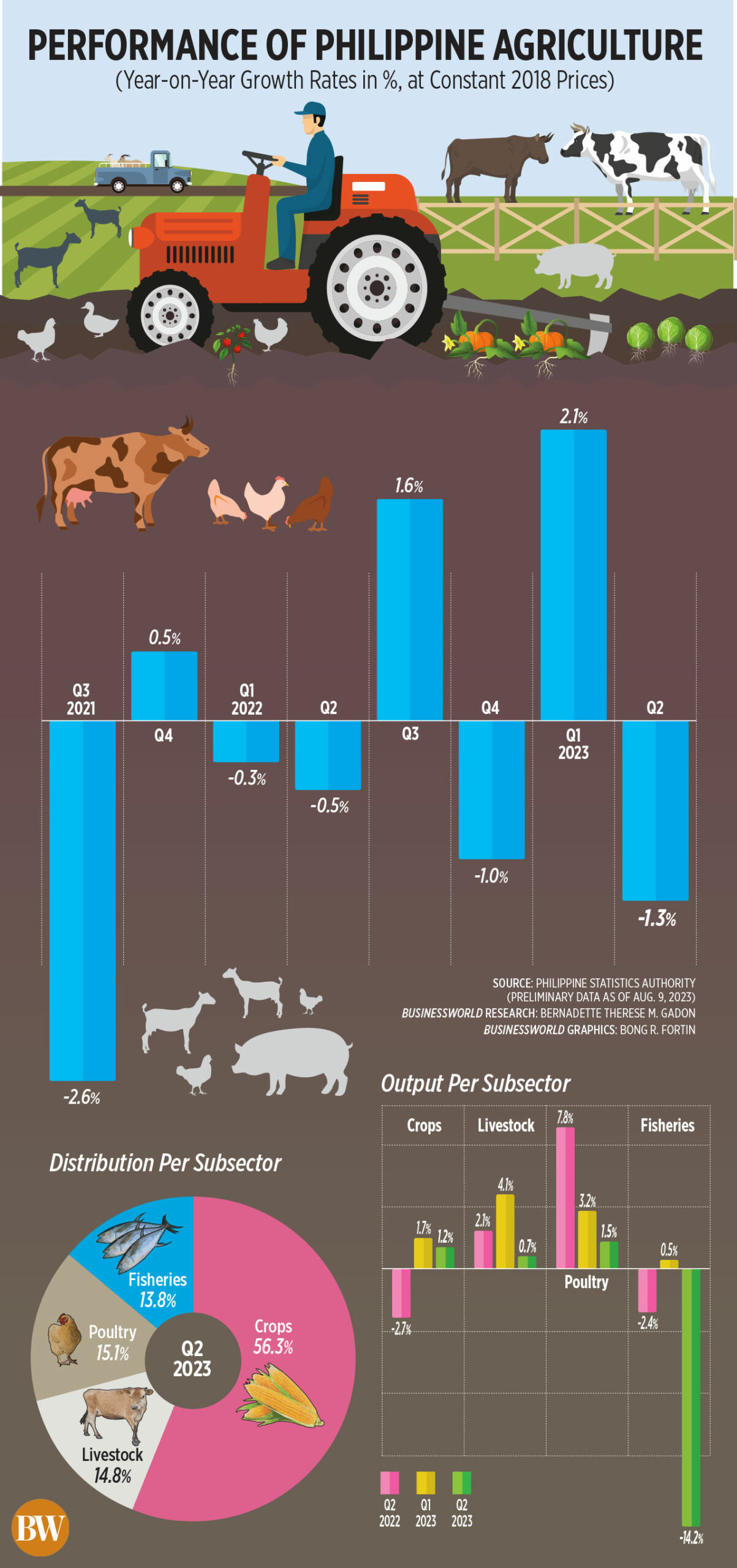

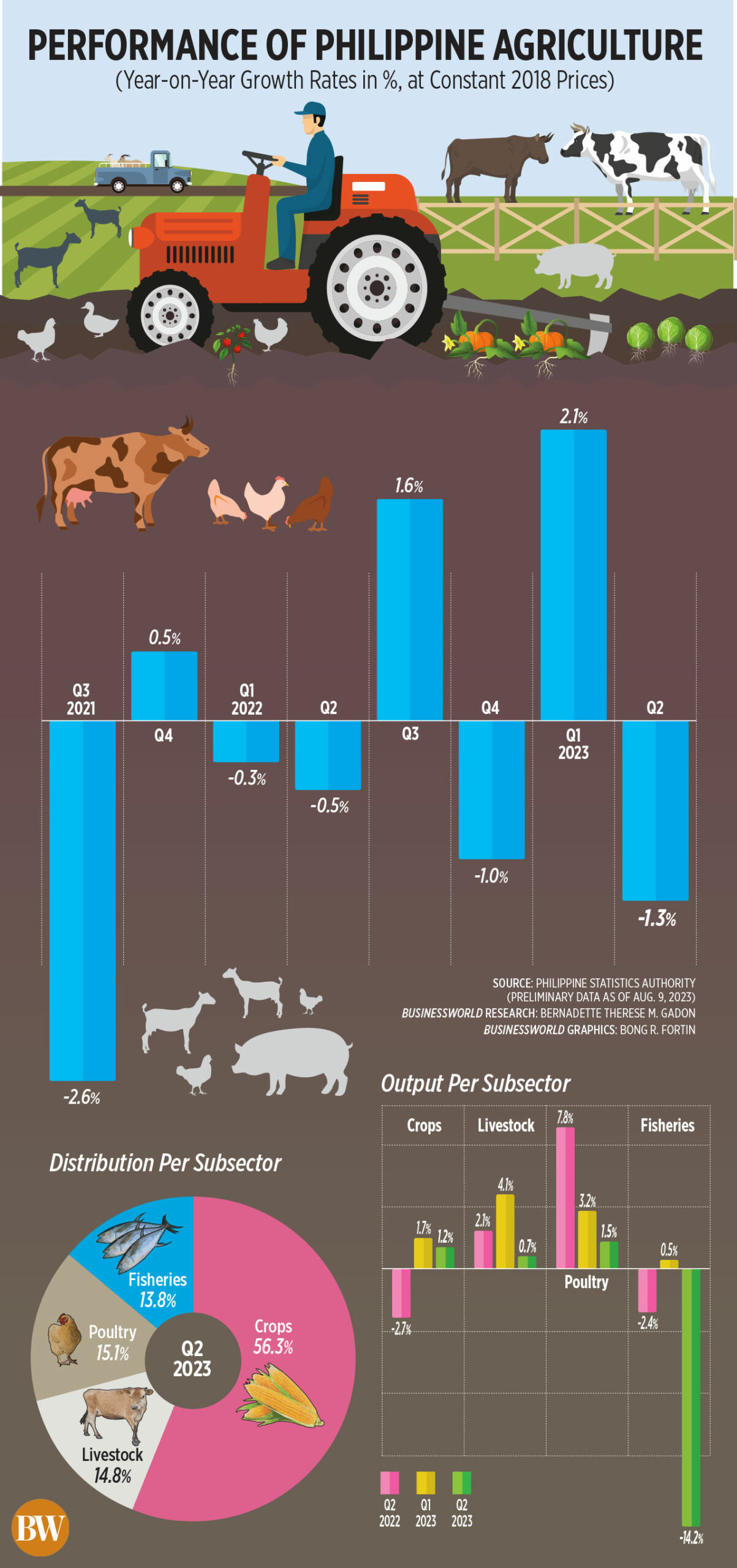

THE PHILIPPINES’ agricultural output contracted in the second quarter due to a double-digit drop in fisheries production, government data showed on Wednesday.

Data from the Philippine Statistics Authority (PSA) showed the value of production in agriculture and fisheries at constant 2018 prices declined by 1.3% to P427.69 billion in the April-to-June period, worsening from the 0.5% contraction a year ago.

This was also a reversal of the 2.1% growth in the first quarter this year.

“This was attributed to the (14.2%) reduction in the value of fisheries production,” the PSA said in a statement.

“This was attributed to the (14.2%) reduction in the value of fisheries production,” the PSA said in a statement.

The value of crops production rose by 1.2%, while livestock and poultry grew 0.7% and 1.5%, respectively.

“While the decline in fisheries seems expected, the mediocre increases in crops, livestock and poultry, given the relatively favorable weather conditions, are not,” Ateneo de Manila economics professor Leonardo A. Lanzona said in a Facebook Messenger chat.

At current prices, the value of production in agriculture and fisheries rose by 3.4% to P551.5 billion in the second quarter.

For the first half, the value of production in agriculture and fisheries at constant 2018 prices grew by 0.4%, a turnaround from the -0.4% during the same period in 2022.

“Although fisheries was the only sector that declined in real terms, the gains in crops, livestock and poultry were not impressive either and did not significantly affect overall growth rates,” Raul Q. Montemayor, national manager of the Federation of Free Farmers, said.

Crops, which made up about 56% of the sector’s overall production, expanded by 1.2% in the April-to-June period, an improvement from the 2.7% contraction in the same period last year but slower than the 1.7% growth in the first quarter.

For the first six months, the value of crop production grew by 1.5%, a turnaround from the 2.2% decline in the same period.

In the second quarter, palay production rose by 1.1% (from -2.7% a year ago), while corn dropped by 0.8% (from 4.3% a year ago).

Mr. Montemayor said he expected better palay and corn output growth because of the favorable weather conditions during the second quarter.

“In fact, other rice farmers shifted to corn because of the good price of corn,” he said.

Only mango production recorded double-digit growth (11.4%), while growth was also seen in cacao (4.1%), calamansi (4%), pineapple (3.8%) and onion (3.4%).

On the other hand, lower production was seen in sugarcane (-11.3%), rubber (-8.5%), sweet potato (-7.5%), cabbage (-4.5%), and eggplant (-3.6%).

Enrique D. Rojas, president of the National Federation of Sugarcane Planters, attributed the decline in sugarcane output to the early start of milling.

“The significant drop in sugarcane harvest and sugar production this crop year were mainly due to the early milling with premature canes and due to too much rain brought by the La Niña weather phenomenon which reduced the sugar yield,” he said in a text message.

FISHERIES DECLINE

Fisheries production, which made up 13.8% of the total farm output, shrank by 14.2% during the April-to-June period, worsening from the 2.4% contraction a year ago and a reversal of the 0.5% growth in the first quarter.

For the first semester, the value of fisheries output at constant 2018 prices contracted by 7.7%, worse than the 3.9% decline a year ago.

“Since 2021, the fishing industry has faced problems of depletion, environmental damage, poverty, low aquaculture and limited utilization of the (exclusive economic zone),” Mr. Lanzona said.

Double-digit declines were seen in bigeye tuna (-49.9%), skipjack or gulyasan (-49.2%), fimbriated sardines (-42.2%), grouper or lapu lapu (-39.9%), yellowfin tuna (-23.2%), slipmouth or sapsap (-20.6%), milkfish or bangus (-19.1%), blue crab (-19.1%), squid or pusit (-17.4%), mudcrab or alimango (-15.5%), frigate tuna or tulingan (-14.5%), and threadfin bream or bisugo (-12%).

Only roundscad or galunggong (30.1%) and tiger prawn or sugpo (0.9%) saw an increase in production in the second quarter.

“For aquaculture species, it’s because of low probability or no profit at all due to increase of feed cost and their inputs,” David B. Villaluz, chairman of the Philippine Association of Fish Producers, Inc., said in a text message.

He noted a 500-gram milkfish is being sold for P135-P150 per kilo, while the production cost is estimated at P150 per kilo.

LIVESTOCK, POULTRY

The value of livestock production inched up by 0.7% in the second quarter, slower than the 2.1% increase in the second quarter of 2022 and 4.1% increase in the first quarter of 2023.

Livestock accounted for 14.8% of the total agricultural output during the April-to-June period.

PSA data showed an increase in the value of production in hog (1%) and carabao (0.5%), while declines were seen for dairy (-10%), cattle (-1%), and goat (-0.2%).

During the first half, the value of livestock production rose by 2.4%.

Alfred Ng, vice-president of the National Federation of Hog Farmers, Inc., said the livestock production may have improved as big farms continued to expand.

However, he said repopulation is still slower as African swine fever (ASF) continues to threaten the industry.

“Farmers are afraid to repopulate because of the high investment cost and the high risk of ASF reinfection,” Mr. Ng said.

Data from the Bureau of Animal Industry showed that active ASF cases are found in 187 barangays within nine regions as of June 29.

Meanwhile, poultry output, which accounts for 15.1% of the total farm output, expanded by 1.5% during the second quarter. This was slower than the 7.8% growth in the same quarter of 2022, and the 3.2% increase in the first quarter.

The value of duck and chicken production grew by 7.1% and 3.2%, respectively. Declines were noted for duck eggs (8.6%) and chicken eggs (2.1%).

From January to June, the value of poultry production at constant 2018 prices jumped by 2.3%.

However, Elias Jose M. Inciong, president of the United Broiler Raisers Association, said the growth is “still below par” as the poultry sector previously logged growth rates of between 4% and 7% based on is historical performance.

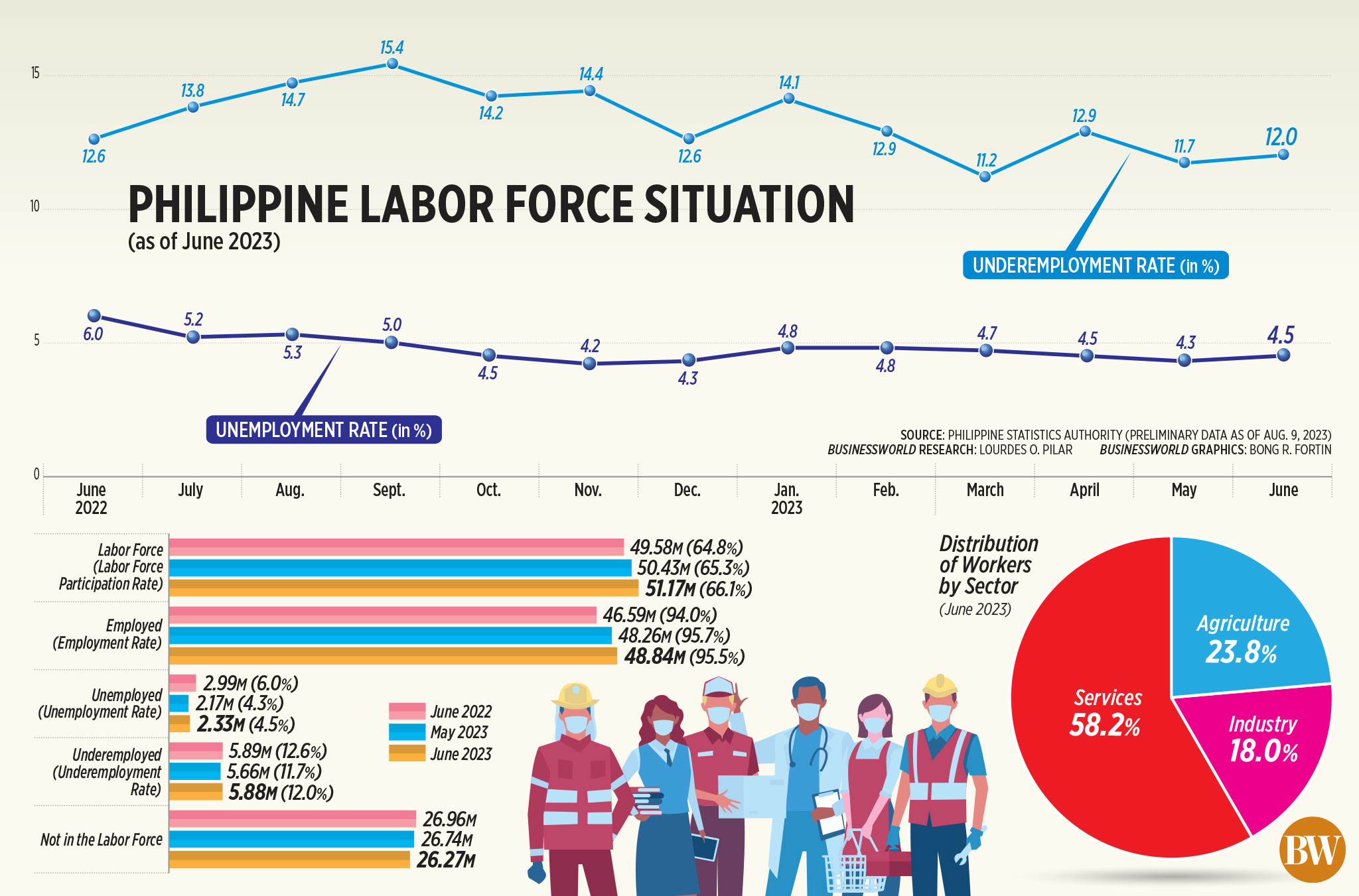

The Agriculture department is targeting 2.3%-2.5% farm output growth this year. Agriculture contributes about a 10th of the country’s gross domestic product and a fourth of jobs.

Mr. Montemayor said that he is “not very optimistic” on the agriculture sector’s outlook for the second half.

“The weather was good in the first half, but the production was lackluster. How much more if there are typhoons and El Niño,” he said in mixed Filipino and English.

The El Niño weather pattern is seen to persist in the Philippines until the first quarter of 2024 and is showing signs of strengthening in the coming months. El Niño increases the likelihood of below-normal rainfall conditions, which could bring dry spells and droughts in some areas of the country,

“With the impending weather disruptions, the prospects are not too bright, especially given the existing conditions shown in the second quarter,” Mr. Lanzona said.

Meanwhile, President Ferdinand R. Marcos, Jr., who also heads the Agriculture department, assured the country has enough rice stock to last even after the El Niño next year.

“The rice situation is manageable and stable,” Mr. Marcos said during a meeting with the Private Sector Advisory Council and the Philippine Rice Stakeholders Movement on Tuesday. “There is enough rice for the Philippines up to and after El Niño next year.”

The Philippines is one of the world’s top rice importers, buying rice mainly from Vietnam.

Agriculture Undersecretary Mercedita A. Sombilla said the Philippines is projected to have a stock of 1.96 million metric tons (MT) of rice at the end of this year, which is enough to last 52 days.

Citing PSA projections, Ms. Sombilla said the rice stock could reach 2.12 million MT by the end of the year, which would last about 57 days. — Sheldeen Joy Talavera with John Victor D. Ordoñez