National leadership and our collective future

(In view of the recent passing of former president Fidel V. Ramos, Introspective is reprinting a tribute column from Jan. 11, 2010.)

Our country is at a crossroad. Results of the May elections, an orderly transfer of power, and no less, the person who will occupy the country’s CEO position, will define the course of our collective future for at least the next six years.

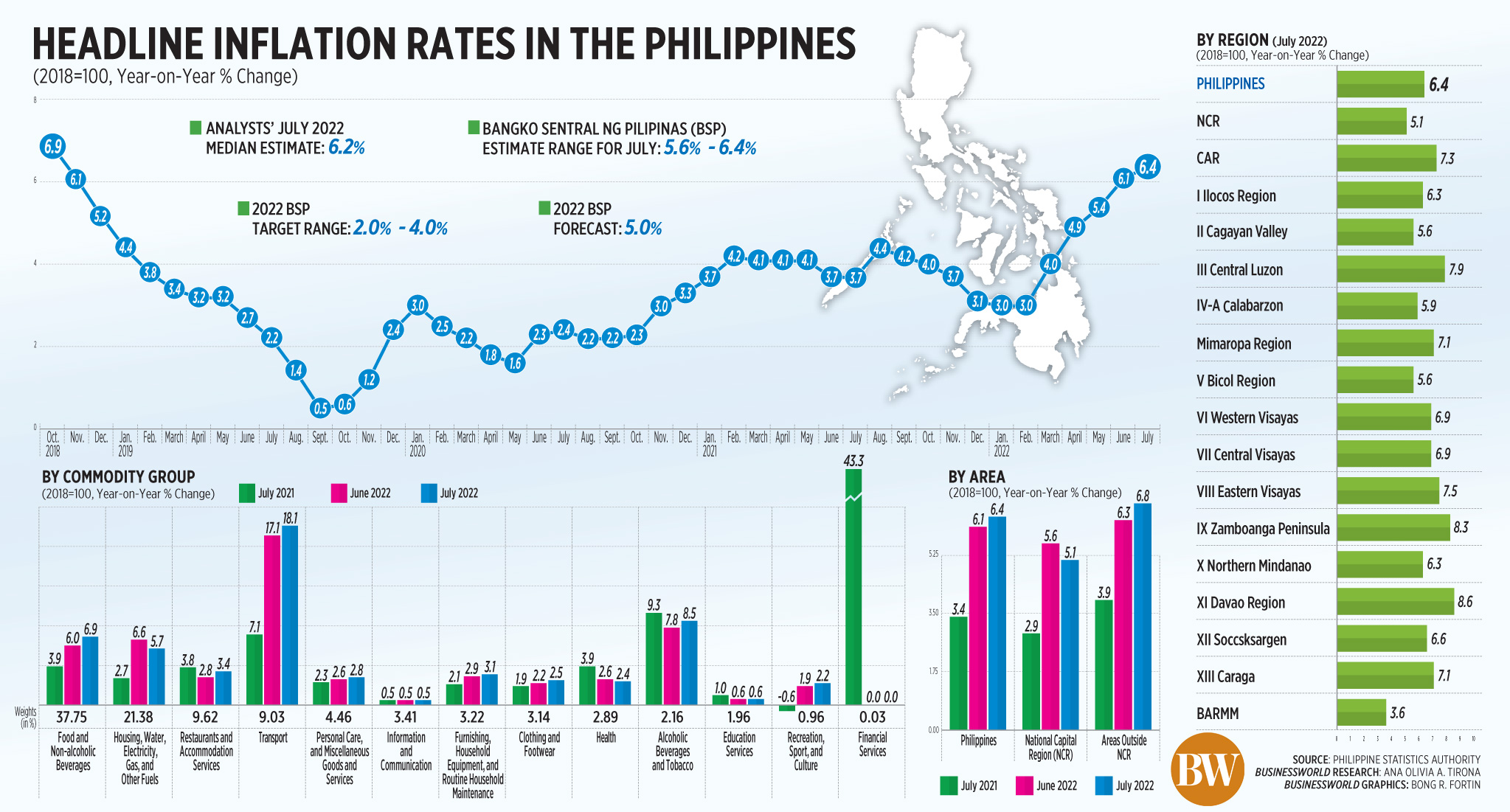

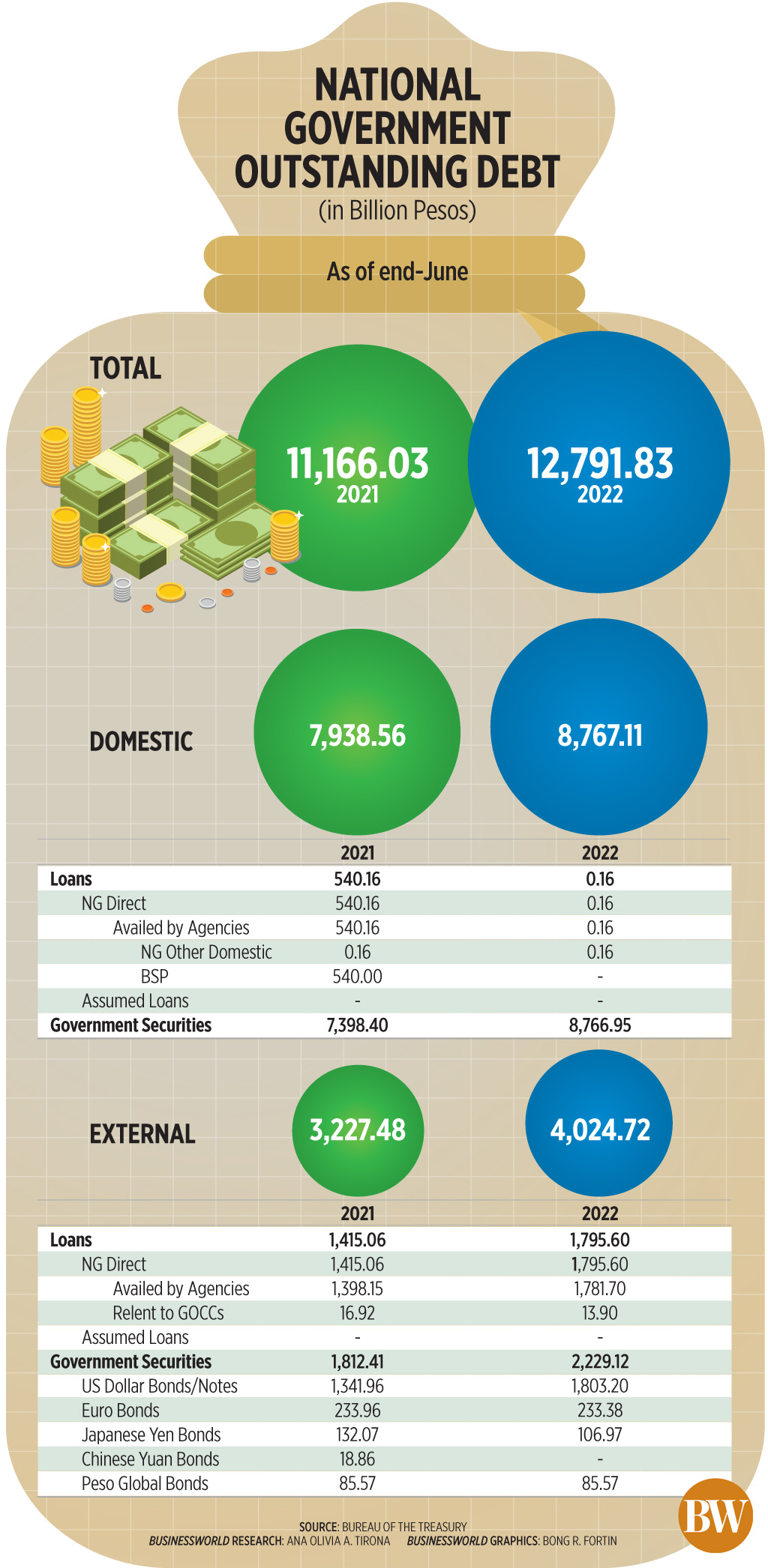

There have been worrisome declines in objective indicators of global competitiveness, governance and transparency, economic freedom, and credit rating since 1998 (see World Economic Forum: Global Competitiveness Index, www.weforum.org;Transparency International: Corruption Perceptions Index, www.transparency.org; The Heritage Foundation: Index of Economic Freedom, www.heritage.org; and Standard & Poor’s, www.standardandpoors.com). While it may be argued that there are factors that contributed to this decline beyond the control of the national leadership, say, economic tsunamis like the Asian and global financial crises, such consistent RELATIVE declines over such an extended period compared to peers outside and within our neighborhood, cannot but be attributed to leadership failure — if not to malign, then benign, neglect.

It has not always been this way, and more importantly, needs not be. For example, can there be good reason for us to be ranked 144 out of 183 in a World Bank report released two weeks ago on ease of doing business, even below Pakistan, Bangladesh, the West Bank, and Gaza, and down there with troubled countries Zimbabwe and Afghanistan? Or worse, continue on a downward descent?

Assuredly none. I earlier wrote about a study that my LBT colleague and I did for the World Bank Growth Commission (chaired by Nobel Prize winner Michael Spence) on the political economy of reform during the Ramos years (https://openknowledge.worldbank.org/handle/10986/28020).

In it, we looked at what it took the Ramos administration to successfully push for reform (in telecom demonopolization, water privatization, and oil deregulation) working against strong special interests (e.g., from affected businessmen, labor constituencies, political ideologues) and using instruments, both formal and informal, at the disposal of the presidency in an environment of weak, lethargic, or sometimes obstructive/compromised institutions, including an underdeveloped and poorly motivated bureaucracy.

It finds, no surprise, that leadership matters crucially.

The personal qualities and experience of the leader for the most difficult job in the country matter much. His ability to think strategically; the clarity of this national vision and its articulation; his ability to attract, inspire, manage, and forge cohesion in a first-class team; his ability to build coalitions and political consensus and educate the public and get their support to overcome obstacles and persevere; and other leadership attributes and management skills come out as elements for success in pushing reforms in a difficult terrain.

Mr. Ramos has had preparation for leadership at an early age. A West Point graduate with degrees in Engineering and an MBA, he honed his executive skills over decades within the military and civilian bureaucracies and his political skills in dealing with politicians and the public in areas of peacekeeping and development. As former Finance Secretary Roberto de Ocampo quipped explaining his successes upon receiving the Finance Minister award from Euromoney in 1996, “A finance secretary has many key decisions to make; not least of them, which president to serve.”

The case studies as well showed the importance of timing. A new president has six years to make a difference. He and his team cannot solve everything in one go — indeed some problems may be so intractable, or be met with overwhelming political opposition, that if he started on them first, he would have sown the seeds, and demonstrably shown, abject failure early on, in what may become the signature of his administration.

He needs to hit the ground running, and score early, and impressive, victories that build confidence and get the public fully behind him for more difficult items down the road of his reform agenda. During the Ramos administration, the immediate problem, and opportunity, was getting the economy on track after debilitating outages that saw GDP contract by 0.6% — to put back the lights both literally and in terms of business confidence. This was achieved in a record time of 15 months, thanks to Ramos’ no-nonsense leadership and empowerment of known achievers: Energy Secretary Del Lazaro, recruited from a distinguished career in the private and briefly in the public sector, and NPC President Sonny Viray, a PhD in Electrical Engineering and dean of the UP College of Engineering.

Such a victory set the stage for reviving investments and rallying public support behind other reforms to improve global competitiveness, including bringing to the next stage, the trade and investment liberalization started earlier, deregulation, privatization/public-private partnerships, fiscal consolidation, that has contributed importantly to the resilience of the Philippine economy even during the Asian crisis and the more recent global financial tsunami. The improvements in objective indicators of competitiveness and governance/transparency, economic freedom, and credit rating since 1992 are a matter of record as have been their deterioration since 1998.

The take-away from all this is not that our country is doomed to take one step forward, and then two steps backward, but that it is possible to reverse the decline. For our next CEO, improving fiscal performance, side by side with a well thought-out and executed infrastructure and social spending program, including through transparent public-private partnerships, would be a good place to start. Our collective future depends on it.

Romeo L. Bernardo was finance undersecretary from 1990-96. He is a trustee/director of the Foundation for Economic Freedom, Management Association of the Philippines, and FINEX Foundation. He is Philippines principal adviser to Globalsource Partners