CHR flags violence, dynasties in polls

THE Commission on Human Rights (CHR) flagged issues that marred the Philippines’ midterm elections on Monday, citing widespread voter exclusion, election-related violence, and the persistent influence of political dynasties.

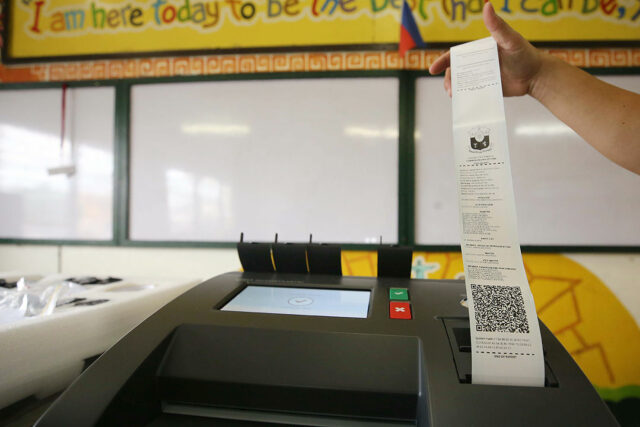

In a post-election assessment on Tuesday, the CHR said that while the technical execution of the vote proceeded without major disruption, deeper structural problems continued to undermine the integrity of the democratic process.

It noted efforts to expand access through early voting for persons with disabilities, older citizens, and pregnant women were undercut by poorly equipped polling centers.

Many lacked ramps, shaded waiting areas, functioning restrooms, or wheelchair access, forcing some voters to climb stairs or wait under extreme heat.

Voting inside jails and detention centers proceeded smoothly, according to CHR, but it noted that prisoners had limited access to campaign-related information, raising concerns about the quality of their electoral participation.

Disinformation remained a major concern, with the CHR flagging a largely reactive response by authorities. Despite interventions by government task forces, social media platforms continued to host manipulated content, including fabricated documents and false narratives targeting candidates and communities.

The CHR called for stricter oversight of digital platforms and earlier intervention to prevent online election interference.

It also noted instances of vote-buying, citing citizen reports of sample ballots distributed alongside cash or goods.

It said existing mechanisms, such as Task Force Kontra Bigay, intervened in specific cases but failed to address the practice at scale.

Election-related violence also continued to plague high-risk areas, particularly the Bangsamoro Autonomous Region in Muslim Mindanao and Abra.

The CHR documented armed confrontations and ambushes linked to political rivalries, saying these incidents endangered the right to vote freely and securely.

In a further blow to democratic credibility, the CHR pointed to the persistent dominance of political dynasties and low levels of women’s representation.

Of over 43,000 candidates, only 21% were women, while more than 2.5% of races were uncontested.

“Entrenched political families hinder democratic competition and meaningful change,” the CHR said.

Calling for systemic reforms, the CHR urged Congress to revisit proposals on an anti-dynasty law while pushing for expanded voter education, better enforcement against electoral violence, and stronger safeguards against disinformation.

It also called on election authorities to prioritize the safety of voters amid increasingly harsh weather conditions driven by climate change.

While noting some innovations in the voting process, the CHR concluded that major gaps remain.

“Persistent barriers to full inclusion, safety, and informed decision-making must be addressed through sustained reforms.”