It’s not something that responsible governments could simply brush off, that potential violation of the recent ceasefire between Iran and Israel peddled and initially, unilaterally announced by US President Donald Trump. But what do we make of President Ferdinand Marcos, Jr.’s statement reported yesterday about the economic consequences of this military discord and describing them to have no “significant effect?”

In this volatile and uncertain moment of history, it is an enormous disservice to the Filipino people for the government to simply retreat to rational inattention. This makes sense only when our decision makers have simply no other information available to them. But our economic management departments, including the Bangko Sentral ng Pilipinas (BSP), have enormous database and econometric capacity to draw up some scenarios that would likely capture various possible outcomes in the Middle East. And they are not all favorable scenarios to be sure. They could also source sensitive primary information from our consular offices and embassies abroad that have started to evacuate our overseas Filipino workers based in these oil-rich labor markets. There should be a logical connect between what we announced and what the rest of government are doing.

We need extraordinary due diligence to substantiate our decision to ignore the potentially debilitating effects of a further escalation of war between Iran and Israel. There is no substitute to calling on the population to hope for the best, but prepare for the worst.

Thus, the President could have been more careful even as he based his comments on the assessment of the country’s economic managers: “May effect siyempre kahit papaano… ang langis (Oil has an effect no matter what.).” We can only presume that the assessment was ostensibly based on the announcement of a truce and the limited impact on macroeconomic stability. We dare say that it is never enough to simply monitor oil prices and anchor all contingencies in their dynamics.

On the ceasefire, this has never been credible, nor will it be durable. It was the US itself that announced it before the two countries could make their own press statements. Despite his assurance that the US would decide on its involvement in two weeks’ time, President Trump immediately ordered the obliteration of Iran’s nuclear program over the weekend. Some of the bombs used were actually bunker busters which could penetrate tens of meters below ground where three nuclear development facilities were established. While satellite photos indicate massive destruction, Trump was enraged by the preliminary US intelligence report released a few days ago that the destruction delayed Iran’s nuclear ambition “by only a matter of months.”

Trump could anytime reverse his decision for a pause. That could set off another series of uncertainties and volatility in the global energy and financial markets.

On both Iran and Israel, no one can safely say they would faithfully abide by the rules of disengagement. Immediately after the US missile attacks, Iran did not waste time in retaliating, not against the US at that point, but against Israel. Two waves of missile strikes were released by Teheran on Tel Aviv last Monday. Given such a propensity for war, it is not surprising that after the truce announcement, there was unmitigated finger-pointing between the two countries at war. Israel vowed to retaliate after saying Iran launched another round of missile attacks into its airspace within two hours of the US announcement. But Iran denied this act of war even as the world, through media reports, heard explosions booming and sirens sounding across northern Israel. Instead of de-escalating the war, the ceasefire seemed to have caused more bad blood.

In response, Israel sought to resume “the intense operations to attack Teheran and to destroy targets of the regime and terror infrastructure.” Not long after, Iran’s Islamic Revolutionary Guard Corps launched a “powerful and devastating missile attack” on US military installation in Qatar’s Al Udeid, saying in a statement that “under no circumstances, leave any aggression against its territorial integrity, sovereignty, or national security unanswered.” Al Udeid’s US military base is reported to house 10,000 US troops.

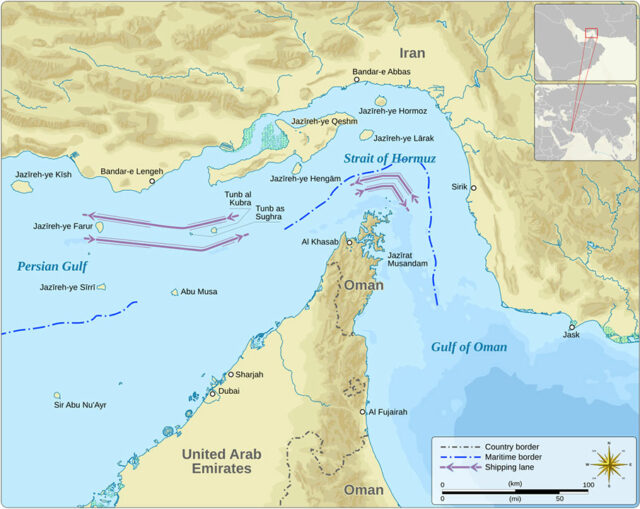

The decline in oil prices as reported by Reuters in Houston, Texas appears to be the driving force behind the analysis that the likely impact of the war on the global energy markets would be broadly modest. Oil prices retreated by more than $5 a barrel after the markets saw that Iran took no action to disrupt oil and gas tanker traffic through the Strait of Hormuz. The following day, even with the fragile ceasefire announcement, oil prices sustained their downtrend.

Therein lies the uncertainty, and that involves the Strait of Hormuz.

The only passage between the Gulf of Oman and the Persian Gulf on to the open sea, the 21-mile-wide Strait of Hormuz is one of the world’s most strategically critical choke points. Iran is north of it, while the south is shared by Oman and the United Arab Emirates. Some 18-21 million barrels of oil per day move through the strait. Thus, it is both a lifeline of energy, and a choke point. Iran, if it feels threatened, especially with the US involvement in the missile war, could simply stop the traffic, or target oil and gas tankers passing through the strait. The price of energy goes up with the escalation of war, or even a threat of it. Passing through the strait is risky and therefore a higher risk premium means higher freight cost. Going around it would be equally costly because freight costs increase with the distance traveled. That’s one real risk to global oil prices.

Another risk derives from Iran’s ability to sell its oil, which is highly determined by the dynamics it shares with the US and Israel. The lower its ability to export even to China at a discount, would imply less ability for the global economy to keep oil prices steady. Reduced oil from Iran would lead China to source it from somewhere else, bloating its global demand and sending oil prices into a hopeless spiral. It would be too naïve for economies to disregard the pervasive impact of the Middle East drama on local oil prices and, ultimately, on food and non-food commodity prices and on to some second-round effects from higher wages and transport fares.

It would therefore be consistent with good risk management if Malacañang called on civil society to be prepared for any eventuality. It would be reassuring, too, for the government to announce a four- or five- or six-point program representing its quick response to the latest developments in the Middle East, particularly on what could likely happen in the Strait of Hormuz. Staggered oil price adjustments, the grant of fuel subsidies to affected public utilities, and a build-up of strategic inventories may be considered.

We cannot dismiss the signs of the times.

The momentum of high growth seems to be losing steam relative to the 6-6.5% growth target for this year. The World Bank expects no more than 5.3% growth this year, and the weak performance to continue up to 2027. The country needs to intensify efforts in pursuing key policy and structural reforms to enhance the business environment and rebuild fiscal space to help spur economic growth. This is in contrast to the credit rating agency S&P’s decision to lift the country’s growth outlook based on, yes, “reduced” global trade uncertainty and benign inflation based on actual inflation and BSP forecasts for the next three years. There was indeed some pause, but there were incremental increases in the base and reciprocal tariffs. They could be unsettling. We see a more balanced assessment by the Philippine Institute for Development Studies that raised an important concern: “…a potential spike in global oil prices, which would raise domestic transport and power costs feeding into inflation. This could reverse recent gains in price stability.”

Finally, on inflation which in the past impinged on private consumption and growth, this stands to get the hit from the sharp oil price spikes should the tension in the Middle East worsen. But it would be difficult to get some guidance from the BSP which has stopped announcing its risk-adjusted inflation forecast this year and for 2026 and 2027. We are more than certain that the BSP has given a fine-tooth comb assessment of the Middle East hostilities, down to the minutest detail of their implications on food and non-food commodities, transport cost, wages, and utilities adjustments.

What we heard from the BSP last week were their inflation projections, presumably their baseline for the next three years. For this year, the BSP dropped its forecast from 2.4% to only 1.6%, from 3.3% to 3.4% in 2026, and from 3.2% to 3.3% in 2027. If I were to replicate the BSP’s practice of assigning risk probabilities to all that is in the air — power adjustment, restoration of tariff rates to old levels, transport, wages, and, yes, the possible escalation of tension between Iran and Israel with US involvement — I would say the risk-adjusted forecasts could be anything above one percentage point above their baseline. This means the next two years could breach the 2% to 4% inflation target.

All because of the Strait of Hormuz and everything it represents. No ground exists for complacency.

Diwa C. Guinigundo is the former deputy governor for the Monetary and Economics Sector, the Bangko Sentral ng Pilipinas (BSP). He served the BSP for 41 years. In 2001-2003, he was alternate executive director at the International Monetary Fund in Washington, DC. He is the senior pastor of the Fullness of Christ International Ministries in Mandaluyong.