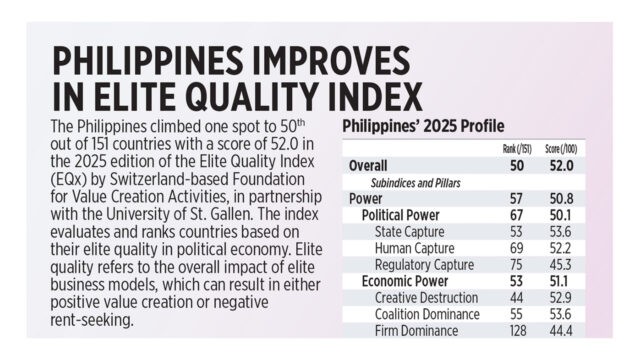

Philippines improves in Elite Quality Index

The Philippines climbed one spot to 50th out of 151 countries with a score of 52.0 in the 2025 edition of the Elite Quality Index (EQx) by Switzerland-based Foundation for Value Creation Activities, in partnership with the University of St. Gallen. The index evaluates and ranks countries based on their elite quality in political economy. Elite quality refers to the overall impact of elite business models, which can result in either positive value creation or negative rent-seeking.

Peso weakens on geopolitical concerns

THE PESO weakened against the dollar on Wednesday as heightened geopolitical concerns affected market sentiment.

The local unit closed at P55.66 per dollar, dropping by three centavos from its P55.63 finish on Tuesday, Bankers Association of the Philippines data showed.

The peso opened Wednesday’s session stronger at P55.58 against the dollar. It dropped to as low as P55.70, while its intraday best was at P55.56 versus the greenback.

Dollars exchanged went down to $1.51 billion on Wednesday from $1.999 billion on Tuesday.

“The dollar-peso initially [rose] to P55.56, still on pressure on the dollar following Moody’s US credit rating downgrade, but risk-off sentiment due to ongoing tension between Israel and Iran lifted the dollar against the peso to P55.70,” a trader said in a phone interview.

The news about Israel’s plan to strike Iran’s nuclear facilities also led to higher global crude oil prices on Wednesday, which dragged the peso further, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message.

For Wednesday, the trader expects the peso to move between P55.50 and P55.80 per dollar on Tuesday, while Mr. Ricafort sees it ranging from P55.55 to P55.75.

New intelligence obtained by the United States suggests that Israel is making preparations to strike Iranian nuclear facilities, CNN reported on Tuesday, citing multiple US officials familiar with the intelligence, Reuters reported.

It was not clear whether Israeli leaders have made a final decision and there was disagreement within the US government about whether the Israelis would ultimately decide to carry out strikes, CNN added, citing the officials.

Reuters could not immediately confirm the report, which contributed to a rise in oil prices by more than 1% on concern such a strike might upset Iranian flows. The National Security Council did not immediately respond to a request for comment.

The Israeli Embassy in Washington, the Israeli Prime Minister’s Office and the Israeli military did not immediately respond to requests for comment.

One source familiar with the intelligence told CNN the likelihood of an Israeli strike on an Iranian nuclear facility “has gone up significantly in recent months.”

The person added that the chance of a strike would be more likely if the US reached a deal with Iran that did not remove all of the country’s uranium, CNN added.

US President Donald J. Trump’s administration has been conducting negotiations with Iran aimed at achieving a diplomatic deal over its nuclear program.

The new intelligence was based on the public and private communications from senior Israeli officials as well as intercepted Israeli communications and observations of Israeli military movements that could suggest an imminent strike, CNN reported.

CNN cited two sources saying that among the military preparations the US had observed were the movement of air munitions and the completion of an air exercise.

Earlier on Tuesday, Iran’s Supreme Leader Ayatollah Ali Khamenei said US demands that Tehran stop enriching uranium are “excessive and outrageous,” state media reported, voicing doubts over whether talks on a new nuclear deal will succeed. — Aaron Michael C. Sy with Reuters

Local stocks eke out gains on bargain hunting

PHILIPPINE STOCKS rose on Wednesday to snap their five-day losing streak as investors bought bargains and waited for fresh leads.

The benchmark Philippine Stock Exchange index (PSEi) rose by 0.63% or 40.02 points to close at 6,375.35, while the broader all shares index went up by 0.46% or 17.37 points to 3,737.94.

“The local market’s sideways movement ended in the positive territory on the back of bargain hunting. Appreciation of corporate fundamentals helped in the rise,” Philstocks Financial, Inc. Senior Research Analyst Japhet Louis O. Tantiangco said in a Viber message.

“Philippine shares booked modest growth on Wednesday, gaining 0.63% despite a slow start earlier in the session, as investors looked for new catalysts following the earnings season,” Regina Capital Development Corp. Head of Sales Luis A. Limlingan said in a Viber message.

Mr. Limlingan added that the local market closed higher despite the weaker performance of US shares overnight.

“Wall Street edged lower from the recent recovery run, halting a six-day streak of gains amid ongoing trade uncertainty and political hurdles over tax legislation affecting investor optimism,” he said.

US stocks fell on Tuesday, with the benchmark S&P 500 ending six straight sessions of gains, under pressure from rising Treasury yields, with the US sovereign debt profile in focus, Reuters reported.

US President Donald J. Trump traveled to Capitol Hill, seeking to persuade Republican lawmakers to pass a sweeping tax-cut bill, which analysts estimate will possibly add $3 trillion-$5 trillion to the federal government’s $36.2 trillion in debt.

The Dow Jones Industrial Average fell 114.83 points or 0.27% to 42,677.24; the S&P 500 lost 23.14 points or 0.39% to 5,940.46; and the Nasdaq Composite lost 72.75 points or 0.38% to 19,142.71.

Moody’s and the other big ratings agencies Fitch and S&P Global Ratings have downgraded the US sovereign credit, citing the government’s debt profile.

At home, majority of sectoral indices closed higher on Wednesday. Mining and oil rose by 4.64% or 419.77 points to 9,453.45; holding firms went up by 1.34% or 72.29 points to 5,447.64; financials climbed by 1.12% or 26.35 points to 2,376.68; and services increased by 0.13% or 2.83 points to 2,110.63.

Meanwhile, property dropped by 0.6% or 13.55 points to 2,236.30 and industrials declined by 0.08% or 7.44 points to 9,029.66.

“Bank of the Philippine Islands led the index members, climbing 4.27% to P136.70. China Banking Corp. was at the tail end, plunging 6.36% to P76.50,” Mr. Tantiangco said.

Value turnover went up P7.63 billion on Wednesday with 712.07 million shares traded from the P7.32 billion with 1.35 billion stocks exchanged on Tuesday.

Advancers outnumbered decliners, 107 to 81, while 52 names were unchanged.

Net foreign selling dropped to P287.34 million on Wednesday from P886.21 million on Tuesday. — Revin Mikhael D. Ochave with Reuters

GOCC dividends seen topping 2024 collections

STATE-RUN FIRMS remitted P76 billion worth of dividends to the Treasury as of May, with the Department of Finance (DoF) expecting the final amount this year to exceed the 2024 total of P138.46 billion.

“The amount is expected to exceed… the level in 2024,” the DoF said in a statement on Wednesday.

The DoF said dividend collections were from 50 government-owned or -controlled corporations (GOCCs), with around 13 firms contributing at least P1 billion each.

Citing preliminary data, the DoF said the top contributors were the Land Bank of the Philippines (P26 billion), the Philippine Amusement and Gaming Corp. (P12.68 billion), the Philippine Deposit Insurance Corp. (P10.13 billion), and the Philippine Ports Authority (P5.20 billion).

This was followed by the Manila International Airport Authority (P3.32 billion), the Philippine National Oil Co. (P2.43 billion), the Bases Conversion and Development Authority (P2.04 billion), the Philippine Charity Sweepstakes Office (P1.77 billion), the Subic Bay Metropolitan Authority (P1.47 billion), and the Maharlika Investment Corp. (P1.45 billion).

“These nontax revenues allow us to support the government’s expenditure program for the year, enabling the DoF to stay on track with its fiscal program and mobilize funds for our priority programs and projects,” Finance Secretary Ralph G. Recto said.

In order to boost nontax revenue, the DoF earlier requested GOCCs to increase the share of its net earnings that goes to the National Government to 75%.

This was higher from the “at least 50%” required by Republic Act No. 7656 or the Dividend Law.

In March, nontax revenue declined 69.36% to P19.6 billion, bringing the total to P66.7 billion in the first quarter. — Aubrey Rose A. Inosante

CAB lowers air passenger fuel surcharge for June

THE Civil Aeronautics Board (CAB) said it will reduce the airline passenger fuel surcharge for June.

The June surcharge has been downgraded to Level 3 from Level 4 the previous month, the CAB said in a May 19 advisory.

The Level 3 fuel surcharge is P83 to P300 for domestic flights and P273.36 to P2,032.54 for international flights originating from the Philippines.

The CAB said the applicable conversion rate for airlines collecting the fuel surcharge in foreign currency is P56.42 to the dollar.

The Level 4 surcharge ranges from P117 to P342 for domestic flights and P385.70 to P2,867.82 for international flights originating from the Philippines.

“Airlines wishing to impose or collect a fuel surcharge for the period must file applications with this office on or before the effectivity period, with fuel surcharge rates not exceeding the above-stated levels,” CAB Executive Director Carmelo L. Arcilla said.

Fuel surcharges are triggered by the movement of jet fuel prices, using a benchmark known as Mean of Platts Singapore.

“We welcome the decision of the CAB to lower the fuel surcharge for the month of June. This recent adjustment supports our efforts to offer more affordable travel to even more destinations, as seen by our increase in routes — especially in our hubs outside of Manila such as Clark, Iloilo, Cebu, and Davao,” Cebu Pacific President and Chief Commercial Officer Alexander G. Lao said in a statement. — Revin Mikhael D. Ochave

Lotte among Korean firms planning PHL investments

THE Department of Trade and Industry (DTI) said South Korean companies led by Lotte Group are planning food service and retail investments in the Philippines.

In a statement on Wednesday, the DTI said it heard expressions of intent from the Korean companies at a May 19 meeting.

“Central to the discussion were the South Korean firms’ plans to leverage their operational expertise and advanced retail models to contribute to the Philippines’ economic growth,” the DTI said.

“These companies aim to invest in joint ventures, master franchise agreements, and localized operations that will generate employment, strengthen supply chains, and modernize retail distribution in the country, progressing beyond exporting their brands,” it added.

It said Lotte Group’s restaurant service arm, Lotte GRS, is preparing to launch its Lotteria flagship brand in the Philippines.

“It is targeting at least 30 store openings across five years. This initiative has a strong focus on local sourcing and workforce development,” the DTI said.

Another potential investor outlined plans to introduce modern convenience store formats following successful tests in Vietnam and Mongolia.

The DTI said this potential investor committed to 95% local sourcing,.

“These include fresh items such as fruits, vegetables, sandwiches, and salads,” it said, adding that the potential investor expressed interest in digital commerce platforms and last-mile delivery services.

“In addition to food service and retail ventures, South Korean firms are also exploring opportunities in restaurant expansion and import-export channels for Philippine agricultural and seafood products,” the DTI said.

“One company, which recently signed a partnership with a Philippine firm, is set to open its first store in Manila by August,” it added. — Justine Irish D. Tabile

Expanded P20 rice program targets 14M beneficiaries

THE Department of Agriculture (DA) said it hopes to expand the coverage of its P20-per-kilo rice pilot test to reach about 14 million beneficiaries by September.

The program will be expanded to parts of Luzon and Mindanao, after having been initially launched in selected Visayan provinces on May 1,the DA said in a statement.

The pilot test for the subsidized-rice program, targeted at vulnerable segments of society like the poor, persons with disabilities, senior citizens, and single parents — is scheduled to run until December.

The second phase of the rollout, which begins in July, will target Zamboanga del Norte, which has a poverty incidence of 37.7%; as well as Basilan, Cotabato City, Tawi-Tawi, the Maguindanao provinces, and Davao Oriental. It will also be offered in Sorsogon, on Luzon.

The third phase, starting in September, will extend coverage to Sultan Kudarat, Lanao del Norte, Agusan del Sur, Sarangani, and Dinagat Islands. Also included in this phase is Catanduanes.

The subsidized rice is sourced from the National Food Authority, whose current inventory is equivalent to around 8 million 50-kilo bags of milled rice.

In locations where local government units (LGUs) share the subsidy, it will be up to the LGUs to determine eligibility, with the limit set at 30 kilos per household. — Kyle Aristophere T. Atienza

5 RE projects endorsed for grid impact study

THE Department of Energy (DoE) said it endorsed five renewable energy (RE) projects to undergo a system impact study (SIS) with the National Grid Corp. of the Philippines.

“In April 2025, the DoE issued five SIS endorsements, which are all new applications,” the DoE said in a posting on its website.

Such studies are conducted to determine the adequacy and capability of the grid to accommodate the new connection.

The DoE issued SIS endorsements to JBD Water Power, Inc.’s 200-MW Abra-Kalinga Wind Power Project in Kalinga; Freya Renewables, Inc.’s 160-MW E.B. Magalona Wind Power Project in Negros Occidental; and Amihan Power, Inc.’s 80-MW Presentacion 3 Wind Power Project in Camarines Sur; PAVI Green Camsur Renewable Energy, Inc.’s 50.104-MWp PAVI Green Naga Solar Power Project in Camarines Sur; and Energy Development Corp.’s 30-MW Botong-Rangas Geothermal Project in Sorsogon.

This year, the department has issued 40 SIS endorsements — 30 to renewable energy projects, two to conventional power projects, and eight to energy storage systems.

Meanwhile, the DoE has endorsed four power projects to the Energy Regulatory Commission.

The biggest project of the four was Isabel Ancillary Services Co. Ltd.’s 86.320-MW Isabel Modular Diesel Power Plant in Leyte.

The DoE also endorsed National Power Corp.’s 0.3-MW Jintotolo Diesel Power Plant in Masbate and 0.19-MW Sibolo Diesel Power Plant in Antique; and Amatera Renewable Energy Corp.’s 65.012-MWdc Vista Alegre Solar Power Project in Negros Occidental.

A certificate of endorsement (CoE) is a prerequisite for generation facilities to be issued a certificate of compliance, a license issued by the ERC that grants permission to operate.

In the first four months, the DoE issued 32 CoEs, of which 14 are conventional projects and 18 renewable energy projects. — Sheldeen Joy Talavera

More investments needed to support EPR law due to dearth of recyclers

THE DISTANCE to recycling centers is keeping plastic waste in the provinces from being processed, according to a fintech offering a global plastic deposit program.

Rene Guarin, Plastic Bank vice-president for the Asia-Pacific region, said the dearth of recycling centers points to an opportunity to tap public-private partnerships (PPP) and blended finance to enable broader compliance with the Expanded Producer Responsibility (EPR) law.

There’s a lot of plastics in the provinces. They just stay there because the main constraint is, “How do I bring this to recyclers if they’re far?” he added.

The expense of transporting plastics to processing facilities could exceed the value of the waste, he noted.

The EPR law requires companies to manage the entire life cycle of their plastic packaging, including disposal. It set a recovery rate target of 80% for all plastic packaging.

“I think if you take a look at recycling industry, not much investment is really coming in,” he said on the sidelines of an EPR event with Philippine companies.

“If there are no bailing machines or crushers, the cost of transport is really higher than the market value,” he said, citing feedback from waste collectors.

“Then the recyclers say, we have the machines, but sometimes our machines need to be upgraded so that they would meet international standards,” Mr. Guarin said.

“For each market, there are different standards, different kinds of machines are needed,” he added.

Mr. Guarin said PPPs and blended finance — which involves pooling public funds and private philanthropy — are key to helping recyclers upgrade their facilities and equipment, as an alternative to commercial bank financing.

“Right now, their investment is really coming from their own funds. If there’s a PPP, that would reduce the cost of money for them to upgrade and expand their capacity,” he said. “That would bring in more recycling in the Philippines.”

Mr. Guarin also cited the need to mainstream blended finance to reduce the burden of loan financing with grants.

“It’s been practiced in other countries,” he added.

“But if you talk to processors, they don’t have any idea because nobody has approached them (with such a scheme) in the Philippines.”

Plastic Bank has a traceable recycling system supported by the blockchain. Garbage collectors, for instance, can exchange the plastic they collect for either cash or social benefits such as health insurance, grocery vouchers and school supplies.

Plastic Bank, a Canadian fintech, sells on the materials it collects to large brands for use as recycled materials.

“We add value to the plastic we sell. We call our material social plastic,” Founder and Chief Executive Officer David Katz said.

“It’s collected by everybody. It’s for everybody.”

Plastic Bank offers solutions in the form of plastic credits to help Philippine companies achieve their 80% recovery rate by 2028.

The EPR law requires all companies with assets exceeding P1 billion to implement EPR programs.

Mr. Guarin said companies may not be able to meet the 80% recovery rate if they do not pay equal attention to waste reduction or using recycled plastic in their packaging.

“This is the experience of other countries. They say that once it hits around 60%, it’s hard to collect that volume for compliance,” he said.

“That’s where the other part of the approach comes in, which is the reduction side.”

“Part of that reduction is you use recycled materials so that that would be deducted from the plastic that was asked of you to recover,” he explained.

“A good combination of recovery and using recycled materials would allow companies to meet that 80% requirement,” he added.

Meanwhile, Canadian Chamber of Commerce of the Philippines President Christopher A. Ilagan called for more incentives for EPR activities including tax deductions for conducting research and development, in order to aid in compliance.

He backs a duty-free import scheme for equipment and green lanes for sustainable inputs, among others.

“Building material recovery facilities, upgrading waste management systems, and deploying traceability technologies are capital intensive,” he said.

“Incentivizing infrastructure investment ensures that EPR is not just a compliance exercise, but also a catalyst for industrial transformation,” he added.

“True circularity begins with design. Companies that invest in packaging that is recyclable, reusable, or made from recycled content should be recognized.” — Kyle Aristophere T. Atienza

Negros sugar farms report pest infestation

SUGAR FARMS in northern Negros Occidental reported an infestation of red-striped soft scale insects (RSSI), which have the potential to reduce sugar content in cane by almost 50%, the Sugar Regulatory Administration (SRA) said on Wednesday.

The infestation might have been brought to Negros from Luzon, “where RSSI infestation…is still present in some farms,” it said.

SRA Administrator Pablo Luis S. Azcona said:

“We cannot afford to have an infestation, as some farmers are already starting to plant their cane for the next crop year,” he said.

“We made a good showing this year despite the challenges brought about by the long drought, and I hope we can maintain the momentum and even exceed our targets for next year if we all help one another in containing this infestation,” he added.

The SRA said earlier this week that sugar production for crop year 2024-2025 could total 1.837 million metric tons (MMT), exceeding the initial estimate of 1.782 MMT but lower than the actual output of 1.92 MMT in the preceding crop year. The new estimate, if realized, would come in just below the US Department of Agriculture’s 1.85-MMT forecast.

The SRA said it will quarantine the farms, following protocols previously practiced by the coconut industry in containing a cocolisap infestation.

It said the spread of the cocolisap was effectively contained by ensuring that agricultural products would not be shipped out of Calabarzon (Cavite, Laguna, Batangas, Rizal and Quezon) while the infestation was active.

Citing the National Crop Protection Center at the University of the Philippines Los Baños, the SRA said insecticides such as dinotefuran, phenthoate,pymetrozine, and thiamethoxam have shown potential in limiting the RSSI infestation.

The process of testing the insecticides will require an emergency-use permit from the Fertilizer and Pesticide Authority, the SRA said, noting that the insecticides are “not yet registered for sugarcane.”

The SRA said it will propose trials to be conducted in Negros. — Kyle Aristophere T. Atienza

IFC technical assistance tapped for PEZA eco-industrial park transition

THE Philippine Economic Zone Authority (PEZA) said it partnered with the International Finance Corp. (IFC) to look into eco-industrial park (EIP) opportunities in the Philippines.

“As we transition to the EIP model, we are optimistic that PEZA’s 427 economic zones (ecozones) and the country’s freeports will adopt the EIP framework and green growth strategies,” PEZA Director General Tereso O. Panga said in a social media post on Wednesday.

“Our ecozones must evolve beyond being just viable locations for foreign direct investment (FDI). They must now enable industrial symbiosis, climate resilience, green infrastructure, and energy efficiency to ensure sustainable growth while upholding social responsibility, environmental stewardship, and ethical excellence,” he added.

According to Mr. Panga, the technical assistance project covers the development of a diagnostic report on EIP opportunities in the country.

Through the project, IFC-WB will help PEZA in benchmarking the EIP frameworks adopted by other countries, reviewing the enabling law necessary for the EIP transition, conducting market assessments on the potential impact of EIP framework adoption, and drafting a roadmap for EIP framework implementation.

“Guided by IFC’s EIP certification program, a global voluntary certification system will be developed to ensure transparent and comparable performance across industrial zones,” Mr. Panga said.

“This international initiative aims to boost the adoption of sustainability standards in industrial parks, freeports, and economic zones through the participation of developers and operators from various countries,” he added.

Five industrial parks will serve as case studies to evaluate the potential impact of EIP adoption. The five are Lima Technology Center, First Philippine Industrial Park, Laguna Technopark, Light Industry and Science Park, and Carmelray Industrial Park.

“These zones will serve as test beds for integrating sustainability into business strategy — helping to attract more investments amid increasing competition from countries also pursuing EIP certification for their economic zones,” Mr. Panga said.

He said that the EIP framework will enable companies in a common property “to gain a competitive advantage through the physical exchange of materials, energy, water, and by-products — thereby fostering inclusive and sustainable development.”

PEZA recently launched the Sustainability Reporting Guide for Exporters and has partnered with Japan’s Zeroboard, Inc. for decarbonization efforts.

“This commitment means a great deal to us in PEZA, as we are responsible for a substantial portion of the country’s FDI in manufacturing and services, contributing approximately 60% of the Philippines’ total annual exports of goods and services,” Mr. Panga said.

“Undoubtedly, these sustainability programs will enhance the competitiveness not only of PEZA but also of our valued ecozone locators and stakeholders,” he added. — Justine Irish D. Tabile