Last week, on May 15, I attended the press conference of the Department of Energy (DoE) presided by Energy Secretary Raphael P.M. Lotilla. While the good secretary discussed many things, from EPIRA to energy mix and diversification, gas, hydrogen, nuclear and renewable energy (RE), and universal charge for missionary electrification (UC-ME), I noticed that two topics kept popping up — the targeted generation mix towards more RE, and electricity prices.

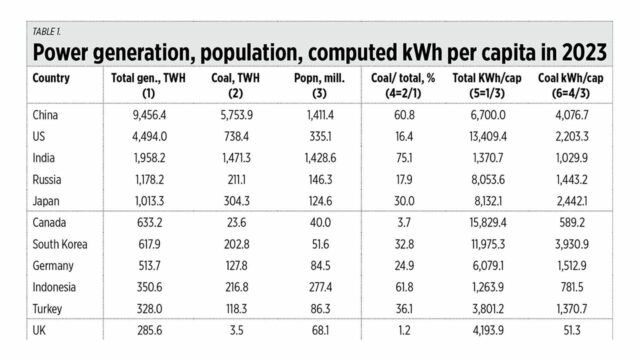

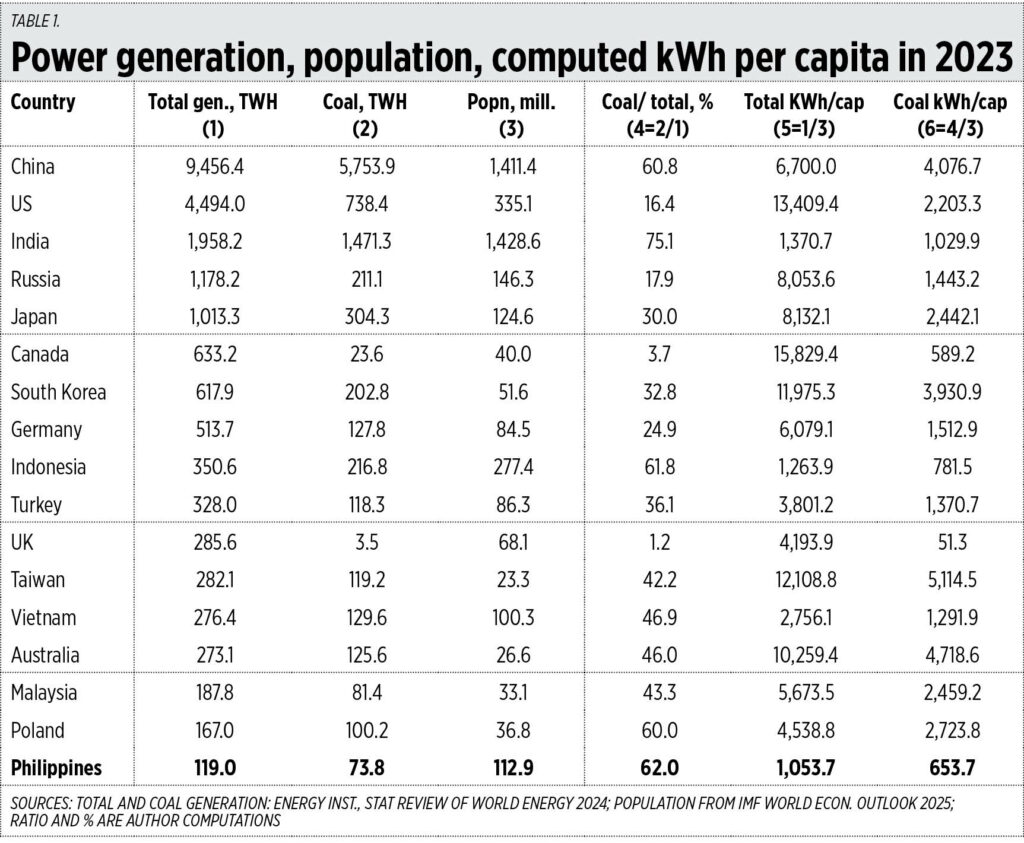

During the question-and-answer section, I suggested that instead of targeting X percent of RE by 2050 or so, we should target to raise our low power generation, from 1,000+ kilowatt hours (kWh) per capita in 2023 to 1,500, then 2,000 kWh per capita, and so on.

I computed the total power generation per capita and that generated by coal in 2023. While the Philippines only produced 1,054 kWh per capita, Indonesia produced 1,264 kWh, Vietnam produced 2,756 kWh, Malaysia produced 5,674 kWh, China produced 6,700 kWh, and Taiwan produced 12,109 kWh per capita (see Table 1).

That means we should be agnostic when it comes to the source of energy — we should just increase generation from all sources and technology every year, and thus stop the yellow-red alerts (if not actual blackouts) that occur yearly, especially in the provinces.

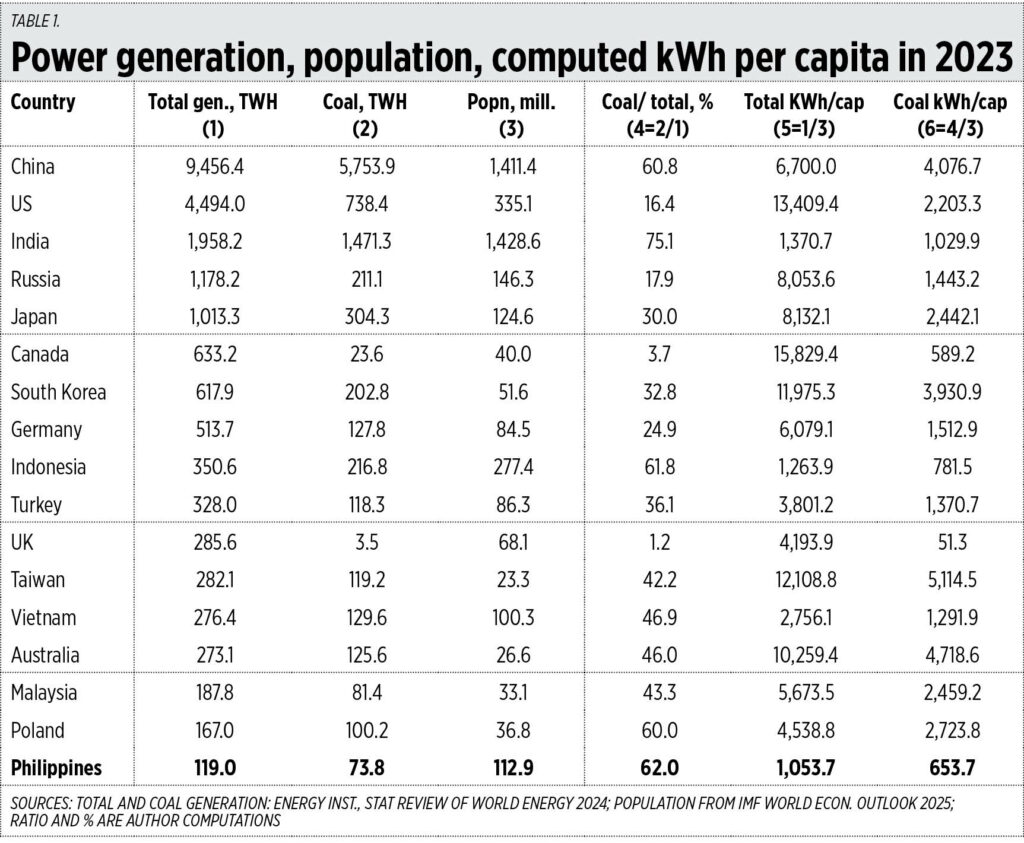

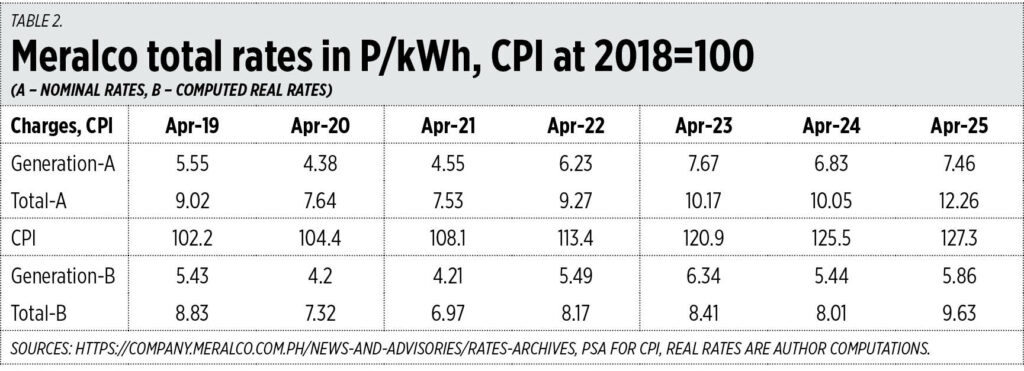

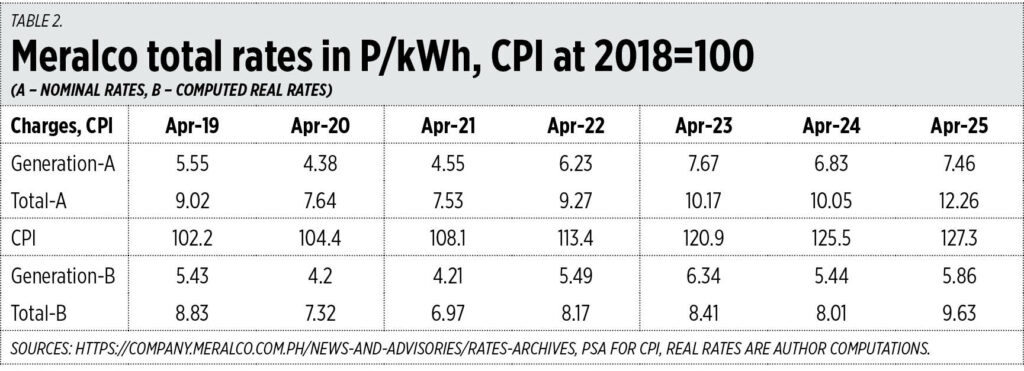

When it comes to electricity prices, people tend to exaggerate the nominal prices and fail to consider the effects of the inflation rate, even the rise in their income including minimum wage earners. So, to look at this, I converted nominal and current prices into real prices by deflating the nominal with the consumer price index (CPI) from the Philippine Statistics Authority. I got the Meralco rates for April which were reflected as May billing period, and compared it with the CPI for April. The latest available data for the CPI is from April.

The results show a fluctuation of prices, not “ever-rising” or “consistently rising” real prices. The overall rate (for 200 kWh/month consumers) was P8.83/kWh in 2019 to P6.97 in 2021 to P8.41 in 2023, and P9.63 this year (see Table 2).

There are many factors for the rise or decline of electricity prices, like the cost of fuel (oil, coal, gas), the appreciation or depreciation of the peso-dollar exchange rate, taxes, UC-ME, the feed-in tariff allowance (FIT-All) for RE, and so on. For the rest of 2025, it looks like P12/kWh nominal prices will stay.

Meanwhile, I read this headline on the National Electrification Administration (NEA) website: “Nearly P2 billion worth of loans granted to 36 electric cooperatives in 2024 — NEA.” I think it further confirms that NEA is a wasteful government agency that needs endless and yearly subsidies from taxpayers.

I checked data on the Department of Budget and Management’s Budget of Expenditures and Sources of Financing (BESF), 2022-2025, Table B.9. Here are the NEA’s subsidies from taxpayers through the years: P12.87 billion in 2020, P2.62 billion in 2021, P2.10 billion in 2022, P2.26 billion in 2023, P3.02 billion in 2024, and it requested P2.62 billion in 2025. The subsidies, on average, are larger than DoE’s annual budget, which went from P1.32 billion in 2020 to P2.61 billion in 2024. And the subsidies are at least three times the Energy Regulatory Commission’s (ERC) annual budget of P0.58 billion to P0.97 billion from 2020-2025.

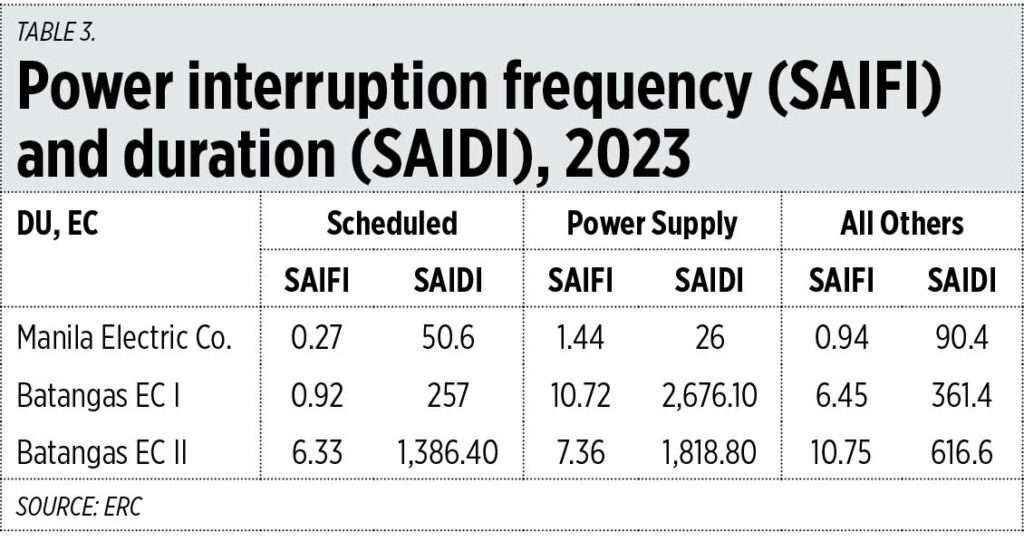

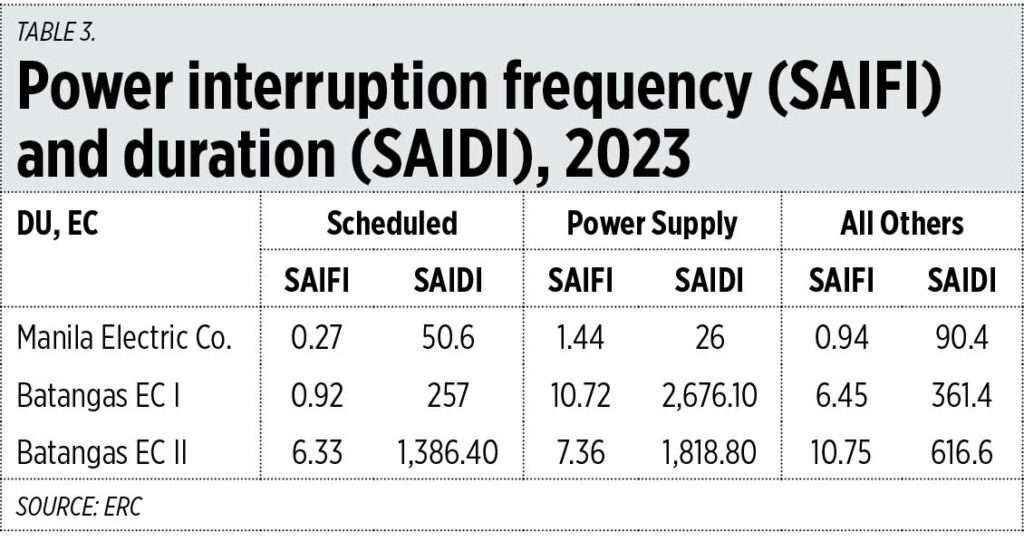

Aside from the endless subsidies for electric cooperatives (EC) and the NEA, many of the cooperatives are highly inefficient compared to private distribution utilities (DUs) like Meralco. Two indicators demonstrate this — the System Average Interruption Duration Index (SAIDI) measured in minutes in a year, and the System Average Interruption Frequency Index (SAIFI), which is how many times in a year there are power interruptions. The lower the indices, the better, the more stable the power supply is.

Three situations are considered: Scheduled maintenance; Power supply or grid-related outages like supply deficiency, plant tripping, transmission maintenance, etc.; and All Others which are things like vehicles hitting poles, etc.

For Scheduled maintenance, in 2023, Meralco’s SAIDI was 51 minutes while Batangas EC (BATELEC) 1’s was 257 minutes (or over four hours) and BATELEC 2’s was 1,386 minutes (23 hours). For Power supply, Meralco’s SAIDI was 26 minutes while BATELEC 1’s was 2,676 minutes (47 hours) and BATELEC 2’s was 1,819 minutes or 30 hours, (see Table 3).

The price per kWh may be similar between ECs and private DUs but the frequency and duration of blackouts by many ECs is horrible for consumers.

I still believe that all electric cooperatives should become corporations, their finance and governance monitored by the Securities and Exchange Commission and not the NEA. And the NEA should go.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.

minimalgovernment@gmail.com

CANNES, France — For Bono, the U2 frontman used to performing at sold-out arenas, being without his bandmates on a sparsely decorated stage for his one-man show, now subject of the new AppleTV+ documentary Bono: Stories of Surrender, feels unfamiliar.

CANNES, France — For Bono, the U2 frontman used to performing at sold-out arenas, being without his bandmates on a sparsely decorated stage for his one-man show, now subject of the new AppleTV+ documentary Bono: Stories of Surrender, feels unfamiliar.