BSP bills’ rates rise on weak demand

YIELDS on the Bangko Sentral ng Pilipinas’ (BSP) short-term securities inched higher on Friday as both tenors went undersubscribed after the offer volume was increased.

The BSP bills attracted only P86.339 billion in total bids, below the P100 billion auctioned off but slightly above the P86.003 billion in tenders for the P80-billion offer a week prior. The central bank accepted all the submitted bids for a partial award.

Broken down, tenders for the 28-day BSP bills reached P35.042 billion, lower than the P40 billion placed on the auction block but higher than the P30.119 billion in demand for the P30-billion offer the prior week.

Accepted yields were from 5.25% to 5.4%, a tad wider than the 5.255% to 5.4% margin seen a week prior. This caused the average rate of the one-month securities to go up by 1.01 basis points (bps) to 5.3555% from 5.3454% previously.

Meanwhile, bids for the 56-day bills totaled P51.297 billion, below the P60-billion offer and the P55.884 billion in tenders for the P50 billion auctioned the previous week.

Banks asked for rates from 5.265% to 5.34%, wider than the 5.29% to 5.34% band last week. With this, the weighted average accepted yield of the two-month papers edged up by 0.08 bp to 5.3114% from 5.3106%.

The central bank uses the BSP securities and its term deposit facility to mop up excess liquidity in the financial system and to better guide short-term market rates towards its policy rate.

The BSP bills also contribute to improved price discovery for debt instruments while supporting monetary policy transmission, the central bank said.

The short-term securities were calibrated to not overlap with the Treasury bill and term deposit tenors also being offered weekly.

The BSP bills are considered high-quality liquid assets for the computation of banks’ liquidity coverage ratio, net stable funding ratio, and minimum liquidity ratio. They can also be traded on the secondary market.

Data from the central bank showed that around 50% of its market operations are done through its short-term securities.

BSP Governor Eli M. Remolona, Jr. earlier said that they are gradually shifting away from the issuance of short-term papers in their liquidity management operations as they want to boost activity in the money market. — Katherine K. Chan

The Subaru Forester goes hybrid

Electrified SUV is priced from P2.498 million

MOTOR IMAGE PILIPINAS, INC. (MIP) recently launched the sixth-generation Subaru Forester, said to boast a “strong hybrid system delivering over 1,000 kilometers of range and uncompromised capability.”

In a release, the distributor added that the Forester blends advanced, eco-conscious performance “with Subaru’s legendary Symmetrical All-Wheel Drive (SAWD),” new-generation safety technologies, and an array of premium comfort features.

The e-Boxer strong hybrid powertrain yields benefits in efficiency and performance while delivering quiet operation and highlighting the “unique driving feel of a Subaru.” The intelligent, self-charging system requires no plugging in. “The system intelligently draws power from either engine, motor or both — ensuring optimal power and efficiency in all conditions,” said MIP.

At low to mid speeds, the vehicle operates on EV Drive mode — electric-only power giving silent, zero-emission urban driving — and switches to the internal combustion engine during highway driving. The electric motor assists during acceleration and hill climbing for a responsive “e-Turbo” feel and “an overall smooth, linear driving experience.”

The powertrain is comprised of a 2.5-liter horizontally opposed, four-cylinder, DOHC 16-valve Subaru Boxer engine with a “powerful electric motor” integrated into the transmission. With the Forester’s 63-liter fuel tank, the setup is expected to deliver a maximum range surpassing the aforementioned 1,000 kilometers per full tank of gas.

An updated Lineartronic transmission integrates the drive motor, power-generation motor, front differential, and electronically controlled coupling into a single compact unit. This efficient design maintains Subaru’s balanced weight distribution while maximizing energy utilization for powerful acceleration and enhanced quietness. A new electric compressor ensures that the air-conditioning system remains running even when the engine is off at idle, maintaining cabin comfort in situations such as stop-and-go traffic.

Chassis rigidity has been improved by 10% versus the outgoing version through a full inner frame construction and the wider use of structural adhesives. “This minimizes vibrations and reduces sudden body movements, providing a unified feel of steering and vehicle stability on any road. A specially designed suspension further improves ride comfort and handling,” added MIP.

The Forester retains its famous symmetrical all-wheel-drive (SAWD) system even as it is paired with the new hybrid system. Ground clearance measuring 220 millimeters is complemented by dual-function X-Mode, which “offers reliable support on rough terrain and makes it easier to free the vehicle from mud. Hill descent control is also included to help maintain a constant speed on slippery downhills.”

Inside is an 11.6-inch full-HD infotainment display which serves as the vehicle’s “intuitive command center.” Content can be enjoyed through an 11-speaker (including a subwoofer) Harman/Kardon audio system with an eight-channel amplifier. The system features wireless Apple CarPlay and Android Auto connectivity. A Qi wireless charging pad accepts compatible devices. Front Type A and Type C ports are available, as well as rear USB power ports.

The latest generation of Subaru’s driver assist technology, EyeSight 4.0, now uses a wide-angle monocular camera, significantly expanding the detection range for pedestrians and bicycles. Nine preventive safety functions are on tap: Lane Centering Function, Lane Departure Prevention, Lane Departure Warning, Lane Sway Warning, Autonomous Emergency Steering, Pre-Collision Throttle Management, and Lead Vehicle Start Alert, as well as Pre-Collision Braking and Adaptive Cruise Control, which have been improved for better performance.

The all-new Subaru Forester is available as the Forester 2.5i-S EyeSight e-Boxer Hybrid, with indicative pricing beginning at P2.498 million. For final pricing and model specifications, customers may contact the nearest authorized Subaru retailer. MIP also announced a renewed commitment to its customers with significant improvements to its after-sales services. “This enhancement promises a seamless journey for every customer, ensuring that every Subaru owner receives exceptional support and peace of mind long after their purchase,” concluded the release.

Brazil coffee exports to US seen declining further if tariffs stay

VITORIA, Brazil — Brazil coffee exports to the US will fall further if US tariffs remain in place, Marcio Ferreira, the head of exporter group Cecafe said, adding the industry was pleased by warming relations between the leaders of the two countries.

US President Donald J. Trump imposed a 50% tariff on Brazilian coffee and other goods, which came into effect in early August, amid tensions between his administration and the government of Brazilian President Luiz Inacio Lula da Silva.

As a result, Cecafe reported that the US was no longer Brazil’s biggest market as coffee sales there fell 46% in August, compared with the year before, when Brazil saw record exports. Through Sept. 19, exports to the US were down a further 20% versus their level in August, Mr. Ferreira told Reuters.

If tariffs continue, exports “will keep falling,” said Mr. Ferreira, who also works as the superintendent of Tristao Trading, a leading exporter of Brazilian coffee.

Only a shift in policy could revive sales, he said, adding that the industry was encouraged by the positive exchange between Mr. Trump and Mr. Lula at the United Nations this week.

US tariffs on goods from Brazil, the world’s largest coffee producer and exporter, have upended the global coffee market, pushing prices upwards.

In the short to medium term, the tariff restrictions may be good for producers, who have benefited from higher prices, Mr. Ferreira said, but added that exporters, roasters, and consumers are suffering.

Some producers are holding on to their stock, betting prices will return towards recent records, said Valdecir Schmidt, warehouse manager for Cooabriel, Brazil’s biggest cooperative of Conilon, a type of coffee related to robusta.

“We have a very high stock level for this time of year,” he said. “Last year, we didn’t even have half of what we’re seeing now, in the month of September.”

As US purchases shrink, exports to other countries are growing. According to Cecafe, total coffee exports to Colombia soared 578% in August.

Cooabriel’s Conilon exports to Colombia — itself a major arabica coffee producer — increased 300%, said Jose Carlos Azevedo, the cooperative’s sales manager, adding that places like Italy and Britain had also increased demand.

Still, the US market is too big for other countries to replace, Mr. Ferreira said. If tariffs remain in place for too long, Americans could grow used to other types of coffee, making it harder for Brazilian companies to recover their position in the US market in the future, he added.

“It’s time to get the kids out of the room and get the adults in to negotiate,” he said. — Reuters

Green Equity tag seen to boost visibility of ESG-focused companies

By Alexandria Grace C. Magno

THE Securities and Exchange Commission’s (SEC) issuance of Green Equity label guidelines is expected to boost the visibility of environmentally focused companies and attract investors seeking opportunities aligned with environmental, social, and governance (ESG) standards, analysts said.

“The Green Equity label could give more visibility to green companies, especially for ESG investors,” AP Securities, Inc. Research Head Alfred Benjamin R. Garcia said in a Viber message on Friday.

“Typically, companies with accreditations like this can command a premium valuation, so this could benefit a few listed companies, notably Acen Corp. (ACEN) and SP New Energy Corporation (SPNEC) to name a few,” he added.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said the move aligns with the global trend toward ESG standards and encourages businesses to follow sustainable practices, which may increase their value.

“The initiative is consistent with the greater shift to ESG standards. Global regulators encourage investors to patronize businesses, entities, and countries that adhere to ESG standards,” he added.

Under Memorandum Circular No. 13, series of 2025, companies listed or preparing to list on the Philippine Stock Exchange may apply for the Philippine Green Equity label.

To qualify, over half of their revenues and capital and operating expenditures must come from or be directed toward green activities, as defined by the Philippine Sustainable Finance Taxonomy Guidelines or the ASEAN Taxonomy for Sustainable Finance. Revenues from fossil fuel-related operations must remain below 5%.

To ensure transparency, the SEC requires applicants to submit an external review assessment report that will be publicly accessible.

The Philippine Stock Exchange will also conduct annual evaluations of label holders to verify ongoing compliance with the standards.

SEC Chairperson Francisco Ed. Lim said the Green Equity guidelines are a game-changing initiative that will help develop the capital market, boost liquidity, and support the country’s climate goals.

“Since compliance with ESG standards signals good business, more companies and governments around the world commit to reducing carbon footprints and implementing sustainability measures,” Mr. Ricafort said.

The Green Equity label guidelines are part of the SEC’s sustainable finance framework, offering an equity-based option alongside the P1.02-trillion sustainable finance fixed-income market for green investments.

Regina Capital Development Corp. Head of Sales Luis A. Limlingan said: “[Having a Green Equity label] may help [attract investors], but I still think more initial public offerings (IPOs), a stable global geopolitical landscape, and better earnings clarity would equally or better attract investors.”

Gucci: All in the family

GUCCI’S new collection, called “La Famiglia” (The Family in Italian) “is a study of the ‘Gucciness’ of Gucci, an expression of the brand as a mindset and a shared aesthetic language,” said a statement. La Famiglia marks Gucci’s return to storytelling, going back to the future by way of the past, defining the aesthetic base upon which designer Demna’s Gucci vision will be built leading up to his first show in February.

It reinterprets the House’s codes through framed portraits of an extended Gucci family, captured by Catherine Opie, made up of singular personalities and distinctive aesthetic attitudes: the different facets of Gucci’s personas.

The lookbook opens with L’Archetipo, a monogrammed travel trunk that highlights the House’s origins as a valigeria (leather goods store or factory), followed by the Incazzata (a rough translation has to do with being incensed with anger) in a 1960s-style little red coat that reflects her fiery demeanor. La Bomba’s (the bombshell) volatile feline sass is mirrored by her stripes, and La Cattiva (the naughty girl) embodies the severe elegance of a femme fatale. Miss Aperitivo is simply preoccupied with having the time of her life, while L’Influencer embodies the social media fashion enthusiast. La Mecenate, La Contessa, Sciura, and Primadonna exude refined Italian elegance, while Principino and La Principessa capture two sides of the same coin: the center of attention — these are all mostly Italian archetypes found in literature, media, or even in the home.

The collection includes slingback kitten heels and soft leather mules; while heritage signatures are revisited and revived. The Gucci Bamboo 1947 bag, a 78-year-old signature, is re-proportioned, alongside the Horsebit loafer, a House icon since 1953. The Flora motif appears as is or reimagined in a nocturnal incarnation. The GG Monogram, Guccio Gucci’s initials, appears throughout, worn with head-to-toe abandon, from lens to loafer.

Silhouettes span extremes, from the maximalist grandeur of a feathered opera coat and high jewelry to the neo-minimal sensuality of seamless hosiery garments. Dressing for pleasure is emphasized, and glamour is carried over into menswear. The elegance of eveningwear is applied to transparent bodycon sets and sophisticated black-tie swimwear. — JLG

Meta’s chatbot scandal is really a culture problem

By Gautam Mukunda

“MOVE FAST and break things.” If there’s a single corporate motto you can identify off the top of your head, that’s probably the one. At this point, Meta Platforms, Inc. Chief Executive Mark Zuckerberg probably regrets its existence, but there’s plenty of evidence that he — and the company — are still okay with the idea of doing some damage on their way to success.

One of the most recent examples is a Reuters investigation, which found that Meta allowed its AI chatbots to, among other things, “engage a child in conversations that are romantic or sensual.” That reporting was a topic at a Senate hearing last week on the safety risks such bots pose to kids — and underlines just how dangerous it is when AI and toxic company cultures mix.

Meta’s chatbot scandal demonstrates a culture that is willing to sacrifice the safety and well-being of users, even children, if it helps fuel its push into AI. The technology’s proponents, including Zuckerberg, believe it has limitless potential. But they also agree that it will, as the Meta CEO has said, “raise novel safety concerns.” One reason the risks from AI systems are so hard to manage is that they are inherently probabilistic. That means even small changes to their inputs can produce large changes in their outputs. This makes it wildly difficult to predict and control their behavior.

Here’s where the importance of a “safety culture” comes in. At companies that have one, safety is always the first priority. Everyone in the organization has the unquestioned right to raise concerns about safety, no matter how junior they are or how inconvenient or expensive resolving the problems they raise might be.

If you know exactly what a system will do, you can push it close to the edge. But with a technology as unpredictable as AI, companies must be more cautious, steering away from gray areas. And that level of caution is a product of culture, not formal rules.

Boeing used to have a culture like that. When it was building the 707, for example, chief test pilot “Tex” Johnston recommended a very costly redesign of the plane’s tail and rudder to correct an instability that could occur if a pilot exceeded the maximum bank angle Boeing recommended in the manual. The chief engineer’s response? “We’ll fix it.” And Boeing assumed the entire cost of the change, rather than push it off onto its customers. Decades later, Boeing management’s obsessive focus on cost-cutting eroded that focus on safety so much that critical safety flaws in the 737 Max-8 were ignored until two planes crashed and 346 people died.

The Reuters report provides a window into what a safety culture is not. It includes content from a Meta document titled “GenAI: Content Risk Standards,” which explicitly states that an AI chatbot may “describe a child in terms that evidence their attractiveness” or tell someone with Stage 4 colon cancer that it “is typically treated by poking the stomach with healing quartz crystals.” Meta revised the document after Reuters asked about it, but that’s not the point. Documents don’t create culture. They are a product of culture. And one so comfortable with harming its users in the pursuit of growth or profits makes a dangerous outcome inevitable.

Meta’s chatbots will only be safe if the company commits to reforming its culture. What would that effort look like? One model could be the transformation Anglo American CEO Cynthia Carroll made at the South African mining giant from 2007-2013. When Carroll took over, the company was averaging 44 fatalities every year. By the time she stepped down that number had dropped by 75%. Her change effort is such a gold standard that it is taught at business schools around the world.

Carroll began by shutting down the company’s Rustenberg platinum mine and retraining everyone who worked there. It was the world’s biggest platinum mine and had five fatal accidents in her first months as CEO. The shutdown cost Anglo American $8 million per day; real money, even for a company of its size.

This was an unambiguous signal to the whole company. Talk, after all, is cheap. Any CEO could say “safety is our number one priority” and be ignored by workers who had heard it before. But putting $8 million per day on the table was a costly — and therefore credible — signal. Carroll backed it up by keeping up the pressure for six more years, putting safety at the center of everything from reformulating promotion and compensation standards to relations with unions and the government.

Zuckerberg could do something similar. He should start by freezing the rollout of Meta’s AI chatbots until it is possible to guarantee that any child could use one in total safety. (Most people would agree, I think, that keeping kids from being propositioned by AI is the bare minimum.) And he could put real force behind that by lobbying for strict government regulations on AI chatbots, and steep penalties for violating them. Meta could reorient pay and promotion so that AI safety, not usage or profitability, is the key factor in determining employee rewards.

If you’re struggling to imagine the Meta CEO doing any of this, that’s probably because it would absolutely have near-term costs. In the long run, however, I’d argue Meta would benefit. Think, for example, of the famous case where Johnson & Johnson pulled Tylenol off the shelves when some of the bottles were poisoned. In the short term, it cost the company millions. In the long run, it secured its reputation as a trusted, and even loved, company — a commodity money can’t buy. It’s also worth remembering that companies can’t survive without a social license to operate; in other words, without the public’s acceptance. It’s hard to think of a better way to lose that than a rogue AI that endangers kids.

Then there’s the vicious fight for AI talent. As a top artificial intelligence scientist, wouldn’t you be more likely to choose an employer that will encourage you to prioritize ethics and safety in your work? At this moment when every major AI company is facing scrutiny, taking the lead on safety could actually be Meta’s best path to taking the lead on AI.

BLOOMBERG OPINION

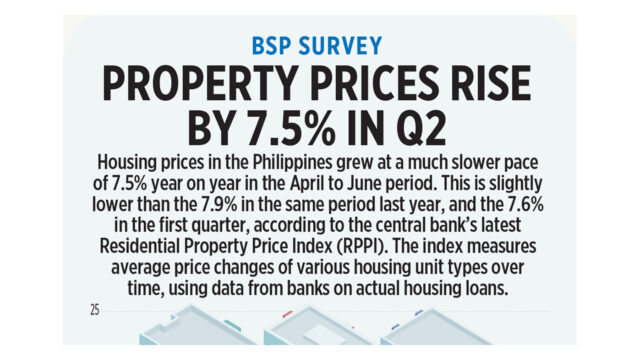

BSP Survey: Property Prices Rise by 7.5% in Q2

Philippine housing prices increased in the second quarter as consumers were less pessimistic about purchasing residential properties, the Bangko Sentral ng Pilipinas (BSP) reported. Read the full story.

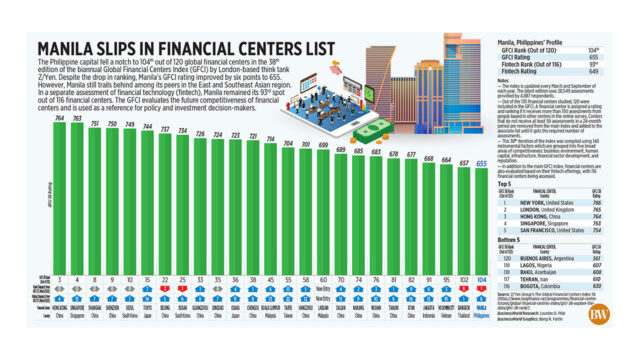

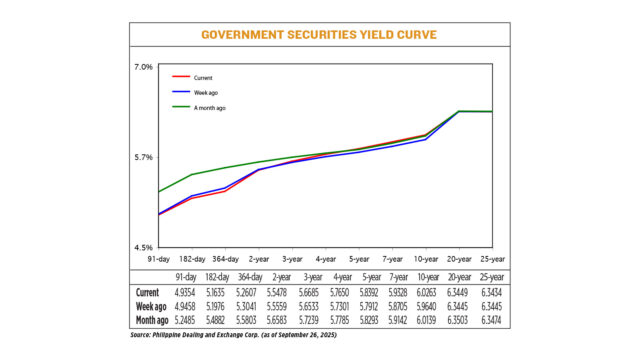

Yields on gov’t debt end mixed amid volatile trade

YIELDS on government securities (GS) traded at the secondary market ended mixed last week amid a rise in US yields and a weakening peso as US Federal Reserve officials signaled caution on future rate cuts.

GS yields, which move opposite to prices, inched up by an average of 1.15 basis points (bps) week on week, based on the PHP Bloomberg Valuation Service Reference Rates as of Sept. 26 published on the Philippine Dealing System’s website.

At the short end of the curve, yields on the 91-, 182-, and 364-day Treasury bills (T-bills) went down by 1.04 bps (to 4.9354%), 3.41 bps (5.1635%), and 4.34 bps (5.2607%), respectively.

Meanwhile, at the belly, rates mostly went up. Yields on the three-, four-, five-, and seven-year Treasury bonds (T-bonds) rose by 1.52 bps (5.6685%), 3.49 bps (5.7650%), 4.8 bps (5.8392%), and 6.23 bps (5.9328%), respectively. On the other hand, the two-year paper saw its rate go down by 0.81 bp to 5.5478%.

Lastly, at the long end of the curve, the 10- and 20-year notes climbed by 6.23 bps and 0.04 bp to yield 6.0263% and 6.3449%, respectively. Meanwhile, the rate of the 25-year T-bond inched down by 0.11 bp to 6.3434%.

GS volume traded declined to P34.38 billion on Friday from P43.82 billion a week prior.

Traders said that yields at the short end mostly went down to reflect bets on the Bangko Sentral ng Pilipinas’ (BSP) policy path.

“The yield curve steepened week on week as investors focused demand at the short end, reflecting sustained conviction in the BSP’s easing cycle,” the first bond trader in a Viber message.

“[Fed Chair Jerome H.] Powell’s remarks about balancing inflation and labor market risks reinforced the ‘higher-for-longer’ stance. This means that the front end was relatively anchored given expectations that the BSP will hold rates steady for now,” the second trader said.

Last week, BSP Governor Eli M. Remolona, Jr. said they could lower borrowing costs further as early as October if the economy shows signs of losing momentum.

The Monetary Board last month slashed benchmark rates by 25 bps for a third straight meeting to bring the policy rate to 5%. This brought cumulative cuts since August 2024 to 150 bps.

Mr. Remolona has described the policy setting as a “Goldilocks rate,” balancing inflation and growth. “We’re in the Goldilocks zone, I would say,” he said. “So, if the forecast stays… we’re going to stay where we are in terms of the policy rate. There may be small adjustments — a pause or an ease — but more or less, we’re going to be at the same range.”

He said 25-bp reductions at their October and December meetings are “possible but not likely.”

Meanwhile, the Fed this month lowered its target rate by 25 bps to the 4%-4.25% range, which was its first cut since December. This brought its total reductions since September 2024 to 125 bps. Its “dot plot” showed projections of two more rate cuts this year.

Mr. Powell said on Tuesday the central bank needed to continue balancing the competing risks of high inflation and a weakening job market in coming interest rate decisions, even as his colleagues staked out arguments on both sides of the policy divide, Reuters reported.

“Meanwhile, the belly to the long end followed the rise in US yields, adding upward pressure and reinforcing the market’s steepening bias,” the first trader said. “We also saw bonds taking cues from US Treasuries, where yields climbed after stronger-than-expected data on home sales, durable goods, and GDP (gross domestic product). The numbers pointed to resilience in the US economy and led markets to rethink the pacing of US Fed rate cuts.”

The result of the Bureau of the Treasury’s dual-tenor bond auction last week came within market expectations and supported the belly of the curve at the start of the week, but yields eventually climbed due to the peso’s weakness, the trader added.

“The risk-off tone from geopolitical concerns and cautious Fed speak weighed on emerging-market assets. The dollar-peso exchange rate hovering above P58 also kept offshore accounts defensive, supporting demand for shorter-dated government securities,” the second trader said.

On Friday, the peso closed unchanged at P58.10 per dollar due to the Fed’s cautious signals and as domestic concerns weighed on market sentiment.

“Attention was on the Bureau of the Treasury’s (BTr) fourth-quarter borrowing plan. The program came in lighter than the previous quarter, which was already expected. While this setup was bond-friendly, sentiment was tempered by corruption headlines onshore that pressured the peso and may have also weighed on appetite for government bonds,” the first trader added.

The government is looking to borrow P437 billion from the domestic market in the fourth quarter, the BTr said in a notice last week. Broken down, it aims to raise P262 billion through T-bills and P175 billion from Treasury bonds T-bonds.

For this week, the trader said GS yields may continue to track the movement of US Treasuries.

“Any sell-offs in government bonds are likely to be shallow, as the outlook still looks constructive given expectations of further BSP cuts and the lighter issuance program. At the same time, political noise and peso swings are things to watch. We also see the bond curve likely continuing to steepen in the near term,” the first trader said.

The second trader said bond yields may move sideways to up due to the Fed’s “higher-for-longer” policy stance and as market players position before the release of September Philippine inflation data next week.

“Investors should monitor the peso’s performance versus the US dollar as further weakness could add pressure on long end yields,” the second trader said. — Heather Caitlin P. Mañago

The Hyundai Venue returns

THE MOST RECENT staging of the Hyundai Mobility Experience was held at the Bonifacio High Street. Aside from the growing hybrid lineup of the South Korean car maker comprised of the Kona Hybrid, Elantra Hybrid, Tucson Hybrid, Palisade Hybrid, and Santa Fe Hybrid, Hyundai Motor Philippines, Inc. (HMPH) also displayed the brand’s flagship electric vehicles, the all-new Ioniq 9 and new Ioniq 5, and the Creta N Line.

But, perhaps more significantly, customers got to see the return of the Hyundai Venue, an entry-level SUV based on Hyundai’s proven global platform. In a release, HMPH said that the Venue “is built for versatility, to match large-scale competitive markets such as the Philippines.” It gets a “premium look,” underpinned by elements such as LED lenticular rear taillights, and headlights equipped with static bending to illuminate the road ahead with every turn of the vehicle.

The Venue’s top-of-the-line variant comes with a keyless push-to-start function for a more smooth and convenient engine start. On the dashboard is an eight-inch display audio system with Wireless Apple CarPlay and Android Auto. In addition, a 4.2-inch digital instrument cluster provides essential driving information.

The Hyundai Venue is powered by a 1.6-liter engine mated to a six-speed automatic transmission “offering smooth and responsive performance.” A 1.6-liter six-speed manual transmission variant is also available. The model is priced as follows: Venue 1.6 GL 6MT (P778,000), Venue 1.6 GL 6AT (P898,000), and Venue 1.6 GLS 6AT (P998,000).

Customers can avail of cash discounts of up to P46,000 through Hyundai Finance, when purchases are made through the brand’s bank partners: EastWest, BDO, and BPI. Additionally, a down payment of as low as P28,000 can be made alongside a monthly amortization as low as P15,000 through the banks’ financing plans.

US will distribute aid to farmers from tariff revenue

WASHINGTON — US President Donald J. Trump said the US will use tariff proceeds to fund aid to farmers.

“We’re going to take some of that tariff money and give it to our farmers,” Mr. Trump said at the White House.

The US farm economy is slumping this year due to low crop prices and trade disputes. Republican lawmakers have warned that farmers are facing significant losses and have urged the administration to issue aid by the end of the year.

Agriculture Secretary Brooke Rollins has said that the administration is weighing an aid program modeled after the approach taken by the previous Trump administration, when farmers were given billions to offset losses from a trade war with China.

Farmers are “for a little while going to be hurt, until it kicks in, the tariffs kick in to their benefit,” Mr. Trump said.

“Ultimately, the farmers are going to be making a fortune,” he said. — Reuters

Aboitiz group says foreign firms drive occupancy at Batangas’ LIMA Tower One

ABOITIZ INFRACAPITAL, Inc. (AIC), the infrastructure subsidiary of the Aboitiz group, said over 12,000 square meters (sq.m.) of office space at LIMA Tower One in Batangas have been leased, citing strong demand from foreign companies seeking to expand in the country.

“A lot of interest is coming from companies that are based internationally and are looking for a world-class office building in the province that’s outside the CBDs (central business districts),” Monica L. Trajano, vice-president for Commercial Strategy at AIC Economic Estates, said on the sidelines of the Arangkada Forum last week.

LIMA Tower One, an 11-storey premium office building with flexible, high-performance spaces, is the first of seven towers at the heart of LIMA Estate’s Biz Hub in Batangas.

It has secured green building certifications such as WELL and BERDE (Building for Ecologically Responsive Design Excellence). The office building is 50% occupied.

Over the weekend, electronic commerce fashion brand REVOLVE opened its office in LIMA Tower One, taking up quarter of a floor.

Aboitiz Power Corp. and JERA Co., Inc. (JERA) have also set up a training facility at LIMA Tower One.

“That pretty much is an exchange of talent between Japan and the Philippines in terms of operating the power plants that Aboitiz Power and JERA own and operate,” Ms. Trajano said. “So, they already have had their first set of students come in.”

Ms. Trajano expressed optimism about demand for LIMA’s office towers, citing the growing return to office, as well as nearby residential and commercial developments.

“For anybody that locates within our estates, there’s that connectivity that we’re providing there, we’re developing our infrastructure to be able to support that, and we’re also integrating residential [developments],” she said.

“We build residential communities that are within or pertinent to our estates.”

LIMA Estate is a 1,000-hectare (ha) mixed-use development owned by the Aboitiz group. It hosts about 4,000 households and is registered under the Philippine Economic Zone Authority. — Beatriz Marie D. Cruz