BW’s Forecast 2025 forum and MUP pension reform

The BusinessWorld Economic Forum today has a theme “Forecast 2025” and among the keynote speakers is Department of Finance (DoF) Undersecretary and Chief Economist Domini S. Velasquez. I have high regard for DoF’s economists in terms of fiscal and macroeconomic forecasting.

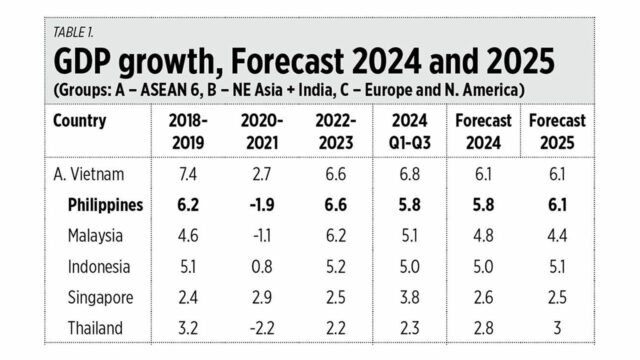

So far, the Philippines has had an average growth of 5.8% in the first three quarters (Q1 to Q3) of 2024. This is third highest among the major economies of Asia after India and Vietnam, and much higher than the average growth of countries in North America and Europe. The International Monetary Fund’s (IMF) forecast for the Philippines in 2025 is 6.1% growth — fair enough (see Table 1).

I saw two pieces of good news last week that I think will help the Philippines attain a growth rate of 6% or higher next year. These reports in BusinessWorld (BW) were: “Canada sending 300-member biz delegation to PHL in December” and “PEZA approvals hit P186B as of mid-Nov.” (Both came out on Nov. 21.)

Senior Trade Commissioner Guy Boileau of the Canadian Embassy in Manila was quoted saying that: “This is the biggest Team Canada Trade Mission that we have done. It is bigger than the delegations sent to Japan and Korea.”

Mr. Boileau also mentioned that among the standout reforms and new laws that helped many Canadian investors to consider the Philippines were: the amendment to the Public Service Act, Public-Private Partnership Code, and the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE).

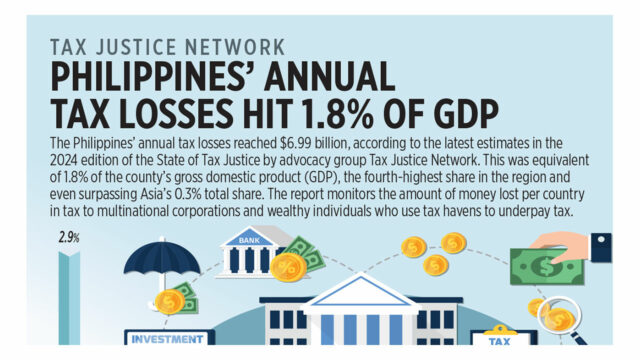

DoF Secretary Ralph G. Recto used a lot of his political capital in pushing the CREATE MORE bill into a law, which was signed by the President on Nov. 11. The reduction in the corporate income tax rate from 25% to 20% is among the big reforms in the CREATE MORE law. I think it is a beautiful law because it responds to tax competition in East Asia, among other reasons.

The Philippine Economic Zone Authority (PEZA) reported that investment approvals in 2023 came to P140.88 billion, and now it is already P186 billion, and the year is not over yet. Cool.

MUP PENSION REFORM

Another piece of good news that was reported in BusinessWorld is this: “Military pension reform ‘not dead’ — DBM chief” (Nov. 25). It quoted Department of Budget and Management (DBM) Secretary Amenah F. Pangandaman and Undersecretary and Principal Economist Joselito R. Basilio.

Ms. Pangandaman said that a different version is being worked out and it is “different from what Secretary Ben [Diokno] has intended from the very beginning.” Mr. Basilio said that “Discussions are still ongoing, there will be updating.”

The pension of the Military and Uniformed Personnel (MUP) in the government’s annual budget should be zero — that is if the MUPs had not been pampered by previous administrations, especially the Ramos administration. Instead, active personnel contribute nothing to their own personal pensions, plus the pensions of retired MUP are indexed to the salaries of active personnel.

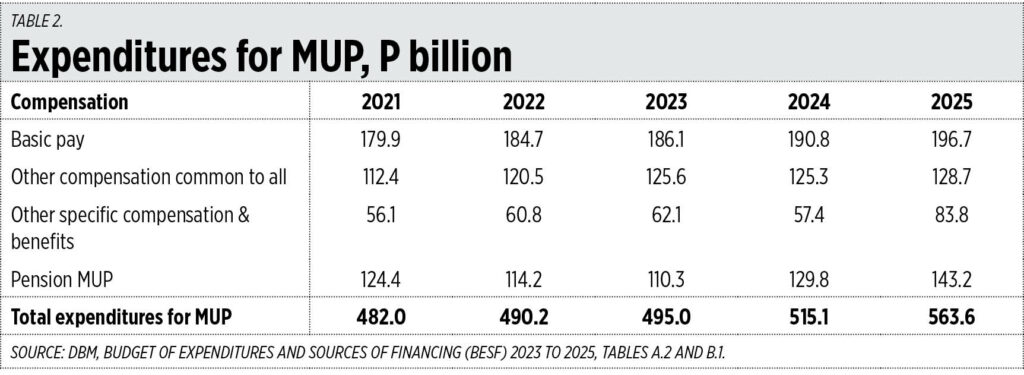

The pension comes out to about P130 billion/year on average. The share of pension to basic pay is 68% to 72% (see Table 2).

There are bills to remedy this oddity, and compared to the House version, I like the provisions in the Senate version, SB 2501, better. It says members of the military should contribute 7% of their base monthly salary to a pension system and the National Government will contribute 14%; indexation is removed and the pension is limited to 50% of the base pay for the last position held by retired MUPs. The ideal, according to Mr. Basilio, is 9% and 11%.

If indexation is retained, as is being lobbied by the Defense department and other agencies, another option is that the pension should be subject to tax, around 25%. This way, pensioners who did not contribute to their pensions during their active days would now be helping contribute to their own pension.

Every year the DBM and DoF come under pressure from so many agencies wanting higher budgets while taxes and other revenues are not able to keep up, leading to a high annual budget deficit and high borrowings. It is time to reduce and cut the subsidies and freebies, both to the public and certain government personnel.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.