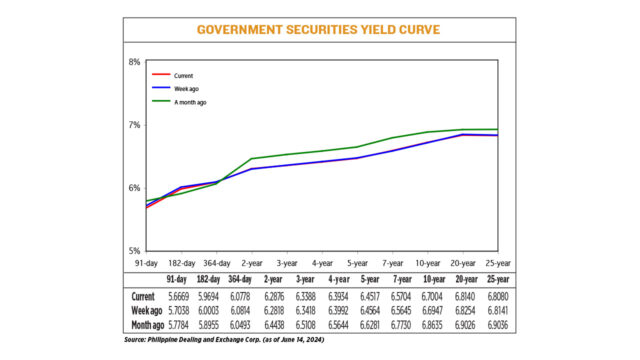

YIELDS on government securities (GS) were mixed last week following the Federal Reserve’s latest policy hints and the release of US consumer and producer inflation data.

GS yields, which move opposite to prices, inched down by an average of 0.77 basis point (bp) week on week, based on the PHP Bloomberg Valuation Service Reference Rates as of June 14 published on the Philippine Dealing System’s website.

At the short end, yields on the 91-, 182-, and 364-day Treasury bills went down by 3.69 bps, 3.09 bps, and 0.36 bp week on week to 5.6669%, 5.9694%, and 6.0778%, respectively.

At the belly, yield movements were mixed. The rates of the three-, four-, and five-year Treasury bonds (T-bonds) dropped by 0.3 bp (to 6.3388%), 0.58 bp (6.3934%), and 0.47 bp (6.4517%), respectively. Meanwhile, the two- and seven-year T-bonds saw their yields climb by 0.58 bp and 0.59 bp to 6.2876% and 6.5704%, respectively.

At the long end of the curve, yields on the 20- and 25-year T-bonds dropped by 1.14 bps (to 6.814%) and 0.61 bp (6.808%), respectively, while the 10-year paper rose by 0.57 bp to fetch 6.7004% on Friday.

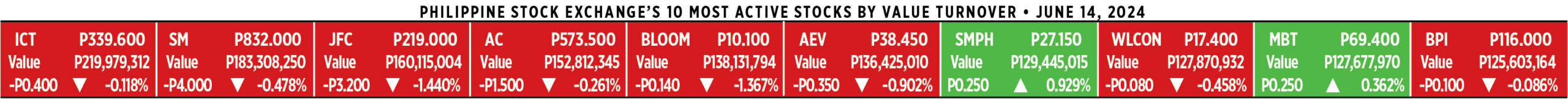

Total GS volume traded reached P28.55 billion on Friday, higher than the P14 billion seen on June 7.

“Local yields initially saw some sell-off [last] week in reaction to the strong nonfarm payrolls in the US. Sentiment improved in the latter part of the week after the release of key data and the latest Federal Open Market Committee meeting result,” Alessandra P. Araullo, chief investment officer at ATRAM Trust Corp., said in a Viber message.

The lower-than-expected US inflation prints and the Fed’s policy comments at the end of their two-day review spurred market optimism towards the end of the week, Ms. Araullo said.

GS rates moved sideways to down due to the Fed’s cautious easing outlook, Jonathan L. Ravelas, senior adviser at Reyes Tacandong & Co., likewise said in a Viber message.

The US central bank on Wednesday kept its benchmark overnight interest rate in the current 5.25%-5.5% range, where it has been since last July, Reuters reported. Fed officials pushed out the start of rate cuts to perhaps as late as December, with policy makers projecting only a single quarter-percentage-point reduction for this year.

The Labor department’s Bureau of Labor Statistics said the producer price index (PPI) for final demand decreased 0.2% in May. That was the biggest drop in the PPI since October and followed an unrevised 0.5% rise in April. Economists had forecast the PPI nudging up 0.1%.

In the 12 months through May, the PPI gained 2.2% after rising 2.3% in April.

The data followed Wednesday’s cooler-than-expected consumer price index (CPI) report. US consumer prices were unchanged in May from April, against market expectations of a 0.1% rise.

The CPI rose at an annual rate of 3.4%, still well above the Fed’s target of 2%.

At home, investors weighed comments from Finance Secretary Ralph G. Recto that the Bangko Sentral ng Pilipinas (BSP) could cut its key interest rate after the Fed begins its policy easing, Ms. Araullo added.

“These factors combined ultimately caused yields to move sideways week on week, with only the front-end bonds being the heavily favored,” she said.

For this week, the leading catalyst for the market activity would be the 15-year bond auction on Tuesday, Ms. Araullo said.

“Investors will try to gauge if the buying momentum will be sustained given that the issuance is a longer-term bond. If decent demand for the bond can be seen, then we may see some follow through buying,” she said.

“Another factor that we will also closely look at is the regular monetary policy meeting by the BSP Monetary Board. The meeting will take place on June 27. Investors will be looking for more concrete guidance from the BSP governor on when the first rate cut for the year will be and their outlook on inflation,” Ms. Araullo said.

GS yields may continue moving sideways this week as investors are expected to stay on the sidelines before the BSP’s next policy meeting, where they expect no adjustments in rates, Mr. Ravelas likewise said.

Anticipation for the release of the Bureau of the Treasury’s borrowing plan for next quarter could also drive market activity this week, Ms. Araullo added.

“This will allow players to reposition accordingly as more bond supply comes in the market,” she said. — Lourdes O. Pilar with Reuters