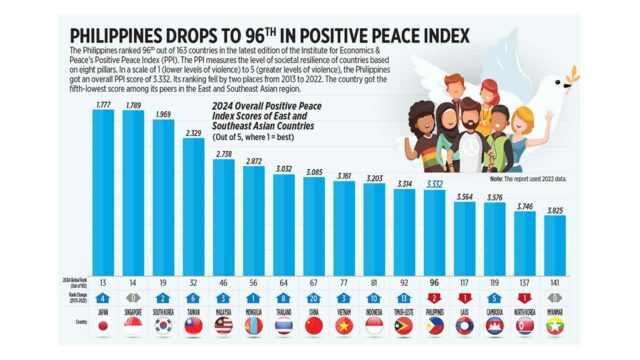

Philippines drops to 96th in Positive Peace Index

The Philippines ranked 96th out of 163 countries in the latest edition of the Institute for Economics & Peace’s Positive Peace Index (PPI). The PPI measures the level of societal resilience of countries based on eight pillars. In a scale of 1 (lower levels of violence) to 5 (greater levels of violence), the Philippines got an overall PPI score of 3.332. Its ranking fell by two places from 2013 to 2022. The country got the fifth-lowest score among its peers in the East and Southeast Asian region.

Peso rises on profit taking after sharp depreciation

THE PESO rebounded slightly against the dollar on Tuesday due to profit-taking after the currency dropped to an over 18-month low the previous trading day.

The local unit closed at P57.84 per dollar on Tuesday, rising by two centavos from its P57.86 finish on Monday, Bankers Association of the Philippines data showed.

Monday’s close was the peso’s worst showing since its P58.19-per-dollar finish on Nov. 10, 2022.

The peso opened Tuesday’s session slightly stronger at P57.85 against the dollar. Its intraday best was at P57.80, while its weakest point was at P57.89 versus the greenback.

Dollars exchanged went up to $1.135 billion on Tuesday from $1.132 billion on Monday.

“The peso slightly recovered due to profit taking by market participants after hitting the low [on Monday],” a trader said in an e-mail.

The peso was also supported by a generally weaker dollar on Tuesday ahead of key US inflation reports and US Federal Reserve Chair Jerome H. Powell’s speech, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message.

The dollar edged higher on Tuesday as traders awaited US inflation data, Reuters reported.

Traders are awaiting the US consumer price index, scheduled for Wednesday, to gauge what path the Federal Reserve will take this year in the wake of recent softer-than-expected US labor market data and comments from officials that indicated the central bank was unlikely to raise rates further.

Money markets have dialed back their expectations of Fed rate cuts this year due to sticky inflation and are now pricing in about 40 basis points of easing this year, compared with 150 bps of cuts anticipated at the start of 2024. They are also pricing in a first rate cut, with a 50% chance, only in September, according to the CME FedWatch tool.

Nearly two-thirds of economists polled by Reuters expect the Fed to cut its key interest rate twice this year, starting in September.

US inflation this week is expected to show that core consumer prices rose 0.3% month-on-month in April, down from a 0.4% growth the prior month, according to a Reuters poll.

But before that, US producer price index data was due to be released later on Tuesday, which analysts will parse through to get a sense of whether inflation is heading towards the Fed’s target of 2%.

In the meantime, the dollar index, which measures the US currency against six rivals, was last 0.17% higher at 105.37. The index has slipped almost 1% in May.

For Wednesday, the trader said the peso will likely remain weak due to Mr. Powell’s speech scheduled overnight.

The trader sees the peso moving between P57.65 and P57.90 per dollar on Wednesday, while Mr. Ricafort expects it to trade from P57.75 to P57.95. — A.M.C. Sy with Reuters

Stocks inch up as market waits for BSP meeting

PHILIPPINE SHARES inched higher on Tuesday amid a lack of leads and market caution ahead of the central bank’s policy meeting this week.

The bellwether Philippine Stock Exchange index (PSEi) rose by 0.06% or 4.11 points to close at 6,608.36 on Tuesday, while the broader all shares index rose by 0.11% or 4.15 points to end at 3,511.91.

“The local market inched up by 4.11 points (0.06%) to 6,608.36 as investors hunted for bargains. Investors maintained a cautious stance, however, while waiting for the Bangko Sentral ng Pilipinas’ (BSP) policy decision later this week, leading to a struggle for the market to find direction,” Philstocks Financial, Inc. Research and Engagement Officer Mikhail Philippe Q. Plopenio said in a Viber message.

“The digestion of first-quarter corporate earnings helped in bringing the local market to a positive close,” Mr. Plopenio said.

The Monetary Board will meet to discuss policy on May 16, Thursday.

A BusinessWorld poll showed 17 out of 19 analysts expect the BSP to keep its policy rate at a 17-year high of 6.5% for a fifth straight meeting this week.

Meanwhile, one analyst expects the central bank to cut rates by 25 basis points (bps), while another sees the Monetary Board raising rates amid persistently elevated inflation.

The BSP raised borrowing costs by a cumulative 450 bps from May 2022 to October 2023.

“Philippine shares ended Tuesday’s trading session in the green as investors looked ahead into the MSCI rebalancing announcement and anticipated key US inflation reports. The producer price index for April is set to be released at 8:30 a.m. Eastern Time,” Regina Capital Development Corp. Head of Sales Luis A. Limlingan said in a Viber message.

“The closely watched consumer price index is due on Wednesday, with expectations of a 0.4% month-on-month increase and a 3.4% year-on-year rise,” he said.

Sectoral indices ended mixed on Tuesday. Property increased by 0.97% or 23.68 points to 2,461.30; mining and oil climbed by 0.56% or 51.40 points to 9,204.87; and holding firms went up by 0.55% or 32.48 points to 5,877.45.

Meanwhile, services dropped by 0.91% or 18.36 points to 1,980.78; financials retreated by 0.2% or 4.31 points to 2,056.47; and industrials went down by 0.05% or 5.26 points to 9,095.54.

“Among the index members, Converge ICT Solutions, Inc. was at the top, climbing 4.41% to P9.24. Century Pacific Food, Inc. lost the most, dropping 3.46% to P33.50,” Mr. Plopenio said.

Value turnover declined to P4.92 billion on Tuesday with 498.39 million shares changing hands from the P11.04 billion with 949.4 million issues traded on Monday.

Decliners narrowly outnumbered advancers, 98 against 94, while 39 names closed unchanged.

Net foreign selling stood at P158.14 million on Tuesday versus the P3.33 billion in net inflows recorded on Monday. — Revin Mikhael D. Ochave

Procurement modernization to launch with vehicle e-market

THE Philippine government on Tuesday said it will launch a virtual procurement platform in the second quarter with vehicles the initial product category to be bid on.

The proposed e-marketplace of the Department of Budget and Management (DBM) digitalizes procurement, which is the “biggest bottleneck or hurdle in the budget utilization of our agencies,” Secretary Amenah F. Pangandaman said at a Palace briefing.

The platform, which was approved by President Ferdinand R. Marcos, Jr. earlier in the day, could cut the procurement process to as fast as three days from the usual 26-136 days, according to Dennis S. Santiago, executive director of the DBM’s Procurement Service (PS).

“You have products already in the system then the government procuring entities will have to select from those products and then already put in an order right there and then,” he said.

Procuring entities could save 8% to 10% using the e-marketplace, which will bypass the need for a bids and awards committee, he added.

Ms. Pangandaman said the virtual platform will be among the Government Electronic Procurement System’s new features, which also include reverse auctions, advanced data analytics, and system integration.

“We’re focusing on the e-marketplace that we will launch around the end of July or early August this year to allow for ease of the procurement in government.”

The proposed platform was first unveiled in August as a means of modernizing its procurement system. The Marcos administration has included a bill seeking to amend the 2003 procurement law in its priority legislation.

With the e-marketplace, the government may attract new bidders, especially foreign entities, according to Terry L. Ridon, a public investment analyst and convenor of InfraWatchPH.

“But they will have to build their track record and financial capacity as well, in order to bid for higher, more substantial budgets for goods or services,” he said via chat.

He said the government will ensure that procurement safeguards remain in place despite digitalization, “ensuring the lowest cost for a particular set of goods or services.”

For the initial vehicle procurement, Mr. Santiago said, “We will not be dealing with dealerships. We will be dealing with manufactures and distributors of motor vehicles,” he said, noting that the PS will looking at suppliers who can provide volume and low prices.

“Can they deliver on time? Do they have the stock in a certain period of time — 30 days, 60 days or 34 to 5 days?”

In the first quarter, government entities including local government units procured about 2,000 vehicles worth P8 billion, he said.

The DBM said local government units may choose to procure motor vehicles outside the e-marketplace pending the issuance of a certificate of non-availability.

“If (the items in the) e-marketplace are either expensive or not available, they can go ahead and make their purchases.”

Under a letter of instruction adopted by the National Government in 1978 to ensure supplies and materials are procured in the most economical and efficient way, common-use supplies and equipment must be obtained from bulk purchases made by the PS. — Kyle Aristophere T. Atienza

Study on ferry service plying Metro Manila waterways targeted for completion this year

THE Department of Transportation hopes to complete a feasibility study within the year on the Manila Bay-Pasig River-Laguna Lake (MAPALLA) Ferry System Project.

“This is something that’s currently under study. This is part of the administration’s initiative to really enhance the Pasig River and make it really liveable again,” Leonel Cray P. de Velez, assistant secretary for planning and project development, told reporters on the sidelines of an Asia and the Pacific Transport Forum on Tuesday.

The MAPALLA ferry system aims to establish a high-capacity, high-frequency and low-carbon ferry system.

The Public-Private Partnership (PPP) Center said the project as envisioned will involve private-sector construction and development of the infrastructure and facilities, include landings and passenger terminals.

The first phase of the project will serve the Pasig and Marikina rivers while the second phase is a possible extension of ferry services into Laguna de Bay and Manila Bay.

For now, the feasibility study “is currently ongoing with the PPP Center. So we hope to have the study within the year,” Mr. De Velez said.

The project could be bid out to interested parties next year, Mr. De Velez said, adding that the project cost is still being determined.

“To be determined. That is currently what we are doing; it will all stem from demand. The number of passengers will determine the number of ferry stations and boats,” he added. — Ashley Erika O. Jose

House panel approves bill expanding road tax to some three-wheeler types

A HOUSE of Representatives committee on Tuesday approved a bill that seeks to extend the road users’ tax to include some types of “unconventional” three-wheeled vehicles, with the measure expected to generate P17 billion in revenue for the government over the next four years.

Under House Bill No. 10038, owners of such vehicles would have to pay a road user’s tax amounting to P2,080 in 2024, P2,560 in 2025, and P3,040 in 2026. The bill prescribes a 5% increase from the 2026 tax rate for the following years.

The measure sets into law a Land Transportation Office (LTO) memorandum issued four years ago prescribing tax rates on three-wheeled vehicles.

The “non-conventional” category includes three-wheeled single-chassis motor vehicles as well as light and heavy quadricycles.

“Memorandum Circular No. 2020-2227 of the LTO serves as a temporary solution in providing a framework for imposing a road user’s tax on non-conventional vehicles which do not fall under current legislation,” Rep. Jose Maria Clemente S. Salceda, who chairs the House Ways and Means Committee, said during the committee hearing.

The LTO issued the memorandum in response to the growing number of non-conventional vehicles on the roads with around 1.4 million units purchased since 2020, according to the bill’s explanatory note.

The proposed measure harmonizes the tax rate for non-conventional vehicles by charging a flat rate.

“This proposal follows the user-pay principle which recommends that road users must be charged based on the wear and tear they cause to the roads,” Department of Finance representative Charmaine B. Odicta told the panel.

Mr. Salceda also questioned the Department of Interior and Local Government (DILG) during the panel hearing, asking the department why it banned non-conventional vehicles from using national roads.

“Why (did the) DILG ban three-wheeled vehicles from the national roads unilaterally?” Mr. Salceda said.

The imposition of road user’s tax on non-conventional vehicles should allow them to use the national roads. “It… disenfranchises a significant share of both users and taxpaying vehicle owners,” Mr. Salceda said in a statement. — Kenneth Christiane L. Basilio

SRA preparing to meet US export quota

THE Sugar Regulatory Administration (SRA) said it is undertaking the initial preparations to help the industry meet the US raw sugar export quota.

“Right now, there is a push from the (Private Sector Advisory Council) and from the refiners and millers, and also exporters, to meet the 24,700 metric tons (MT) quota,” SRA Administrator Pablo Luis S. Azcona said in a briefing.

He added that the regulator is readying the initial paperwork to allow the export of sugar, with an initial shipment targeted for June.

“Our exporters have pre-qualified for the program because they participated in Sugar Order No. 2. These will be the same people who will be involved in the export program if it happens,” Mr. Azcona added.

Sugar Order No. 2 called for the voluntary purchase of domestically produced sugar in order to stabilize farmgate prices. Participants were eligible to avail of an allocation for a future import program.

The Philippines last shipped raw sugar to the US market during the crop year 2020-2021, amounting to 112,008 MT of commercial weight raw sugar.

The Philippines has not exported sugar to the US since, due to domestic supply concerns.

During the 2023-2024 crop year, raw sugar production hit 1.92 million MT as of May 5.

The US granted the Philippines an additional export quota of 25,300 metric tons raw value (MTRV) of raw sugar, on top of the 145,235 MTRV quota for the year.

Mr. Azcona said earlier that millers and traders were volunteering to export 30,000 or 60,000 MT of raw sugar to the US.

Last week, PSAC’s agriculture group had also recommended importing raw sugar and refining it for export.

“If we ship to other countries who accept refined sugar and they don’t specify where the raw sugar comes from, it’s possible,” Mr. Azcona added. — Adrian H. Halili

Catch landed at fishports up 13% in Q1

THE catch landed at regional fishports (RFPs) rose 13% year on year during the first quarter, according to the Philippine Fisheries Development Authority (PFDA).

In a report, the PFDA said the landed catch was 134,746.84 metric tons (MT) during the three-month period, up from 118,419.49 MT a year earlier.

On a quarter-on-quarter basis, fish volumes fell 6.7% compared with the fourth quarter of 2023.

“This January to March 2024 period, the PFDA opened the year with significant numbers in terms of fish unloading and handling,” it said, citing the effects of the closed fishing season on fish volumes.

Republic Act No. 8550 or the Fisheries Code imposes a three-month closed fishing season to repopulate certain fish species. The season typically ends during the first two months of the following year.

Fishing bans are declared in Northern Palawan, Ilocos, Negros Occidental, Capiz, and Cebu during the fourth quarter of the year.

“During (the first quarter), all PFDA RFPs maintained a positive trend both in terms of the quarterly number of vessel arrivals and the number of clients served,” it said.

The PFDA added that the daily average of fish unloaded rose 12% year on year to 1,480.73 MT. The average was down 5.6% from a quarter earlier.

“The ports opened their doors to 25,200 vessel arrivals and attended to 10,869 clients throughout the quarter,” it added. — Adrian H. Halili

ADB supports incentives for nurses settling, working in underserved areas

NURSES must be offered incentives to settle and work in rural and underserved areas, the Asian Development Bank (ADB) said.

“With the ongoing escalation of health challenges across Asia and the Pacific, the nursing profession assumes an increasingly pivotal role in meeting the evolving healthcare needs,” Ayesha Jamshaid de Lorenzo, health specialist at the ADB’s Human and Social Development Sector Office, said in a blog.

She noted that the region’s nurses are in short supply and an “overall decline in the dignity of the profession” amid “chronic underinvestment” in education and training, with their numbers not keeping up with population growth.

“Ultimately, investing in the nursing sector not only addresses immediate healthcare needs but also has the potential to create millions of new jobs, spur economic growth, and foster broader socioeconomic development across the region,” Ms. De Lorenzo said.

Governments must invest in education and training, increase funding for nursing programs, and align such programs with each population’s healthcare needs.

“Increasing nursing sector challenges in the context of the broader macro-trends require health systems to review the effectiveness of past policies and strategies and adopt new, fit-for-purpose approaches to transform their health workforce from planning, education, deployment, managing, and rewarding workers,” she added.

By 2030, the global health sector could face a shortage of 18 million healthcare workers, the World Health Organization estimates.

The Asia-Pacific region in particular faces an increasing demand for nurses amid ageing populations, climate vulnerability, emerging diseases, and growing populations.

However, inadequate healthcare policy drives nurses to migrate to countries with more established healthcare systems.

“For example, despite the Philippines being a major provider of nurses abroad, it faces chronic understaffing in its own hospitals due to low pay, lack of tenure, and burnout,” Ms. De Lorenzo said.

Filipino nurses are lowest paid among their Southeast Asian peers, according to data aggregator IPrice. An experienced nurse is estimated to earn 57% less than an equivalently credentialed nurse in Vietnam, it added.

A total of 6,789 Filipino nursing graduates took the US licensure exam in the first three months of the year, Quezon City Rep. Marvin D. Rillo said in a statement.

“We expect a large number of Philippine nursing graduates to persist in pursuing their career aspirations in America and other foreign labor markets as long as we continue to underpay them here at home,” said Mr. Rillo, who co-chairs the House Committee on Higher and Technical Education.

Outmigration, which boosts remittances to nurses’ home countries, must be balanced with other strategies to help address the source countries’ own growing demand for nurses, Ms. De Lorenzo said. — Beatriz Marie D. Cruz

ADB launches ‘toolkit’ for design of environment-friendly roads

THE Asian Development Bank (ADB) said on Tuesday that it launched a toolkit that would aid governments and transport industries in building low-carbon and inclusive road infrastructure.

The ADB, along with the International Road Federation and MetaMeta Research, launched the Green Roads Toolkit, to guide the planning, design, construction and maintenance of roads while ensuring environmentally sustainable practices.

“We need to do road investments and other transport infrastructure better to develop them sustainably and ensure accessibility for all,” James Leather, director of the bank’s transport sector office, said during the Asia and the Pacific Transport Forum.

The framework seeks to address the region’s need for eight million kilometers of roads by 2030, as estimated in the Asian Transport Outlook.

It also aims to ensure beneficial land and water use, reduce pollution, push for restorative and regenerative ecosystems, and ensure the public safe and affordable mobility in the region.

“This toolkit will provide engineers, planners, decision makers, and practitioners with the guidance to balance the economic, social and environmental objectives to make roads in Asia and the Pacific greener,” Mr. Leather said.

The guide details 150 best practices in road design and planning, tackling decarbonization, sustainable materials and construction, fostering inclusive growth, climate resilience, reducing pollution, preserving biodiversity, water and land management, disaster preparedness, and improving quality of life.

“It will guide project teams in recommending interventions that support the alignment of road investments with the Paris Agreement on climate change and other sustainability agendas,” said Rebecca Stapleton, ADB’s senior analyst for the transport sector group and co-lead on the ADB Green Roads Initiative.

Around 400 million people in the Asia-Pacific region live more than two kilometers away from an all-season road, Mr. Leather said.

Roads account for 18% of the world’s energy-related carbon dioxide emissions.

The toolkit will be regularly updated to include additional best practices to develop and manage “green roads.”

Over 1.7 billion across Asia do not have access to reliable transport, Managing Director General Woochong Um told the forum.

“Our focus now is not only on moving cars and other forms of vehicles. It is also not only on moving goods and people. We focus now also on shaping sustainable futures for our developing member countries,” Mr. Um said.

The ADB is also supporting the transition to electric vehicles, Mr. Um said.

“Transitioning to electric vehicles represents a significant step forward, yet this alone is insufficient to tackle broader issues, such as accessibility, congestion, or safety. Our approach must be holistic, incorporating a range of innovative solutions to ensure that our transport systems are not only environmentally sustainable, but also universally accessible and safe,” he said. — Beatriz Marie D. Cruz

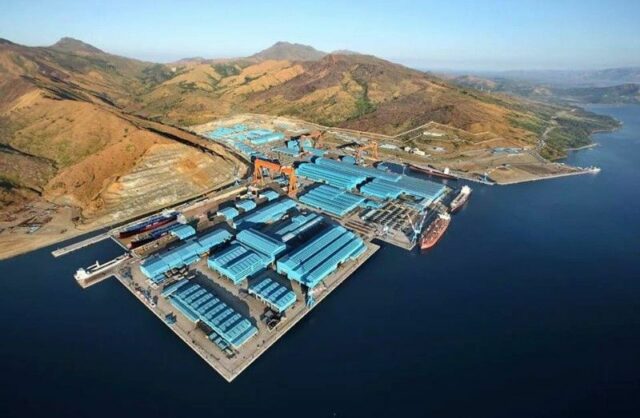

Marcos touts shipbuilding ‘fresh start’ as Hyundai Heavy invests in Subic

PRESIDENT Ferdinand R. Marcos, Jr. said he is optimistic the Philippines will boost its position in shipbuilding and achieve its renewable energy goals, after South Korea’s HD Hyundai Heavy Industries Co., Ltd. and Cerberus Capital Management, L.P. announced a new venture at the Subic economic zone.

“We welcome Hyundai Heavy’s investment that will not only open new doors for our offshore wind industry, but will also bring maritime manufacturing back to Subic and eventually restore the glory days of shipbuilding to our shores,” he said at the partnership launch event hosted by the Palace.

“Not only would it generate thousands of jobs, but also enable the transfer of critical skills and improve the Philippines’ position in the global market.”

Under the partnership, Hyundai Heavy will lease a drydock at Agila Subic, a multi-use facility that Cerberus acquired in April 2022.

Hyundai Heavy will use the facility for construction focused initially on offshore wind projects.

“Hyundai Heavy’s initial focus on the development of offshore wind platforms (bodes) well for our goal to transition to renewable energy,” Mr. Marcos said.

He added that the Philippines looks forward to the opportunity to usher in an “era of shipbuilding” with Hyundai Heavy’s entry.

The Philippines was the seventh-largest shipbuilder in the world in 2022, building nearly 400,000 gross tons of newly built seagoing vessels.

“This is a far cry from our capacity in the past, and even far behind the output of shipbuilding leaders like South Korea and Japan,” he said.

“With this initiative of Cerberus and Hyundai Heavy, we will have a fresh start and a strong foundation in realizing our vision to be amongst the largest and most consequential shipbuilders in the world,” he added.

He said Cerberus will also be involved in developing Philippine microelectronics, semiconductors, and critical metals.

He said Cerberus has also helped attract other locators including Sancom, the world’s leading subsea cable company, and V2X, Inc., a global logistics corporation.

“And you have worked closely with our Philippine Navy while establishing a world-class operating base for our Navy,” he added.

“The investments that will be created hereafter are especially beneficial to Subic because these will strengthen the Freeport area’s vital role as a hotspot for industrial, commercial, and other economic activities.”

Mr. Marcos, meanwhile, said he also hopes that the investment plans will also help in the “upskilling and reskilling of the Filipino workforce” in adapting to new technologies required by industry.

“We encourage Hyundai Heavy to partner with our Commission on Higher Education and Technical Education and Skills Development Authority, or TESDA, in finding projects for the development of our very talented workforce,” he said. — Kyle Aristophere T. Atienza