Spotify shares rebound after Joe Rogan apology, Citigroup upgrade

US podcaster Joe Rogan apologized and pledged more balance on his show amid a backlash against coronavirus disease 2019 (COVID-19) misinformation on the streaming service that wiped more than $2 billion off its market value last week.

On Monday, investors appeared to shrug off the controversy that hurt shares last week, as Spotify’s stock price jumped 12% after brokerage Citigroup raised the stock rating to “buy” from “neutral” saying the Swedish company would be able to improve its advertising business. Spotify said it would add a content advisory to any episode with discussion of COVID to try to quell the controversy, a first step into the field of content moderation that other tech platforms have found challenging and costly.

Mr. Rogan’s show, The Joe Rogan Experience, has been the most listened-to podcast on Spotify and is central to its plan to expand beyond music and take on rivals such as Apple and Amazon.com for a share of the podcasting market. In a 10-minute Instagram video post on Sunday evening, Mr. Rogan apologized to Spotify for the backlash but defended inviting contentious guests.

“If I pissed you off, I’m sorry,” Mr. Rogan said. “I will do my best to try to balance out these more controversial viewpoints with other people’s perspectives so we can maybe find a better point of view.”

Mr. Rogan is a prominent vaccine skeptic and his views on vaccines and government mandates to control the spread of the virus alienated prominent figures from singer-songwriter Neil Young to guitarist Nils Lofgren to best-selling US professor and author Brene Brown. Singer-songwriter Joni Mitchell also asked for her music to be taken off Spotify, citing a letter from hundreds of medical professionals urging the platform to prevent Mr. Rogan spreading falsehoods on the pandemic.

Spotify, which reports its quarterly earnings on Wednesday, has spent billions to build its podcast business and currently has over 3 million titles on its platform. Although it has an exclusive license to distribute the podcast, Mr. Rogan himself owns the show.

According to the company, it reviewed the episodes and decided that they did not meet its threshold for removal.

Spotify CEO Daniel Ek said late on Sunday that he might disagree with the views of some individuals on the platform but that it was “important to me that we don’t take on the position of being content censor.”

Its new policies include adding an advisory to any pandemic-related podcast that will direct listeners to a COVID-19 hub containing information from medical and health experts, as well as links to authoritative sources.

But the task of content moderation that it has now been dragged into is very different from removing songs with copyright violations, a job that Spotify is familiar with.

PODCAST MODERATION

Social media giants Facebook, Alphabet’s YouTube and Twitter have struggled with balancing the rights to free expression with moderating harmful content on their platforms amid intense regulatory scrutiny. Technology companies have invested in human content moderators as well as artificial intelligence technology over the past few years.

Under increasing pressure to police false content on their platforms, these companies have tightened their rules on vaccine misinformation. YouTube last week banned Fox News host Dan Bongino for making rule-breaking statements about the effectiveness of masks in stopping the spread of COVID.

Podcasts, which researchers have argued can be a powerful conduit for misinformation both due to their reach and the intimate relationship created with listeners, have often received less scrutiny over content moderation decisions than social media platforms. The challenges of monitoring and analyzing audio, coupled with the open nature of the podcasting ecosystem, has also complicated moderation.

Research from the Brookings Institution recently showed how misinformation about voter fraud was pushed on podcasts ahead of the US Capitol riot on Jan. 6, 2021, including on Steve Bannon’s War Room podcast, which was removed from Spotify in 2020 but is available on Apple and Google. — Reuters

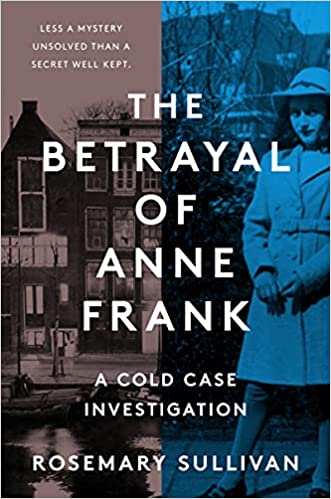

AMSTERDAM — A Dutch publisher has suspended printing of a book that suggested a Jewish notary betrayed Anne Frank, saying there were questions about the research behind it, according to an internal e-mail seen by Reuters. The Betrayal of Anne Frank, released on Jan. 18, caused a sensation when it said investigators had named Arnold van den Bergh as the main suspect. Other researchers later criticized the findings, saying they were “full of errors.”

AMSTERDAM — A Dutch publisher has suspended printing of a book that suggested a Jewish notary betrayed Anne Frank, saying there were questions about the research behind it, according to an internal e-mail seen by Reuters. The Betrayal of Anne Frank, released on Jan. 18, caused a sensation when it said investigators had named Arnold van den Bergh as the main suspect. Other researchers later criticized the findings, saying they were “full of errors.”