Urban congestion and traffic violations pose a major challenge to public safety and governance globally, particularly in the Philippines. A significant part of this issue stems from reliance on traditional traffic enforcement involving human enforcers, who are prone to corruption, inconsistent application of laws, and questionable judgment due to inadequate training.

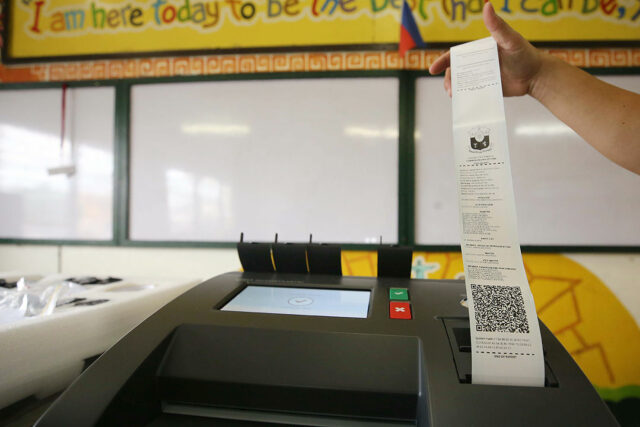

I have consistently advocated for a shift toward technology-based enforcement — specifically, the no-contact apprehension program (NCAP). However, this system has remained in limbo for nearly three years since its suspension in various Metro Manila cities following a Supreme Court restraining order in August 2022.

Despite its imperfections, I firmly support NCAP, believing in the effectiveness of technology in enforcing traffic rules. Technology is dispassionate, impartial, and free from personal discretion when determining violations. Although technology cannot be held personally accountable, it also cannot be corrupted. Thus, the Philippines should consider adopting a national law to institutionalize NCAP.

Oral arguments regarding NCAP have already been presented before the Supreme Court, and the necessary comments have been submitted. While it is unclear if the issue is now ready for a decision, I hope the Supreme Court resolves the matter promptly and restores the use of NCAP in traffic enforcement.

Meanwhile, according to submissions by the Metropolitan Manila Development Authority (MMDA) and the Land Transportation Office (LTO), the average monthly number of traffic violations recorded by surveillance cameras increased threefold since the suspension of NCAP in August 2022.

As previously mentioned in another column, no-contact apprehension is not a new concept. Other countries have utilized camera-based traffic enforcement since the 1960s. The Dutch company Gatsometer BV introduced the first film-based red-light camera in 1965, followed by the first road traffic radar in 1971 and the first mobile speed camera in 1982.

Globally, many cities adopting camera-based enforcement systems report significant improvements in traffic compliance, accident reductions, and increased transparency in administrative processes. In London, extensive camera enforcement has substantially reduced traffic-related fatalities and violations.

Similarly, Singapore employs a comprehensive automated enforcement system with cameras strategically placed citywide, ensuring consistent compliance, enhancing discipline, and significantly reducing opportunities for corruption.

The advantages of automated, camera-based enforcement are clear. Firstly, it provides impartiality and consistency — two essential elements often missing from human-led enforcement. Cameras enforce traffic rules uniformly, without regard to drivers’ socioeconomic or political backgrounds. This transparency significantly reduces bribery and corruption risks, issues frequently encountered in enforcement systems reliant on human discretion.

Additionally, automated systems generate substantial efficiency gains. Cameras operate continuously, accurately documenting violations and providing reliable evidence for adjudication. In the United States, cities like New York and Washington, DC, effectively use traffic cameras, reducing the workload for enforcement personnel and allowing officers to focus on more critical law enforcement tasks.

For NCAP to reach its full potential, however, we must establish robust judicial or administrative frameworks to swiftly and fairly handle disputes. International best practices suggest specialized traffic adjudication boards or dedicated traffic courts as efficient mechanisms for managing contested citations.

Continued reliance on poorly trained human enforcers exacerbates inefficiency and inconsistency. Human-led enforcement often results in arbitrary decisions and selective enforcement, eroding public confidence and weakening overall effectiveness. Automated enforcement mechanisms, by contrast, apply rules consistently, enhancing public trust.

Cities such as Dubai and Tokyo demonstrate that combining automated enforcement with rigorous adjudication standards significantly improves traffic compliance cultures.

Once the Supreme Court resolves the current issue, the Philippines must adopt and rigorously enforce NCAP, supported by stricter penalties. Higher fines, clear communication of consequences, and systematic enforcement will be crucial to the program’s success.

Moreover, as Congress possibly considers legislation to institutionalize NCAP nationwide, it should also explore creating dedicated traffic adjudication boards in urban areas to ensure fair and swift resolution of disputes, improving overall acceptance of automated enforcement.

Updating the current Land Transportation Code is necessary to accommodate emerging technologies and set clear national standards for road use and traffic enforcement. Additionally, regulations should be rationalized, especially regarding public utility vehicles, motorcycles, bicycles, and other personal mobility devices sharing roads.

Legislative reviews can align NCAP systems with existing traffic enforcement laws and introduce scientific and data-driven standards for fines. A common argument against NCAP highlights the arbitrary nature of fine setting. Although legally grounded, fines rarely reflect scientific studies or algorithmic analysis. Traffic fines typically remain static and are seldom adjusted to inflation or evolving driver behavior.

As previously argued, if fines aim to correct behavior and prevent violations effectively, penalties should adapt to changing behaviors over time. If a specific violation persists or grows, its penalty should correspondingly increase. Current fines are legally set without considering their long-term effectiveness.

Furthermore, within Metro Manila, consistency and alignment of regulations, violation lists, and fine amounts across different territories are essential. Regular reviews of fines, based on data-driven assessments of policy effectiveness, should become standard practice.

As emphasized before, the primary goal is enforcement, not entrapment. Cities should aim to improve traffic flow and ensure public safety. NCAP should not serve primarily as a revenue-generating tool; fine collection is merely a consequence of effective enforcement. Effective fines should lead to improved traffic flow and compliance.

Lastly, effective NCAP systems require simultaneous improvements in road conditions, markings, signage, and signals. With support from Public Works, these enhancements can be implemented at local, national, and tollway levels.

Enforcement remains the primary objective — not entrapment. The ultimate goal is improving public safety, traffic flow, and quality of life. NCAP systems should strive to positively influence driver behavior rather than merely punish wrongdoing.

Marvin Tort is a former managing editor of BusinessWorld, and a former chairman of the Philippine Press Council

matort@yahoo.com