Expanding MSME reach: A Q&A with Small Business Corp.

THE PAST TWO years have been rough on micro-, small-, and medium-sized enterprises (MSMEs). According to the Philippine Statistics Authority’s (PSA) List of Establishments data, the number of the country’s MSMEs fell by 4.3% to 952,969 in 2020 from 995,745 the year before. The closure of around 43,000 of these firms led to approximately 130,000 jobs lost.

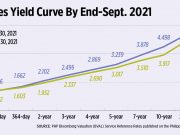

PHL recovery hopes to support financial markets

ANALYSTS expect the country’s financial markets to recover along with the economy next year, but cautioned risks remain with the threat of the coronavirus disease 2019 (COVID-19), as shown by the mixed performance in the third quarter.

Analysts give rosy outlook on stocks

WITH THE ECONOMY showing signs of recovery, investors may consider bank stocks for next year as lenders are seen to be in a better position to bounce back compared with the previous quarters.

(Re)building credit: The role of CIC and credit bureaus in the new normal

It is often said that past performance is not a guarantee of future results. Nevertheless, the credit information that displays payment histories is considered a key ingredient in the financial sector as it helps address the problem of asymmetric information by helping lenders screen borrowers and providing an incentive for borrowers to repay their loans.

The power of one: A Q&A with UNObank

Unobank secured a digital banking license from the Bangko Sentral ng Pilipinas (BSP) in June, adding to the roster of lenders offering all-online services.

Get to know one of the country’s credit reporting providers

It was in 2011 when the country’s five large domestic and foreign banks — BDO Unibank, Inc., Bank of the Philippine Islands, Citibank Philippines, Metropolitan Bank & Trust Co. (via its then-credit card subsidiary Metrobank Card Corp.), and Hongkong and Shanghai Banking Corp. (HSBC) — teamed up with Chicago-based credit information management firm TransUnion to set up the country’s first international private credit bureau TransUnion Philippines.

PHL prepares for digital, branchless banks

While online banking is not new in the Philippines, banks without physical branches could sooner or later become the norm in the country as the central bank distinguishes digital-only banks from those with brick-and-mortar presence.

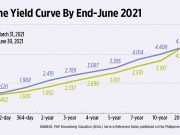

Renewed COVID worries cloud market outlook

THE reimposition of lockdowns amid renewed coronavirus disease 2019 (COVID-19) concerns, coupled with weaker economic recovery prospects drove sentiment in the country’s financial markets for much of the second quarter.

Recovery prospects continue to drive bank stocks

ANALYSTS noted the relatively better performance of banks in the second quarter due to higher earnings but said the attractiveness of bank stocks remain tied to prospects of economic recovery.

Fitch cuts rating outlook on six Philippine banks to ‘negative’

FITCH RATINGS on Monday cut its outlook on rated local lenders to reflect the revision done for the Philippines, which could mean a rating...

FIST Law to cast safety net for banks

MONETARY AUTHORITIES have repeatedly said the banking industry still has sufficient resources and buffers, but amid the rising soured loans, it still pays to have a safety net for banks should they be overburdened with these nonperforming assets (NPAs).

Vaccine rollouts, coronavirus surge, and stricter lockdowns: Financial markets on a spin in first...

FINANCIAL MARKETS in the first quarter of 2021 continued to be driven by developments surrounding the coronavirus disease 2019 (COVID-19) pandemic with the arrival of vaccines lifting investor sentiment in the early part of the quarter before being offset by the renewed strict lockdowns due to a fresh surge in coronavirus cases.