustains tourism. But each tremor or wisp of smoke reminds locals of how fragile those gains are.

Taal has erupted more than 30 times in recorded history, with major events in 1754, 1911, 1965, and 2020. Each eruption reshaped the terrain and forced communities to rebuild from the ashes.

Five years after its most recent major eruption, Batangas continues to rebuild while keeping one eye on the horizon — and another on the volcano that both threatens and defines it.

“Taal Volcano has always been the centerpiece of our tourism campaign,” Ms. Terrible said. “It’s an ecological wonder, so people will keep coming back to the volcano and the lake.”