By Lourdes O. Pilar, Researcher

YIELDS on government securities (GS) mostly rose last week after the Bangko Sentral ng Pilipinas (BSP) held benchmark rates unchanged and as faster US inflation supported expectations of slower easing by the US Federal Reserve.

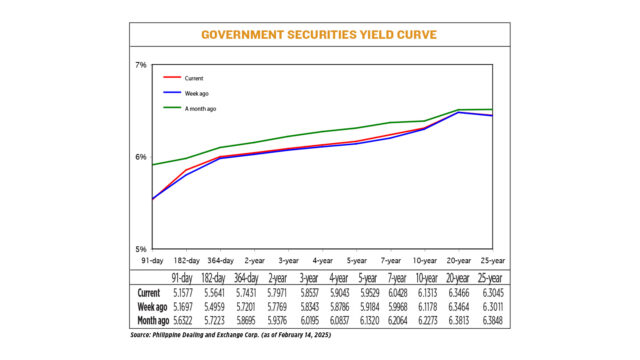

GS yields at the secondary market went up by 2.2 basis points (bps) on average week on week, based on the PHP Bloomberg Valuation Service Reference Rates as of Feb. 14 published on the Philippine Dealing System’s website.

Rates of all benchmark tenors rose week on week except for the 91-day Treasury bill (T-bill), which dropped by 1.2 bps to fetch 5.1577%.

At the short end of the curve, yields on the 182- and 364-day T-bills went up by 6.82 bps and 2.30 bps to 5.5641% and 5.7431%, respectively.

At the belly, rates of the two-, three-, four-, five-, and seven-year Treasury bonds (T-bond) increased by 2.02 bps (to 5.7971%), 1.94 bps (5.8537%), 2.57 bps (5.9043%), 3.45 bps (5 5.9529%), and 4.60 bps (6.0428%), respectively.

At the long end, yields on the 10-, 20-, and 25-year T-bonds rose by 1.35 bps, 0.02 bp, and 0.34 bp, respectively, to 6.1313%, 6.3466%, and 6.3045%.

Total GS volume traded reached P40.92 billion on Friday, higher than the P38.39 billion seen on Feb. 7.

Government securities were well supported early last week as market participants positioned for a widely expected rate cut by the BSP, Alessandra P. Araullo, chief investment officer at ATRAM Trust Corp. said in a Viber message.

“However, the market’s bullish sentiment was challenged by Federal Reserve Chair Jerome H. Powell’s bearish commentary and the stronger-than-expected US CPI (consumer price index) data for January,” Ms. Araullo said.

“The trading week was marked by the BSP’s surprise pause as it kept policy rates unchanged at 5.75%, catching the market off guard and pushing yields higher by 5 to 12 bps. By Friday, bonds pared some losses as the local bond market tracked the rally in US Treasuries and as investors took the opportunity to buy back at favorable levels. Local bond yields ended the volatile trading week just 2 to 5 bps higher week on week,” she said.

Dino Angelo C. Aquino, vice-president and head of fixed income at Security Bank Corp., likewise said in an e-mail that GS yields ended the week marginally higher following the BSP’s “unexpected” hold and data showing faster US consumer inflation in January.

“US yields were also marginally higher week on week in reaction to their higher CPI, which further dampened the sentiment locally,” Mr. Aquino said.

A sell-off following the BSP’s policy decision on Thursday caused yields to rise sharply before eventually correcting lower, he said.

“Most market players were expecting a cut — hence they reacted quickly upon the unexpected move by the BSP,” Mr. Aquino added. “Overall, despite the BSP keeping benchmark rates unchanged last Thursday, I personally view it as a “dovish hold” as an April move remains on the table. The BSP also echoed that the RRR (reserve requirement ratio) cut may come sooner than they initially planned, which would impact bonds in a positive way.”

The BSP’s policy-setting Monetary Board on Thursday unexpectedly held interest rates steady as global uncertainties threaten the outlook for inflation and growth.

At its first policy meeting of the year, the Monetary Board left the target reverse repurchase rate unchanged at 5.75%.

This marks the BSP’s first pause following three consecutive 25-bp cuts since it began its easing cycle in August 2024.

The decision took the market by surprise as 19 out of 20 analysts polled by BusinessWorld had anticipated a fourth straight 25-bp cut at Thursday’s meeting, and just one analyst expected the BSP to keep rates steady.

Meanwhile, US consumer prices increased by the most in nearly 1-1/2 years in January, with Americans facing higher costs for a range of goods and services, reinforcing the Federal Reserve’s message that it was in no rush to resume cutting interest rates amid growing uncertainty over the economy, Reuters reported.

The consumer price index jumped 0.5% last month, the biggest gain since August 2023, after rising 0.4% in December, the Labor Department’s Bureau of Labor Statistics (BLS) said.

In the 12 months through January, the CPI increased 3%. That was the biggest gain since June 2024 and followed a 2.9% advance in December. Economists polled by Reuters had forecast the CPI gaining 0.3% and rising 2.9% year on year.

For this week, Mr. Aquino said the local GS market may track US Treasury yield movements and the Bureau of the Treasury’s auction of reissued 10-year bonds for leads.

“Overall, yields remain range-bound, and sell-offs would continue to remain shallow as the market remains awash with excess liquidity,” he said.

Ms. Araullo said debt yields may rise further on higher inflation expectations.

“The market will now shift its focus to the 10-year auction, wherein awarded yields may clear at the higher-end of indications given the latest pronouncements by the BSP. Fed guidance and tariff headlines will also continue to impact future trading sessions,” she said. — with Reuters