By Beatriz Marie D. Cruz, Reporter

AS ARTIFICIAL INTELLIGENCE (AI) takes over simple office tasks, coaching and simulation platform Arbolo hopes to upskill information technology-business process management (IT-BPM) workers for more advanced roles to address their concerns about being replaced by AI.

“What we’ve usually seen with these technologies that are feared to replace humans is that the number of jobs for humans actually increases, but the nature of their work changes,” Arbolo Cofounder and Chief Executive Officer (CEO) Martin B. Tan said in an interview with BusinessWorld.

“They start doing more sophisticated, more complex tasks that require more marketing, sales, and emotional intelligence,” he said.

The demand for more advanced skills in the IT-BPM industry is increasing, as more firms adopt AI to take over basic tasks like customer experience.

“The way to help prepare a workforce is to help them transition from what I call ‘lifers’ — people who think, ‘I’m going to be a customer service agent forever and just be relaxed here,’ to becoming lifelong learners,” Mr. Tan said.

“With Arbolo, you can have IT-BPM workers perform more complex tasks within the customer experience segment, or transition them to roles like sales, which require more emotional intelligence.”

The IT and Business Process Association of the Philippines (IBPAP), an IT-BPM organization in the country, reported that 67% of firms saw enhanced productivity and operational efficiency after integrating AI into their operations. However, 8% of its members reduced their workforce because of AI implementation.

The number of job cuts due to AI will not increase if firms will retrain and upskill their talents, IBPAP President and CEO Jack Madrid said in October.

AI-POWERED TRAINING

Launched in January, Arbolo uses AI to provide automated training, feedback, and role play simulations for IT-BPM workers.

Its Cofounder and Chief Technology Officer Nicolás Rivas leads the development of the platform in Santiago City in Chile, a leading tech hub in Latin America.

The platform aims to solve inefficiencies in the traditional methods of IT-BPM training, such as delayed feedback and the longer waiting hours when conducting a one-on-one session with a trainer.

“You can imagine that the agent gets feedback quite sporadically, once a week, if not once a month,” Mr. Tan said. “With our tool, now they can get feedback right after every call.”

Arbolo’s AI-powered training seeks to address five key pain points of contact centers: reduce employee turnover, accelerate speed to competency, improve agent performance, automate quality assurance, and improve workforce management.

However, the Philippines still trails behind other markets rapidly adopting AI amid a skills gap as well as underdeveloped infrastructure.

According to Oxford Insights’s 2023 Government AI Readiness Index, the Philippines dropped 11 places to 65th out of 193 countries. It scored 51.98 out of 100, higher than the 44.94 average readiness of countries in adopting AI.

Mr. Tan said that to mitigate the risk of AI displacement, IT-BPM workers should enhance their skills by moving from customer experience roles, which are increasingly being automated, to more complex tasks such as sales and marketing.

With this, the platform also provides training for industry-specific roles like in sales, financial services, and telecommunications.

Mr. Tan compared the distribution of expertise in the IT-BPM industry to a pyramid, where the majority of workers with less complex skills are concentrated at the base.

“Our goal with the upskilling platform is to help that pyramid look more like a diamond, where the bulk of our people are in the middle area where [they specialize in] sales or complex types of tasks.”

“If the Philippines becomes a destination for these more complex jobs, we need to help prepare the workforce to transition to those more complex jobs,” he noted.

Mr. Tan said that once IT-BPM workers have enhanced their skill sets, Arbolo intends to deploy its own “AI agents” to handle the simpler tasks left behind by these upskilled employees.

Meanwhile, Mr. Madrid previously said that the talent gap in advanced skills such as AI, programming, and data analytics continues to be a significant concern for 21% of over 60 IT-business process outsourcing (BPO) companies in the country.

CAN AI REPLACE JOBS?

Arbolo derives its name from the bolo knife, used as both a tool and weapon in the Philippines, as it encapsulates the dual nature of AI as either a productivity tool or a potential threat.

A report published recently by the World Bank cited the Philippines, Thailand, and Malaysia as “relatively more exposed” to AI’s displacement compared to its East Asia-Pacific neighbors due to its “higher engagement in cognitive services sectors” such as customer service.

But for Mr. Tan, AI can increase the number of job opportunities for humans while changing the nature of their work, if they are trained well.

“In the ’70s, everybody thought that the introduction of ATMs (automated teller machines) would lead to a replacement of bank tellers,” he said.

“But what the ATMs also did was it made it much cheaper to operate a bank branch,” Mr. Tan said, noting that this led to the opening of more branches, thus increasing the number of job opportunities for tellers.

Additionally, the adoption of ATMs upgraded the job of bank tellers from simply handling cash withdrawals and deposits to specializing in sales and marketing functions, he added.

A basic subscription to Arbolo costs $25 (around $1,461) per agent per month, while an enterprise subscription with more advanced features would cost an average of $45 (around P2,630), Mr. Tan said.

Basic features include 20 customized role play situations, agent role play feedback, a summary of an agent’s strengths and weaknesses, calls integration and transcription, call feedback, and summary insights and analytics.

Last month, Mr. Tan announced that Arbolo had set up its headquarters in the Philippines and developed its Tagalog and Taglish capabilities.

It has also been in talks with a top BPO company that showed interest in training its workers through Arbolo, he added.

The Philippines, dubbed as the “call center capital of the world,” is the “ideal space” to kick-start Arbolo’s global expansion, according to Mr. Tan.

By 2025, the company aims to generate around $5 million of annual recurring revenue from the Philippine market alone, supporting around 15,000 IT-BPM trainees.

It also aims to capture around 31% of the Philippines’ IT-BPM market by 2029.

Mr. Tan noted that starting a large-scale expansion in Southeast Asia would be difficult amid language and cultural barriers.

“Whereas with the Philippines, we figured, 10% of this country’s GDP (gross domestic product) is generated by this industry (IT-BPM). It’s a large slice of the global pie,” he said.

“That means we can create a global market leader by simply focusing on this country.”

Metro Pacific Investments Corp. (MPIC) took home the Best ESG Program Award for its Gabay Kalikasan Program, which addresses key communication challenges and supports measurable progress in ESG goals.

Metro Pacific Investments Corp. (MPIC) took home the Best ESG Program Award for its Gabay Kalikasan Program, which addresses key communication challenges and supports measurable progress in ESG goals. In environmental sustainability, Mondelez International Philippines set the standard in the food manufacturing sector, with Maynilad Water Services Inc. showing exemplary performance in both environmental and social sustainability within water utilities. Manila Electric Company (Meralco) distinguished itself by leading efforts in energy distribution, excelling in both environmental and social impact within the energy sector.

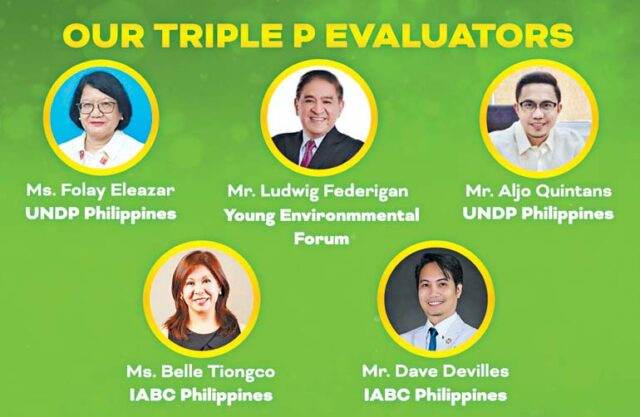

In environmental sustainability, Mondelez International Philippines set the standard in the food manufacturing sector, with Maynilad Water Services Inc. showing exemplary performance in both environmental and social sustainability within water utilities. Manila Electric Company (Meralco) distinguished itself by leading efforts in energy distribution, excelling in both environmental and social impact within the energy sector. To be eligible for the Triple P Awards, companies and organizations must be registered and operational in the Philippines, with submissions highlighting work implemented between January 2023 and December 2023. The awards are open to a wide array of industries, including Holding Companies, Information Technology, Energy, Water Utilities, Construction, Infrastructure, Banking, Retail, Real Estate, Food & Beverage, and Transportation. This inclusive eligibility framework allows the awards to capture a broad spectrum of exemplary sustainable practices across the Philippine business landscape.

To be eligible for the Triple P Awards, companies and organizations must be registered and operational in the Philippines, with submissions highlighting work implemented between January 2023 and December 2023. The awards are open to a wide array of industries, including Holding Companies, Information Technology, Energy, Water Utilities, Construction, Infrastructure, Banking, Retail, Real Estate, Food & Beverage, and Transportation. This inclusive eligibility framework allows the awards to capture a broad spectrum of exemplary sustainable practices across the Philippine business landscape.