Entertainment News (04/08/22)

CCP offers grants for animation, games, comics

THE CULTURAL Center of the Philippines (CCP) is launching the CCP Grants, with P20 million in development funding meant to generate original Intellectual Property (IP) content that reflects the country’s rich cultural heritage with its folktales, myths, and legends. This program hopes to stimulate the local creative economy by providing financial and technical and educational support to local creative businesses, content developers, artists, and students. Filipino content creators can pitch their ideas in any of the following three categories: Game Development Grant, Animation Grant, and Comics Grant. For the Game Development Grant, up to four Securities and Exchange Commission (SEC)-recognized game development organizations will be awarded a maximum funding of P1.5 million each, and a maximum of P300,000 each to independent game developers to create and complete a digital game project with a mix of creative, cultural, and commercial outcomes, and content derived from the CCP Encyclopedia of Philippine Art. The Comics grant offers P330,000 for a potential of six winners; while the Animation Grant has funding of P2 million each for four potential winners to bring into life five-minute animated short films. Both the animation and comics output must be developed around the theme, “Philippine Folktales, Myths and Legends.” In addition, a training component with industry professionals will be integrated for the winners. The CCP Grants program is supported by the Creative Content Creators Association of the Philippines, the Game Developers Association of the Philippines, the Animation Council of the Philippines, and KOMIKET. For details, check out the Game Development Grant Application form: https://forms.gle/cvM1UNqLmWSEK6239 and the Animation and Comics Grant Application form: https://forms.gle/7P6PNASVPsXhtgUo9.

Star Cinema films will soon air on GMA

ABS-CBN will license titles from the Star Cinema library of films to GMA Network. This development was announced at a virtual event on April 5 attended by executives from both networks. “To us, we are very pleased because the significance of our partnership today ushers in possibility of a far broader set of conversations, potential partnerships and cooperation that will have the benefit not only mutually to GMA and ABS-CBN but as importantly, if not perhaps more importantly, to the benefit of the public we both serve — the Filipino viewer,” GMA Network President and Chief Operating Officer Gilberto R. Duavit, Jr. said. “Since we have, as they say, broken the ice, there is great optimism that these conversations will start and continue, and we look forward to the possibility of this type of an opportunity again moving forward,” he said. Meanwhile, ABS-CBN President and Chief Executive Officer Carlo L. Katigbak said that he is hoping to bring Star Cinema movies to more viewers through this partnership. “Every storyteller’s dream is to have as many people as possible experience their creations. Now, because of the kindness of our friends at GMA, we have the special opportunity to bring our Kapamilya stories to a new audience. We hope the Kapusos find joy and inspiration in viewing our Star Cinema movies and we also look forward to a new era of friendship and cooperation within our small industry,” he said, using the networks’ nicknames, Kapamilya and Kapuso. Among the Star Cinema movies which will air on GMA-7 are Alone/Together, How to Be Yours, Ang Babae sa Septic Tank, Just The Way You Are, Fantastica, No Other Woman, The Panti Sisters, James & Pat & Dave, Feng Shui, Suddenly It’s Magic, and I Love You, Hater.

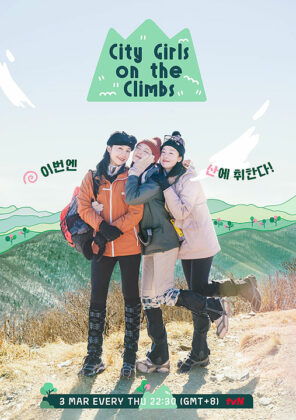

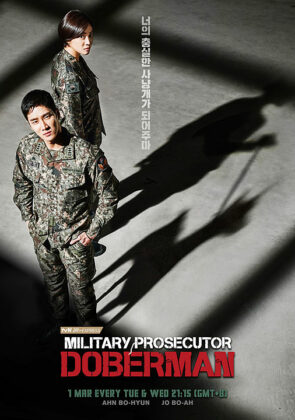

GigaPlay app offers shows for free

FOR a limited time until July 15, mobile services provider Smart Communications, Inc. will allow subscribers to enjoy entertainment and sports content on the GigaPlay app for free, with no subscription needed and no data charges. The GigaPlay app now offers tvN, a popular cable network in South Korea known for airing K-dramas. Some of the most popular titles that currently show on the GigaPlay app via its tvN partnership include Jirisan, Military Prosecutor Doberman, and City Girls on the Climbs. Aside from entertainment, GigaPlay streams live NBA action via NBA TV Philippines. Catch the PBA and the PBA 3×3, as well as the Japan B League, the National Basketball League (NBL) and the FIBA World Cup. GigaPlay is also the official digital streaming partner of the ongoing UAAP and is currently streaming Season 84’s basketball eliminations, as well as the UAAP Volleyball and Cheerdance competition. Smart subscribers can download the GigaPlay app on the App Store or Google Play Store. To watch for free, users can connect their phone to Smart or TNT mobile data or PLDT Home WiFi while accessing the app, without incurring data charges. For more information, visit https://smart.com.ph/Pages/gigaplay.

BAFTA awardee filmmaker holds online workshop

AWARD-winning British filmmaker, writer, and director Craig Lines will share his experience in a full online Certificate Program in Film Making for Content Creators, slated on select Fridays of April and May. Mr. Lines will guide participants based on the following: What do you want to achieve or promote? What is the subject? Who is the target market? Also an introduction to filmmaking, students will be immersed in the language of camerawork, its background and diverse genres, plus how its tools and techniques can be utilized in conceptualizing and creating videos and materials that are entertaining, informative and educational. The module will provide attendees with the understanding of the whole content creation process, from writing the script from scratch, preparing the workflow and equipment to shooting and post-production editing. Mr. Lines has been in the industry for over 30 years and has earned several TV and film accolades including three BAFTA Awards (British Academy Film Awards) and two Royal Television Society Awards. The Certificate Program in Film Making for Content Creators will be held on April 22 and 29 and May 6 and 13, from noon to 6 p.m. The module fee for the full online course is P12,895. It is designed for users who have a good understanding of the English language and have a laptop or desktop. The program is hosted by the School of Professional and Continuing Education (SPaCE) of the De La Salle-College of Saint Benilde (DLS-CSB). To register and to learn more about its course selections, visit SPaCE on the Benilde website or on its official Facebook account.

MNL48 releases new single

AFTER a year, girl group MNL48 returns with its 7th single, “No Way Man,” a dance-centric song with a message that mirrors the girl group’s can-do attitude. “No Way Man” is led by center girl MNL48 Abby with Senbatsu members Sheki, Jamie, Ruth, Ella, Jan, Andi, Jem, Yzabel, Princess, Lara, Coleen, Rianna, Lyza, Dana, and Dian. The music video for “No Way Man” is now up on MNL48’s YouTube channel. MNL48 will also be releasing a music card with mini photobook and a handshake ticket for their fans. For more updates, follow the group’s official Facebook (www.facebook.com/mnl48official), Twitter (@mnl48official), Instagram (@mnl48official), and YouTube (www.youtube.com/MNL48Official).