BSP to hike rates by 50 bps — poll

By Keisha B. Ta-asan

THE BANGKO SENTRAL ng Pilipinas (BSP) is likely to continue its rate hike cycle on Thursday, with several analysts forecasting a 50-basis-point (bp) increase as the US Federal Reserve is also expected to further tighten policy this week.

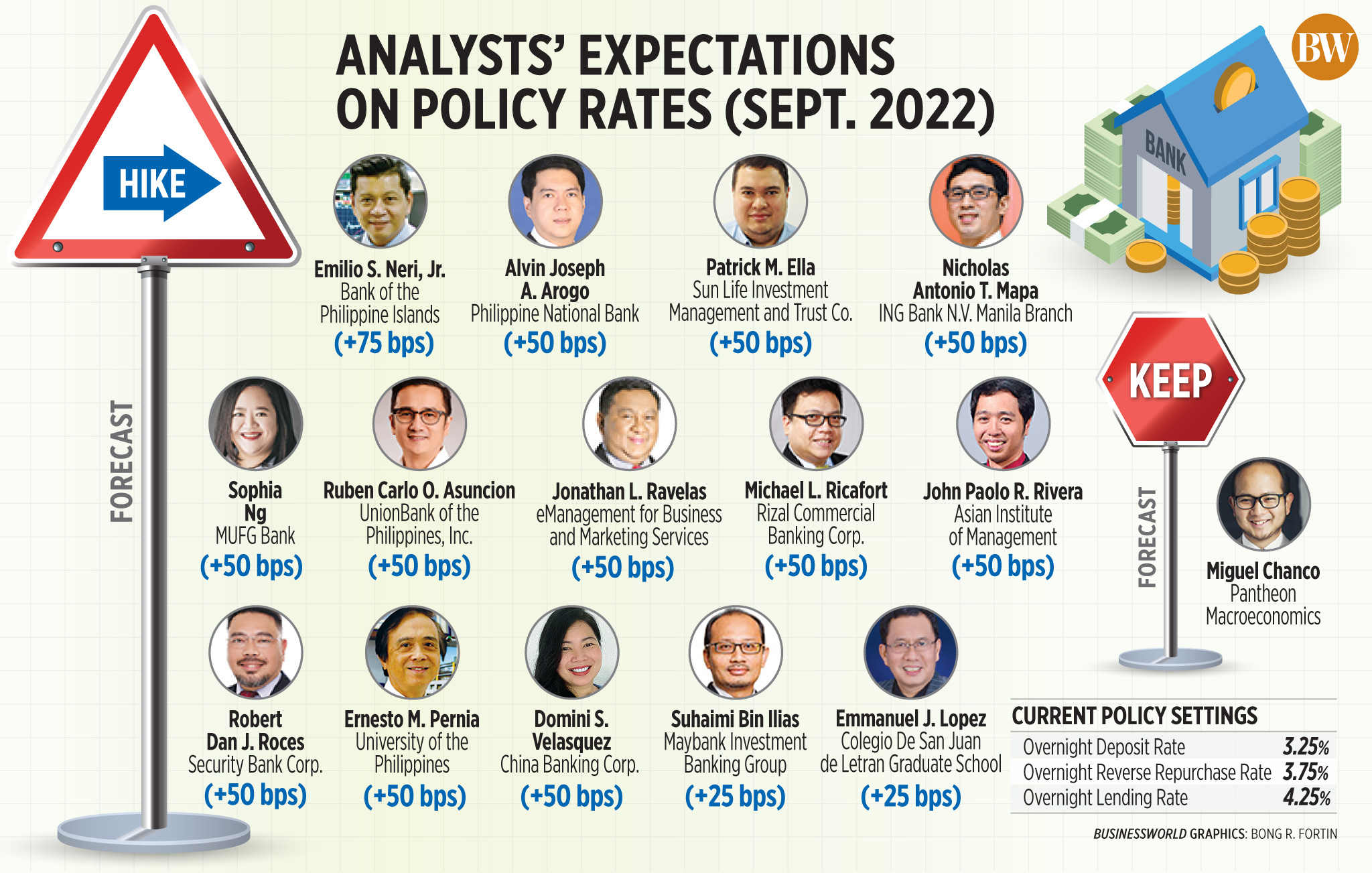

A BusinessWorld poll last week showed 14 out of 15 analysts expect the Monetary Board (MB) to raise its benchmark interest rate at its Sept. 22 meeting.

Eleven analysts believe the central bank will deliver a hike of 50 bps, while two analysts see a 25-bp increase. One analyst expects a 75-bp hike, while another sees the BSP keeping rates unchanged.

“Inflation and peso weakness will remain the key consideration in the upcoming Monetary Board meeting, and we expect it to raise interest rates by 50 bps to bring the RRP (reverse repurchase rate) to 4.25%,” Security Bank Corp. Chief Economist Robert Dan J. Roces said in an e-mail.

Latest data from the Philippine Statistics Authority (PSA) showed the consumer price index (CPI) climbed 6.3% year on year in August, from the nearly four-year high of 6.4% in July. It remained significantly higher than the 4.4% seen in August 2021.

August marked the fifth consecutive month that inflation exceeded the BSP’s 2-4% target range for the year.

“Inflation may have eased slightly to 6.3% year on year but core CPI accelerated, and the (Philippine peso) fell to new record lows against the (US dollar) in recent weeks which would raise imported inflationary pressures,” MUFG Bank currency analyst Sophia Ng said in an e-mail.

The local unit closed at a new all-time low of P57.43 on Friday, dropping by 27 centavos from its P57.16 finish on Thursday, data from the Bankers Association of the Philippines showed.

For the year so far, the peso has weakened by P6.43 or 12.6% from its Dec. 31, 2021 close of P51 per dollar.

“Further, the (Federal Open Market Committee) is likely to signal a more aggressive pace of tightening in its updated dot plot at the September meeting. A more aggressive Fed means the BSP may have to hike more. Hence, a 50-bp hike at the upcoming meeting seems to be a more likely scenario rather than a modest 25-bp increase,” Ms. Ng added.

The US Federal Reserve is expected to announce a third consecutive 75-bp hike at its meeting this week.

Bank of the Philippine Islands (BPI) Lead Economist Emilio S. Neri, Jr. anticipates a 75-bp hike from the BSP this week.

“We are also revising our end 2022 RRP forecast from 4.25% to 5.25% on stubbornly elevated US core inflation,” Mr. Neri said.

As US inflation unexpectedly quickened to 8.3% year on year in August, market players are now expecting another large rate increase from the US central bank at its Sept. 20-21 meeting.

“The BSP will likely raise the RRP rate by 50 bps assuming the FOMC raises the Fed funds rate by 75 bps,” Philippine National Bank economist Alvin Joseph A. Arogo said in an e-mail.

The FOMC raised the target range for the federal funds rate by 75 bps in July. The US central bank’s overnight interest rate is now at a level between 2.25% and 2.5%.

“As the peso breached its all-time low, we expect BSP to be more mindful of further depreciation pressures as a cheap peso will add on to inflation for the rest of the year and in 2023,” China Banking Corp. Chief Economist Domini S. Velasquez said in an e-mail.

“The impact is especially more pronounced as the government is stepping up importation of essential goods to address domestic shortages,” Ms. Velasquez said.

The Sugar Regulatory Administration (SRA) issued Sugar Order (SO) No. 2 which authorized the import of 150,000 metric tons (MT) of refined sugar for the current crop year “to ensure domestic supply and manage sugar prices.”

Earlier this month as well, President Ferdinand R. Marcos, Jr. said he discussed the possibility of securing coal and fertilizer supply from Indonesia during his meeting with President Joko Widodo.

“Growth momentum, though slowing, remains strong and as such will be able to absorb the hike. This move will also put a premium over the expected 75-bp hike by the US Fed before the MB meeting,” Mr. Roces said.

“The economy is in full recovery and can handle tightening and we expect BSP to do so, taking the policy rate to 4.75% by yearend with follow-up rate hikes at the last two meetings for the year,” ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said in an e-mail.

The Philippine economy expanded by 7.4% in the second quarter as rising inflation weighed on consumer spending, based on preliminary data released by the PSA. To date, gross domestic product (GDP) grew by 7.8%, slightly above the 6.5-7.5% government target.

“However, to support the relatively smooth flow of the economy and investment including employment, the BSP is expected to keep policy rates to a minimum,” Colegio de San Juan de Letran Graduate School Associate Professor Emmanuel J. Lopez said, adding that he expects the BSP to raise by 25 bps on Thursday.

“We are looking at a 25-bp hike to 4% as BSP eases the rate hike quantum after the 75-bp hike in July and 50-bp hike in Aug. At this juncture we expect BSP rate to settle at 4%,” Maybank Investment Bank Chief Economist Suhaimi Bin Ilias said.

The Monetary Board has increased borrowing costs by 175 bps so far this year, bringing the overnight repurchase rate to 3.75%.

“The risk to our view is BSP decides to be more hawkish in response to US Fed rate hike which is expected to be another 75-bp hike at the Sept. 20-21 FOMC meeting, mainly to stabilize Philippines peso vs US dollar,” Mr. Ilias added.

After Thursday, there are two more Monetary Board meetings scheduled this year — Nov. 11, and Dec. 15.

“It just so happens that we have a rather ‘cute’ and specific term in our national language for what could be roughly translated to English as ‘retail culture,’” he added.

“It just so happens that we have a rather ‘cute’ and specific term in our national language for what could be roughly translated to English as ‘retail culture,’” he added.