DeepSeek shows Silicon Valley’s huge blind spot on AI

LAST YEAR, the chief executive officer of a leading AI firm was asked at a private Silicon Valley dinner about how his company differentiated from others building “foundation models,” the systems underpinning chatbots like ChatGPT. Did he have a moat? Yes, he answered, according to another CEO who was there. No one else had raised the billions of dollars that he had. That was his moat.

This shortsighted approach to doing business, that huge sums of money alone can keep competition at bay, is why giants like Meta Platforms, Inc. are in panic mode about DeepSeek, a Chinese company that’s built a formidable AI model for roughly the salary of a single AI executive in the US. Its breakthroughs now pose a shift in the balance of power and a reckoning for tech giants, who are suddenly no longer the guaranteed winners of AI.

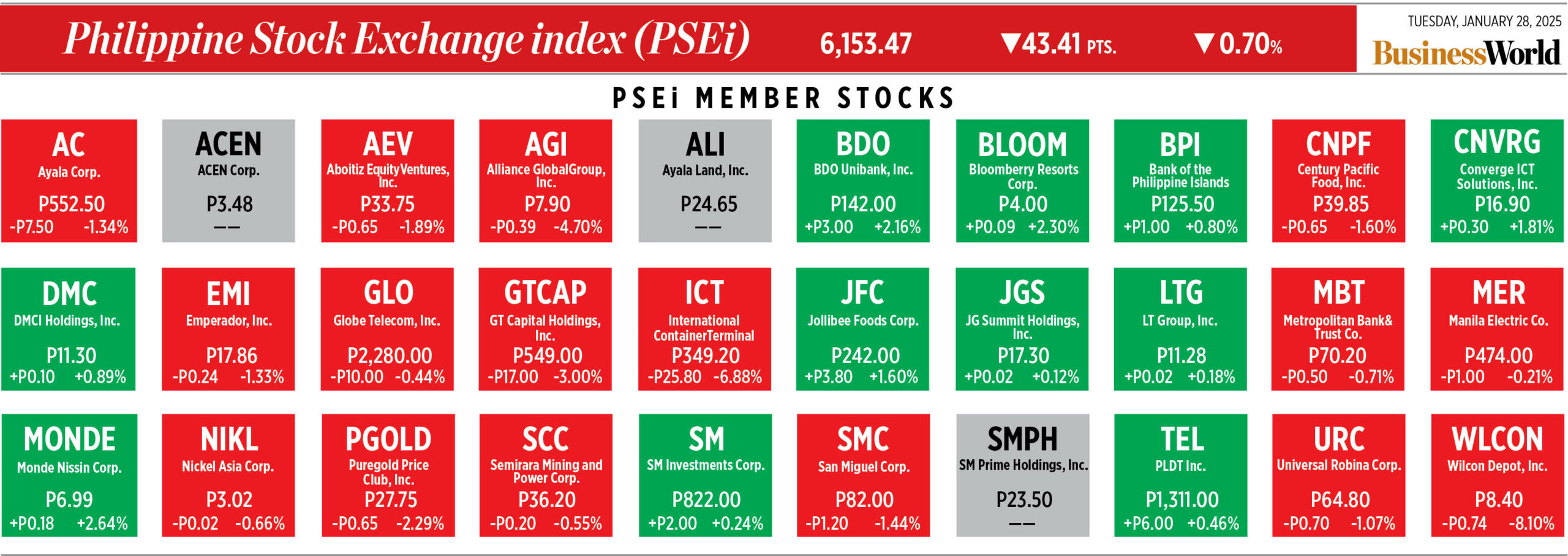

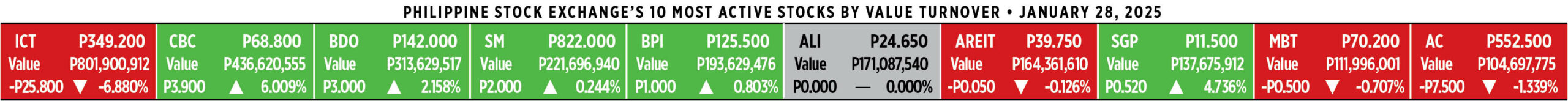

On Monday the panic had spread to Wall Street, as Nasdaq 100 futures fell by more than 3% and put tech stocks on track for a $1 trillion rout.

The reason is obvious. OpenAI recently raised the largest venture capital round in history ($6.6 billion), while Mark Zuckerberg has said Meta will spend up to $65 billion on AI projects this year. Tech giants have been spending heavily on AI, and now it looks like a giant waste.

DeepSeek’s latest R1 model, released on Jan. 20, was built with just $6 million in raw computing power and inferior AI chips, a fraction of the money and resources spent by firms like OpenAI and Alphabet, Inc.’s Google. It’s not only tied with ChatGPT in a closely watched ranking of AI model capabilities and can perform chain-of-thought reasoning, it’s a hit with the public too, having topped app stores in the US, UK, and Canada1. It’s open source and free for personal use, and also cheap for businesses2. Silicon Valley soothsayer Marc Andreessen has called it “AI’s Sputnik moment.”

Does this mean that all the billions poured into chips, talent and energy infrastructure in the US have been for nothing? Not exactly, but that investment is no longer enough on its own. DeepSeek has shown that the future winners of AI will need both raw computing power and the efficiency innovations that Chinese firms have been forced to develop given US chip curbs.

Monday’s grim market also points to major blind spots that both Wall Street and tech firms have had on AI. First, DeepSeek’s growing capabilities have been public for months; my Bloomberg Opinion colleague Catherine Thorbecke wrote about the company in June. But it’s also been clear for more than a year that companies like OpenAI, Anthropic, and Google had no moats around their foundation model businesses. Enterprises and consumers could swap one for the other with ease. That was already a risky state of play, one that a Google engineer warned about in an infamous memo almost two years ago. Even so, OpenAI has continued burning money with no obvious path to profit in sight.

Part of the problem was that Silicon Valley broligarchs focused far too much on making AI that topped the benchmark rankings in an ego-driven, my-model-is-bigger-than-yours-contest, and spent far less on turning those innovations into well-designed products that businesses and consumers could use. DeepSeek’s success should serve as a wake-up call for firms like OpenAI to differentiate by focusing on what their customers need. And that still leaves plenty of room for them to stay ahead of competitors in China, where talent and hunger for AI supremacy abounds.

There’s another reason for Silicon Valley to remain optimistic. Just a few months ago, the tech industry was worrying about a looming plateau for AI’s capabilities, as so-called scaling laws hit a brick wall. But DeepSeek has shown that doesn’t have to be the case, and that there are workarounds to those limits.

Most important is the shift that DeepSeek has sparked in the competitive landscape. In the two years since ChatGPT was launched, large tech firms have been the biggest financial beneficiaries of the generative AI boom. But making AI cheaper — and not just bigger or better — is far more impactful to the rest of the world, something that tech leaders in their cloistered bubbles have failed to appreciate. When small organizations can do big things with AI, that promises a healthier and more dynamic market.

The great irony is that OpenAI’s Sam Altman and other AI leaders can finally relate to the workers their AI systems are displacing. Now they must try and do more with less, or see themselves displaced too.

BLOOMBERG OPINION

1DeepSeek’s app ranked at No. 1 on Apple’s App Store, and No. 5 on the Google Play Store at the time of writing.

2Accessing DeepSeek R1’s application programming interface (API) costs just $0.55 per million input tokens, compared to OpenAI’s API, which costs $15.