By Bernadette Therese M. Gadon, Researcher

THE NUMBER of registered overseas Filipino workers (OFWs) picked up by 7.6% last year as the lifting of pandemic restrictions provided them employment opportunities abroad, analysts said on Wednesday.

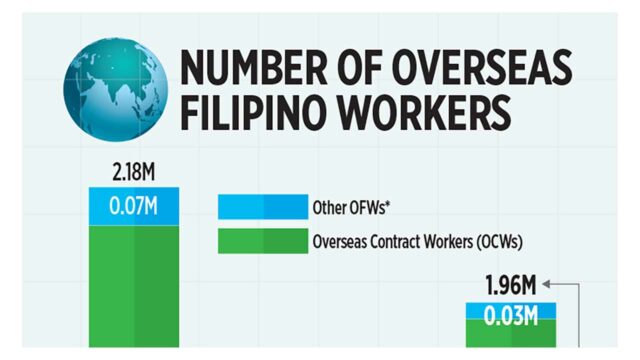

From the 1.83 million registered OFWs at the height of the pandemic in 2021, the number increased by 138,377 to 1.96 million last year, according to the latest Survey on Overseas Filipinos by the Philippine Statistics Authority (PSA).

Overseas contract workers (OCWs) or those based abroad made up the bulk of OFWs, growing by 10.1% year on year to 1.94 million in 2022 from 1.76 million in 2021.

Other OFWs — Filipinos working abroad with a valid working visa or work permit, including crew members of airlines such as pilots, stewards, stewardesses, and those whose employers are foreign nationals — dropped by more than half to 26,147 last year from 65,093 in 2021.

Other OFWs — Filipinos working abroad with a valid working visa or work permit, including crew members of airlines such as pilots, stewards, stewardesses, and those whose employers are foreign nationals — dropped by more than half to 26,147 last year from 65,093 in 2021.

Analysts attributed the rise in deployments to the easing of pandemic restrictions worldwide, creating job opportunities for OFWs who went back or those who are looking for higher pay.

In an e-mail note, University of Asia and the Pacific (UA&P) senior economist Cid L. Terosa said that Filipinos seeking work abroad because of the need to recover from pandemic-related plunge in income also fueled the rise in deployments.

“The lag in the economic recovery of the country relative to other countries created incentives for many Filipinos who lost their jobs during the pandemic to seek work abroad,” he said.

“Labor supply constraints in many OFW host or destination countries after the pandemic, particularly in the recreational and leisure industry as well as in the healthcare and medical sector, also contributed to the increase in the number of OFWs,” he added.

In a Viber message, China Banking Corp. (ChinaBank) chief economist Domini S. Velasquez said that demand for seafarers also picked up last year on lighter restrictions.

Women continued to dominate overseas as their numbers increased by 3.3% to 1.14 million last year from 1.10 million a year prior. Male OFWs, however, surged by 14.1% to 828,468 from 726,363.

Overall, 23.4% of OFWs were aged 30 to 34, followed by aged 45 and above at 22.7%, and aged 35-39 at 18%.

By occupation type, a 44.4% share of the total OFWs were in elementary occupations, which comprised of simple and routine work that requires the use of hand-held tools and physical efforts such as cleaning, restocking, manufacturing including product-sorting and simple hand-assembling of components.

Other occupation types include service and sales workers (15.5% share), and plant and machine operators and assemblers (12.4%).

Mr. Terosa said the surge in elementary occupations was just a re-establishment after Filipinos in those jobs had to go back home during the pandemic.

“Elementary occupations have always been a significant type of work for our OFWs. Destination countries of our OFWs more often look for individuals who can ably do simple and routine tasks that require physical effort such as housekeeping and similar services,” Mr. Terosa said.

Around 15.3% or 1.96 million deployed OFWs came from the Calabarzon region. Some 13.3% of the total share came from Central Luzon, while 11.1% were from Western Visayas.

More than eight in 10 Filipinos worked in Asian countries with Saudi Arabia as the top destination for a 23% share of the total of OFWs last year. United Arab Emirates (UAE) had a 13.7% share of deployed OFWs and Kuwait had 7.7%.

Other destinations were in Europe (with 9% share), North and South America (6.3%), Australia (2.9%), and Africa (1%).

Average remittances increased by 21.6% year on year to P110,656 from P91,000 in 2021.

Total remittances reached P197.47 billion, up 30.5% from P151.33 billion in 2021. These comprised of cash sent with P145.40 billion from P127.13 billion, cash brought home (P43.90 billion from P20.17 billion), and in kind (P8.17 billion from P4.03 billion).

Bank transfers are the preferred mode of remittance by more than half of total cash remittances (or P83.19 billion). Others remit via money transfer services (P59.85 billion), and agency and/or local office (P1.49 billion).

Last September, President Ferdinand R. Marcos, Jr. signed the Trabaho Para sa Bayan Act into law in a bid to create a national masterplan to address unemployment and underemployment in the country.

“The government has realized that the post-pandemic market for our OFWs has become more stringent in terms of desired skills and competence. Hence, upskilling and retooling of our workers is a government priority,” Mr. Terosa said.

He added that the government’s move to pursue bilateral labor agreements with other OFW destinations can boost job opportunities for Filipinos in the future.

“Moving forward, we still see continued demand for OFWs given much needed skills in host countries. Higher pay, [and] positive experience of fellow Filipino migrants in host countries will likely encourage more Filipinos to seek opportunities abroad,” ChinaBank’s Ms. Velasquez said.

“I believe the increase in the number of OFWs this year will hover between 5 to 7 percent. It will be better next year. If the geopolitical tension in the Middle East will escalate and be protracted, the steady rise in the deployment of OFWs will be dented,” UA&P’s Mr. Terosa said.

The reference period for the survey was from April to September 2022.