INVESTORS largely betting against a European Central Bank (ECB) interest rate increase next week are “maybe” underestimating the likelihood of it happening, according to Governing Council member Klaas Knot.

While a slowdown in the euro zone’s 20-nation economy is sure to damp demand, updated inflation projections won’t differ much from the last round in June, the Dutch central bank chief said.

Whether such an outlook, which only just envisages price gains returning to target over the medium term, warrants a 10th straight hike is a “close call,” he said in an interview in Amsterdam.

“I continue to think that hitting our inflation target of 2% at the end of 2025 is the bare minimum we have to deliver,” Mr. Knot said. “I would clearly be uncomfortable with any development that would shift that deadline even further out. And I wouldn’t mind so much if it shifted forward a little bit.”

The euro rose and bonds fell after Mr. Knot’s comments, as the market boosted wagers that the Governing Council will prolong the most aggressive bout of monetary tightening in ECB history when it convenes on Sept. 13-14. The chances of a quarter-point increase now stand at about 35% — up from 30% earlier.

Coming just hours before a week-long quiet period preceding that meeting, Mr. Knot’s remarks offer some of the final clues and confirm that the outcome remains very much up in the air. The deposit rate is now at 3.75% — on the verge of climbing to a record high.

“The markets are struggling,” Mr. Knot said. “They’re probably going through a similar struggle we will have to go through next week. But I can assure you, at the end of the struggle, there will be a decision.”

SEPTEMBER PREFERENCES

Since their summer breaks, more than half of the euro region’s national central bank bosses have publicly spoken about the September meeting.

Governors from Germany, Belgium, Austria and Latvia have signaled support for another quarter-point step — probably the last of this cycle. Their counterparts from Italy and Portugal, however, are among those underscoring that economic risks are starting to play out.

“I’m not going to say today what we will decide Sept. 14, all the more so because our options are open for this meeting as they are for following meetings,” Bank of France head Francois Villeroy de Galhau said on Wednesday. “But I’m convinced we are close or very close to the high point of interest rates.”

Mr. Villeroy also highlighted the benefits of keeping borrowing costs higher for longer. Bundesbank President Joachim Nagel struck a similar tone in a Handelsblatt interview published Tuesday, saying “it would be wrong to speculate that an interest rate peak will soon be followed by cuts.”

ECB President Christine Lagarde hasn’t committed on September, saying simply that inflation is too high, the ECB is determined to tame it and decisions will be based on relevant data.

“We’ve reached the finessing phase of the tightening cycle,” Mr. Knot said. “Tightening — a further hike — is still a possibility, but not a certainty.”

While markets have focused on Europe’s services sector following manufacturing into a downturn and the troubles roiling China’s economy, the only major hard indicator the ECB has got since July is second-quarter gross domestic product, which “was actually more resilient than expected,” according to the Dutch official.

What’s more, labor markets have proved resilient, real incomes are beginning to recover and there are signs the housing market has bottomed out.

“I want to caution against too much pessimism,” Mr. Knot said. “We’re talking about weakness here. We’re not talking about outright recession.”

Progress on inflation is tricky to judge, too. Underlying pressures seem to have plateaued and will “come down significantly” in the coming months, he said.

Pay negotiations and corporate-pricing behavior will be key in how rapidly inflation heads back to the target.

“It’s quite crucial in the disinflation process toward 2% by the end of 2025 that wage growth decelerates visibly,” Mr. Knot said. “If I look at current wage agreements, they are still pretty far off longer-run compatibility with a 2% inflation target plus half a percent productivity growth.”

Inflation expectations remain “well anchored — even though some of them are, let’s say, on the upper end of where I’m comfortable with,” he said.

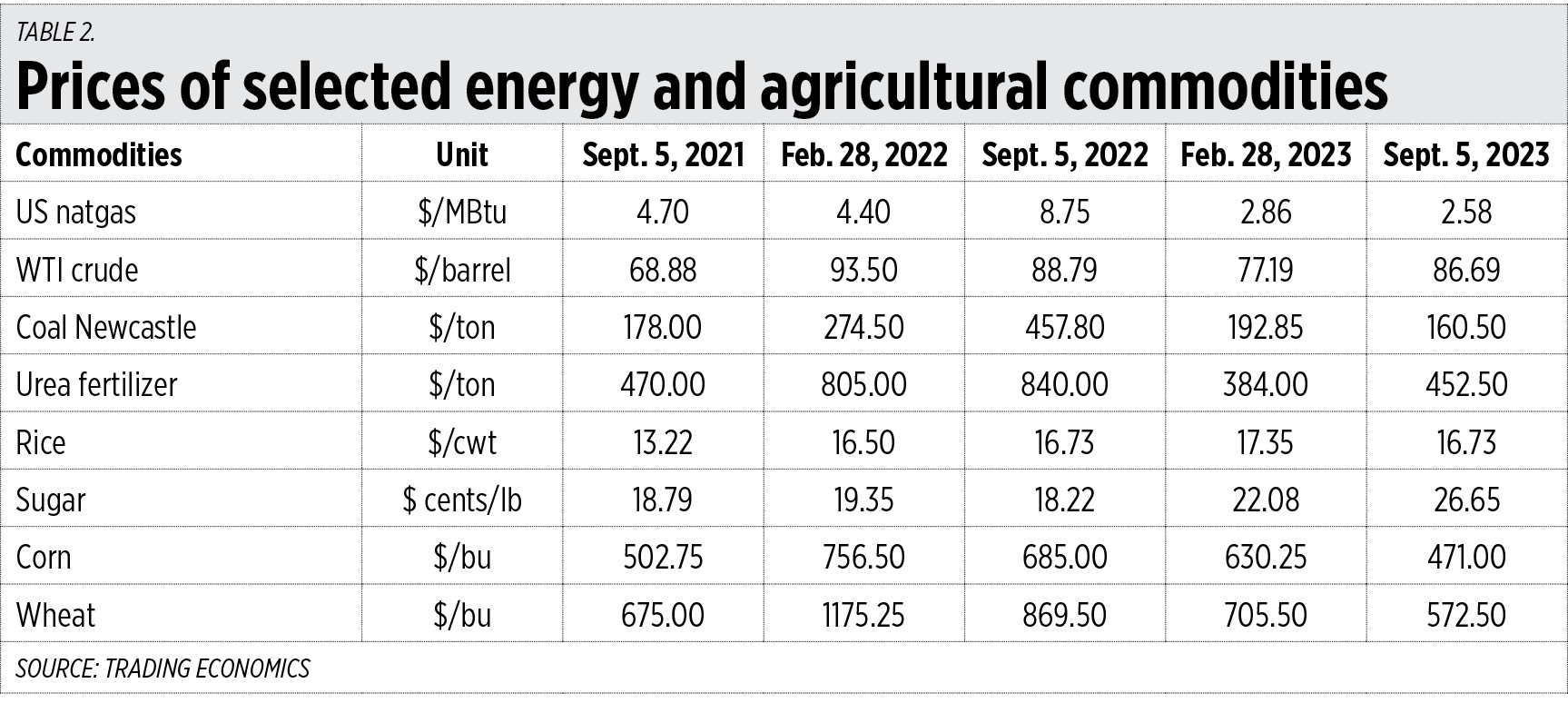

In a sign of the continuing upside risks to prices, Saudi Arabia and Russia on Tuesday prolonged their unilateral oil supply curbs by another three months — a more aggressive move than traders had been expecting.

While rates have been the ECB’s primary tool to regain control over inflation, policy makers have complemented their efforts by shrinking their balance sheet.

Banks have repaid €1.6 trillion ($1.7 trillion) of long-term loans since mid-last year and maturing bonds from an older quantitative-easing portfolio are rolling off, rather than being reinvested.

“The market has absorbed it quite well,” Mr. Knot said. “That’s encouraging to see.”

He reckons the roll-offs can continue even when the ECB eventually starts cutting rates — provided the process is well “in train.”

Reinvestments under the ECB’s pandemic program are set to run through end-2024, and few officials have taken a stance on whether that commitment — dating back to December 2021 — should be rethought.

“There’s no denying that the world today and the inflation outlook is quite different from the outlook we had in mind back then,” Mr. Knot said. “The rationale for continuing the reinvestments is becoming weaker. But at the same time, we also know that reneging on earlier guidance has a cost. At this moment I don’t think we should incur this cost.” — Bloomberg