Exploring the food scene in Singapore

By Brontë H. Lacsamana, Multimedia Reporter

AS a tourist, it’s easy to get all shopped out and tired from strolling in the malls or exploring the wide range of cultural sights that Singapore has to offer, so the best thing to do in such instances is seek refuge in a cozy place and fill yourself with good food.

Homegrown cafés and restaurants keep Singapore’s food scene as vibrant as ever, featuring flavors from the country’s many influences, whether it’s Chinese, Malay, Indian, or even Western.

Though the pandemic did put up challenges for such places all over the world, many withstood the circumstances to continue showcasing the colorful cuisine of Singapore.

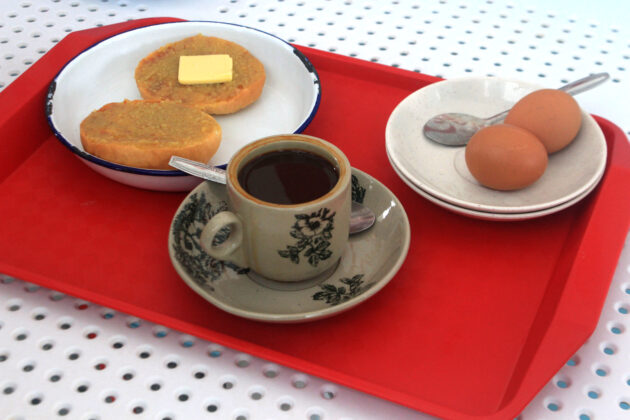

BREAKFAST & COFFEE

Kaya toast with eggs and coffee is popular breakfast fare in the straits, available in many of its oldest cafés. On Joo Chiat Road, Chin Mee Chin Confectionery (the pale blue shophouse on the far right) is an institution that has served this classic since 1925.

How to eat it? You can dip the buttered and kaya-filled toast in a plate of beaten eggs and/or in your coffee. You can even opt to eat it as is and drink the coffee separately. What is fun is that it’s all up to you.

HAWKER FOOD STALLS

If you haven’t eaten at a hawker center before, do yourself a favor and go for the char kway teow (stir-fried flat noodles), char siew (barbecued pork), chicken rice, fried oyster, or anything else that strikes your fancy. Find comfort in the many choices you have.

Even if you order a lot, you won’t have to spend more than $5 for a single meal. And go early because stalls cater to the breakfast and lunch crowd, which means ingredients can run out quickly.

Try these: Maxwell Food Centre, Tiong Bahru Market, Old Airport Road Food Centre.

TRENDY BUT CLASSIC

Though not as inexpensive as hawker centers, trendy restaurants in Singapore are putting their own twist on classic dishes, making them popular among tourists.

In Kampong Glam, many stores offer authentic Malay, Indian, and Middle Eastern food. For a taste of the local, visit The Coconut Club found along Beach Road, so you can grab a bite of their delicious nasi lemak before continuing your stroll in the area.

For popiah, or Singapore’s version of fresh spring rolls, go to the Po Restaurant inside The Warehouse Hotel on Havelock Road. After putting together your own popiah with fresh ingredients, its lowkey ambience is perfect for a leisurely cocktail at the bar.

Exploring the lush greens of Dempsey Hill in the middle of the city center can involve eating too — the Open Farm Community located in the area sources its ingredients from its own sustainable garden. Cauliflower wings are its bestselling vegan dish.

If you are a fan of chicken rice, visit Chatterbox, a longtime institution on Orchard Road. It’s been open since 1971 — though it is now found in the Hilton Hotel — and is known for an elegantly prepared chicken rice set that ups the ante of the classic favorite.

PERANAKAN CUISINE

Originating from Chinese diaspora and incorporating Malay and Western elements, Peranakan culture can be credited for giving flavor and color to Singapore’s cuisine.

The neighborhood of Katong & Joo Chiat is your best bet at trying some traditional Peranakan food. Start in Chilli Padi Nonya, a humble local restaurant that opened in 1997 and was recently featured in the 2022 Singapore Michelin Guide.

Must-try items on the menu include kueh pai ti (a crispy pastry tart shell filled with a sweet and spicy mix of shredded Chinese turnips, thinly sliced vegetables, and prawns) and ngoh hiang (fried pork rolls wrapped in beancurd skin — like the Philippines’ kikiam).

For those who like their food hot, there are also much spicier dishes like rendang.

Afterwards, as you stroll in Katong & Joo Chiat, keep an eye out for the go-to store for immersing yourself in the local culture: Rumah Kim Choo. Aside from Peranakan clothes, shoes, and souvenirs, its boutique center offers traditional sweets.

If you join a tour, you’ll have snacks, which includes kueh lapis (a rice treat like Filipino sapin-sapin but with multicolored layers eaten one by one), pineapple tart, and nyonya rice dumpling (a rice cake with sweet and savory meat, wrapped in pandan leaves).

To help gulp down this mini feast is butterfly pea flower tea with pandan and lemongrass in it, its blue color a satisfying balance to the eye-catching food on your plate.

THE NIGHTLIFE

As a booming financial center, Singapore is home to a slew of expats from all over the world, further livening up its multicultural image. These days, the hip nightlife scene caters to foreigners and tourists hoping to let loose in the Lion City.

In Chinatown, there are many relatively new places where everyone goes to socialize, one of which is Potato Head. Open since 2014, it takes up four floors of a shophouse on Keong Saik Road.

The lower floors have sit-down dining for those who want to try the burgers and fries or enjoy the occasional music gig. The rooftop bar is where it’s at, though — take pictures with your friends holding tiki-themed cocktails as the sun sets on the Singapore skyline.

Another hotspot in Chinatown is Native Bar, this time located in Telok Ayer Street. It’s known for its multi-awarded cocktail menu of regional flavors.

Vijay Mudaliar, the owner of the bar, told BusinessWorld that the menu is constantly updated to experiment with the various flavor trends in Asia. One of its recent stars is the Oolong Highball, which takes inspiration from the Japanese salaryman’s bento.

Meanwhile, those seeking out the hard stuff can venture towards the trees of Dempsey Hill to find a gin distillery sitting amidst the city’s peaceful slice of nature.

Tanglin Gin Distillery offers a tour and tasting experience that lets you try its handcrafted gin, featuring distinct Singaporean flavors — the Orchid Gin celebrates the tastes of hawker food and the Singapore Gin is citrusy with chili and ginger notes.

One of the brand’s partners, Bradley Young, will be able to explain what goes into smelling and later tasting the flavors in a gin. Make sure you have no other important places to be afterwards because this experience will set you up for the night.

Like Singapore’s own culture, the variety of smells and tastes in a single drink reflects just how exciting it can be to explore the city’s most unique offerings.