Ortigas Malls launches first Toy Club for Pinoy collectors

GREENHILLS Mall is known as a favorite destination of serious toy collectors and enthusiasts. To keep hobbyists and toy lovers engaged despite the pandemic, Ortigas Malls is launching the Toy Club: a way of keeping everyone updated on everything from the latest board games to collector’s items. Members of the Ortigas Malls Toy Club are entitled to a wide array of perks and privileges: coupons, discounts, and gifts with purchases from toy stores such as WRC Toys, Angelomarcus Toys, GH Minicon, Toyzone Xpress, Total Dibs Toys Trading, Whistle Toys Café, Kramer Toywarden, Fortress Toys & Hobbies, Bestoys, and R&G Enterprises. Club members will be the first to know about deals and get the first crack at the latest releases and promos. There will also be unboxing videos. Members will also get exclusive invites to toy events and activities, whether online or on-ground. To join the Ortigas Malls Toy Club, download the Ortigas Malls mobile app (http://onelink.to/xx58zg) on the Google Playstore or the Apple App Store. This will let one sign up and create their own digital ID, which they can use to enjoy all the perks of a club member. Registration is free and comes with exclusive sign-up privileges.

Lazada director to give e-commerce tips in online webinar

LAZADA Category Director for General Merchandise Mariel Caraig will headline a webinar entitled “The New Normal in Buying Behavior: Offline to Online,” which delves into the latest developments in the e-commerce scene and the impact of the pandemic on the industry, on July 2. Ms. Caraig will explain how the global epidemic shifted the attention of both buyers and consumers into alternative digital platforms and how this change challenged traditional marketing techniques. She plans to reveal explorable key product and e-commerce trends, new online business strategies that will be helpful for entrepreneurs for the years to come. Hosted by the Environment Studies Cluster of DLS-CSB, the webinar will be conducted via Zoom on Friday, July 2, from 1 to 2 p.m. Interested participants may register through this link: https://docs.google.com/forms/d/e/1FAIpQLSc_y7ZGPIZGYMLCqJisvrYohQY8p_5nWHJeXCdIQi1FbZRTYA/viewform. For more details, e-mail melissa.matugas@benilde.edu.ph.

Sarangani video bags NY film fest award

A TWO-MINUTE tourism video featuring snippets of Sarangani province’s top tourist attractions, Sarangani: Nature, Adventure, Culture, was conferred the Gold Excellence Award at the 11th International Film Festival in Manhattan (IFFM) spring edition in May. The video, which was directed by Sarangani Provincial Tourism Council chairperson Michelle Lopez-Solon, was submitted under the corporate category, and was among 15 Philippine entries that made the cut in the nine-country competition. The video features snippets of the experiences people can enjoy in the province, such as its vibrant beach festivals and parties, water sports, white water rafting, scuba diving, paragliding, sightseeing, and cultural immersions. Released in 2019, the video, which used footage from local videographers, was edited by Champ Biala and produced by Rain Ramas. Previous IFFM editions showcased selected videos and films in Manhattan, but the annual competition shifted online this year due to the coronavirus disease 2019 (COVID-19) pandemic.

Spotify launches Pride initiative

AUDIO streaming platform Spotify has unveiled its latest Pride initiative — Claim your Space. It includes the launch of Spotify’s Pride Hub, an all year long dedicated hub that features and promotes LGBTQIA+ artists, podcasters, and themed playlists from around the world. These LGBTQIA+ creators, cultural figures, and activists continue to blaze the trail for a more vibrant and inclusive society by inspiring the community and showcasing who they authentically are on the Spotify platform. In the Philippines, listeners can search for “Pride” on Spotify to discover tunes and talk from artists like Paul Pablo and podcasters like AC Soriano. “Bahaghari” is the Philippine’s dedicated Pride playlist in the Hub, featuring top tracks from international and local LGBTQIA+ artists and allies that are popular among Filipinos, including tunes like “Bangin,” “R.Y.F.,” “Fix Me,” and “This Love Isn’t Crazy.” Local Pride-inspired podcasts like Gabi ng Bading, Huwag ‘tong Makakalabas, and Becky Nights are also available on Pride Hub. Throughout the month of June, the Pride Hub offers exclusive Spotify video content from global artists including Kehlani, Hayley Kiyoko, Hope Tala, Claud, Urias, ILOVEMAKONNEN, Princess Nokia, Leland, and Kaydence.

Watch Asian dramas on Viu via PLDT Home

PLDT HOME has partnered with Viu, a pan-regional OTT video streaming service, to give more Filipino families access to a wide catalog of Asian dramas. PLDT Home subscribers can now enjoy a Viu Premium subscription for a discounted rate of P80/month that comes with free Viu Premium access for one month for uninterrupted viewing with zero ads, unlimited downloads, and first access to the latest Viu shows. The Asian dramas on Viu include: The Penthouse Season 3, Doom at Your Service, the hospital drama Youth of May, Hwarang: The Poet Warrior Youth, A World of Married Couple, and the satire Sky Castle. Download the Viu app on the App Store, Google Play, and selected Smart TVs, as well as on the web at www.viu.com to access Korean and other Asian shows.

Paolo Sandejas drops first Tagalog song, music video

AFTER the success of his recent collaboration with Joey Tha Boy on the song “Feel Alive,” Paolo Sandejas comes out of his comfort zone in his second single for 2021, “Misteryo” under Universal Records. “It’s always been a goal of mine to release a song in Filipino,” Mr. Sadejas said of the song. Originally penned in English and titled “Enigma,” the song talks about losing touch of someone. Produced by Eunice Jorge of Gracenote and co-written by Darwin Hernandez (composer of Moonstar88’s “Torete”), “Misteryo” leans towards alternative rock. “Misteryo” is available to stream on Spotify and Apple Music.

Doja Cat releases new album

AMERICAN rapper and singer Doja Cat (real name: Amala Ratna Zandile Dlamini) has released a new album, Planet Her, via Kemosabe/RCA Records/Sony Music. Alongside the album release is the release of the music video for “You Right,” a collaboration with multi-platinum R&B singer The Weeknd. The video was shot earlier this month and directed by Quentin Deronzier. To buy, stream, and watch “You Right,” visit https://smarturl.it/xYouRight. Planet Her is available at https://smarturl.it/xPlanetHer.

Netflix confirms cast of Seoul Vibe

NETFLIX confirmed the production of Seoul Vibe, an action film starring Yoo Ah-in, Ko Kyoung-pyo, Lee Kyoo-hyung, Park Ju-hyun, Ong Seong-wu, Kim Sung-kyun, Jung Woong-in, and Moon So-ri. Seoul Vibe follows the drivers of the Sanggye-dong Supreme Team who become mired in the slush fund investigation of a powerful person on the day of the 1988 Seoul Olympics opening ceremony. With all eyes of the world on Seoul Olympics, the chaos in the city provides opportune timing for moving illegal funds. The special operation to chase the money reels in baby drivers with amazing drifting skills. Directed by Moon Hyun-sung, the film features the sounds of old-school hip hop. Seoul Vibe will be released soon worldwide on Netflix.

Universal Pictures releases trailer for Sing 2

SING 2 is the new chapter in Illumination’s animated franchise, featuring the ever-optimistic koala, Buster Moon, and his all-star cast of performers as they prepare to launch their most dazzling stage show. There’s just one hitch: They first must persuade the world’s most reclusive rock star — played by global music icon Bono, in his animated film debut — to join them. Sing 2 is written and directed by returning filmmaker Garth Jennings and features additional characters voiced by music superstar Pharrell Williams, Black Panther’s Letitia Wright, and comedians Eric Andre and Chelsea Peretti. Sing 2 will open soon in Philippine cinemas. Watch the Sing 2 trailer on the YouTube channel of Universal Pictures (Ph).

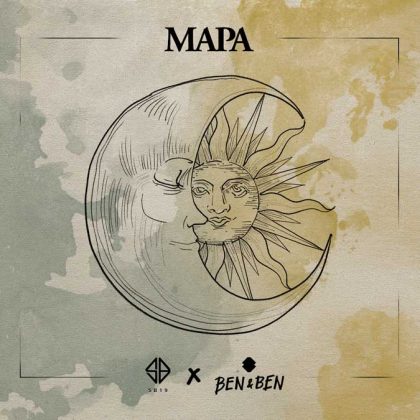

SB19 and Ben&Ben release their version of ‘MAPA’

SB19 and Ben&Ben joined forces to record a new version of the former’s smash single “MAPA” under Sony Music. In a year marked by self-imposed isolation and forced withdrawal from the outside world, the inspirational ballad brims with positive light as it honors every loving and hardworking parent out there. Packed with jazzy, orchestral details, inviting harmonies, and expansive arrangements, the new version of “MAPA” frames its paean of parental love with commitment to emotional sincerity and nuanced storytelling. SB19 gave Ben&Ben permission to rearrange the material. SB19 and Ben&Ben recently shot a performance video of the song at the historic Manila Metropolitan Theater. The performance video is now out on SB19’s Official YouTube account. SB19 and Ben&Ben’s “MAPA” is out now on all digital music platforms worldwide via Sony Music.