Human capital damage from coronavirus could worsen poverty — WB

By Luisa Maria Jacinta C. Jocson, Reporter

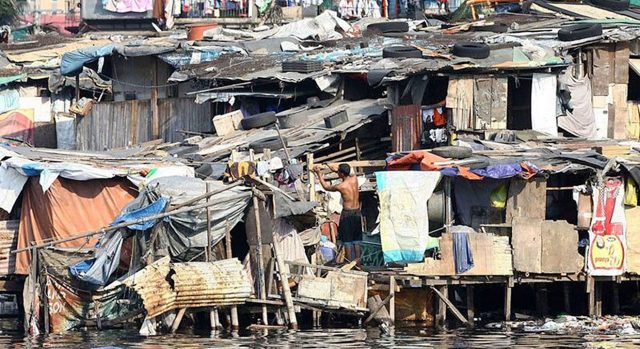

THE CORONAVIRUS PANDEMIC is expected to cause long-term scarring of human capital development in the Philippines, which could lead to more Filipinos becoming poor, the World Bank (WB) said in a report on Wednesday.

“Over half of households estimate that their children learned from remote learning less than half what they would have learned from face-to-face schooling,” it said. “The proportion increases to 68% in poor households.”

“Extended distance learning is expected to have reduced the learning-adjusted years of schooling by over a full year,” the World Bank said. “Learning loss, combined with the deskilling associated with prolonged unemployment, could lead to sizable future earnings losses.”

The multilateral lender said the pandemic had partly reversed decades-long gains in reducing poverty and inequality.

The pandemic halted economic growth momentum in 2020 and unemployment shot up in industries that require in-person work, it said. The economy has begun to rebound, but signs are emerging that the recovery will be uneven.

The World Bank study cited a shift to less productive work in occupational categories.

From January 2020 to April 2021, employment in high- and middle-skilled routine occupations fell, while employment in middle-skilled nonroutine and in low-skilled occupations rose, with the latter rising slightly faster.

“Considering wage occupations only, employment seems to have been shifting from middle-skilled to low- and high-skilled occupations, which suggests that the polarization in wage employment that apparently started in the mid-2010s will persist during the recovery and may worsen in the next few years,” the World Bank said.

The digital economy would probably expand and job transformation would quicken during the post-coronavirus era, it said.

“These changes may further the transition of workers from middle-skilled to low- and high-skilled occupations,” according to the report. “Concerns have been raised in many countries about heightened job polarization and income inequality with the transformation of jobs post-COVID-19.”

The government can reduce inequality by creating jobs, improving education access and quality, promoting inclusive rural development and strengthening social protection.

“The Philippines can still leverage the crisis generated by the pandemic to promote necessary reforms,” the World Bank said. “The pandemic has exposed areas of high vulnerability in both advanced and developing economies, but it has also opened an opportunity to address these weaknesses through commitment to policies to build back better.”

State policies should support vulnerable population and ensure macroeconomic and fiscal sustainability, it added. The government should boost vaccination against the coronavirus, support schools in assessing student learning, provide learning recovery programs, strengthen social protection, provide well-targeted help and develop a fiscally viable unemployment insurance program.

Labor policies should support worker reskilling, redeployment and resilience especially for those most affected by disruptions.

“Use education and training to build pathways to better jobs and help the workforce to adapt to a rapidly changing labor market and make the business environment supportive of entrepreneurship,” according to the report.

It also cited the need to address gender inequality in the labor market and promote inclusive rural development. Health and education programs should also be expanded.

These include increasing access to quality and affordable healthcare in the countryside, bringing more skilled teachers to the provinces and providing incentives to poor households so they could send their kids to school, the World Bank said.