Topline secures final SEC approval for April PSE debut

CEBU-BASED fuel retailer Top Line Business Development Corp. (Topline) has secured approval from the Securities and Exchange Commission (SEC) for its planned initial public offering (IPO).

“Our listing is a key step to our continued expansion as part of our vertical integration strategy to sustain our rapid capital appreciation,” Topline Chairman, President, and Chief Executive Officer Eugene Erik C. Laparasan Lim said in a media release on Monday.

The company said it obtained final regulatory approval from the SEC for the public sale of about 22% of its common shares, or 2.15 billion primary common shares, with an over-allotment option of up to 218.84 million secondary common shares.

Last month, the Philippine Stock Exchange (PSE) issued a notice of approval allowing the company to list its common shares on the PSE main board.

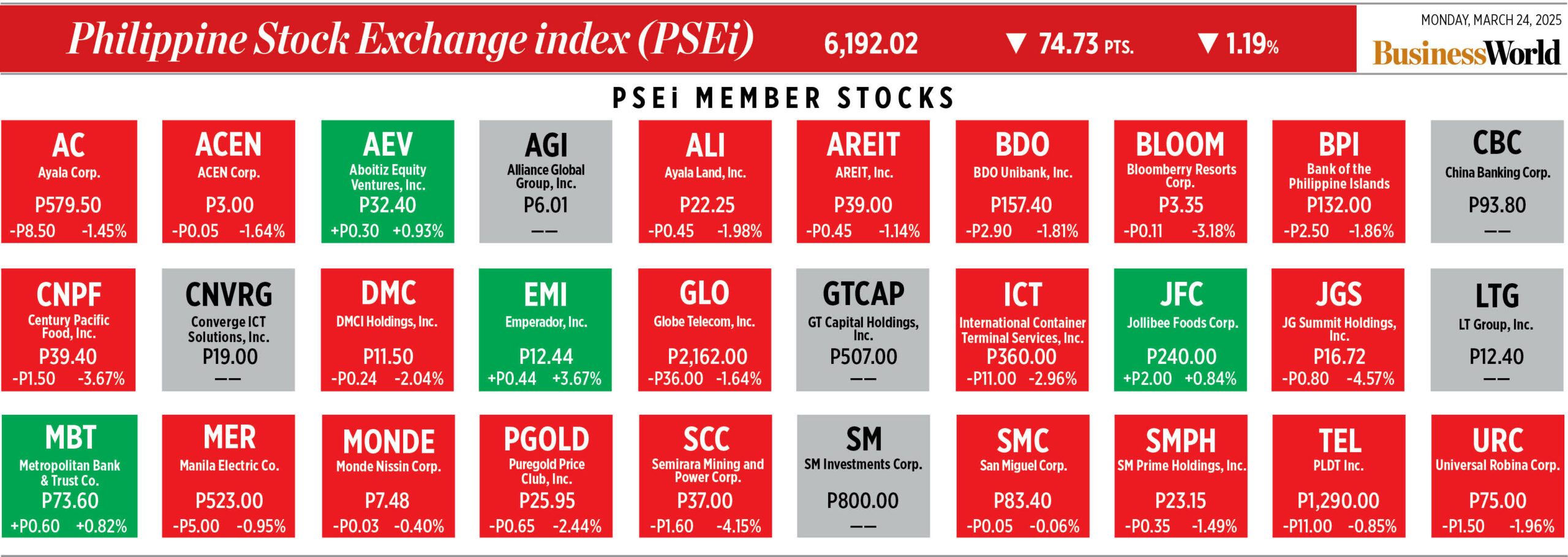

The IPO offer period will run from March 24 to 31, 2025. The company’s shares will be traded under the symbol “TOP” starting April 8.

The final offer price of 31 centavos per share was determined through a book-building process involving international and Philippine-based institutional investors, the company said.

Topline has designated Investment & Capital Corp. of the Philippines as the issue manager, joint lead underwriter, and joint bookrunner for the IPO, while PNB Capital and Investment Corp. will serve as the joint lead underwriter and joint bookrunner.

“We believe in Topline’s strong growth potential and its ability to deliver on its commitments. Throughout the IPO process, we have seen firsthand the company’s drive, passion, and strategic vision. With strong leadership at the helm, we are excited to see Top Line take this significant step toward its listing on the PSE,” ICCP Senior Managing Director Jesus Mariano P. Ocampo said.

Topline expects to raise about P624.6 million in net IPO proceeds, adding that it remains committed to its expansion plans, with P300 million allocated for the construction of 20 service stations and P180 million earmarked for fuel tanker acquisitions.

Due to the adjustment in its offer price, the company said it has also revised the allocation of IPO net proceeds, setting aside P134.6 million for working capital and P10 million for corporate purposes.

“We are fully committed to our IPO strategy, which focuses on integration, importation, and expansion to sustain our strong profit margins. This is why we are maintaining our allocation as initially planned for the construction of service stations and the acquisition of additional fuel tankers,” Mr. Lim said. — Ashley Erika O. Jose