Marcos needs to detail plan to boost revenues in his second SONA

By Kyle Aristophere T. Atienza, Reporter

PRESIDENT Ferdinand R. Marcos, Jr. should detail how he plans to boost state revenues to fund education, health and social welfare programs in his second address to Congress today (July 24), economists and political analysts said.

They also cited the need for Mr. Marcos to provide a clear plan for economic development amid a global slowdown, spiraling prices, weather disruptions and geopolitical tensions.

“In the short term, the President, in his State of the Nation Address (SONA), should be able to address the need to further expand government revenues in order to provide resources for expansion of important education, health and social welfare programs,” Ateneo School of Government Dean Philip Arnold “Randy” P. Tuaño said in a Facebook Messenger chat.

“In the long term, programs to address the malnutrition problem and the learning crisis, addressing sustainability efforts in the country and modernizing the bureaucracy — which was the theme of his previous speeches — should be featured in the SONA,” he added.

Sherwin E. Ona, a political science and development studies professor at De La Salle University, said via Viber that Mr. Marcos should give a “clearer economic development agenda to ensure growth and development” during his SONA.

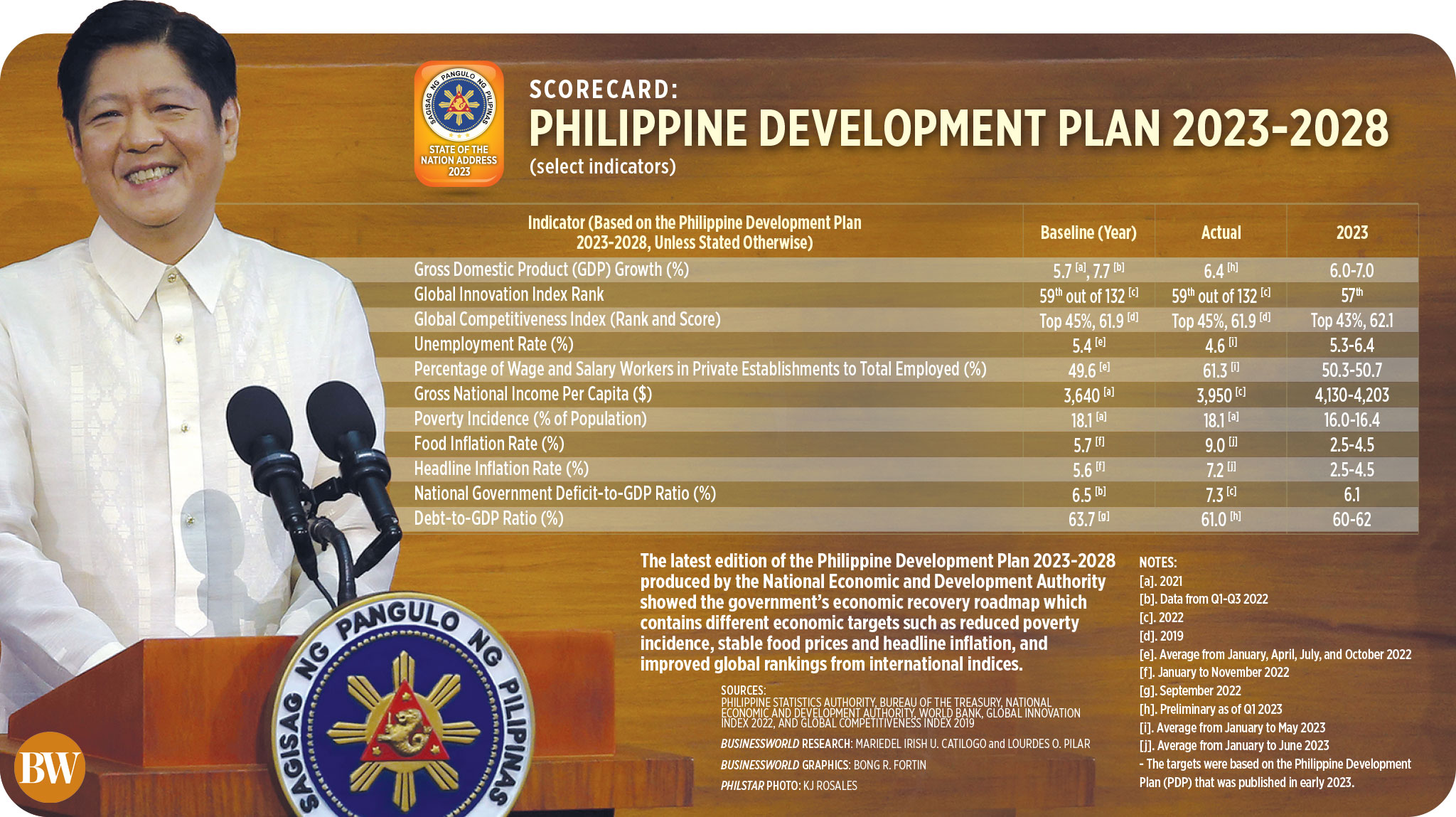

The Philippine economy grew by 6.4% in the first quarter, the slowest in two years. The government is targeting 6-7% gross domestic product (GDP) growth for this year, which would be slower than the 7.6% expansion in 2022.

“The President needs to expound on his administration’s development priorities especially because of the limited fiscal space and the higher budget deficit,” public finance expert Zyza Nadine M. Suzara said via Messenger chat.

The National Government’s budget deficit shrank by an annual 28.86% to P326.3 billion in the January-to-May period, as revenues rose by 10.83% to P1.59 trillion.

For this year, the government set the deficit ceiling at P1.499 trillion, equivalent to 6.1% of GDP. The Marcos administration is targeting to bring this down to 3% of GDP by 2028.

George N. Manzano, an economist from the University of Asia and the Pacific, said Mr. Marcos should detail how the country plans to achieve food security, modernize agriculture, and reduce urban blight and congestion.

“He should also discuss inflation; how to boost investments, particularly foreign direct investments; how to strengthen the manufacturing sector; how to foster the digital economy, and address poverty,” he said in an e-mail.

While inflation has been on a downtrend since January’s 8.7%, inflation remains elevated averaging 7.2% in the first half — still above the central bank’s 2-4% target range.

George T. Barcelon, chairman of the Philippine Chamber of Commerce and Industry (PCCI), hopes the Philippine leader will discuss how he plans to make domestic industries, especially the manufacturing and the agriculture sectors, competitive.

“When I reflect back to the first SONA, many issues that were mentioned by the President are still of concern. We still need to improve the productivity of the agriculture sector; our area of production must be competitive,” he said by telephone.

He also cited the high costs of logistics and power in the country, which he said prevent domestic sectors from improving their productivity.

“If you compare the amount of foreign investments we are getting, we are still lagging behind Singapore, Malaysia and Vietnam. That means we may not be that competitive, that is why foreign investors are not coming here,” Mr. Barcelon said.

NEW TAXES?

Traditionally, SONA speeches are reviews of policy accomplishments of the administration in the previous year, Mr. Tuaño said.

Despite Mr. Marcos’ huge mandate, only one of the legislative priorities mentioned in his first SONA was passed into law. The President signed New Agrarian Emancipation Act, which condones farmers’ debts, into law earlier this month.

“Therefore, we would expect that we would hear from the President how his priorities discussed in the last SONA would be put into action,” Mr. Tuaño said.

Filomeno S. Sta. Ana III, coordinator of Action for Economic Reforms, said addressing malnutrition and hunger and boosting the implementation of the Universal Health care Law — which are among the administration’s priorities — would require new sources of revenues.

“Taxes on sweetened beverages and junk food are being proposed. While justifiable, several quarters have opposed these taxes for their regressiveness,” he said. “The administration must form a narrative why new taxes are necessary.”

Finance Secretary Benjamin E. Diokno last month said the government is pushing for taxes on junk food and sweetened beverage to address “diabetes, obesity, and non-communicable diseases related to poor diet,” as well as raise P76 billion in additional revenues in the first year of implementation.

Instead of junk food, Mr. Sta. Ana proposed further increasing taxes on alcohol, tobacco and motor vehicles.

He said an innovative tax policy can help facilitate the transition to renewable energy, which Mr. Marcos has vowed to prioritize.

The Marcos administration is also pushing for a measure that would reforms the pension system for retired military and uniformed personnel, which if left unchanged may lead to what the Finance department described as a “fiscal collapse.”

“For instance, how will his government fund education, health and poverty alleviation while the military pension system which poses a fiscal crisis remains unreformed?” Ms. Suzara said.

While not mentioned in his first SONA, Mr. Marcos last week signed into law another priority measure that created the country’s first sovereign wealth fund or the Maharlika Investment Fund.

Ms. Suzara said Mr. Marcos should discuss how the government plans to generate additional resources with the Maharlika Investment Fund (MIF) in the picture, noting that it “competes with all of the development needs of the country in terms of the government’s sources of financing for the national budget.”

“Thus, it is not enough to present the numbers in the Medium-Term Fiscal Program as he did in his first SONA,” she said. “He needs to lay down the vision for the Philippines and tell us citizens exactly how we will get there.”

INFRASTRUCTURE

With the approval of the MIF and the approval of the P170-billion public-private partnership for the rehabilitation of the country’s major airport, “the President is expected to tout his plans for infrastructure in Monday’s SONA,” said Terry L. Ridon, convenor of infrastructure think tank InfraWatch PH.

“The President will surely provide updates on the Metro Manila subway and the North South Commuter Railway projects, both of which are currently proceeding well into their construction stages,” he said via Messenger chat.

He said the President should provide clarity on the primary objective of the MIF — “on whether it will be used to fund flagship infrastructure projects or whether it will be used to invest in various endeavors to yield higher than average market returns.”

“Pursuing both objectives may be incompatible as infrastructure projects do not typically yield high margins,” he said.

Meanwhile, Mr. Ridon said the bidding for the rehabilitation of the Ninoy Aquino International Airport will be the “first key test” to the public-private partnership program under the Marcos administration.

“It will test the Marcos administration on how it will deal with various private sector interests that will compete for the project,” he said, asking the president to urge the Transportation department to “ensure full transparency and efficiency in the proceedings.”

Meanwhile, the Philippine Business for Education urged Mr. Marcos to use his huge mandate to prioritize education reforms.

“We must make education and nutrition our national concern and national priority. If we focus on developing our people first, many of our problems — from corruption to poverty, to low productivity to joblessness—will be easier to solve,” it said in a statement. — with inputs from Beatriz Marie D. Cruz