GCash, AB Capital Securities partner to make investing simpler for everyday Filipinos

Diving into the stock market can be quite daunting, especially for beginners looking to grow their extra funds. However, with the right guidance, starting one’s investment journey can not only be simple, butalso rewarding

In a concerted effort to make investing more accessible to Filipinos nationwide, GCash, the country’s top finance app and largest cashless ecosystem, has forged an alliance with one of the leading stock brokerage firms, AB Capital Securities Inc. (ABCSI) to offer a beginner-friendly stock trading platform through GStocks PH.

According to Jong Layug, Group Head of Wealth Management, “Our collaboration with ABCSI is a testament to our commitment to helping Filipinos achieve financial freedom by providing them an easy, affordable, and accessible way to invest for their future. We are proud to team up with one of the leading stock brokerage firms in the country, sharing the same mission of enabling finance for all.”

GStocks PH is ABCSI’s online retail securities trading services made accessible through the GCash App, where investors can buy, sell, and manage their securities in companies listed on the Philippine Stock Exchange (PSE).

To start investing, one can simply log onto the GCash App, tap the GInvest icon on the dashboard, select GStocks PH, and select ABCSI as their broker of choice.

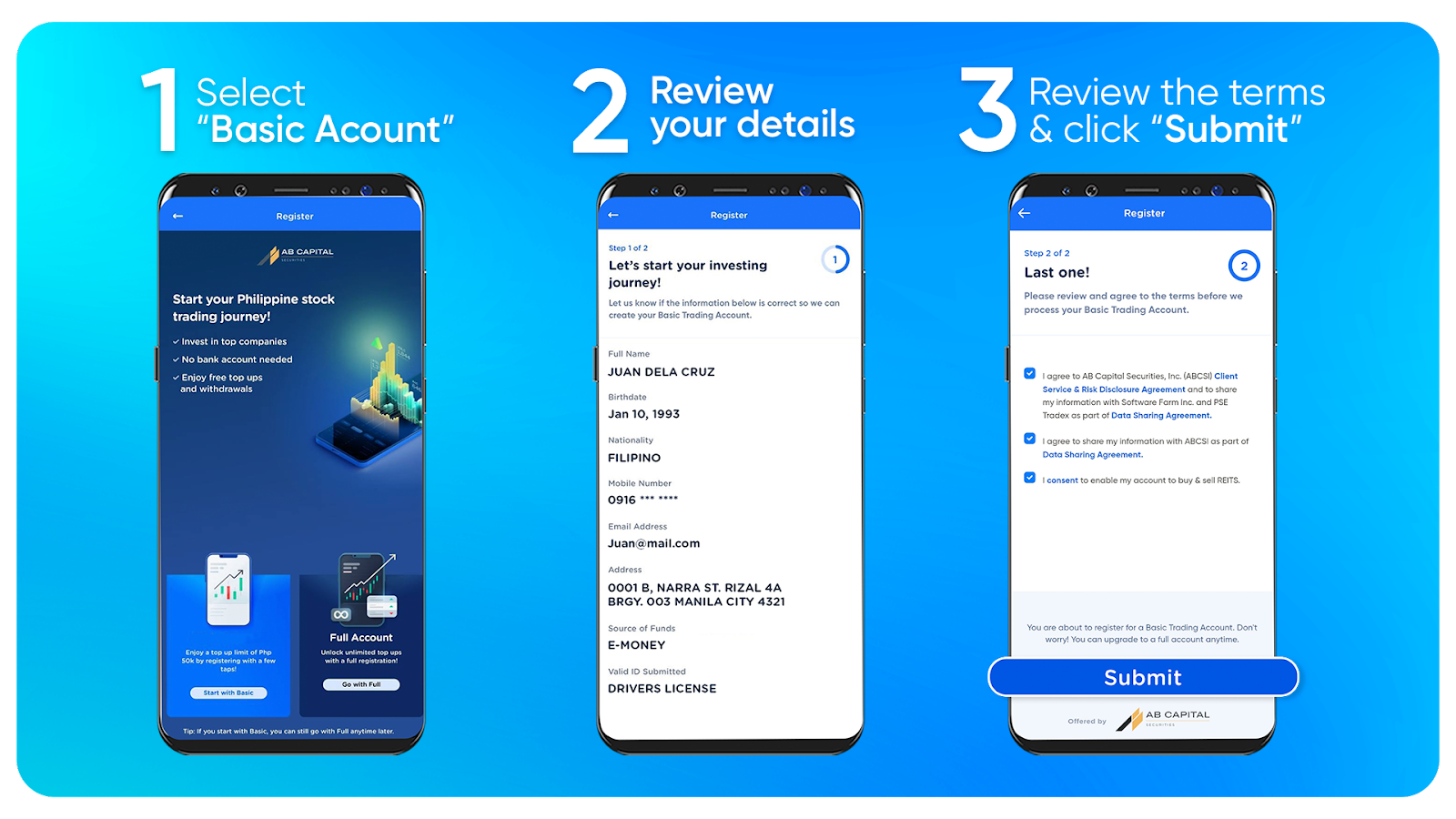

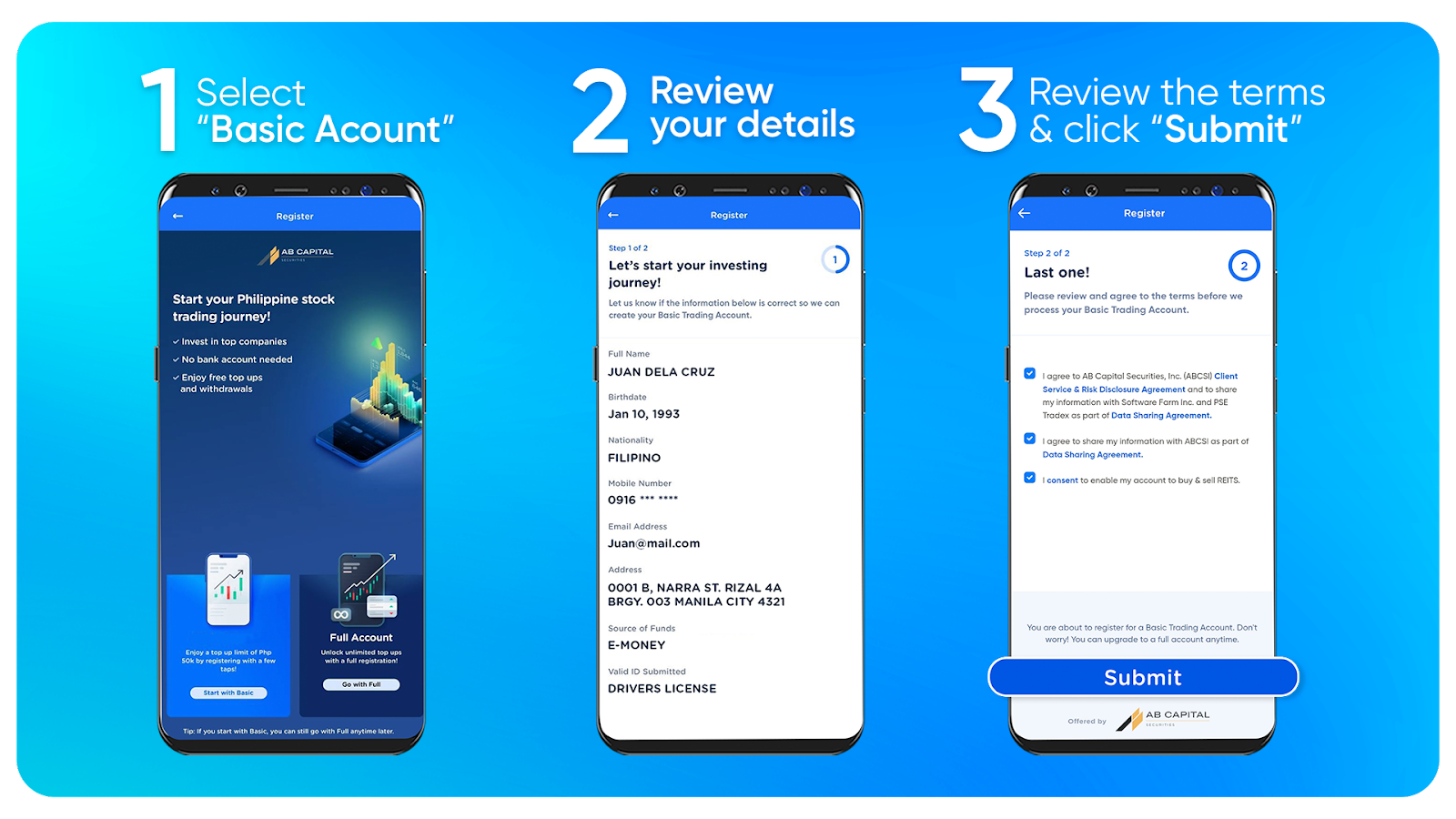

This trading service was developed to guide more Filipinos in unlocking the value of investing for their financial growth. Aspiring investors can easily follow these simple steps to begin their wealth-building path:

Step 1: Open a trading account instantly

Fully verified GCash users can create a trading account without the hassle of signing and submitting multiple documents. By simply opening the GStocks PH feature on the GCash app and clicking “Get Started”, users can select AB Capital as their broker of choice. From there, they will be redirected to the online trading platform, where they can register for either a basic or a full account, bringing them one giant leap closer to their investment dreams.

“Through GStocks PH, we break down complicated investment terminology and processes in the hopes of reaching more of our countrymen,” Mark Ilao, GCash Head of Market Education, said.

Step 2: Top up your trading account in just a few taps

Once registered, users can seamlessly top up and withdraw funds using the GCash wallet, eliminating the need to link a bank account. With GStocks PH, users can enjoy the convenience of zero charges on AB Capital transfers to and from their GCash wallet.

“Users can directly fund their accounts anytime and anywhere, without having to coordinate with agents or go to physical branches. We designed it this way to provide investors with the peace of mind that goes with having full autonomy and control over their finances,” Ilao added.

Step 3: Start investing in well-loved brands

Once the trading account is sufficiently funded to cover the stock and standard fees, investing in stocks becomes as simple as tapping the “Buy/Sell” button on the screen and selecting a desired stock on the Market Page. With a selection of over 280 PSE-listed companies nationwide, users can then click the “Buy” button on the stock page, and input the desired number of shares.

“Even if we offer the convenience and flexibility that most stock platforms fail to provide, we collaborate with and strictly adhere to PSE’s standards. For instance, trades may only be placed from 9:00 am to 2:59 pm everyday, except on weekends and holidays,” Ilao shared.

GStocks PH’s convenient and accessible interface makes it so beginner-friendly that anyone can easily invest in local stocks. Through the platform, GCash enables investment rookies with the tools they need to kickstart their journey to financial growth.

“Keeping Filipinos well-informed about their finances is a shared responsibility among financial service providers, regulators, and consumers, as it not only boosts financial wellbeing but collectively strengthens the foundation of a resilient community. It is our hope at GCash that economic prosperity becomes a right for every Filipino and not just a privilege to enjoy, and we believe that investment education plays a crucial role in making that possible,” Layug concluded.

Want to do more with your money? Simple na mag-invest via GStocks PH. No GCash yet? Download the GCash App on the Apple App Store, Google Play Store, or Huawei App Gallery. Kaya mo, i-GCash mo!

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by publishing their stories on the BusinessWorld Web site. For more information, send an email to online@bworldonline.com.

Join us on Viber at https://bit.ly/3hv6bLA to get more updates and subscribe to BusinessWorld’s titles and get exclusive content through www.bworld-x.com.