Belmont celebrates 7 years with special buffet

OCTOBER is a special month for Belmont Hotel Manila as it marks its anniversary. The Megaworld Hotels & Resorts property in Newport City has been serving local and foreign travelers for the last seven years. This year’s anniversary theme is “Proud to Be Local” and it aims to emphasize the hotel’s pride in being a homegrown hotel brand providing authentic Filipino hospitality. For the anniversary, the hotel has rolled out the Taste of the Islands weekend buffet at Café Belmont. Every Friday and Saturday, guests can enjoy dinner buffets that feature hot dishes and delicacies inspired by the country’s regions. These main offerings are complemented with a lineup of live stations such as the Hot Pot, Pasta, Pizza and Dessert stations. Café Belmont is also offering a 6 +1 dinner buffet promotion for the anniversary. Every 7th guest dining in a group will partake of the buffet for free. The dinner buffet is priced at P1,100 net per adult, while children ages six to 12 years old are 50% off. Those ages five and below dine free of charge. To make the buffet even more local, Café Belmont also released three P-Pop Coolers (Pinoy Pop Coolers): Melon Malamig, Coffee Jelly, and Sago at Gulaman. The al fresco rooftop lounge, Rooftop 11, is also celebrating the occasion with an “All White Friday Night” party on Oct. 28, 6 p.m. onwards. Guests are invited to come in white to enjoy unlimited cocktails and beers for P560 and savor tapas and pica pica. A guest DJ is also set to provide the music for the evening. Entrance to the party is free but advance table reservation is highly advised. For more information, call 5318-8888 or e-mail info@belmontmanila.com.

Century Park Hotel opens poolside bar

IN 2021, Century Park Hotel’s poolside outlet, Palm Grove Bar, was transformed into an Unlimited Samgyeopsal place in the heart of Manila. The picturesque setting continues to be a perfect backdrop for all those Tiktok, IG and FB-worthy posts. This year, the hotel is geared to elevate that experience with the Palm Grove Bar, open on Friday and Saturday nights (5-11 p.m.). A bang for the buck deal is its Buy 1, Take 1 offer on Frozen Fruity Margaritas, Frozen Sangrias, Heineken and Tiger beers during Happy Hour from 5-8 p.m. Then there is the bar chow: Wings & Dips (P495 net), Beef Salpicao (P445 net), or go for Pizza Flatbreads such as Margarita Flatbread (P395 net) or Formaggio Quattro (P395 net). Burgers are also available for big appetites starting from P395 net. Pair drinks with Pinoy favorites from the Street Food Treats menu and enjoy Kwek-kwek (P69 net), Chicken Tail (P89 net), Squid Balls (P139 net) or Pork Skin (P349 net) and a whole lot more. There are cocktails like Feeling Korean (P245 net), Banana Colada (P325 net), and Mojito (P355 net), and Pitcher Deals for as low as P249 net (Gnarly Dude!) to P499 net (Hard Lychee Soda). Beers can also be availed for as low as P195 net (Brew Kettle). The bar also serves Asahi, Heineken, and Tiger Beer Black and Crystal Light. “After the success of our Unlimited Samgyeopsal, we want to introduce to the market another refreshing poolside bar experience. Palm Grove has been steadily gaining momentum and on top of our Korean grill specialties, this area is an ideal place to unwind and simply have fun with friends and loved ones over drinks and lovely food,” said Anthony Tan, Century Park Hotel’s General Manager. For reservations at The Palm Grove Bar, call 0956-523-2880.

Crimson Boracay Gets Passionately Pink in October

OCTOBER is Breast Cancer Awareness Month and since 2017, Crimson has helped raise awareness regarding breast cancer through Passionately Pink, a joint initiative with the women’s health support group Stage Zero by Project Pink. Passionately Pink features a selection of staycation promos, dining offers, and special events in line with the theme of women’s resilience through better education and improved quality of life. This month, in commemoration of Passionately Pink’s sixth year, Crimson Resort and Spa Boracay is blushing pinker than any of the island paradise’s famed sunsets with its guest packages, limited-edition amenities, and activities. Enjoy a three-night stay at Crimson Boracay with staycation packages that start from P36,965 (the price includes a donation to Stage Zero by the Project Pink Support Group). Along with airport transfers and access to the Welcome Center upon arrival at Station Zero, guests can enjoy a daily breakfast for two, pampering services for two, as well as a roster of discounts for a variety of on-site dining and leisure experiences. Additional amenities will be enjoyed by those booked at one of the suites or villas. Guests will find macarons and bonbons in their room in a delicate shade of pink. There are Passionately Pink pastries and desserts at Saffron Café’s breakfast buffet. There are also refreshing cocktails at Station Zero like the Pink Lady, a rosy riff on the classic Gin ‘n’ Juice (a blend of Bombay Sapphire gin with grenadine syrup, lemon, and peach schnapps), the Jose Cuervo tequila-based Pink Sunset (with hints of pomegranate, guava, and lime), and Pink Paradise made with classic Stolichnaya vodka and mixed fruit juices, Monin cherry syrup, and a touch of Campari. Part of the proceeds from this month’s range of promotions will be donated to Stage Zero by Project Pink in support of their numerous initiatives for the welfare of cancer patients, survivors, and their families in their time of need.

Laguna’s Liberica, Benguet’s Arabica win at coffee tilt

TWO of the country’s coffees made history at the Global Coffee Championship held recently in Kintex, Korea. The Philippine’s Liberica and Arabica coffees took on some of the best coffees in the globe and captured Silver and Bronze at the Global Coffee Championship Signature Coffee Award: Latte and Signature Coffee Award: Brewer. Michael Harris Conlin, 2019 Philippine National Barista Champion represented the country in the competitions. Out of over 30 competitors per category, Sta. Maria, Laguna’s Liberica won the Silver award in Signature Coffee Award: Latte; while Balili, Benguet’s Arabica won the Bronze award in the Signature Coffee Award: Brewer. The coffee competition was judged by 12 world class coffee experts in a blind round of judging with the judges not knowing who the barista was. “When the opportunity came up to join a brewing and latte competition that is judged purely on sensory and blind with the judges not knowing who the barista was, I felt it was the best way to see how Philippine Arabica and Latte would fair against some of the best baristas and coffees from around the world,” said Mr. Conlin. Conlin’s Henry & Sons team worked closely with coffee farmers from the Juan Santiago Agriculture Cooperative (JSACOOP), an OTOPreneur from Santa Maria, Laguna, and the Dado family of Agnep @benguetarabica farm in processing and introducing the country’s Laguna Liberica and Benguet Arabica to the world. For more information, visit www.henryandsons and www.thevault.ph.

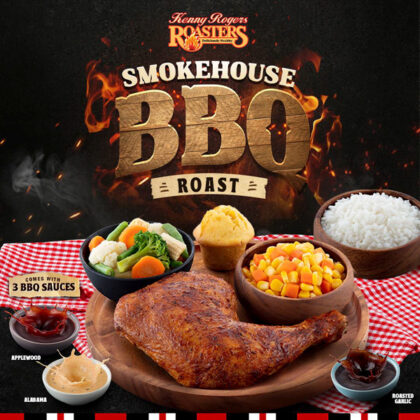

Kenny Rogers has new Smokehouse BBQ Roast & Ribs

KENNY Rogers Roasters is bringing an American-style barbeque holiday with its newest offerings, the Smokehouse BBQ Roast & Ribs. Their flavors are further amplified with three new sauces: Roasted Garlic, Applewood, and Alabama. The Smokehouse BBQ & Ribs comes in two forms: the Smokehouse BBQ Roast Chicken, which is marinated in a special blend of barbecue and spices for flavorfully tender meat and crisp, lightly seared skin; and the Smokehouse BBQ Ribs, with the signature fall-off-the-bone ribs made flavorful with chipotle and special spices. Customers can now order the Smokehouse BBQ Roast & Ribs with Kenny Rogers Roasters favorites: Each Solo B plate comes with the three new sauces, a choice of two slides, rice, and muffin. The Smokehouse BBQ Roast Solo B (P305) comes with a quarter roast chicken while the Smokehouse BBQ Ribs Solo B (P480) comes with a half-slab of ribs. The Group Meal also comes with the three new sauces, four side dishes, four cups of rice, four muffins, and 1.5 liters of soda. The Smokehouse BBQ Roast Group Meal comes with a whole roast chicken (P1,085) while Smokehouse BBQ Ribs Group Meal comes with four half-slab ribs (P1,760). These are available in all Kenny Rogers Roasters stores nationwide for dine-in, takeout, or delivery through www.kennyrogersdelivery.com.ph, hotline: 8-555-9000, or via Grab Food and Food Panda.

Mang Inasal offers a Family Fiesta

MANG Inasal introduces the all-new Mang Inasal Family Fiesta — a special bundled group meal composed of char-grilled favorites including Chicken Inasal, Pork BBQ, or Grilled Liempo that’s perfect for office parties, family reunions, and different gatherings this holiday season. Starting at P709, customers can choose from four different bundles: All-Chicken Inasal bundle with six pieces Chicken Paa and Java Rice Platter; the All-Pork bundle, complete with two pieces Grilled Liempo, eight pieces Pork BBQ, and Java Rice Platter; and the combos — the Chicken Inasal and Pork BBQ bundle, with three pieces Chicken Inasal Paa, six pieces Pork BBQ, and Java Rice Platter, and the Chicken Inasal and Grilled Liempo bundle, with four pieces Chicken Inasal Paa, two pieces Grilled Liempo, and Java Rice Platter. The Mang Inasal Family Fiesta is available for takeout or by ordering at http://manginasaldelivery.com.ph/. Diners can also place an order via the Mang Inasal Delivery app, or through other food delivery apps like GrabFood and foodpanda.

7-Eleven intros 4 Filipino meals by chef Claude Tayag

THE LATEST Chef Creations collaboration between convenience store chain 7-Eleven and chef Claude Tayag is a Pinoy feast with a new four-set line of single-serve, heat-to-eat packs. The new items under the Chef Creations x Linamnam line are Batchoy, Palabok, Sinampalukang Manok, and Bicol Express. For those craving a lighter bite, there is IloIlo’s famous pork and innards noodle dish Batchoy (P95) or Malabon’s famed noodle dish Palabok (P95) with shrimp sauce topped with cooked shrimp, chicharon, tinapa flakes, and hard-boiled egg. For a more filling set, there is Bataan’s Sinampalukang Manok (P115), their own take on chicken sinigang (sour soup) made with tamarind leaves and pulp, or spice it up with Bicol’s famous Bicol Express (P95) flavored with real chilies, coconut milk, and shrimp paste. Also part of the Chef Creations x Linamnam line is the traditional Filipino dish, Pork Sinigang sa Kamias (P105) made with real kamias and served with assorted vegetables that was launched previously. All variants of the Chef Creations are now available in select 7-Eleven Luzon stores.

Honeybon’s new Sugar-free Swiss Chocolate Cake

Despite being known for its decadent cakes and pastries, Honeybon aims to serve the best treats for everyone — even those who can’t have sugar. Just in time for the holiday season, Honeybon is launching the Sugar-free Swiss Chocolate Cake. Sweetened with a zero-calorie sugar substitute, the cake has layers of moist yet fluffy chocolate chiffon filled and covered with rich Swiss chocolate ganache made with sugar-free couverture chocolate. The new Sugar-free Swiss Chocolate Cake is available via www.honeybon.ph, at Honeybon stores at SM Megamall and Festival Mall Alabang, and select Tokyo Bubble Tea branches (The Fort Residences, BGC; Banawe, Quezon City; and Wilson, San Juan City) for P1,480 (whole) and P195 per slice.

Visum Ventures’ new executive pastry chef is Miko Aspiras

Award-winning pastry chef Miko Aspiras recently joined Visum Ventures as its new Executive Pastry Chef Partner, as announced by John-Michael “Mike” Hilton, the company’s President and CEO. Mr. Aspiras will curate desserts for all Visum brands, as well as introduce new concepts. Mr. Aspiras has had a stellar career, starting as a commis chef at the Shangri-la Manila, and subsequently working at the Raffles & Fairmont, Resorts World Manila, and executive pastry chef at Hilton Hotel Sydney and Ovolo Hotel Sydney. He has several awards and recognitions, including the 2011 Highest Gold Medal, Hongkong Food Exposition/Hongkong Culinary Classis; Highest Gold Medal, 2012 Philippine Culinary Cup; Gold Medal 2012 World Association of Chef’s Societies Congress; Gold Medal and Best of the Best Award, 2013 Hongkong Food Exposition; Highest Gold Medal 2013 Philippines Culinary Cup; among others. Some of his new dessert creations shared during a media night in September included his version of banana-Q, with langka, mousse with banana financier and mille feuille; Black Forest with Auro Dark Chocolate Mousse, with cherries and dark chocolate; Calamansi Cake with Auro White Chocolate Glaze; and Dumaguete passion fruit pastille. Visum Ventures, which was founded in 2019 just before the pandemic struck, bringing in Koomi, the natural drinking yoghurt from Australia, which now has over 100 branches nationwide; Oh My Greek and Zig in 2021, and Sante and Meraki in April 2022. Visum is also the exclusive distributor of T2 teas and Salt and Ice Bar (fresh oysters and craft cocktails).