In many family businesses, succession is treated as a checklist: draft legal documents, name a successor, divide the shares. But beneath these formalities lies a far more fragile foundation — the relationships that hold the family together. Succession, at its core, is not just a business decision. It’s deeply personal.

And while strategy can be written on paper, family harmony determines whether that plan will stand — or shatter under pressure. In the Philippine setting, where family is both a source of strength and a web of complexities, unity is just as critical as capability.

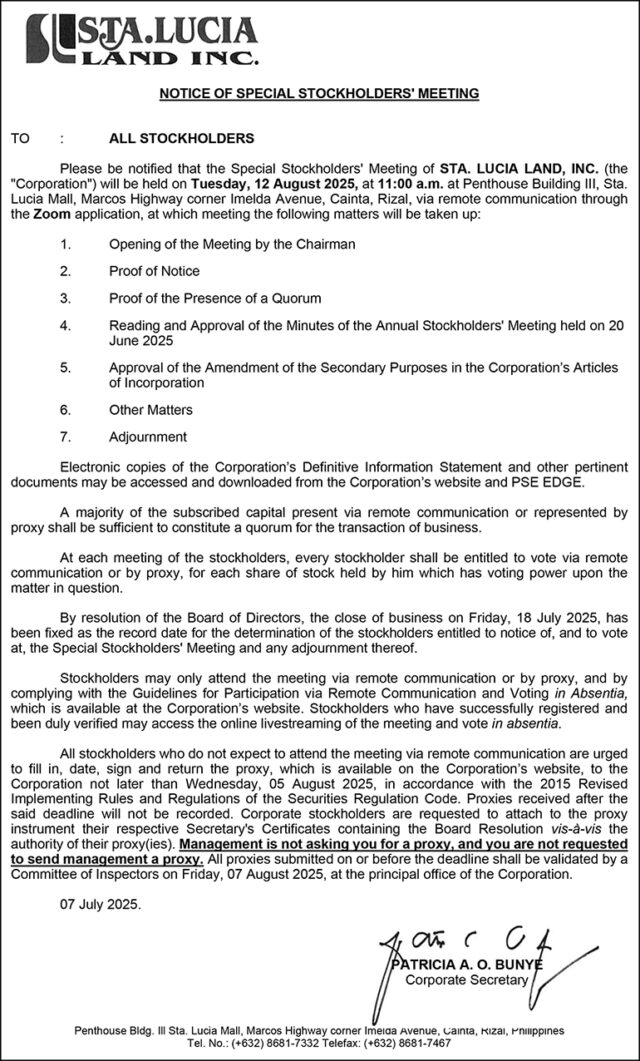

Family-owned enterprises make up nearly 80% of all businesses in the Philippines, forming a vital backbone of the economy, according to studies from institutions such as De La Salle University and the Center for Business and Economic Research. Yet many of these businesses falter at the point of succession — often due to emotional reluctance, lack of planning, or deeply rooted cultural dynamics.

Research consistently highlights a recurring pattern: succession is postponed until a crisis strikes. As founders age and competition intensifies, the decisions made today about governance and leadership grooming will define the next chapter of Philippine entrepreneurship.

COMMON PITFALLS IN FAMILY SUCCESSION

Despite good intentions, many succession efforts in Filipino family businesses fall apart due to a lack of understanding the real obstacles:

1. Emotional Reluctance from Founders – Letting go can feel like surrendering identity or purpose. Without clear milestones, successors remain in limbo.

2. Assuming the Eldest should Lead – Leadership should be based on capability, not seniority. Defaulting to age can create resentment or power struggles.

3. Equating Ownership with Management – Heirs may own shares but not be suited to lead. Leadership and ownership must be distinct.

4. No Governance Structures – Without shareholder agreements or family constitutions, personal disputes spill into business decisions.

5. Avoiding Hard Conversations – Succession is emotional, but silence creates risk. Clarity prevents deeper fractures.

In addition to these pitfalls, here are five warning signs that a family business may not be ready for succession:

1. There is no clear timeline for the leadership transition.

2. A successor has not been identified or trained.

3. Governance documents, such as a family constitution or shareholder agreement, are missing.

4. Difficult conversations are continuously avoided.

5. Roles between ownership and leadership remain undefined.

WHAT SUCCESSION SHOULD LOOK LIKE

Succession doesn’t happen overnight — but it must happen intentionally. A strong plan includes:

1. Open Dialogue – Begin with conversations about who is best prepared to lead, what compensation is given to the predecessor, and how the family will support the process.

2. A Family Constitution – A guiding document that lays out values, leadership criteria, conflict resolution, and expectations.

3. Role Clarity – Distinguish between shareholders (owners), executives (managers), and board members (governors).

4. Leadership Development – Successors need mentoring, cross-functional exposure, and formal training to grow into the role. Families should treat leadership like any other discipline — worthy of investment, feedback, and long-term support.

5. Legal and Tax Planning – Shareholder agreements, estate plans, and trusts should be in place to prevent legal issues. It’s not just about protecting wealth, it’s about protecting relationships.

6. Periodic Review – Update the plan every few years or when major life or business events occur. A static plan can become irrelevant quickly in a fast-changing environment.

It’s also important to clarify the difference between succession and inheritance. In many Filipino families, these terms are used interchangeably — but they are not the same. Succession refers to the planned transition of leadership, focusing on choosing and preparing someone to manage the business. Inheritance, on the other hand, is the transfer of ownership or wealth, usually after death. It deals with distribution, not direction.

Confusing these two concepts can cause instability. The most capable leader may not be the largest heir, and not every heir is meant to lead. Recognizing this distinction allows families to preserve both business continuity and family relationships.

A TIME FOR COURAGE, NOT JUST PLANNING

Succession in a Filipino family business is never just a handover — it’s a handoff of vision, values, and trust. Too often, families wait until succession is forced on them by illness or crisis. But the most resilient transitions are those planned early, with clarity and respect.

Proactive succession is an act of stewardship — one that acknowledges that the business is bigger than any one person. It’s a sign of maturity in leadership, and of love in the family. Taking action now doesn’t just secure the company’s future — it strengthens the bonds between generations.

Succession is not only about leadership — it is about legacy. And that legacy will either be protected through proactive planning, or put at risk by silence.

The next generation deserves direction. Founders deserve peace of mind. And the business deserves continuity.

Ask the hard questions. Make room for open dialogue. Engage trusted professionals. Don’t wait.

“Family legacy is not what you leave behind, but what you build to last.”

Sarah S. Songalia is a member of the Management Association of the Philippines’s NextGen Committee. She is the founder of Saavedra Songalia & Associates, a certified public accountant and a transformation consultant who is an advocate for building lasting legacies through clarity, structure, and heart.

map@map.org.ph

email@sarahsongalia.com