BoP deficit hits $1.57 billion in June

THE PHILIPPINES’ balance of payments (BoP) position remained in a deficit for a third straight month in June, as more dollars flowed out of the country to pay for the government’s foreign debt.

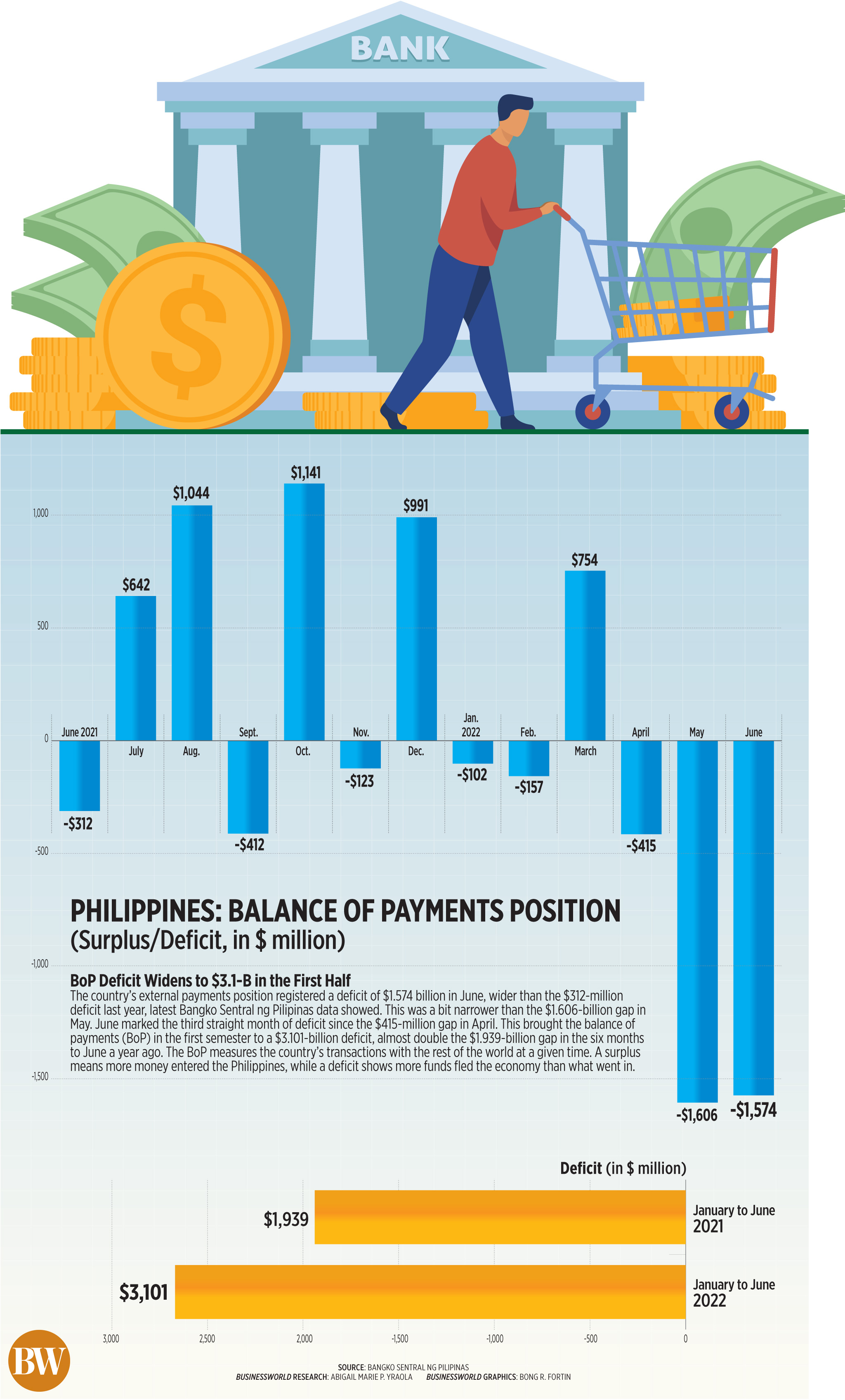

Data released by the Bangko Sentral ng Pilipinas (BSP) late on Tuesday showed the BoP deficit widened to $1.57 billion in June, from the $312-million deficit in the same month last year.

However, the June deficit slightly narrowed from the $1.61-billion gap in May, which was the widest since $2.019 billion in February 2021.

“The BoP deficit in June 2022 reflected outflows arising mainly from the National Government’s payments of its foreign currency debt obligations,” the BSP said in a statement.

“The BoP deficit in June 2022 reflected outflows arising mainly from the National Government’s payments of its foreign currency debt obligations,” the BSP said in a statement.

The BoP measures the country’s transactions with the rest of the world at a given time. A deficit means more funds fled the economy than what went in, while a surplus shows that more money entered the Philippines.

In the first half of the year, the BoP deficit widened to $3.1 billion, from the $1.9-billion deficit in the same period in 2021.

“Based on preliminary data, this cumulative BoP deficit reflected the widening trade in goods deficit,” the central bank said.

The trade deficit for January-May 2022 rose by 70.5% to $24.9 billion from the $14.6-billion deficit in the same period a year prior, preliminary data from the Philippine Statistics Authority’s (PSA) showed.

The BoP deficit reflected the near-record trade gap as net imports have been bloated by elevated prices of imported oil and other commodities, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a note.

Global prices of oil and other commodities have spiked since Russia invaded Ukraine in late February.

The central bank noted that this BoP position reflects the final gross international reserves (GIR) level of $100.9 billion, 2.6% lower than the $103.6 billion as of end-May.

“Nonetheless, the latest GIR level represents a more than adequate external liquidity buffer equivalent to 8.4 months’ worth of imports of goods and payments of services and primary income,” the BSP said.

“Specifically, it ensures availability of foreign exchange to meet balance of payments financing needs, such as for payment of imports and debt service, in extreme conditions when there are no export earnings or foreign loans.”

The GIR can also cover up to 7.1 times the country’s short-term external debt based on original maturity and 4.5 times based on residual maturity.

“Short-term debt based on residual maturity refers to outstanding external debt with original maturity of one year or less, plus principal payments on medium- and long-term loans of the public and private sectors falling due within the next 12 months,” the BSP said.

China Banking Corp. Chief Economist Domini S. Velasquez said the country will likely continue to post BoP deficits in the next few months, as the current account is expected to remain in deficit.

“However, we expect more contained deficits in the next few months as import prices of major commodities such as oil and food are coming off from its highs after Russia invaded Ukraine,” Ms. Velasquez said in a Viber message.

Mr. Ricafort said a prolonged Russia-Ukraine war could continue driving up the prices of oil and other commodities, which “may lead to near record-high trade deficits/net imports, thereby partly leading to weaker peso exchange rate vs. the US dollar as seen in recent weeks/months.”

At the same time, Mr. Ricafort said the country’s BoP could still improve as remittances from overseas Filipino workers remain high and the economy further reopens.

Ms. Velasquez also said that expectations of lower commodity prices will bring the BoP deficit “to more sustainable levels” next year.

Last month, the BSP said it expects the country to post a wider BoP deficit this year due to a weaker global growth outlook that could affect trade and capital flows.

Earlier, the Monetary Board revised its BoP deficit forecast to $6.3 billion, or equivalent to -1.5% of gross domestic product (GDP), higher than the previous projection of a $4.3-billion gap (-1% of GDP).

The BSP also projected a wider current account deficit at $19.1 billion (-4.6% of GDP) this year, from $16.3 billion (-3.8% of GDP) previously.

The country’s GIR is expected to hit $105 billion by end-2022 and $106 billion by end-2023, lower than the March projections of $108 billion and $109 billion, respectively. — Keisha B. Ta-asan