Harris closes campaign in Philadelphia, Trump in Michigan on eve of deadlocked election

PHILADELPHIA/GRAND RAPIDS, Michigan – Donald Trump and Kamala Harris both predicted victory as they campaigned across Pennsylvania and other battleground states on Monday in the final, frantic day of an exceptionally close U.S. presidential election.

The campaign has seen head-spinning twists: two assassination attempts and a felony conviction for Republican former President Trump, and Democratic Vice President Harris’ surprise elevation to the top of the ticket after President Joe Biden, 81, dropped his reelection bid under pressure from his own party. More than $2.6 billion has been spent to sway voters’ minds since March, according to AdImpact, an analytics firm.

Nevertheless, opinion polls show Mr. Trump, 78, and Ms. Harris, 60, virtually even. The winner may not be known for days after Tuesday’s vote, though Mr. Trump has already signaled that he will attempt to fight any defeat, as he did in 2020.

Both candidates predicted victory as they converged on Pennsylvania on Monday to urge supporters who have not yet cast their ballots to show up on Election Day. The state offers the largest share of votes in the Electoral College of any of the seven battleground states expected to determine the outcome.

Mr. Trump also campaigned in North Carolina and Michigan on the final full day of the campaign and was due to return to his home in Palm Beach, Florida, to vote and await election results.

Ms. Harris scheduled five campaign stops in Pennsylvania, including two cities where Mr. Trump also visited, Reading and Pittsburgh.

She ended the day in Philadelphia with a star-studded event at the “Rocky steps” of the Philadelphia Museum of Art, the site of a famous scene from the movie “Rocky.”

Despite enjoying the support of A-list celebrities including Lady Gaga and Oprah Winfrey, both of whom rallied the Philadelphia crowd before Harris took the stage, Ms. Harris called herself the underdog who like Rocky was ready to “climb to victory.”

“The momentum is on our side,” Ms. Harris told a crowd that chanted back, “We will win.”

“Tonight, then, we finish as we started: with optimism, with energy, with joy,” Harris said, predicting one of the closest elections in U.S. history.

In Allentown, Ms. Harris appealed to the city’s substantial Puerto Rican community who were outraged by insults from a comedian at a Trump rally last week. Later she went door-knocking in Reading and held a brief rally in Pittsburgh, where pop star Katy Perry played a set.

Mr. Trump led his fourth and final rally after midnight before a packed arena in Grand Rapids, Michigan, the third presidential election in a row that he has used the city for his last event.

He promoted his signature issues of increasing border security while attacking the economic record of the Biden-Harris years.

It was also likely the last campaign rally of his career, since he has said he does not plan to run for president again should he fail attain the high office in Tuesday’s election.

“This is the last one,” said Mr. Trump, estimating he had conducted 930 rallies since he began his first campaign in 2015.

“If we get out our people, it’s over, there’s nothing they can do about it. … To make you feel a little guilty, we would only have you to blame,” added Trump, who received a boost earlier in the night with an endorsement from podcaster Joe Rogan.

GENDER GAP

The Harris campaign says its internal data shows undecided voters are breaking in their favor, and says it has seen an increase in early voting among core parts of its coalition, including young voters and voters of color.

Trump campaign officials said they were monitoring early-voting results that show more women have voted than men. That is significant given Ms. Harris led Mr. Trump by 50% to 38% among female registered voters, according to an October Reuters/Ipsos poll, while Trump led among men 48% to 41%.

“Men must vote!” the world’s richest person Elon Musk, a prominent Trump supporter, wrote on his X social media platform.

Mr. Trump’s campaign has outsourced most of the voter outreach work to outside groups, including one run by Mr. Musk, which have focused on contacting supporters who do not reliably participate in elections, rather than undecided voters.

A Pennsylvania judge ruled that Mr. Musk could continue his $1 million voter giveaway in the state, which a local prosecutor said amounted to an illegal lottery.

Mr. Trump has vowed to protect women “whether the women like it or not” and said that the decision of whether to ban abortion should be up to individual states, after the conservative majority he cemented on the U.S. Supreme Court in 2022 ended the nationwide right to abortion. In Reading, he vowed to keep transgender athletes out of women’s sports, as supporters waved pink “Women for Trump” signs behind him.

One Trump campaign official said they thought the Republican would carry North Carolina, Georgia and Arizona, which would still require him to carry one of battleground states in the Rust Belt – Michigan, Wisconsin or Pennsylvania – to win the White House.

Republicans also appeared to be posting strong early-vote results in Nevada, and have been heartened by robust early-voting numbers in the hurricane-ravaged western counties of North Carolina.

“The numbers show that President Trump is going to win this race,” senior adviser Jason Miller told reporters. “We feel very good about where things are.”

Mr. Trump and his allies, who falsely claim his 2020 defeat was the result of fraud, have spent months laying the groundwork to again challenge the result if he loses. He has promised “retribution” if elected, spoken of prosecuting his political rivals and described Democrats as the “enemy from within.”

Harris campaign officials said his attempts to allege fraud will fail. “Voters select the president, not Donald Trump,” Dana Remus, a campaign legal adviser, told reporters. – Reuters

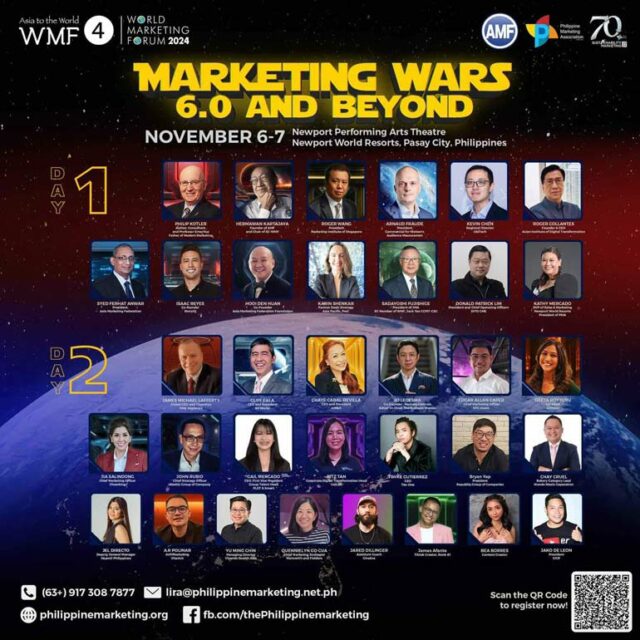

“The two marketing events go beyond simply exchanging ideas; they serve as a battleground where strategies are put to the test and new paradigms are shaped,”

“The two marketing events go beyond simply exchanging ideas; they serve as a battleground where strategies are put to the test and new paradigms are shaped,”