Free Spanish films shown on Vimeo

THIS month, Instituto Cervantes, in collaboration with the Festival de Cine Europeo de Sevilla and the Embassy of Spain in the Philippines, will present the film cycle “New Cinephilias Online,” featuring four recent movies which, due to their language and their themes, innovate, take risks and play with contemporary structures and narratives. The films will be shown through the Instituto Cervantes channel on the Vimeo platform (https://vimeo.com/channels/institutocervantes). They will be freely accessible for 48 hours from their start date and time. The film series will kick off on Nov. 6 and 7 with the thriller Arima (Jaione Camborda, 2017). Four women and a girl who, upon the arrival of two strangers, see how their environment becomes unbalanced and how fear and desire emerge, discovering a tangle of echoes from the past, mysteries and mirror games. The movie will be available on demand through the link https://vimeo.com/607360275, for 48 hours, until Nov. 9 at 3 a.m. The series will continue on Nov. 13 and 14 with the comedy Violeta no coge el ascensor (Mamen Díaz, 2019); Nov. 20 and 21 with the documentary This Film is About Me (Alexis Delgado, 2019); and on Nov. 27 and 27 with the comedy La reina de los lagartos (Burnin’ Percebes, 2019). The films will be in Spanish with English subtitles. Admission is free. For the schedule, film details and further information, log on to Instituto Cervantes’ website (http://manila.cervantes.es), or Instituto Cervantes Facebook page, www.facebook.com/InstitutoCervantesManila.

Don’t Breathe 2 opens on Nov. 17

FROM the minds behind blockbuster thrillers Don’t Breathe and Evil Dead comes what Indiewire describes as “a clever, twisted continuation that breathes new life into the horror sequel,” Columbia Pictures’ Don’t Breathe 2. The sequel opens exclusively in Philippine cinemas on Nov. 17. In 2016’s Don’t Breathe, Norman Nordstrom (Stephen Lang) was underestimated by everyone because of his blindness, but ultimately revealed a will to survive and get what he wants, and a monstrous, evil side of his personality. Now, in Don’t Breathe 2, eight years have passed, and Nordstrom lives with 11-year-old Phoenix. When intruders once again come to his home, Norman will reveal for a second time what’s hidden inside him, in new and unexpected ways. Starring Stephen Lang, Brendan Sexton III, and Madelyn Grace, Don’t Breathe 2 is directed by Rodo Sayagues.

Malignant to open on Nov. 24

WARNER Bros. Philippines has announced that James Wan’s new original horror film Malignant will open in Philippine cinemas starting Nov. 24. Malignant is the latest creation from Conjuring universe architect James Wan, and marks his return to his roots with this new original horror thriller. In the film, Madison is paralyzed by shocking visions of grisly murders, and her torment worsens as she discovers that these waking dreams are in fact terrifying realities. Malignant stars Annabelle Wallis, Maddie Hasson, George Young, Michole Briana White, Jacqueline McKenzie, Jake Abel, and Ingrid Bisu).

Kids’ shows at the Kapamilya Channel

CHILDREN nationwide can learn from animated and Kapamilya kiddie shows as YeY returns to TV on National Children’s Month starting Nov. 6 on Jeepney TV and the Kapamilya Channel. YeY shows will air all week on Jeepney TV’s YeY Weekend and YeY Weekdays blocks. Airing every Saturday is Kongsuni and Friends at 8 a.m., followed by Team YeY at 9 a.m., and kiddie gag show Goin’ Bulilit at 9:30 p.m. Sunday mornings will feature child-friendly blockbusters on KidSine Presents from 8-10 a.m. Kids can watch their favorite animated shows on Jeepney TV from Monday to Friday on its YeY Weekdays block, featuring back-to-back episodes of science-fantasy cartoon series Johnny Test at 8 a.m., followed by the adventures of Max Steel at 9 a.m. Meanwhile, the Kapamilya Channel will show YeY Weekend every Saturday from 6-7:40 a.m., with back-to-back episodes of Max Steel (6 a.m.), and Kapamilya kiddie shows Team YeY (6:45 a.m.), and Goin’ Bulilit (7:10 a.m.). On free TV, kids can also watch YeY shows Peppa Pig and Rob the Robot every Saturday (8 to 9 a.m.), Team YeY and Goin’ Bulilit every Saturday and Sunday (9-10 a.m.) via A2Z’s Kidz Weekend, beginning Nov. 6. For more updates on shows, events, and promos, parents can follow YeY on Facebook (fb.com/yeychannel), Instagram (@yeychannel), TikTok (@yey.channel), and YouTube channel (youtube.com/yeychannel).

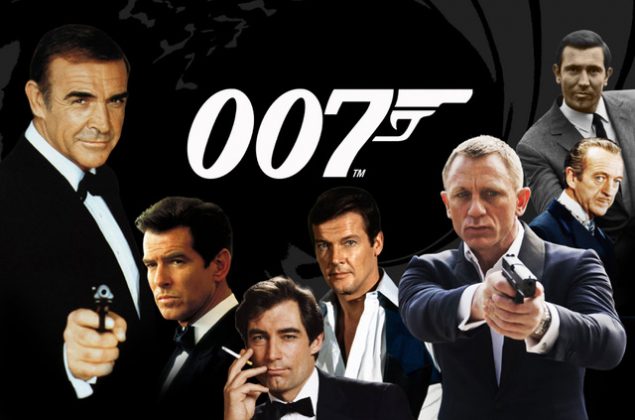

TapGO streams 25 James Bond films

THE WORLD’S longest-running film franchise, James Bond, can be viewed in the “James Bond Movie Marathon” on streaming app TapGO. With the 25th James Bond film, No Time to Die, yet to hit Philippine cinemas, viewers can watch previous releases of the franchise, from the 1962 film Dr. No to 2015’s Spectre, on demand. TapGO is the first subscription streaming service in the Philippines that provides access to live premium sports content as well as entertainment programs. Programs such as the UFC, Formula 1, the Tonight Show with Jimmy Fallon, and Chicago PD can be viewed on TapGO. The James Bond film library on TapGO can be viewed for P199 monthly through the TAPGO GOLD subscription package. To subscribe, visit www.tapgo.tv or download the TapGO app on IOS and Android.

Ed Sheeran releases new album

ED SHEERAN has just released his new album “=” (Equals), written and produced by Mr. Sheeran, Johnny McDaid, and Fred Gibson. The fourth installment in Mr. Sheeran’s symbol album series, the new album finds Mr. Sheeran taking stock of his life and the people in it as he explores the varying degrees of love, loss, resilience, and fatherhood, while also processing his reality and career. Ed Sheeran will embark on the first leg of his + – = ÷ x Tour (pronounced “The Mathematics Tour”) in April 2022. He will perform across the UK, Ireland, Scandinavia, and Central Europe. Shows in other territories will be announced in due course.

Hannah Pangilinan releases EP

SINGER-SONGWRITER Hannah Pangilinan continues her musical journey this year with the release of her new EP, Phases. Embracing a broader explorative path with her musicality, Ms. Pangilinan presents the song “Hinto,” which asks “When was the last time you let yourself rest?,” and the English track “Nothing,” which is characterized by colorful melodies and easy-listening lyrics. The five-track EP includes her previously released singles “Limits,” “’Pag Nandiyan,” and “All the Way,” her collaboration with Rico Blanco. Phases is now available on Spotify, Apple Music, YouTube Music, Amazon Music, and Deezer.

Cheats releases music video of single

CHEATS released the music video for its melancholic new single, “Hakbang,” the first single off of their upcoming third studio album. Directed by filmmaker Quark Henares, the black and white video stars Piolo Pascual as someone dealing with a nervous breakdown in his apartment, while the band members of Cheats are in the background, trying to cope with the challenging times by acting relaxed and normal. The music video ends with the actor joining the Cheats members in a dance sequence choreographed by PJ Rebullida. The music video of “Hakbang” can be seen at www.youtube.com/watch?v=3X4i3BpfRWY.