Security Bank’s cash management deal with MUFG ‘credit positive’

THE CASH management tie-up between Security Bank Corp. and Mitsubishi UFJ Financial Group, Inc. (MUFG) will be “credit positive” for the local lender as it could boost business flows while credit demand remains subdued amid the pandemic, Moody’s Investors Service said.

“Security Bank’s expanded partnership with MUFG [is] credit positive because it will encourage increased business flow and help Security Bank expand its corporate client base to MUFG customers while credit demand in Philippines is subdued in the uncertain domestic business climate,” the debt watcher said in a note on Friday.

The bank currently holds a Baa2 rating with a stable outlook from Moody’s.

Last month, the lenders expanded their partnership to allow MUFG clients access to Security Bank’s cash management system called DigiBanker. This will allow the Japanese lender’s clients to tap Security Bank’s system for disbursement requirements and to expand their collection network in the Philippines.

Moody’s said the deal will benefit Security Bank as it will provide opportunities for the lender to expand its client base for cross-selling to MUFG’s corporate clients.

“This will support Security Bank’s recent strategy of selected growth in the corporate loan book after a significant deterioration last year in its retail loan portfolio’s credit quality because of coronavirus pandemic-related disruptions,” Moody’s said.

Last year, bad loans in Security Bank’s portfolio increased to 3.9% of the total from 1.2% at end-2019, mainly due to its retail loan segment.

The debt watcher said the cash management tie-up will also boost Security Bank’s low-cost corporate deposits, trimming funding costs.

“Security Bank could also benefit from fee income through ancillary services such as overseas transfers and settlements,” Moody’s said.

MUFG’s partnership with Security Bank dates back to 2016 when the Japanese bank bought a 20% stake in the local lender.

Security Bank’s net earnings dropped 26.7% to P7.4 billion last year from P10.1 billion in 2019 due to higher credit loss provisions amid the crisis.

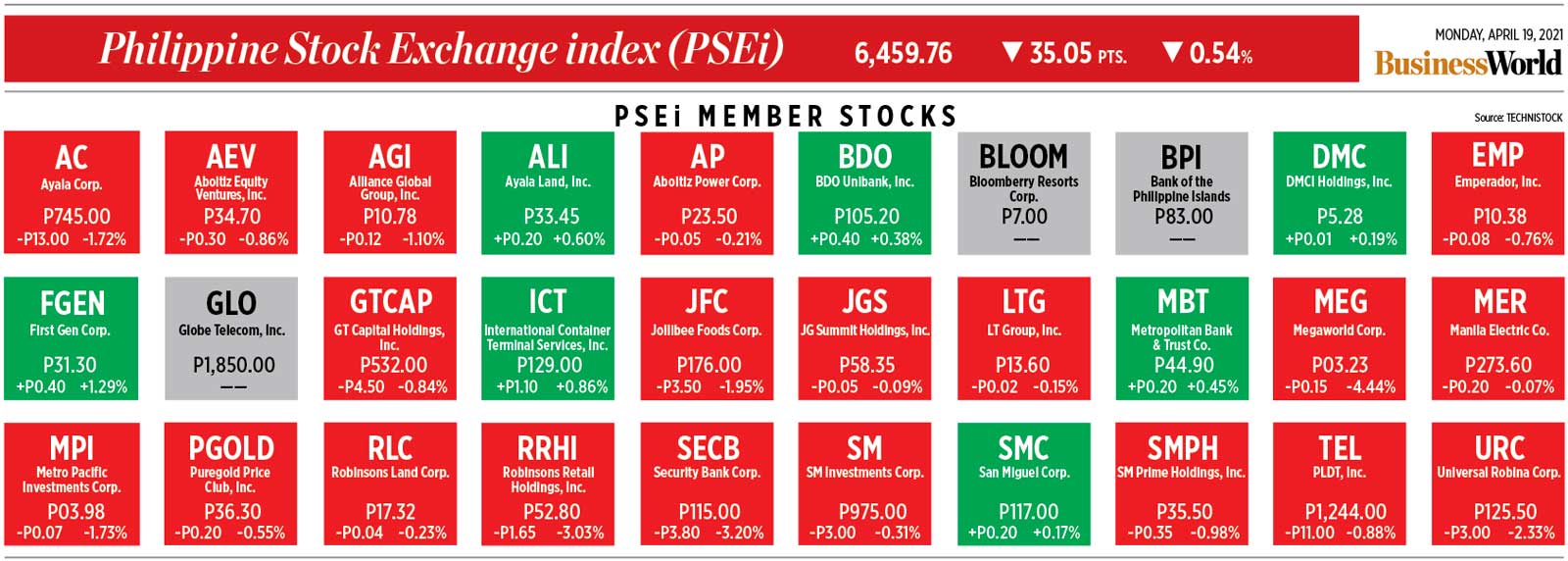

Its shares closed at P115 apiece on Monday, down by P3.80 or 3.2% from its previous finish. — Luz Wendy T. Noble