By Abigail Marie P. Yraola, Deputy Research Head

YIELDS on government securities (GS) traded in the secondary market rose across the board last week as the market remained cautious amid monetary easing expectations here and in the United States and uncertainty ahead of the upcoming US presidential elections.

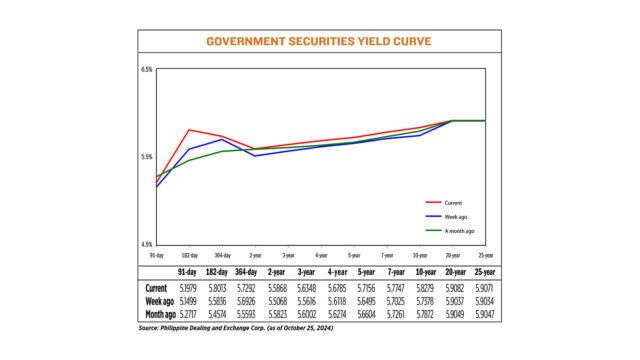

GS yields, which move opposite to prices, rose by an average of 6.90 basis points (bps) week on week, according to the PHP Bloomberg Valuation Service Reference Rates as of Oct. 25 published on the Philippine Dealing System’s website.

Rates at the short end of the curve rose, with the 91-, 182-, and 364-day Treasury bills (T-bills) climbing by 4.8 bps (to 5.1979%), 21.77 bps (5.8013%), and 3.66 bps (5.7292%) week on week, respectively.

At the belly, yields likewise went up across all tenors. The two-, three-, four-, five-, and seven-year Treasury bonds (T-bond) saw their rates increase by 8 bps (to 5.5868%), 7.32 bps (5.6348%), 6.67 bps (5.6785%), 6.61 bps (5.7156%), and 7.22 bps (5.7747%), respectively.

Tenors at the long end also saw their rates climb. The 10-, 20-, and 25-year T-bonds rose by 9.01 bps, 0.45 bp and 0.37 bp to fetch 5.8279%, 5.9082%, and 5.9071%, respectively.

GS volume traded was at P39.31 billion on Friday, higher than the P25.76 billion recorded a week earlier.

“Bond yields broadly moved higher during the week as traders remained cautious due to uncertainty concerning the future US monetary and fiscal policy. This was mainly due to lack of clear lead on the US presidential race polling,” a bond trader said in an e-mail.

The trader said market expectations have shifted towards more gradual Fed rate cuts after various officials discussed the implications of the 50-bps rate cut made in September.

“On the local front, demand for Treasury bills (T-bills) remained consistently strong as investors maximize the higher yields for short-term issuances in anticipation of future BSP (Bangko Sentral ng Pilipinas) policy rate cuts,” the trader added.

The Bureau of the Treasury last week raised P20 billion as planned from the T-bills it auctioned off, with total bids amounting to P55.069 billion, higher than the P51.735 billion a week earlier.

ATRAM Trust Corp. Vice-President and Head of Fixed Income Strategies Lodevico M. Ulpo, Jr. said that the GS yields rose following the T-bill auction results and by volatility in US Treasuries amid strong economic data and mixed signals from Federal Reserve officials on their policy easing path.

“Late in the week, stabilizing global rates and an anticipated P300-billion liquidity boost from the BSP’s RRR (reserve requirement ratio) cut led to improved liquidity, nudging local yields slightly lower,” Mr. Ulpo said.

Effective Friday, the BSP reduced the RRR for universal and commercial banks and nonbank financial institutions with quasi-banking functions by 250 bps to 7% from 9.5%.

It also cut the RRR for digital banks by 200 bps to 4%, while the ratio for thrift lenders was brought down by 100 bps to 1%. Rural and cooperative banks’ reserve requirement was slashed by 100 bps to 0%.

Republican former President Donald Trump and Democratic Vice President Kamala Harris are polling neck-and-neck in crucial swing states ahead of the Nov. 5 election. Investors are anxious about a contested result roiling world markets and unleashing fresh geopolitical uncertainty, Reuters reported.

Mr. Trump is neck and neck with Ms. Harris in the polls. Yet investors are taking their cues from betting markets, where the odds have shifted in Mr. Trump’s favor.

The dollar has rallied more than 3% so far in October as bond yields have climbed towards three-month highs, partly because markets are preparing for potentially higher US tariffs flagged by Mr. Trump if he wins that could push up inflation and force the Federal Reserve to keep rates higher.

Traders are pricing in near-95% odds of a 25-bp cut at the Fed’s November meeting, according to the CME Group’s FedWatch Tool. The yield on benchmark US 10-year notes rose 3.8 bps to 4.24%.

Four Fed policy makers on Monday expressed support for further interest rate cuts, but appeared to differ on how fast or far they believe any cuts should go.

Three of them, citing the strength of the economy and an uncertain outlook, expressed a preference for going slow, using words like “modest” and “gradual” to describe their views on the right pace for rate cuts.

The fourth, San Francisco Fed President Mary Daly, said she feels Fed policy is “very tight” and does not believe that a strong economy, as long as inflation continues to fall, should keep the central bank from continuing to reduce rates.

The remarks provide a small taste of what’s expected to be a broad but closed-door debate of the appropriate path for policy at the Fed’s upcoming policy meeting, on Nov. 6-7.

Meanwhile, the BSP has so far cut borrowing costs by a total of 50 bps this year since it began its easing cycle in August, with its policy rate currently at 6%.

BSP Governor Eli M. Remolona, Jr. has signaled another 25-bp cut at the Monetary Board’s last policy review for the year on Dec. 19.

For this week, GS yields may continue to climb as the market remains cautious, both analysts said.

“Investors are expected to remain cautious, balancing duration risk against near-term volatility as monetary policy expectations evolve. In the near term, many may stay on the sidelines, awaiting clearer signals from global policy makers and developments in US politics,” Mr. Ulpo said.

“Yields might continue fetching higher amid domestic inflationary concerns emanating from the recent peso weakening and potential supply disruptions from the impact of Typhoon Kristine,” the bond trader added.

Yields could remain range-bound in the coming weeks, supported by improved liquidity from the BSP’s RRR cut, dovish signals from the BSP, as well as lower bond supply due to the reduced number of Treasury bond auctions this quarter, Mr. Ulpo said.

“However, volatility in US Treasuries will likely apply upward pressure, particularly on the medium to long end of the curve,” he said.

“In the longer term, yields could gradually decline as investors anticipate easing amid a slowdown and limited government bond issuance. Further dovish BSP signals or global market stability may add downward momentum on yields, though US Treasuries and inflation data will continue to be key short-term factors to balance direction,” Mr. Ulpo added. — with Reuters