A portrait of a Filipino as a consumer: Spending wiser, saving smarter

By Abigail Marie P. Yraola, Deputy Research Head

FILIPINO CONSUMERS are walking a financial tightrope — tightening belts, gripping wallets, and bracing for every shift in the economic winds.

In the second quarter, Filipino consumers are seen to be optimistic about their earnings but remain cautious. Consumers are adjusting their attitudes towards budgets and savings, despite the increase in their pay checks to brace for economic shocks.

This consumer behavior is reflected in a quarterly survey from TransUnion. In its Q2 2025 Consumer Pulse Study, it assessed the everchanging consumer attitudes based on the dynamics of income, debt, and identity theft.

“The report underscores a dual reality: optimism about future income coexists with persistent financial stress and caution,” Ruben Carlo O. Asuncion, chief economist at Union Bank of the Philippines, Inc., said in a Viber message.

He added that the report implies that consumer confidence is fragile and highly sensitive to economic headwinds such as inflation and job security.

For the banking industry, the future isn’t just about expanding credit access — it’s about earning trust through transparency, personalization, and education.

Mr. Asuncion said that banks that integrate financial wellness tools, alternative credit scoring, and proactive fraud protection will not only meet immediate needs but also position themselves as long-term partners in resilience.

“The winners will be those who shift from being lenders to becoming financial enablers,” he said.

Development Bank of the Philippines (DBP) President and Chief Executive Officer (CEO) Michael O. De Jesus said that banks have the responsibility to improve financial literacy among the population.

But to do this, a better understanding of individual attitudes toward savings is needed.

SAVING SMARTER

Mr. De Jesus pointed out that saving is essentially setting aside the money we earn due to different reasons, and mostly these reasons for savings are valid enough but the challenge is not in “piling up cash” but how we manage it.

“Saving may be a ‘good idea,’ but it is never going to make one seriously wealthy unless you can save a massive proportion of your income and your income is massive as well,” he said in an e-mail.

While saving is a commendable act, investing, on the other hand, can generate wealth, provided there is money to begin with.

“Saving can be a virtue, but you have to move beyond keeping your money in savings and start investing to reap the full benefit,” he advised.

He added that as financial institutions, providing consumers the knowledge (financial literacy), planning tools (wealth and asset management) and savings and investment products to achiever their life goals are necessary.

INCOME AND SPENDING

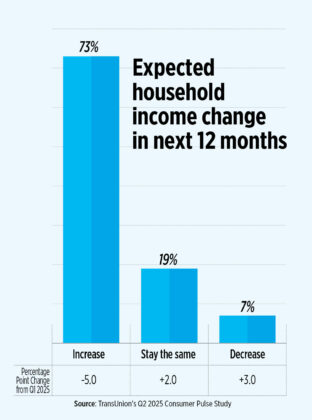

According to the TransUnion report, consumer financial health stayed mostly stable as 41% of consumers suggested a rise in their income for the past three months, while 73% of Filipino consumers expect a rise in come next year, an optimistic outlook on their financial futures.

Still, financial stress is evident with 44% of consumers expecting difficulties in paying bills.

This financial worry mirrors that consumers are cautious in spending and adjusting their savings, driven by concerns in inflation and job securities.

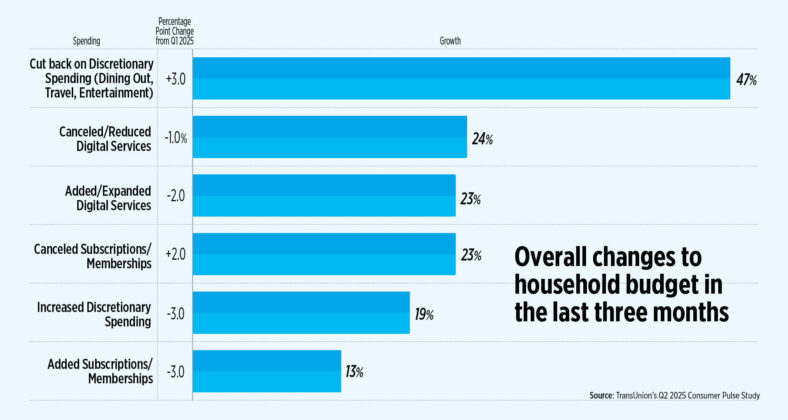

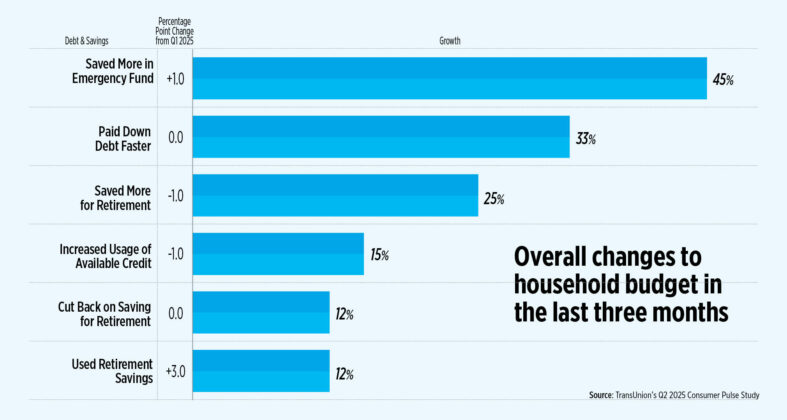

Still, the report highlighted that there was a 45% increase in emergency savings and a 47% cutback in discretionary spending in the past three months.

Moreover, some were upbeat in managing their finances by increasing savings and paying off debt faster.

“Spending patterns reflected a balancing act between optimism and constraint,” the report noted.

“This often leads to a ‘bunker’ mentality as consumers scrimp on spending and buttress their savings for the expected ‘rainy days’ ahead,” he noted.

He cautioned that if this “behavior” cascades among consumers, it could lead to a recession. In turn, businesses may respond to reduce demand by cutting back on productions on their services and goods.

“The shift in savings behavior means many households adopt a more conservative mindset, prioritizing liquidity and financial safety versus ‘wants’ spending — which benefits the consumer, the financial institutions, and the economy in the long run,” Maybank Philippines said in an e-mail.

This provides peace of mind for consumers amid uncertainty and prevents them from falling into debt in emergencies. While they continue to spend, consumers will seek value to justify what they spend.

“Consumers may become more receptive to financial literacy campaigns and products framed around security, preparedness and long-term goals,” Maybank said.

This indicates an increased demand for savings accounts, time deposits and low-risk investment products as the appetite for personal loans and credit card spending tempers.

“Higher savings means better ability to lend out these funds to businesses,” it said, which in turn will boost long-term growth and help strengthen the economy.

For Nicholas Antonio T. Mapa, chief economist at Metropolitan Bank & Trust Co., this behavioral shift aligns with conventional economic thought as households shift their budgets to prioritize essential while cutting back on discretionary spending during challenging periods.

“The growth in personal loans have helped support domestic consumption throughout the period of elevated inflation, delivering robust household expenditure,” Mr. Mapa said in an e-mail.

He added that as inflation slows, this should at least help restore some purchasing power to help households restore savings or pay down loan balances.

SAVINGS AND CREDIT BEHAVIOR

As highlighted by the report, rising prices, job security and interest rates were the sources of caution of consumers and financial institutions are taking countermeasure in addressing these financial woes.

For Rizal Commercial Banking Corp. Credit Cards President and CEO Arniel Vincent B. Ong, financial institutions can ensure their borrowers added value for using their credit cards on everyday essentials to help address rising prices and cost of living pressures

“Lenders can help address the concern on job security (and its resulting income uncertainty) by offering flexible payment programs for customers,” Mr. Ong said in an e-mail.

For Mr. Mapa, the central bank’s lowering borrowing costs provide relief to households and firms.

“Lower interest rates will help firms hire more workers or invest to bolster operations, resulting in increased efficiencies and or job creation,” Mr. Mapa explained.

Latest government data showed inflation picked up 1.5% in August from 0.9% in July. This was the fastest reading since the 1.8% recorded in March.

A year earlier inflation rate was higher at 3.3%.

Meanwhile, in late August, the Monetary Board slashed the target reverse repurchase rate by 25 basis points (bps) to 5% from 5.25%, for a third straight meeting.

Since it began its easing cycle in August last year, the BSP has reduced borrowing costs by a total of 150 bps. In its last two meeting this year, it delivered two 25-bp cuts each in April then in June.

On the other hand, government data also showed that the Philippine economy expanded by an annual 5.5% in the April-to-June period, slower than the 6.5% growth in the same period last year.

However, this was a tad faster than the 5.4% in the first three months.

In the first semester, GDP growth averaged 5.4%, significantly slower than the 6.2% a year earlier.

The latest gross domestic product print (GDP) missed the lower end of the government’s 5.5% to 6.5% growth target this year.

Results of the study also showed that 58% of Filipinos see access to credit as a “major enabler” of their financial goals. But even so, 57% had dropped their application or refinancing proposal due to fears of rejection resulting from income or work status and the high cost of new credit.

“To meet strong demand for credit while addressing fears of rejection and high costs, banks need to adopt a more inclusive and transparent lending approach,” UnionBank’s Mr. Asuncion said.

This, he added, includes leveraging alternative data such as utility or rental payment history, for credit scoring to assist those with limited credit files.

He noted that ultimately, banks must position credit as an enabler of financial stability, not just consumption.

For RCBC’s Mr. Ong, an effective way for banks to adapt their lending approach is by utilizing nontraditional sources of data.

“Banks have relied on a combination of traditional employment documents proof and data from credit bureaus — which means that first-time borrowers or those working in the gig economy have no access to credit,” he said.

In this day and age where data is king, there are numerous other data points available that can help predict a borrower’s creditworthiness, Mr. Ong said.

“Financial institutions must make a strategic decision to leverage this alternative data in order to expand the population of credit-worthy individuals.”

MANAGING FINANCIAL STRESS

It is worth noting enough that banks should invest in financial literacy or education to aid consumers in making informed decisions to adjust their spending and saving patterns amid inflationary pressures, and economic uncertainty.

For the Bangko Sentral ng Pilipinas (BSP), it said that it has been a pioneer in promoting financial literacy in the country when it established the BSP Consumer Education Committee.

This established a structured financial education program to empower Filipinos in making informed financial decisions.

Efforts include BSP e-Learning Academy, collaborative programs, innovative programs for marginalized sectors, training and capacity building, financial learning sessions, digital platforms, and educated materials.

For RCBC’s Mr. Ong, banks can play a crucial role in enhancing consumers’ financial literacy and health through various strategies such as educational resources, user-friendly tools and apps, transparent information and promoting savings.

“Private financial institutions as well as BSP roll out programs to help grow financial learning and literacy to equip households and firms with the understanding and knowhow to navigate the challenging economic landscape with the help of financial market tools,” Mr. Mapa said.

For Mr. Asuncion, banks in the country and the BSP are investing heavily in financial literacy to help consumers make informed decisions amid inflation and uncertainty.

Initiatives [may] aim to build resilience, promote responsible borrowing, and empower Filipinos to navigate inflationary pressures and economic uncertainty, said Mr. Asuncion.

The central bank strongly urges banks to go beyond providing basic access to financial services and improve in strengthening their clients’ financial health.

“Banks are well-positioned to champion financial literacy because of their direct interaction with consumers and their central role in financial transactions,” the BSP said in an e-mail.

It added that by embedding financial literacy into their products, promoting responsible lending, scaling education through partnerships, and tracking client outcomes, banks can help convert financial inclusion into financial resilience and well-being.

Banks, businesses, and the government should work to shore up confidence in the overall economy, Mr. De Jesus said.

“[This can be done] by loosening credit, such as through interest rate reductions initiated by the BSP, making it easier for borrowing and lending, encouraging business investments that boost the business climate, and ensuring that the ventures we fund will have maximum impact on employment and incomes.”