Korean medical thriller to debut on Disney+

THIS month, medical crime drama Hyper Knife will see two of South Korea’s biggest stars go head-to-head. The show follows visionary neurosurgeon Jeong Seok (played by Park Eunbin) who must continue to carry out back-alley operations when her medical license is stripped after discovering a shocking truth. Her former mentor (played by Sul Kyunggu) then comes asking for help despite being responsible for her downfall. The series comes to Disney+ on March 19.

British Council presents Five Films for Freedom

FIVE powerful LGBTQIA+ (lesbian, gay, bisexual, trans, queer, intersex, asexual plus) short films from Indonesia, New Zealand, USA/China, and the UK, will be available online this month as the British Council presents the program in partnership with the BFI Flare film festival. The films are DragFox from the UK, If I Make it to the Morning from the USA and China, NGGAK!!! from Indonesia, We’ll Go Down in History from the UK, and Wait, Wait, Now! from New Zealand. Aside from being on the British Council’s YouTube channel until March 30, they will be screened in physical venues in the Philippines: University of the Philippines Cebu on March 19, 2:30 p.m.; Negros Museum’s Cinematheque in Bacolod on March 21, 9 a.m. and 3:30 p.m.; and the National Teachers College on March 24, 26, 27, and 28.

Waiian releases third album

FILIPINO rapper Waiian has dropped a raw unfiltered commentary on music and personal life with his third album, BACKSHOTS. The nine-track release takes a stand against the music establishment, trends, and conforming to social expectations. It draws inspiration from artists like Teezo Touchdown, Kanye West, Brockhampton, Kendrick Lamar, and Denzel Curry. Waiian’s BACKSHOTS is out now on all digital music streaming platforms.

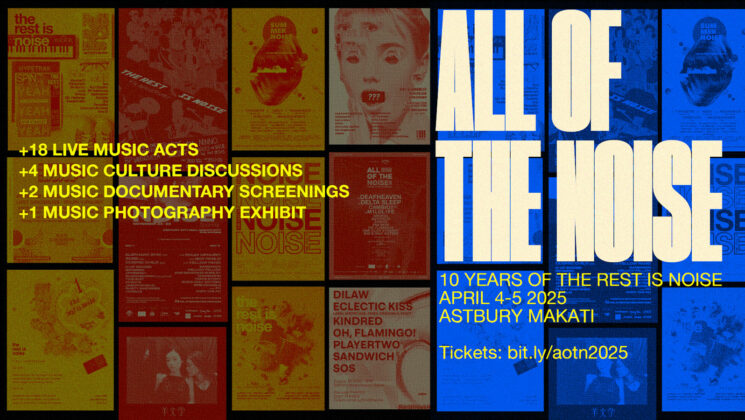

The Rest Is Noise presents All Of The Noise 2025

A TWO-DAY music program in April will feature music documentary screenings, panel discussions, keynote presentations, an exhibit, and a live music showcase featuring more than 16 music acts from the Philippines, Taiwan, Singapore, Indonesia, and Thailand. Organized by The Rest Is Noise (TRIN), a Philippines-based music curation and events production outfit for its 10th anniversary, All Of The Noise 2025 will take place at Astbury Makati on April 4 and 5. It is the third iteration of the event, but the first since the pandemic. The headliner musicians are Taiwanese soft-rock band The Chairs, Thai alt-pop band KIKI, Singaporean hip hop artist San The Wordsmith, and Indonesian experimental electronic act Logic Lost. The event will feature screenings of two local music documentaries: Budots: The Craze by Jay Rosas and Mark Limbaga on April 4, and Jingle Lang Ang Pahina by Chuck Escasa on April 5. Finally, there will be an exhibit featuring the work of Karen De La Fuente, a photographer who has captured iconic Filipino musicians during live performances.

Pamungkas, Scrubb headline PHL-only concert

GABI NA NAMAN Productions (GNN) is marking its 10th anniversary of producing shows and concerts with a one-day concert top-billed by Pamungkas from Indonesia and Scrubb from Thailand. GNN10 Presents: Pamungkas and Scrubb Live in Manila will take place on April 26 at 123 Block in Mandala Park, Mandaluyong City. The show is a Philippine-only event. Indonesian singer-songwriter and producer Pamungkas and Thai alt-pop duo Scrubb were previously brought to Manila by GNN in 2022 and 2024, respectively.

Lil Nas X drops new single

AWARD-WINNING artist Lil Nas X has unveiled his single “HOTBOX” via Columbia Records/Sony Music Entertainment. The new track was produced by his previous collaborators Take a Daytrip, Omer Fedi, and Ojivolta. Its accompanying music video sees Nas taking a dip into a pink pool, turning into a pink transformer, getting knocked out in a pink boxing ring, and frolicking through various pink dreamscapes. It was directed by Elias Talbot. “HOTBOX” is out now on all digital music streaming platforms.

Wilbros Live unveils artist lineup for anime music festival

ANISAMA World 2025 in Manila, to be held on June 7 at Araneta Coliseum, Quezon City, will have eight artists performing to fans of Japanese anime and music. Wilbros Live has unveiled three of the eight artists headlining the music festival: rock band ASH DA HERO, who did theme songs for Blue Lock; girl band Ave Mujica known for their music on the series BanG Dream!; and Mayu Maeshima, former lead vocalist of pop-rock band MYTH & ROID, which did songs for Re:Zero, Full Dive, Overlord, and Uncle from Another World. More details about the festival will be revealed soon.

The Summer I Turned Pretty slated for final season in July

PRIME VIDEO has announced that the third and final season of the global hit series The Summer I Turned Pretty will premiere this July. Season three of the Amazon Original series will have 11 episodes. It is led by showrunners Jenny Han and Sarah Kucserka and is co-produced by Amazon Studios and wiip. Based on the best-selling book trilogy from Jenny Han, the drama hinges on a love triangle between one girl and two brothers, the ever-evolving relationship between mothers and their children, and the enduring power of strong female friendship. Its 3rd season will premiere on Prime Video in July.

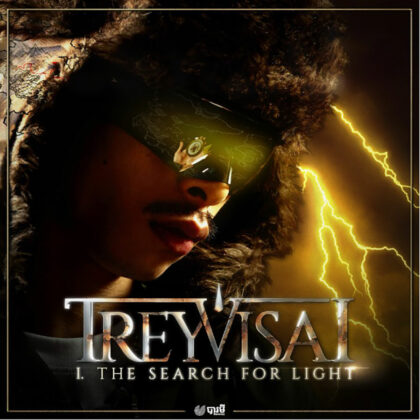

Cambodian rapper VannDa to drop mini-album series

SUPERSTAR rapper from Cambodia, VannDa, is set to release a trilogy of mini-albums entitled TREYVISAI (Khmer for “The Compass”). The first installment, The Search for Light is out now, containing high-energy tracks like “Out of My Mind”, “Me, My Flow, and I,” and “Fishing.” It sets a triumphant, celebratory tone while hinting at the deeper themes to be explored in subsequent releases. Its lead track “Smoke Up” features a collaboration with Thai rap icon YOUNGOHM, marking a significant moment in Southeast Asian hip-hop. The trilogy will continue on March 21 with Burn Like the Sun, and on May 1 with The Return to Sovannaphum.

Global dance show Burn the Floor comes to Manila in July

BALLROOM dance phenomenon Burn the Floor: Ballroom Reinvented is bringing its modern take on ballroom dance to Filipino audiences from July 10 to 15. Taking place at The Theatre at Solaire, the show has aimed to redefine the art of dance since its debut in 1999. It will showcase standard ballroom dances such as the Slow Waltz, Tango, Viennese Waltz, and Foxtrot, alongside Latin American ballroom dances including the Cha-Cha, Samba, Rumba, Paso Doble, and Jive.

Burn the Floor: Ballroom Reinvented is represented in Manila by GMG Productions on behalf of Dance Partner Productions. Tickets go on sale on March 20 via TicketWorld.

TBA Studios taps Iain Glen to join historical biopic Quezon

SCOTTISH actor Iain Glen is joining the cast of TBA Studios’ biographical historical movie Quezon. Mr. Glen, who is known for playing Jorah Mormont in the fantasy drama television series, Game of Thrones, has been cast as Leonard Wood, the United States Army major who served as governor-general of the Philippines. The actor met the cast and crew of the film for their script reading at The Manila Hotel earlier this year. Quezon director and co-writer Jerrold Tarog said of the casting: “Iain Glen has gravitas. But at the same time, he can let loose, which is important for the role of Leonard Wood.” The National Commission for Culture and the Arts, the Film Development Council of the Philippines, the Department of Tourism, and the QCinema Film Foundation have given their support to the film. Mr. Glen joins Jericho Rosales, who plays the title role of Philippine President Manuel L. Quezon.

Rich Brian releases single, announces album due in May

ASIAN star Rich Brian has announced his forthcoming album WHERE IS MY HEAD? due May 23. The announcement is paired with the arrival of his new single “Little Ray Of Light,” the first official offering from the project, alongside a new music video. The song marks a notable sonic shift from the catalog on which Rich Brian has built his career. It is built around analog instrumentation and sees him primarily embracing his singing voice in a way that past releases have not. The song’s music video, directed by Jared Hogan, is raw and diaristic, with Brian conducting a string section. “Little Ray Of Light” is out now on all digital music streaming platforms.