Origin, evolution, key milestones

Pag-IBIG has come a long way from its origin on June 11, 1978 via PD 1530 to address two mandates that it continues to uphold: a national savings program and affordable housing finance for workers.

From a fragmented set up of two separate funds — the Social Security System (SSS) handling funds for the private sector and the Government Service Insurance System (GSIS) handling the savings of government workers — it was rationalized when EO 527 (March 1, 1979) transferred the administration of the two separate funds to the NHMFC (the National Home Mortgage Finance Corp., then under the Ministry of Human Settlements), while EO 538 (June 4, 1979) merged the funds into one.

The entity that we now know as Pag-IBIG Fund was spun off from NHMFC — through PD 1752 of 1980 which amended PD 1530 — with its own governing Board of Trustees. PD 1752 (Section 4) made Pag-IBIG membership mandatory for all SSS and GSIS employees.

In the aftermath of EDSA 1, Pag-IBIG contributions were suspended during May-July 1986 pending a review by the Cory Aquino administration but resumed in August of the same year. Contributions became voluntary for eight years from January 1987 until 1994.

The mandatory coverage was restored by RA 7742, signed into law by then President Fidel Ramos on June 17, 1994. Former Senator Joey Lina authored the Senate version of the bill (No. 189) that restored the mandatory coverage.

For those wondering what the acronym Pag-IBIG meant, RA 9679, signed into law by President Gloria Macapagal-Arroyo on July 21, 2009, spelled it out thus — Pagtutulungan sa Kinabukasan: Ikaw, Bangko, Industriya at Gobyerno. RA 9679 expanded the membership beyond SSS and GSIS members to include the military and uniformed personnel (MUP) and overseas workers.

A crucial provision of RA 9679 (Section 19) was the grant of tax exemption on Pag-IBIG earnings from operations and the income distributed to its members as dividends. It also gave the Pag-IBIG board of trustees the flexibility to set the contribution rates, hence allowing for bigger contributions from members.

From a purely member-funded provident fund, Pag-IBIG diversified its funding base by accessing the financial markets in 2001 with a P2 billion issuance of five-year bonds that matured in 2006.

PERFORMING ON THE MANDATES — SCOPE AND REACH

The Pag-IBIG fund’s dual mandate is to generate savings and provide housing finance for its members. Its membership base hit a high of 15.90 million, dipped to 12.769 million in the pandemic year 2020, and recovered to 15.9 million by 2023 — of which 2.25 million are overseas Filipino workers (OFWs). With initiatives for more inclusion, the 2023 membership number already includes 17,885 TNVS riders (i.e., Grab drivers).

The annual reports from 2017 to 2020 stated as a goal to hit 90% of “coverable workers” given the mandatory coverage provision of RA 9679. SSS and GSIS have different definitions of their members “coverable” by Pag-IBIG (active, inactive members). Given this vagueness, the 15.9 million Pag-IBIG members roughly translates to less than 40% of the combined membership of SSS and GSIS.

To serve the substantial customer base that includes OFWs and self-employed workers, the Pag-IBIG branch network has grown from 112 in 2015 to 208 in 2023. Over the last 10 years, its ability to interface with members was greatly enhanced beyond the branch network to include a website, mobile apps, and online platforms able to deliver services 24/7, especially for OFWs.

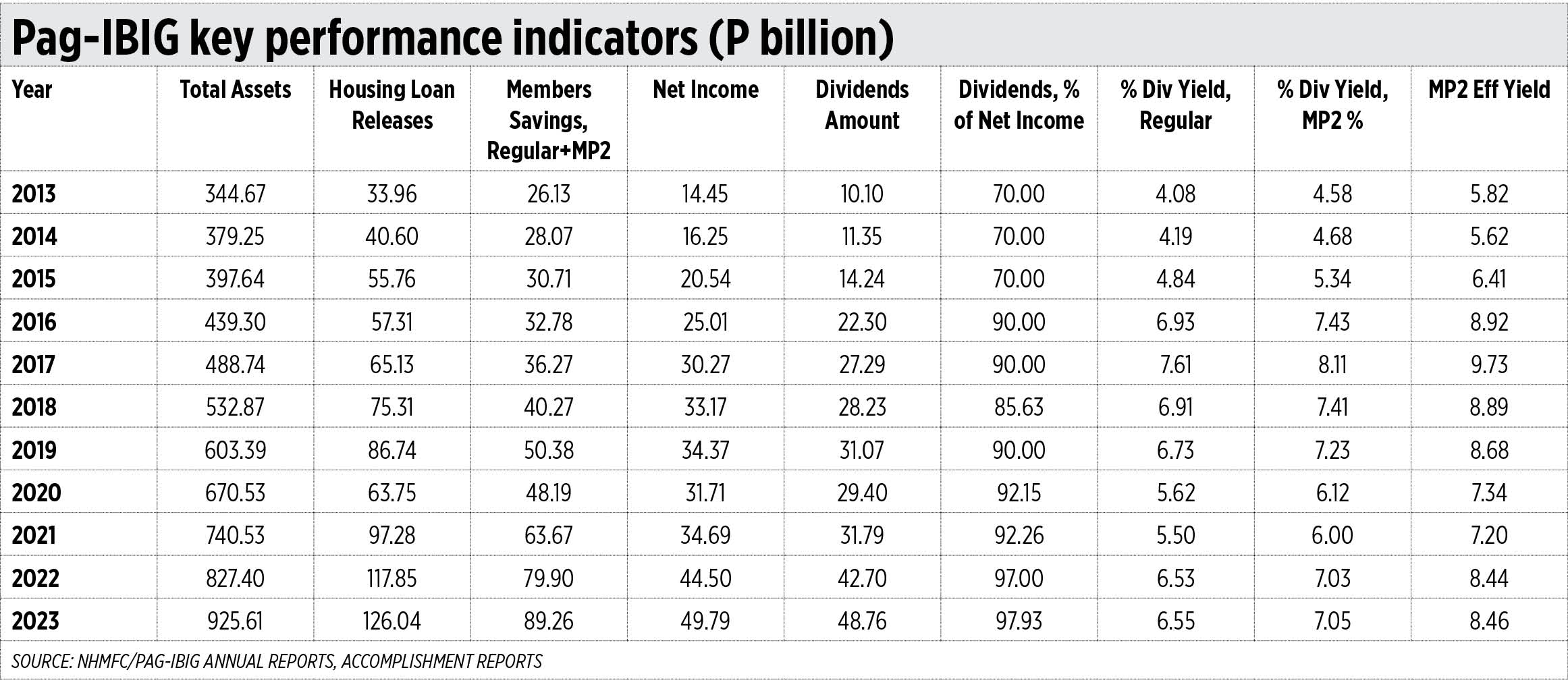

The performance of the Pag-IBIG Fund maybe best appreciated with a longer view over 11 years from 2013 to 2023 covering the terms of three presidents (Aquino III, Duterte, and Marcos Jr.) and three CEOs (Darlene Berberabe, Acmad Rizaldy Moti, and Marilene Acosta). The current CEO, Marilene Acosta, is a 43-year Pag-IBIG veteran who rose from the ranks.

HOW WELL HAS IT EXECUTED ON ITS MANDATE — HOUSING FINANCE

From 2013 to 2023, its total assets grew 2.7 times, from P344.67 billion to P925.61 billion, very much on track to hit the P1 trillion milestone in 2024. During the same period, housing loan releases grew at a faster clip of 3.7 times, from P33.96 billion to P126.04 billion — hitting the P100 billion milestone for the first time in 2022.

By 2022, the last full year for which audited financial statements are available, the housing loan releases benefited 105,212 borrowers — of which 18,657 members were from the underserved sector.

To provide further impetus to the housing finance mandate, Pag-IBIG launched an upstream program to provide P250 billion financing for the period 2023-2028 under the DDLP or Direct Developmental Loan Program to tap developers, contractors, and LGUs to help address the massive housing backlog estimated at six million units.

HOW WELL HAS IT EXECUTED ON ITS MANDATE — SAVINGS ACCOUNTS

Savings from members accelerated with change allowing for more than the P100 minimum contribution, growing 3.4 times from P26.13 billion in 2013 to P89.26 billion in 2023.

MP2, or the Improved Pag-IBIG Savings, account was at a modest P265.8 million in 2013 or only 1% of the P26.13 billion total savings of members. Due to its superior dividend yield, MP2 balances grew to P46.54 billion by 2023 or 52% of total.

The Regular Savings account is available only to Pag-IBIG members who are currently employed or self-employed while the MP2 Savings account is available to those who have recently retired. The Regular Savings Account is counted under Pag-IBIG members’ equity, while MP2 is classified as a financial liability in the balance sheet due to its five-year term.

The Pag-IBIG savings accounts are superior investments in the following ways:

1. Pag-IBIG savings accounts are guaranteed by the Republic of the Philippines up to the full amount of the investment, better than the PDIC coverage for bank deposits up to P500,000.

2. The earnings of the current year become part of the principal the following year. Most fixed-term instruments credit your interest earnings to a settlement account and do not compound.

3. Because of tax exemption provided by RA 9679, the MP2 dividend yield rate of 7.05% for 2023 translates to an effective net yield of 8.46% (grossed up for the 20% withholding tax). The regular savings account yield of 6.55% means an effective yield of 7.86%.

These yields are superior to the yields on bonds (subject to the 20% withholding tax), the preferred shares of the big corporate names, and the Real Estate Investment Trusts (REITs) listed in the PSE whose dividends are subject to a 10% withholding tax.

SOLID PAG-IBIG FINANCIALS

The business model of Pag-IBIG is closer to that of a cooperative or a credit union where the funding source is composed mostly of contributions from members and its revenues are derived mostly from loans to members. Hence, its leverage and capital ratios are much more solid than a typical financial institution.

Its members’ equity practically doubled, from P317.818 billion in 2014 to P628.923 billion in 2022. This translates to a very solid equity-to-assets ratio of 83.8% in 2013 and 76% in 2022. In short, every peso of its assets is funded by 83.8 centavos of equity in 2013 and 76 centavos in 2022.

Its debt/equity ratio was only 0.193 in 2014 and 0.316 in 2022. In other words, for every peso of equity Pag-IBIG had debt of only 19.3 centavos in 2013 and 31.6 centavos in 2022. In contrast, a typical bank would have a debt/equity ratio of 9-10 times. Industrial companies would have a debt/equity of 1.

In short, the Pag-IBIG Fund has recorded impressive strides in executing its dual mandate. In doing so, its financial footing remained solid, stable, and sound. A very good foundation to do more, serve more “coverable” members and serve them even better.

Alexander C. Escucha is the president of the Institute for Development and Econometric Analysis, Inc., and chairman of the UP Visayas Foundation, Inc. He is a fellow of the Foundation for Economic Freedom and a past president of the Philippine Economic Society. He wrote the Handbook on the Overview of the Banking Industry for the Bankers Association of the Philippines’ 60th anniversary in 2014. He is an international resource director of The Asian Banker (Singapore).

alex.escucha@gmail.com