By Beatrice M. Laforga, Reporter

ECONOMIC MANAGERS once again slashed macroeconomic growth targets for this year as coronavirus-related quarantine restrictions continue to be implemented in parts of the country, but remained hopeful the economy will see a strong recovery starting in 2021.

“The Philippines has endured the worst economic impacts of the COVID-19 pandemic through prudent fiscal management and evidence-based and decisive actions to address the global health emergency. As the economy gradually moves towards full reopening, we expect significantly better economic outcomes next year,” the Development Budget Coordination Committee (DBCC), said in a statement released Thursday evening.

During its meeting, the DBCC once again cut its gross domestic product (GDP) estimate to an 8.5 to 9.5 contraction this year, “following the prolonged imposition of community quarantines in various regions in the country.” This is lower than the 4.5-6.6% slump it estimated during its July 28 meeting.

“Despite a lower projection than what was initially adopted back in July 2020, further relaxation of restrictions, as we have improved our healthcare system capacity, will keep our economy on the right track towards full recovery,” the DBCC said.

The economy remained in a recession after GDP shrank by 11.5% year on year in the third quarter. But DBCC said it expects a further improvement in the fourth-quarter GDP, adding that “strong economic recovery and solid growth remains within our reach.”

Despite the expected lower base this year, the DBCC kept its growth forecast for 2021 at 6.5-7.5%, while it raised its growth projections for 2022 to 8-10%.

In a press briefing late Thursday, Acting Socioeconomic Planning Secretary Karl Kendrick T. Chua said next year’s projected growth would depend on the further relaxation of quarantine rules and the availability of a vaccine against the coronavirus disease 2019 (COVID-19).

Citing preliminary estimates, Mr. Chua said the impact of the recent typhoons that struck the country could shave off 0.62 percentage point from fourth-quarter GDP, or a reduction in full-year output by 0.17 percentage point.

At the same time, the economic team projected the average inflation rate to range from 2.4-2.6% this year. It retained its inflation forecast for 2021 and 2022 at 2-4%.

“In line with recent trends in global trade, the growth assumption for goods exports is maintained at -16% for 2020, while growth of goods imports for 2020 was further adjusted to -20%. These are expected to pick up by 2021 and 2022 with the growth of goods exports maintained at 5% and growth of goods imports pegged at 8%,” the DBCC said.

Services exports and import growth are expected to contract by 21.4% and 19%, respectively, this year.

“However, these are assumed to rebound by 2021 with projected growth reaching 6% for services exports and 7% for services imports. This accounts for the gradual opening up of the domestic economy and increase in travel-related activities,” it said.

FISCAL PROGRAM

The DBCC raised its revenue collection target for the year to P2.85 trillion, equivalent to 15.7% of GDP, from its previous target of P2.52 trillion, after the Bureau of Internal Revenue and Bureau of Customs exceeded its revised goals since July.

“Revenue projections for 2021 and 2022 have also inched up to P2.88 trillion and P3.31 trillion, respectively. The adjustments already factor in the expected impact from the implementation of the CREATE bill, as passed by the Senate,” it said, referring to the Corporate Recovery and Tax Incentives for Enterprises Act (CREATE) which will cut corporate income tax to 25% from the current 30%.

This year’s disbursements are expected to reach P4.23 trillion, equivalent to 23.3% of GDP and 11.5 higher than in 2019, but lower than the P4.335 trillion projected in July.

Infrastructure spending is expected to reach P824.9 billion or 4.5% of GDP by end-2020, versus the 4.2% of GDP forecasted in July.

The spending program will reach P4.66 trillion (23.4% of GDP) for 2021 and P4.95 trillion (21.9% GDP) for 2022.

“Given the revised revenue and disbursement program, the deficit program for 2020 is narrowed down from 9.6% of GDP to 7.6% of GDP in 2020. This is adjusted to an estimated 8.9% of GDP in 2021 and 7.3% of GDP in 2022. Our deficit program is designed to balance the requirement of supporting economic recovery while keeping our debt-to-GDP ratio beneath a sustainable threshold. We will not abandon the prudent fiscal management set by President Duterte when he assumed office in 2016 and put us in a good fiscal position ahead of the pandemic,” the DBCC said.

For next year, Finance Secretary Carlos G. Dominguez III said the government is hoping to extend the validity of this year’s P4.1-trillion budget to allow agencies to utilize unspent funds, as well as those under Bayanihan II, for another round of stimulus measure next year.

“At this point, we cannot say that we are supporting another Bayanihan III bill. However, we are planning to spend what is unspent for this year in both the budget and the Bayanihan II, that is an additional P213 billion, that could be a stimulus for next year,” Mr. Dominguez said in a press briefing Thursday.

The DBCC has proposed a higher, P5.024 cash-based budget, equivalent to 22.2% of GDP, for 2022 to support the government’s health-related response and measures to boost economic growth.

The cabinet-level DBCC is composed of heads of the Department of Budget and Management, National Economic and Development Authority, the Department of Finance, as well as the Executive Secretary. The Bangko Sentral ng Pilipinas also sits as the committee’s resource institution.

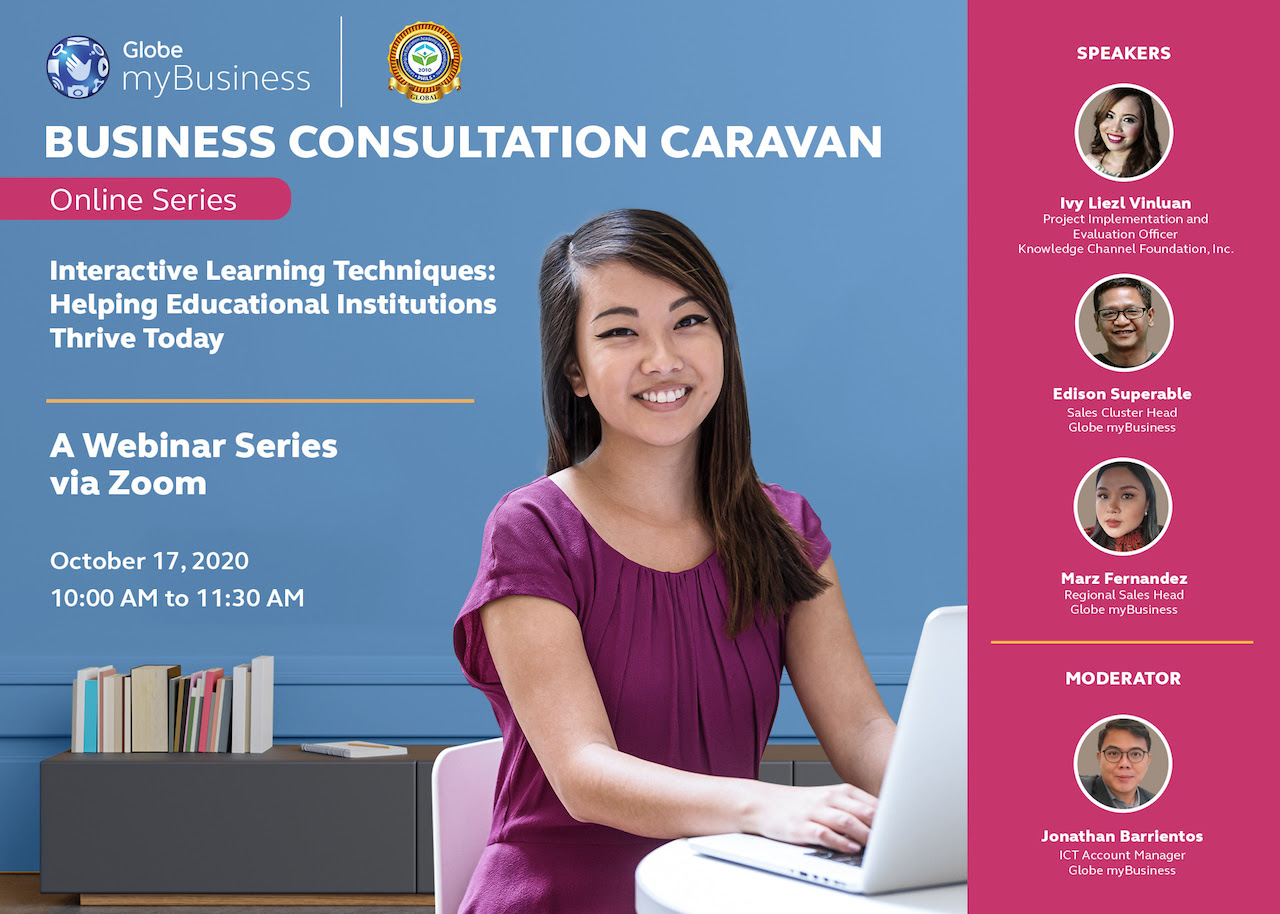

Educational institutions, on the other hand, were able to gain insights on how they could cope with the current situation through the Interactive Learning Techniques: Helping Educational Institutions Thrive Today webinar held on October 17.

Educational institutions, on the other hand, were able to gain insights on how they could cope with the current situation through the Interactive Learning Techniques: Helping Educational Institutions Thrive Today webinar held on October 17.  The Stevie® Awards are the world’s premier international business awards program, and the Asia- Pacific competition pits the best communications campaigns and business innovations from 29 nations in the Asia-Pacific region.

The Stevie® Awards are the world’s premier international business awards program, and the Asia- Pacific competition pits the best communications campaigns and business innovations from 29 nations in the Asia-Pacific region.