Gov’t debt yields go up

YIELDS on government securities (GS) mostly climbed last week as investors turned cautious ahead of the release of December inflation data and amid rising US Treasury rates.

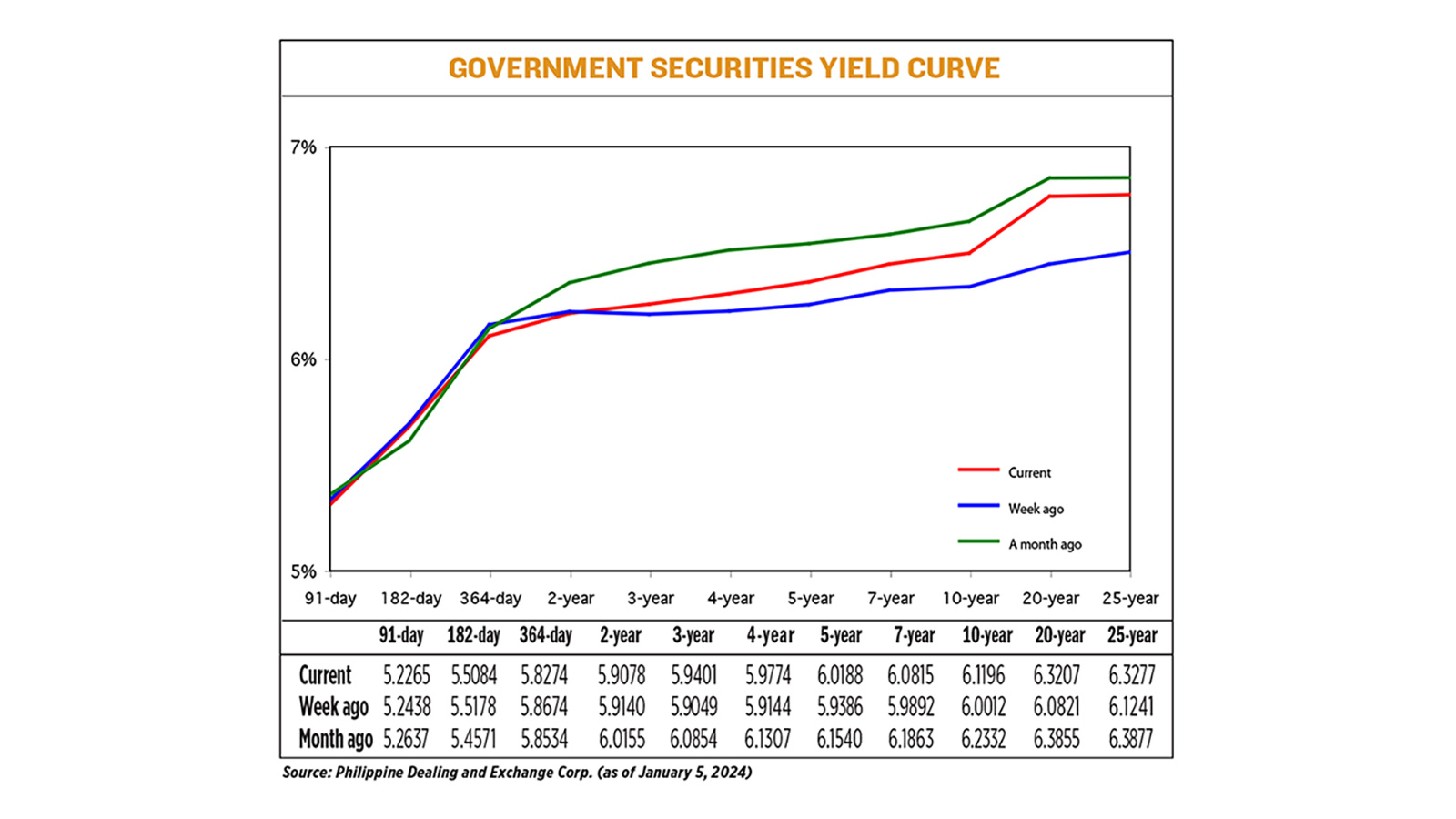

GS yields, which move opposite to prices, rose by an average of 6.89 basis points (bps) week on week, based on PHP Bloomberg Valuation Service Reference Rates data as of Jan. 5 published on the Philippine Dealing System’s website.

Higher rates for most Treasury bond (T-bond) tenors drove the week-on-week rise in GS yields.

At the belly, the three-, four-, five-, and seven-year T-bonds saw their yields climb by 3.52 bps (to 5.9401%), 6.3 bps (5.9774%), 8.02 bps (6.0188%), and 9.23 bps (6.0815%), respectively.

The long end saw bigger increases as the 10-, 20-, and 25-year debt jumped by 11.84 bps, 23.86 bps and 20.36 bps to yield 6.1196%, 6.3207%, and 6.3277%, respectively.

Meanwhile, the two-year bond saw its rate inch down by 0.62 bp to 5.9078%.

Yields on the short-tenored Treasury bills (T-bills) likewise dropped. Rates of the 91-, 182- and 364-day T-bills went down by 1.73 bps, 0.94 bp and 4 bps to 5.2265%, 5.5084% and 5.8274%, respectively.

Total GS volume picked up to P15.05 billion on Friday from P14.06 billion on Dec. 29.

“Yields on the belly to the long end were pushed higher during the first week of the year… Local market participants took a defensive stance ahead of the CPI (consumer price index) release as US Treasuries’ yields also rose,” Alessandra P. Araullo, chief investment officer at ATRAM Trust Corp., said in a Viber message.

“Better-than-expected local consumer price index data, and recent offshore developments showing a still rescinding US labor market justifies investor defensive throughout the week with traded volume on staying on the low side,” added Ms. Araullo.

Inflation slowed to 3.9% in December, settling within the central bank’s 2-4% target range for the first time in nearly two years, amid easing prices of food and utilities.

Preliminary data from the Philippine Statistics Authority (PSA) released on Friday showed the overall year on year increase in prices of widely used goods and services eased to 3.9% in December from 4.1% in November and 8.1% a year ago.

This was the slowest reading in 22 months or since the 3% reading in February 2022 and was a tad lower than the 4% median estimate in a BusinessWorld poll. It was also within the 3.6% to 4.4% estimate given by the Bangko Sentral ng Pilipinas (BSP) for the month.

For 2023, headline inflation averaged 6% for 2023, slightly faster than 5.8% in 2022 and marking the second straight year that the CPI exceeded the BSP’s 2-4% target.

This was also the fastest print in 14 years or since the 8.2% full-year average in 2008, at the height of the global financial crisis.

Meanwhile, the yield on the benchmark 10-year note rose 6 basis points to 4.051%, Reuters reported. On the week, the 10-year’s yield rose 13.1 basis points, the largest weekly gain since mid-October.

GS yields moved sideways with an upward bias amid the lack of catalysts and as the December CPI print was within expectations, a bond trader said in a Viber message.

“Global yields were trending higher as well, adding to pressure on local bond market,” the bond trader said.

For this week, the trader said the Bureau of the Treasury’s (BTr) T-bond and T-bill auctions could drive GS yields.

“Expect yields to trade sideways with an upward bias,” the bond trader said.

“For this week, there will be a five-year bond issuance, which is expected to clear at a 5.875-6.125% coupon rate. This will gauge the appetite of the local GS market as we anticipate for more developments locally and offshore,” Ms. Araullo likewise said.

Minutes of the BSP’s December meeting, which are scheduled for release this week, could also affect GS trading, she added.

The BTr will offer P30 billion in new five-year T-bonds on Tuesday. — L.O. Pilar with Reuters