One more BSP rate cut likely this year

THE BANGKO SENTRAL ng Pilipinas (BSP) is likely to implement just one more rate cut this year amid persistent global uncertainty, according to Deutsche Bank Research.

“The ongoing uncertainty is likely a larger factor than interest rates in businesses holding back their decisions to borrow,” it said in a note on Monday. “We expect BSP to cut by 25 bps (basis points) in the coming August meeting.”

The forecast is more cautious than that of BSP Governor Eli M. Remolona, Jr., who said last week that there is room for two more rate cuts in 2025, as inflation stays within the 2-4% target and given the government’s lower economic growth outlook.

The BSP trimmed its key policy rate by 25 bps to 5.25% in May amid easing inflation and weaker-than-expected first-quarter growth. Since mid-2024, the central bank has slashed rates by 125 bps.

“We agree to some extent, as overall credit growth has not gained much momentum despite BSP’s cumulative 125-bp rate cuts so far,” Deutsche Bank Research said.

Outstanding loans by universal and commercial banks rose by 11.12% year on year to P13.25 trillion in April, the slowest in five months.

The research firm expects BSP to monitor underwhelming growth, subdued inflation, currency movements, and the US Federal Reserve’s easing cycle after the anticipated August cut.

“The first two factors have arguably been met, increasing the possibility of further rate cuts after August,” it added.

The Development Budget Coordination Committee (DBCC) has lowered its 2025 GDP growth forecast to 5.5-6.5% from 6-8% due to global headwinds such as shifts in the US trade policy and war in the Middle East.

For 2026-2028, the growth forecast was also narrowed to 6-7%.

June inflation in the Philippines inched up to 1.4% from 1.3% in May, the fourth straight month it stayed below the BSP’s 2-4% target. Year-to-date inflation averaged 1.8%.

Meanwhile, ING Think expects the BSP to implement two more 25-bp cuts — one in the third quarter and another in the fourth — bringing the policy rate down to 4.75% by end-2025.

“We continue to expect two more rate cuts of 25 bps in the third and fourth quarters each to end 2025 at 4.75%, driven by a lower-than-expected inflation trajectory and downside risks to domestic growth,” the firm said in a separate note.

It cited improved external trade and gains in the manufacturing sector as possible growth drivers. It forecasts GDP to expand by 5.5% this year to hit the lower end of the government’s target.

The trade deficit narrowed to $3.29 billion in May from $4.73 billion a year earlier and from $3.97 billion in April, the smallest shortfall in three months. Year to date, the trade deficit stood at $19.68 billion, down from $20.72 billion a year earlier.

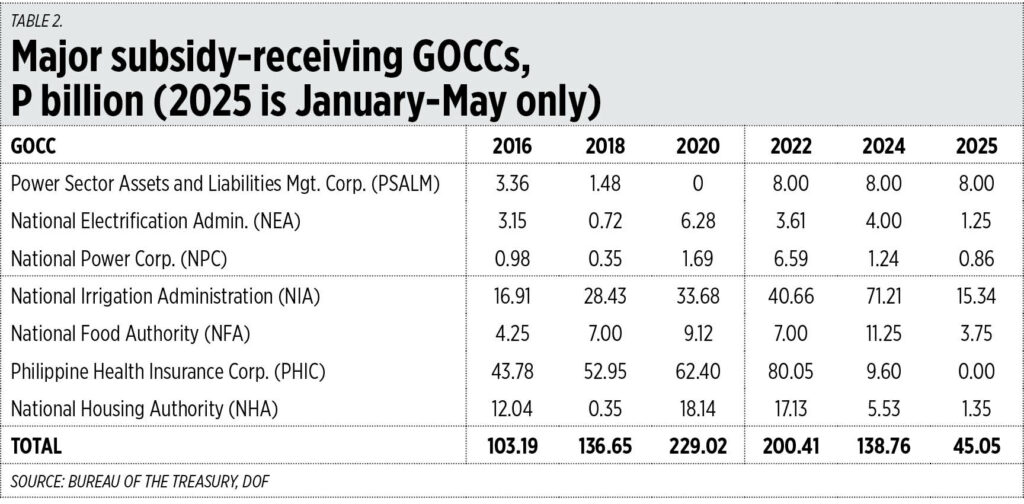

Despite this, ING Think said muted private investment could persist, citing fiscal adjustments.

“We believe the revised 5.5% [fiscal deficit] target is more realistic, given the government’s focus on capital expenditures amid global growth weakness,” it said. “Slower global growth is likely to weigh on revenue performance and may necessitate further fiscal easing to support GDP growth.”

“The pace at which key infrastructure projects are executed will be a critical factor in shaping the growth trajectory moving forward,” it added.

Inflation is expected to remain “contained,” ING Think said, due to easing domestic rice prices and global oil costs. “Additionally, easing pressures on the local currency in June should mean lower imported inflation.” — Aaron Michael C. Sy