By Jam Magdaleno

RECENTLY, momentum has been building in Congress and public forums for a proposed P200 mandated nationwide wage hike. Supporters of this proposal raise several arguments that downplay the risks associated with such a mandate. Let’s examine four of the most common claims and critically assess them one by one.

Claim 1: Real wage increases haven’t caught up with productivity gains, and “capitalists” are pocketing the difference.

This argument omits an important detail: 99.6% of all registered businesses in the Philippines are micro, small, and medium enterprises (MSMEs), which collectively employ over 62.4% of the total workforce. By lumping all “capitalists” into a single category, the argument ignores the vast differences in cost structures, pricing flexibility, and profit margins between large corporations and the overwhelming majority of employers.

Yes, the Top 1,000 corporations may be able to absorb a flat P200 wage hike by accepting slimmer profit margins. But for the over one million MSMEs, where wages often account for 30% to 60% of operating expenses (according to ADB, SSRN, and UP-CIDS), a blanket national wage hike could be existential.

While some attribute post-2020 productivity growth to labor, they often overlook a key point: recent productivity gains have largely been driven by capital-deepening — investments in automation, digitization, and AI — particularly in sectors like logistics, banking, manufacturing, and retail. These technologies have increased output per worker not because workers themselves became more productive, but because machines and systems now perform a larger share of the work.

The World Bank (2023) reported that labor productivity rebounded quickly in high-capital sectors post-COVID, while MSMEs in labor-intensive and informal sectors continue to lag behind pre-pandemic levels. Labor productivity is typically measured as GDP per worker or per hour worked. However, this aggregate figure includes gains from technological innovation, economies of scale, and cost efficiencies — factors that disproportionately benefit capital-rich firms. National productivity growth does not imply a uniform rise in productivity across all businesses or workers.

Claim 2: A wage hike won’t cause inflation or lead to job losses.

This assumes that labor demand is static, but decades of economic literature show otherwise. When labor costs rise, especially in price-sensitive sectors, firms adjust. This includes reducing headcount, freezing hiring, or shifting toward automation.

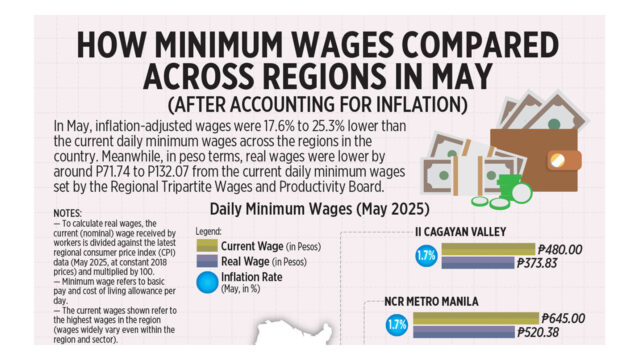

Minimum wage hikes often lead to reduced employment, particularly in small firms where labor demand is highly elastic. Simulations and policy projections from institutions such as the National Economic and Development Authority or NEDA (now the Department of Economy, Planning, and Development) and the Department of Labor and Employment (DoLE) have consistently warned that significant across-the-board wage hikes may lead to substantial job losses — especially among microenterprises and labor-intensive sectors like retail, hospitality, and agriculture. For instance, NEDA previously estimated that even a P35 daily wage hike in Metro Manila could result in up to 40,000 to 140,000 job disruptions. Extrapolating this to a large, nationwide increase of P200 highlights the magnitude of the employment risk involved.

Moreover, institutions such as NEDA, the Bangko Sentral ng Pilipinas, the Department of Finance, and international organizations like the World Bank and ADB have consistently cautioned against nationwide wage hikes. Instead, they recommend targeted, productivity-linked wage adjustments based on regional conditions and sectoral capacities. In 2024, NEDA Secretary Arsenio Balisacan warned against a proposed P100 wage hike, stating that it could result in 100,000 to 340,000 job losses and induce inflation ranging from 0.2% to 0.8%. Worse, UA&P economist Victor Abola noted that every P100 wage increase could add 3% to 4% to overall inflation.

To demonstrate this further, let’s look at disparities in income levels, cost structures, and market demand between urban and rural economies. While a large firm in Metro Manila may be able to absorb a P200 daily wage hike, MSMEs in regions like BARMM, Mimaropa, Region VIII, and Region VII face a drastically different reality.

Consider a small business in Cotabato with just five employees earning the current regional minimum wage of P430 for non-agricultural and retail/service industries (as of June 1). A mandated P200 daily increase would raise the per-employee wage to P630 — a 46.5% jump. For five employees working 26 days a month, this would translate to an additional P5,200 per employee monthly, or P62,400 annually. For the whole team, that’s an extra P312,000 in annual wage costs.

But that’s not all. Employers are legally required to remit additional contributions to SSS, PhilHealth, and Pag-IBIG based on monthly wages. These contributions increase proportionally with any wage hike. Using conservative estimates, the total additional cost burden from a P200 wage hike (including mandatory contributions) could approach P370,000 annually for a small business with just five minimum-wage employees, an amount that could easily wipe out businesses with already thin profit margins.

As the ADB noted in its 2023 Philippines: Private Sector Development Report, most MSMEs outside Metro Manila lack economies of scale, operate informally or semi-formally, and are highly vulnerable to wage shocks. In such contexts, a one-size-fits-all policy disproportionately hurts smaller players and undermines inclusive development.

Claim 3: The government can subsidize MSMEs to absorb the wage hike.

This proposal is both fiscally and logistically unsound. First, the fiscal position of the Philippine government is already under strain. As of end-2023, the national debt stood at P14.62 trillion, with a budget deficit of P1.51 trillion, equivalent to 6.2% of GDP. Interest payments alone consume more than 11% of the national budget, crowding out essential expenditures in health, education, and infrastructure.

A wage subsidy scheme could cost hundreds of billions of pesos annually, depending on the magnitude of the hike and the number of MSMEs covered. For example, a P100 daily subsidy for just half of the 17 million MSME-employed workers (about 8.5 million) would already cost over P400 billion annually — nearly 10% of the national budget, and larger than the entire budget of the Department of Health.

Second comes the governance challenge. With over 1 million registered MSMEs, many of them informal or semi-formal, administering a fair and efficient subsidy program would require massive bureaucratic capacity that the state simply does not possess. Even the Small Business Wage Subsidy (SBWS) program during the pandemic, despite being temporary and time-bound, faced delays, leakage, and exclusion errors.

Third, subsidies often create perverse incentives. They discourage productivity improvements, promote dependence, and are politically difficult to withdraw once implemented. Asking a heavily indebted government with limited administrative capacity to finance such a massive program is wishful thinking.

Claim 4: National wage hikes are needed for equality and fairness.

This claim leads to the politicization of wage-setting, undermining existing institutions. The Philippines adopted the regional tripartite wage board system (RA 6727) precisely to account for differences in regional cost of living and productivity. A national legislated wage hike would override this system, rendering wage boards ineffective and politicizing wage policy.

If wage-setting becomes a matter of legislation instead of technical consultation, it risks turning into a populist bargaining chip, especially in an election cycle. This weakens the credibility and functionality of the country’s wage institutions.

SUSTAINABLE DEVELOPMENT NOT POPULIST REDISTRIBUTION

A more sustainable and inclusive approach to improving workers’ welfare is not through blanket wage hikes but by increasing their real disposable income, which means the income left after paying for basic expenses like food, housing, transport, and utilities. This can be achieved through structural reforms that reduce the cost of living and improve economic efficiency.

Food alone accounts for about 35-40% of household expenditure among the poorest 30% of Filipinos, based on Philippine Statistics Authority Family Income and Expenditure Surveys. By liberalizing agricultural imports, particularly by removing quantitative restrictions (QR) and tariffs on staples such as rice, corn, chicken, pork, sugar, and fish, prices could fall significantly.

On the supply side, increasing farm productivity through reforms in land markets is critical. Raising land retention limits, which are currently capped at five hectares under agrarian reform laws, would encourage land consolidation, mechanization, and private investment. Fragmented farms result in low productivity and high food costs.

Filipinos pay some of the highest broadband costs in Southeast Asia. The proposed Konektadong Pinoy Bill, which promotes open access and competitive broadband markets, could lower prices by 30-50% over time, based on estimates by ICT advocates and the Department of Information and Communications Technology.

Taken together, these reforms, and a lot more, would have a far more meaningful and lasting impact on worker welfare than across-the-board wage increases that risk job losses, inflation, and business closures. Instead of shifting the burden onto struggling MSMEs, policymakers should focus on expanding access, reducing costs, and empowering consumers, paving the way for sustainable development.

Jam Magdaleno is a political and economic researcher, writer, and communication strategist. He is the head of Information and Communications of the Foundation for Economic Freedom, a Philippine-based think tank.